Plastic Films & Sheets Market Market Size, Share, Growth Analysis Report - Forecast 2034

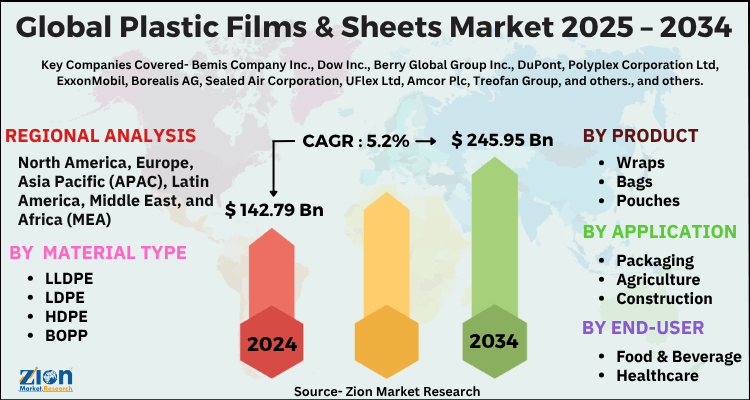

Plastic Films & Sheets Market Market By Material Type (LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, PA, EVOH), By Product (Wraps, Bags, Pouches, Laminates, Liners, Others), By Application (Packaging, Agriculture, Construction, Medical, Consumer Goods, Others), By End-user (Food & Beverage, Healthcare, Industrial, Personal Care, Electronics), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

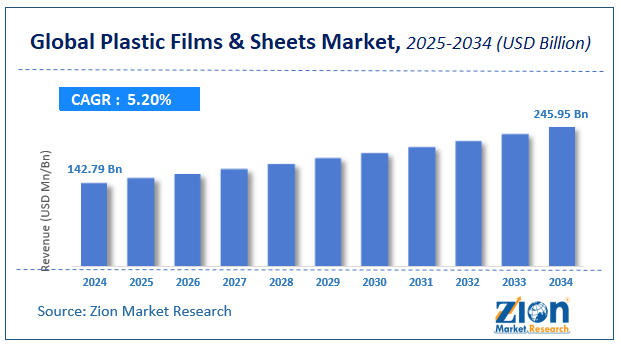

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 142.79 Billion | USD 245.95 Billion | 5.2% | 2024 |

Plastic Films & Sheets Market Size

The global plastic films & sheets market size was worth around USD 142.79 Billion in 2024 and is predicted to grow to around USD 245.95 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.2% between 2025 and 2034. The report analyzes the global plastic films & sheets (LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, PA and EVOH) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the plastic films & sheets (LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, PA and EVOH) industry.

Plastic Films & Sheets Market: Overview

Plastic films and sheets are defined as a continuous and extended form of plastic material that is extremely thin. In the case of plastic films, they are typically wound on a core whereas sheets are typically cut into specific size pieces. Most plastic films are available in sizes ranging between 0.06 mm to 0.010 mm. When they are thicker than this size range, plastic films are then known as sheets. The market for plastic films and sheets is filled with an extremely wide range of options including films made of simple single-use material and more complex materials with advanced structure with different coatings and materials. Some of the most common plastic sheets and films are LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, PA and EVOH. LLDPE stands for linear low-density polyethylene, LDPE represents, low-density polyethylene, HDPE is high-density polyethylene, BOPP is biaxially oriented polypropylene, BOPET is known as biaxially oriented polyethylene terephthalate, CPP is cast polypropylene, PVC represents polyvinyl chloride, PES is polyethersulfone, PA is polyamide, and EVOH is ethylene vinyl alcohol. Each plastic film type offers specific advantages and disadvantages.

Key Insights

- As per the analysis shared by our research analyst, the global plastic films & sheets market is estimated to grow annually at a CAGR of around 5.2% over the forecast period (2025-2034).

- Regarding revenue, the global plastic films & sheets market size was valued at around USD 142.79 Billion in 2024 and is projected to reach USD 245.95 Billion by 2034.

- The plastic films & sheets market is projected to grow at a significant rate due to rising demand in packaging, agriculture, construction, and healthcare, with material innovation for sustainability and performance enhancement.

- Based on Material Type, the LLDPE segment is expected to lead the global market.

- On the basis of Product, the Wraps segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Packaging segment is projected to swipe the largest market share.

- By End-user, the Food & Beverage segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Plastic Films & Sheets Market: Growth Drivers

Growing expansion of new sustainable plastic film production rate to drive market growth

The global plastic films & sheets market is expected to grow owing to the increasing number of new sustainable plastic films and sheets production rate as companies continue to work toward meeting the rapidly rising demand from end-consumers. As the world swiftly moves toward environmentally friendly packaging solutions, the demand for recycled and degradable plastic films or sheets is on the rise. In May 2023, INEOS, a global chemical company, announced the launch of rigid and ultra-thin film specially intended to be applied for recyclable flexible packaging products. The range is made of more than 50% recycled plastic. These developments have also resulted in a greater need for dedicated facilities that either produce large volumes of recycled plastic or use it to create a circular economy. In July 2023, NOVA Chemicals Corporation announced the expansion of its Circular Solutions business. In a recent move, the company has invested in constructing and developing its first mechanical recycling facility in Connersville. The unit will use post-consumer plastic films for the production of SYNDIGO™ recycled polyethylene (rPE) at a commercial scale by the end of 2025. In other news, 2022 marked the announcement of the launch of eco-friendly GEOPLAS HCT3 by Gunze. The product will be heat-shrinkable and made of recycled resin.

Plastic Films & Sheets Market: Restraints

Phasing out of single-user plastic to restrict market growth

The global plastic films & sheets market growth is expected to be restricted due to the steady phasing out of single-use plastic since these variants cannot become a part of the circular economy and leave a drastic impact on the environment. The extensive use of single-use plastics and lack of disposal process are known as the leading causes of global warming. As per estimates, landfills filled with single-use plastic accounted for more than 15% of methane emissions. Around 22 million tonnes of plastic was added to the environment in 2019. These numbers and their impact on global ecosystems have caused several countries to take action against the use of harmful plastic variants. For instance, as of January 2021, the use of single-use plastic for straws & stirrers, plates, cutlery, food containers, and other products has been banned in France.

Plastic Films & Sheets Market: Opportunities

Increased demand for highly durable plastic films and sheets for online sales channels may create more expansion possibilities

The industry for plastic films & sheets is expected to gain higher growth momentum due to the increased demand and consumption of highly durable plastic films and sheets for online purchases. The e-commerce industry is one of the fastest-growing sectors. In addition to this, globalization has created more growth scope for official company websites and third-party sellers of commercial, industrial, and residential products. All of these factors have worked in tandem to generate tremendous growth potential for suppliers of durable and strong plastic films and sheets. In 2022, Amazon, a global and world’s leading e-commerce company, generated a net revenue of USD 514.1 billion and similar statistics are observed for other regional and global companies. The increased consumer reach, higher access to product discounts, and an extensive range of options have led to surging consumerism causing more demand for plastic sheets and films for packaging purposes.

Growing use in the food and beverages sector to fuel market growth trajectory

The plastic films & sheets industry growth prospects look positive because of the increasing demand for plastic films and sheets used in food and beverage labeling especially BOPET and BOPP since these plastic films can be easily printed without compromising on film integrity. Furthermore, the growing demand for food products as the world population is growing at an alarming rate along with higher disposable income and rapid globalization strategy adopted by food companies. A surging segment of consumers demanding organic food products is a promising market segment.

Plastic Films & Sheets Market: Challenges

High market fragmentation due to the presence of alternate solutions may lead to a loss of revenue

As world leaders and end-user corporations continue to invest in more sustainable and eco-friendly solutions, the demand for global market product offerings is projected to reduce as the consumption trend of other substitutes such as paperboards, glass, metal, wood, and fabric rises. Furthermore, the presence of multiple options leads to the market being extremely fragmented.

Plastic Films & Sheets Market: Segmentation

The global plastic films & sheets market is segmented based on Material Type, Product, Application, End-user, and region.

Based on Material Type, the global plastic films & sheets market is divided into LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, PA, EVOH.

On the basis of Product, the global plastic films & sheets market is bifurcated into Wraps, Bags, Pouches, Laminates, Liners, Others.

By Application, the global plastic films & sheets market is split into Packaging, Agriculture, Construction, Medical, Consumer Goods, Others.

In terms of End-user, the global plastic films & sheets market is categorized into Food & Beverage, Healthcare, Industrial, Personal Care, Electronics.

Plastic Films & Sheets Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Films & Sheets Market |

| Market Size in 2024 | USD 142.79 Billion |

| Market Forecast in 2034 | USD 245.95 Billion |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 218 |

| Key Companies Covered | Bemis Company Inc., Dow Inc., Berry Global Group Inc., DuPont, Polyplex Corporation Ltd, ExxonMobil, Borealis AG, Sealed Air Corporation, UFlex Ltd, Amcor Plc, Treofan Group, and others., and others. |

| Segments Covered | By Material Type, By Product, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plastic Films & Sheets Market: Regional Analysis

Asia-Pacific is expected to witness the highest growth rate during the forecast period

The global plastic films & sheets market will be led by Asia-Pacific during the projection period. The high consumption of single-use plastic packaging solutions as the consumption rate across sectors such as healthcare, e-commerce, and consumer electronics is on the rise. Furthermore, the expansive chemical industry in China and India is likely to help the regional market grow further. China is keen on investing in recycling plastic films and sheet production. In January 2021, Alibaba Group and Unilever announced that they have created an artificial intelligence (AI) enabled recycling system capable of automatically identifying plastic packaging and putting high-grade plastic back into the economy. In the same year, Lucro Plastecycle, an Indian homegrown recycling company, and global chemical leader Dow signed a memorandum of understanding (MoU) as the companies plan to launch post-consumer recycled polyethylene (PE) film solutions in the Indian market.

Plastic Films & Sheets Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the plastic films & sheets market on a global and regional basis.

The global plastic films & sheets market is dominated by players like:

- Bemis Company Inc.

- Dow Inc.

- Berry Global Group Inc.

- DuPont

- Polyplex Corporation Ltd

- ExxonMobil

- Borealis AG

- Sealed Air Corporation

- UFlex Ltd

- Amcor Plc

- Treofan Group

- and others.

The global plastic films & sheets market is segmented as follows;

By Material Type

- LLDPE

- LDPE

- HDPE

- BOPP

- BOPET

- CPP

- PVC

- PES

- PA

- EVOH

By Product

- Wraps

- Bags

- Pouches

- Laminates

- Liners

- Others

By Application

- Packaging

- Agriculture

- Construction

- Medical

- Consumer Goods

- Others

By End-user

- Food & Beverage

- Healthcare

- Industrial

- Personal Care

- Electronics

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Plastic films and sheets are thin, flat materials made from various polymers like polyethylene, polypropylene, or PVC. Films are usually flexible and used in packaging, while sheets are thicker and used in construction, signage, and industrial applications.

The global plastic films & sheets market is expected to grow due to rising demand in packaging, agriculture, construction, and healthcare, with material innovation for sustainability and performance enhancement.

According to study, the global plastic films & sheets market size was worth around USD 142.79 Billion in 2024 and is expected to reach USD 245.95 Billion by 2034.

The CAGR value of plastic films & sheets market is expected to be around 5.2% during the forecast period.

The global plastic films & sheets market will be led by Asia-Pacific during the projection period.

The global plastic films & sheets market is led by players like Bemis Company Inc., Dow Inc., Berry Global Group Inc., DuPont, Polyplex Corporation Ltd, ExxonMobil, Borealis AG, Sealed Air Corporation, UFlex Ltd, Amcor Plc, Treofan Group, and others., among others.

The report explores crucial aspects of the plastic films & sheets market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Plastic Films Sheets Market SizePlastic Films Sheets OverviewKey InsightsPlastic Films Sheets Growth DriversPlastic Films Sheets RestraintsPlastic Films Sheets OpportunitiesPlastic Films Sheets ChallengesPlastic Films Sheets SegmentationPlastic Films Sheets Report ScopePlastic Films Sheets Regional AnalysisPlastic Films Sheets Competitive AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed