Polyalkylene Glycol Market Size, Share, Analysis, Trends, Growth, 2028

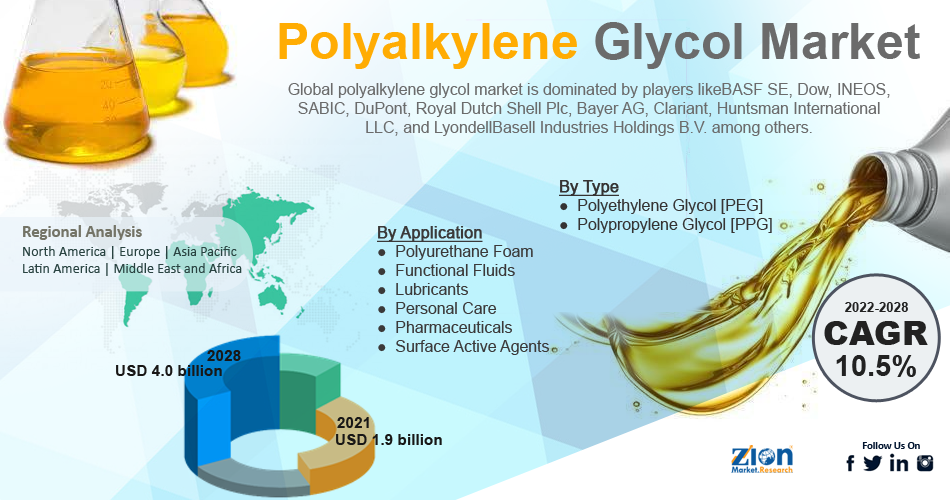

Global Polyalkylene Glycol Market By Type (Polyethylene Glycol [PEG] and Polypropylene Glycol [PPG]), By Application (Polyurethane Foam, Functional Fluids, Lubricants, Personal Care, Pharmaceuticals and Surface Active Agents), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.9 Billion | USD 4.0 Billion | 10.5% | 2021 |

Polyalkylene Glycol Industry Prospective:

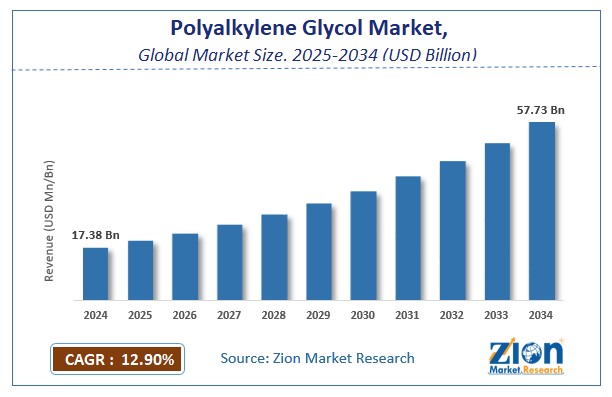

The global polyethylene glycol market size was worth around USD 1.9 billion in 2021 and is predicted to grow to around USD 4.0 billion by 2028 with a compound annual growth rate (CAGR) of roughly 10.5% between 2022 and 2028. The report analyzes the global polyalkylene glycol market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polyalkylene glycol market.

Polyalkylene Glycol Market: Overview

Ethylene oxide, propylene oxide, or copolymers of these are used to make polyalkylene glycol. These offer more performance advantages and are used to replace petroleum-based lubricants. Polyalkylene Glycol is more viscous, has a higher viscosity index, a lower vapor pressure, a higher flash point, and has higher solvency when compared to petroleum-based lubricants. They are also less likely to produce tar and sludge and have lower metal and ash contents.

To know more about this report, request a free sample copy.

Key Insights

- As per the analysis shared by our research analyst, the global polyalkylene glycol market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2022-2028).

- In terms of revenue, the global polyalkylene glycol market size was valued at around USD 1.9 billion in 2021 and is projected to reach USD 4.0 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, Polypropylene Glycol (PPG) was predicted to dominate the market in the year 2021

- Based on application, the lubricants segment held the largest market share in 2021

- Based on region, Asia Pacific held the largest revenue share in 2021

Request Free Sample

Request Free Sample

Polyalkylene Glycol Market: Growth Drivers

Increasing use of polyalkylene glycol in lubricants to drive the market

Because polyalkylene glycol is excellent for metal-on-metal applications with operating temperatures ranging from -40°C to 200°C, it is used as a base oil for lubricants such as gear lubricants, metalworking lubricants, refrigeration oil, and hydraulic fluids, among others. They are also used in situations requiring thermal stability and elastomeric compatibility at high temperatures. The development of high-performance lubricants for many end-use industries, including automotive, textile, food & beverage, and others, is being supported by the global lubricants industry participants' use of synthetic base oils. Leading lubricant manufacturers are creating PAG-based hydraulic and gear lubricants, including Shell, Castrol, Cargill, and Exxon. In October 2020, Shell Plc increased its lubricants business and added a few fire-resistant fluids based on polyalkylene glycol (PAG) to its product line. In end-use industries, these items are made to operate superbly even under difficult situations. Thus, driving the global polyalkylene glycol market growth.

Polyalkylene Glycol Market: Restraints

The availability of substitute products might hamper the market

There are many alternatives to polyalkylene glycol, including polyalphaolefin (PAO), artificial esters, ionic fluids, and more. The expansion of the global polyalkylene glycol market is being restrained by replacements since they have comparable chemical characteristics, functionality, and other characteristics like temperature range, viscosity, and more. The production of lubricants frequently substitutes polyalphaolefin (PAO). In terms of mineral oil solubility, polyalkylene glycol is inferior to polyalphaolefin because only some mineral oils are soluble in it, but polyalphaolefin is completely soluble in them. When compared to polyalphaolefin, the rolling wear feature of polyalkylene glycol is weaker. Additionally, the average cost of polyalkylene glycol ranges from about USD 2,800 to much more when comparing prices. While the average cost of polyalphaolefin per metric tonne is between USD 2,500 and USD 3,000. Thus, the aforementioned reasons are expected to limit the market growth during the forecast period.

Polyalkylene Glycol Market: Opportunities

Increasing demand for food-grade industrial lubricants is expected to drive market

During the forecast period, the demand for food-grade industrial lubricants is anticipated to increase significantly in the food processing sector. This is mostly due to a shift in demand for automated factories and lubrication systems. Common uses for polyalkylene glycol include metalworking fluids, food-grade lubricants, quenchants, and lubricants for hydraulic and compressor equipment. It is projected that these factors will produce profitable opportunities for the global polyalkylene glycol market.

Polyalkylene Glycol Market: Segmentation

The global polyalkylene glycol market is segmented based on type, application, and region

Based on the type, the global market is bifurcated into Polyethylene Glycol [PEG] and Polypropylene Glycol [PPG]. Polypropylene Glycol [PPG] held the largest market share in 2021 and is expected to show its dominance during the forecast period. As it is used to create a range of foams, including hard, spray, and flexible, PU foam is one of PPG's biggest customers. Additionally, it is frequently utilized as a lubricant and in deicing agent formulations in the automotive and aviation industries. Strong global demand for PU foam and lubricants will therefore have a beneficial impact on business growth. On the other hand, Polyethylene Glycol [PEG] is projected to grow at the highest CAGR during the forecast period due to its adaptable qualities, which make it desirable for widespread application across industries like plastics, chemicals, pharmaceuticals, and personal care. PEG is additionally utilized in lubricant formulations and functional fluids in the industrial, refrigeration, aerospace, and automotive industries.

Based on the application, the global polyalkylene glycol market is categorized into polyurethane foam, functional fluids, lubricants, personal care, pharmaceuticals, and surface active agents. The lubricants segment held the largest market share in 2021 and is expected to show similar trends over the projection period. This is due to the higher performance provided by PAG-based lubricants, which aid in achieving high performance in powerful vehicle engines, aircraft, marine applications, and automotive applications under difficult circumstances. Additionally, they are favored over their more established competitors because of their environmental friendliness.

Recent Developments:

- In July 2021, Dow, the global leading materials science company, announced a plan to expand its propylene glycol (PG) capacity at its existing facility in Map Ta Phut Operations, Rayong, Thailand. This high return, incremental investment supports growing demand and advances Dow’s leading positions in attractive flavor and fragrance, personal care, food, and pharmaceutical markets growing above GDP.

- In April 2022, Univar Solutions China Limited, a subsidiary of Univar Solutions Inc. ("Univar Solutions" or "the Company"), a global chemical and ingredient distributor and provider of value-added services, announced an extension of its relationship with Dow in connection with UCON PAG-based synthetic products in China. The strategic relationship with Dow allows them to provide customers with access to a robust portfolio of industrial product components.

Global Polyalkylene Glycol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Polyalkylene Glycol Market |

| Market Size in 2021 | USD 1.9 Billion |

| Market Forecast in 2028 | USD 4.0 Billion |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 168 |

| Key Companies Covered | BASF SE, Dow, INEOS, SABIC, DuPont, Royal Dutch Shell Plc, Bayer AG, Clariant, Huntsman International LLC, and LyondellBasell Industries Holdings B.V. among others |

| Segments Covered | By Product Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 - 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyalkylene Glycol Market: Regional Analysis

The Asia Pacific dominates the market during the forecast period

The Asia Pacific region is expected to dominate the global polyalkylene glycol market in 2021 and is expected to grow during the forecast period. The presence of major manufacturers such as China National Petroleum Corporation, BP Plc (Castrol), China Petroleum & Chemical Corporation, Royal Dutch Shell Plc, and ExxonMobil Corporation is the major factor that drives the market growth in the region. Moreover, Developing countries like China and India are producing more passenger cars, which is boosting the market's expansion over the projected period. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), the total automobile production in China reached 2,60,82,220 units in 2021, an increase from 2,52,25,242 units in 2020, and 2,57,20,665 units in 2019 respectively. Furthermore, the increasing disposable income of the population is one of the significant aspects that propel the market growth.

North America is expected to grow at a significant pace during the forecast period owing to the prevalence of substantial PU foam and lubricants demand in the U.S. Additionally, the existence of prominent players in the pharmaceutical industry propels the market growth in the region.

Polyalkylene Glycol Market: Competitive Analysis

The global polyalkylene glycol market is dominated by players like

- BASF SE

- Dow

- INEOS

- SABIC

- DuPont

- Royal Dutch Shell Plc

- Bayer AG

- Clariant

- Huntsman International LLC

- LyondellBasell Industries Holdings B.V.

- among others.

The global polyalkylene glycol market is segmented as follows:

By Type

- Polyethylene Glycol [PEG]

- Polypropylene Glycol [PPG]

By Application

- Polyurethane Foam

- Functional Fluids

- Lubricants

- Personal Care

- Pharmaceuticals

- Surface Active Agents

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global polyalkylene glycol market cap may grow owing to the increasing use of polyalkylene glycol in lubricants. The development of high-performance lubricants for many end-use industries, including automotive, textile, food & beverage, and others, is being supported by the global lubricants industry participants' use of synthetic base oils.

According to Zion Market Research, the global polyalkylene glycol market size was worth around USD 1.9 billion in 2021 and is predicted to grow to around USD 4.0 billion by 2028 with a compound annual growth rate (CAGR) of roughly 10.5% between 2022 and 2028.

The global polyalkylene glycol market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the increasing industrialization.

The global polyalkylene glycol market is dominated by players like BASF SE, Dow, INEOS, SABIC, DuPont, Royal Dutch Shell Plc, Bayer AG, Clariant, Huntsman International LLC and LyondellBasell Industries Holdings B.V. among others.

Choose License Type

List of Contents

Polyalkylene Glycol Industry Prospective:Polyalkylene Glycol OverviewKey InsightsPolyalkylene Glycol Growth DriversPolyalkylene Glycol RestraintsPolyalkylene Glycol OpportunitiesPolyalkylene Glycol SegmentationRecent Developments:GlobalReport ScopePolyalkylene Glycol Regional AnalysisPolyalkylene Glycol Competitive AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed