Polyester Staple Fiber Market Size, Share, Trends, Growth and Forecast 2032

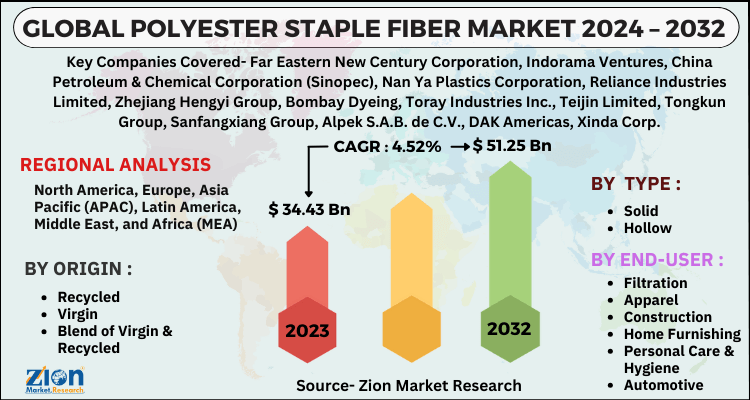

Polyester Staple Fiber Market By Origin (Recycled, Virgin, and Blend of Virgin & Recycled), By Type (Solid and Hollow), By End-User (Filtration, Apparel, Construction, Home Furnishing, Personal Care & Hygiene, Automotive, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

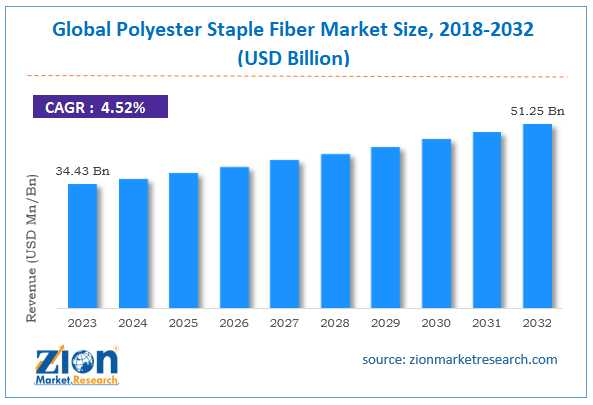

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.43 Billion | USD 51.25 Billion | 4.52% | 2023 |

Polyester Staple Fiber Industry Prospective:

The global polyester staple fiber market size was worth around USD 34.43 billion in 2023 and is predicted to grow to around USD 51.25 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.52% between 2024 and 2032.

Polyester Staple Fiber Market: Overview

Polyester staple fiber (PSF) is an artificially made synthetic fiber with applications across major industries. PSF is produced from materials such as Purified Terephthalic Acid (PTA) and Mono Ethylene Glycol (MEG) using a polymerization process.

The materials are subject to high pressure and temperature, leading to the production of PSF. The demand for polyester staple fiber has been growing due to increased demand from end-user industries since the material offers several advantages. For instance, PSF is known to have higher durability as compared to wool and cotton.

In addition to this, PSF also delivers higher abrasion and wrinkle resistance. The demand for PSF is witnessed across major industries such as textile, clothing & accessories, home decor, and automotive sectors.

However, since polyester staple fiber is artificially prepared, it is considered an environmental pollutant as it is non-biodegradable.

On the other hand, market players are trying to counter the environmental damage by using recycled raw materials which could help the polyester staple fiber industry expand further during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the global polyester staple fiber market is estimated to grow annually at a CAGR of around 4.52% over the forecast period (2024-2032)

- In terms of revenue, the global polyester staple fiber market size was valued at around USD 34.43 billion in 2023 and is projected to reach USD 51.25 billion by 2032.

- The polyester staple fiber market is projected to grow at a significant rate due to the rising use in the fast-fashion industry.

- Based on origin, the virgin segment is growing at a high rate and will continue to dominate the global market, as per industry projections.

- Based on end-user, the apparel segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Polyester Staple Fiber Market: Growth Drivers

Rising use in the fast-fashion industry will drive the market demand rate

The global polyester staple fiber market is projected to grow due to the rising use of the material in the fast-fashion clothing industry.

Generally, PSF is used in tandem with other materials, such as natural fibers, to improve the final application. Polyester staple fiber is known to have superior strength, cost-effectiveness, water absorption, abrasion resistance, and availability in multiple colors or designs. These characteristics have made the material highly sought after among the companies operating in the fast-fashion industry.

According to market experts, PSF can be used for producing a variety of clothing or textile-based products ranging from intimate wear to sports apparel. The rapid expansion of the fast-fashion industry across the globe is projected to continue impacting the demand for polyester staple fiber.

In 2023, the global fast-fashion industry was one of the fastest-growing industries, especially influenced by the emergence of several new online portals selling trendy clothing items at affordable rates.

In addition, the ultra-fast fashion industry is one step ahead of its predecessor. It leads to the production of clothing and fashion items at a rate quicker than fast fashion.

Growing applications in the automotive sector will promote higher market revenue in the long run

Polyester staple fibers have extensive applications in the growing automotive industry. The materials are used for several fabric-based parts of a vehicle, including carpet & floor mats, seat upholstery & fabric, and headliners & interior linings.

Alongside, PSF is also well-regarded to be used in the production of air & cabin filters, soundproofing materials & vibration dampening solutions in the vehicle.

The growing demand in the automotive industry for affordable yet high-functioning vehicles is expected to fuel expansion trends in the global polyester staple fiber industry.

For instance, PSF is easy to clean and maintain, which makes the material highly popular among automakers. The ongoing investments toward the rise of the automotive industry in emerging economies such as African regions, Asian countries, and others could provide new avenues for higher growth to the industry players.

Polyester Staple Fiber Market: Restraints

Environmental damage caused by PSF could limit the industry’s expansion rate

The global industry for polyester staple fiber is projected to be limited by concerns over environmental damage caused by the uncontrolled use of the material.

For instance, virgin PSF is produced using polyethylene terephthalate (PET), which is one of the largest environmental pollutants at present.

Additionally, the PSF production process is resource-intensive, with high energy and water demands. Since PSF is non-biodegradable, it acts as a key contributor to microplastic pollution as it survives in the environment for decades.

Polyester Staple Fiber Market: Opportunities

Changing focus toward PSF produced using recycled PET will generate more growth opportunities

The global polyester staple fiber market is expected to generate growth opportunities due to the growing focus on producing PSF using recycled PET.

According to industry experts, recycled polyethylene terephthalate acts as an efficient solution to the environmental damage caused by PET and PSF applications across end-user verticals.

The process of generating PSF from PET is relatively less resource-intensive and promotes a circular economy focusing on recycling and reusing existing materials for the production of new items.

For instance, in May 2021, Green Fiber, a leading Romanian recycler and a part of the Green Group family, announced that it was investing in recycling 2 billion polyethylene terephthalate bottles per year for producing sustainable polyester staple fiber with uses across major industries.

According to company claims, their 100% recycled polyester fibers will produce 50% less carbon dioxide (CO2) emissions compared to virgin counterparts.

Moreover, growing investments in PET recycling technology will help industry players scale up their PSF production rate, thus overcoming one of the major challenges in the polyester staple fiber sector.

In October 2024, Alterra, a novel plastic circularity process technology, announced the closure of its most significant equity investment round from Chevron Phillips Chemical, LyondellBasell, and Infinity Recycling.

Polyester Staple Fiber Market: Challenges

Competition from alternate solutions to challenge the market expansion trajectory

The global industry for polyester staple fiber is projected to be challenged by the high competition it faces from alternate solutions.

Some of the more popular substitute solutions include natural fibers such as cotton or wool, plant-based synthetic fibers including, lyocell, or bio-based synthetic fibers. These alternatives are more eco-friendly as well as currently available in large quantities.

Polyester Staple Fiber Market: Segmentation

The global polyester staple fiber market is segmented based on origin, type, end-user, and region.

Based on the origin, the global market divisions are recycled, virgin, and blend of virgin & recycled. In 2023, the highest growth was witnessed in the virgin segment.

The extensive use of newly produced PSF from raw materials such as PET is greater in the textile industry. The rising end-vertical application of virgin PSF is driven by the superior performance and versatility of the solutions. According to market research, a t-shirt made of 100% polyester contains around 150 grams of PSF.

Based on type, the global polyester staple fiber industry is divided into solid and hollow.

Based on the end-users, the global market segments are filtration, apparel, construction, home furnishing, personal care & hygiene, automotive, and others.

In 2023, the highest demand was listed in the apparel segment. It is driven by the growing use of PSF-based fabric in the clothing industry, especially in the form of fast and ultra-fast fashion.

The rising demand for affordable clothing solutions across age groups will promote segmental expansion trends in the future. The global ultra-fast fashion market was valued at USD 37.35 billion in 2023.

Polyester Staple Fiber Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyester Staple Fiber Market |

| Market Size in 2023 | USD 34.43 Billion |

| Market Forecast in 2032 | USD 51.25 Billion |

| Growth Rate | CAGR of 4.52% |

| Number of Pages | 215 |

| Key Companies Covered | Far Eastern New Century Corporation, Indorama Ventures, China Petroleum & Chemical Corporation (Sinopec), Nan Ya Plastics Corporation, Reliance Industries Limited, Zhejiang Hengyi Group, Bombay Dyeing, Toray Industries Inc., Teijin Limited, Tongkun Group, Sanfangxiang Group, Alpek S.A.B. de C.V., DAK Americas, Xinda Corp, Hyosung TNC., and others. |

| Segments Covered | By Origin, By Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyester Staple Fiber Market: Regional Analysis

Asia-Pacific to deliver the highest revenue during the projection period

The global polyester staple fiber market will be driven by Asia-Pacific during the forecast period. Countries such as China, India, Bangladesh, and others will drive regional market growth revenue in the coming years. China, for instance, is one of the leading producers of synthetic chemicals and materials for several end-user industries.

The presence of a large and robust manufacturing industry helps China deliver higher production-based revenue compared to other countries in the region.

In April 2024, China’s Xinjiang Uygur autonomous region in Korla city witnessed the operational inauguration of a new facility for the production of polyester staple fiber.

The annual output capacity of the unit is around 250,000 tonnes, thus becoming the largest producer of PSF in northwest China. Similarly, in a recent event, India’s largest conglomerate, Reliance, announced a new strategic partnership with Indian Oil Corporation (IOC) for the development of a new state-of-the-art PSF production facility in Gujarat.

The regional market is also impacted by the growing demand for PSF-based materials across the Asian automotive industry, which is expected to emerge as an influential player on the global scale by the end of the decade.

Polyester Staple Fiber Market: Competitive Analysis

The global polyester staple fiber market is led by players like:

- Far Eastern New Century Corporation

- Indorama Ventures

- China Petroleum & Chemical Corporation (Sinopec)

- Nan Ya Plastics Corporation

- Reliance Industries Limited

- Zhejiang Hengyi Group

- Bombay Dyeing

- Toray Industries Inc.

- Teijin Limited

- Tongkun Group

- Sanfangxiang Group

- Alpek S.A.B. de C.V.

- DAK Americas

- Xinda Corp

- Hyosung TNC.

The global polyester staple fiber market is segmented as follows:

By Origin

- Recycled

- Virgin

- Blend of Virgin & Recycled

By Type

- Solid

- Hollow

By End-User

- Filtration

- Apparel

- Construction

- Home Furnishing

- Personal Care & Hygiene

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyester staple fiber (PSF) is an artificially made synthetic fiber with applications across major industries.

The global polyester staple fiber market is projected to grow due to the rising use of the material in the fast-fashion clothing industry.

According to study, the global polyester staple fiber market size was worth around USD 34.43 billion in 2023 and is predicted to grow to around USD 51.25 billion by 2032.

The CAGR value of the polyester staple fiber market is expected to be around 4.52% during 2024-2032.

The global polyester staple fiber market will be driven by Asia-Pacific during the forecast period.

The global polyester staple fiber market is led by players like Far Eastern New Century Corporation, Indorama Ventures, China Petroleum & Chemical Corporation (Sinopec), Nan Ya Plastics Corporation, Reliance Industries Limited, Zhejiang Hengyi Group, Bombay Dyeing, Toray Industries, Inc., Teijin Limited, Tongkun Group, Sanfangxiang Group, Alpek S.A.B. de C.V., DAK Americas, Xinda Corp and Hyosung TNC.

The report explores crucial aspects of the polyester staple fiber market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed