POP Display Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

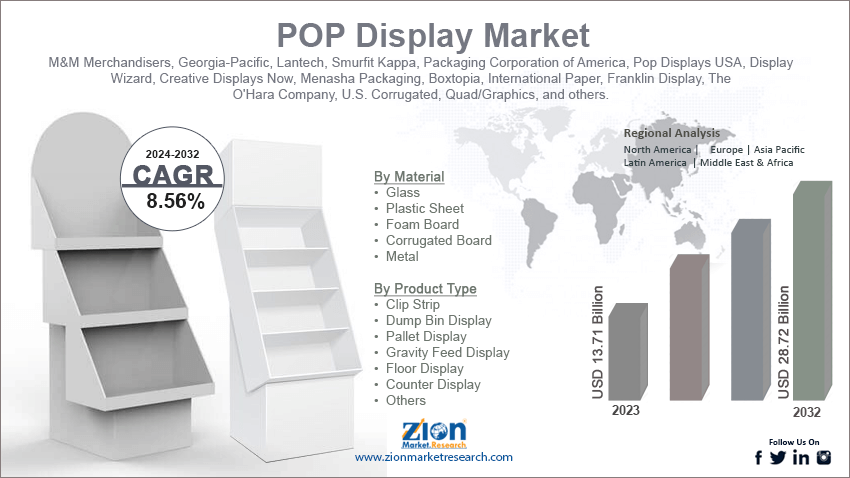

POP Display Market By Sales Channel (Departmental Stores, Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, and Others), By Material (Glass, Plastic Sheet, Foam Board, Corrugated Board, and Metal), By Product Type (Clip Strip, Dump Bin Display, Pallet Display, Gravity Feed Display, Floor Display, Counter Display, and Others), By Application (Automotive, Electronics, Printing & Stationery, Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

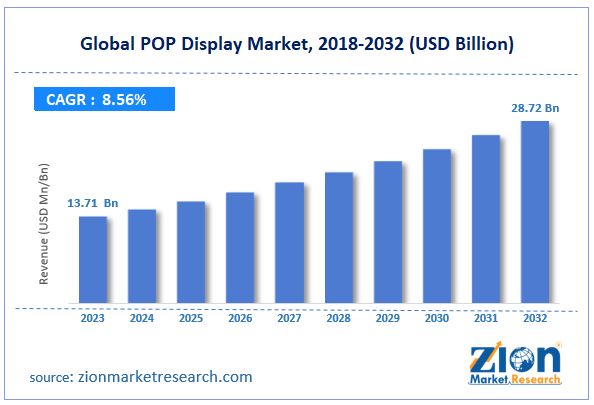

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.71 Billion | USD 28.72 Billion | 8.56% | 2023 |

POP Display Industry Prospective:

The global POP display market size was worth around USD 13.71 billion in 2023 and is predicted to grow to around USD 28.72 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.56% between 2024 and 2032.

POP Display Market: Overview

A point of purchase (POP) display is a part of a marketing technique that focuses on encouraging customers to make more purchases. According to market experts, POP displays can be highly effective in improving brand awareness and influencing customer shopping behavior when they are in-store. The ideal location of a POP display is near the product the shop management wants to sell or promote since point-of-purchase displays improve product visibility. Generally, POP displays can be located in high-traffic areas, including dump bins, freestanding displays, end caps, and floor graphics. POP displays typically use bold and color-coded letters to attract consumer attention.

Furthermore, the messages are tailored to tell a story or promote product value. POP displays are available in printed and electronic formats. They are either placed near the checkout area of a physical store or in the form of virtual signs in the case of online shops. POP displays are of three types: permanent, semi-permanent, and temporary. The use of permanent POP displays is generally seen among major brands since these products last for many years. During the forecast period, the demand for POP displays is projected to continue growing due to multiple factors. However, the rapidly evolving characteristics of POP displays could impact the final revenue in the POP display industry.

Key Insights:

- As per the analysis shared by our research analyst, the global POP display market is estimated to grow annually at a CAGR of around 8.56% over the forecast period (2024-2032)

- In terms of revenue, the global POP display market size was valued at around USD 13.71 billion in 2023 and is projected to reach USD 28.72 billion by 2032.

- The POP display market is projected to grow at a significant rate due to the growing number of supermarkets and hypermarkets.

- Based on sales channel, the hypermarkets & supermarkets segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on product type, the counter display segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

POP Display Market: Growth Drivers

Growing number of supermarkets and hypermarkets will drive the market demand rate

The global POP display market is expected to grow due to the rising number of hypermarkets, supermarkets, and convenience stores around the globe. Market analysis suggests a growing trend of increased footfall in retail outlets that offer multiple types of products and brands under one roof. Modern buyers are seeking solutions that reduce shopping time and offer excellent shopping convenience. Supermarkets traditionally house an extensive range of products, including food & beverage items to household electronic solutions. Consumers are not required to visit multiple stores to buy products to fulfill various needs.

In addition, official reports indicate an increase in strategic expansion policies adopted by major supermarket and hypermarket brands aiming to enter new consumer markets, especially in emerging nations.

For instance, the Swedish retail company Ikea has been investing huge amounts of resources in the Indian market in the last few years. In September 2024, the company broke grounds for an INR 5,500 crore mixed-use project in the Noida region of the country. POP displays are commonly found in supermarkets since the novel marketing tool is an excellent source for advertising new products or brand offers. Additionally, the growing competition among brands by adopting extensive product fragmentation policies has further encouraged the use of new techniques to hold consumer loyalty while garnering new buyers.

Online shopping stores to generate demand for more digital point-of-purchase displays

The global POP display market is expected to generate more revenue with the increasing investments in online shopping experiences. POP displays used across online portals are significantly different from the counterparts used in physical stores.

For instance, POP displays on websites include pop-up windows recommending new products or services. It may also include promotion banners with attention-grabbing text offering special discounts or incentives. A widely popular technique adopted by POP display users in the online space includes exit intent pop-ups that appear when a consumer is about to make the final checkout, thus encouraging them to indulge in impulse shopping.

POP Display Market: Restraints

Evolving characteristics of POP displays to limit the industry’s growth rate

The global POP display industry is expected to be restricted due to the constantly evolving trait of the solution. POP displays can easily become redundant after a few weeks or months and brands may have to come up with a new format of using the point-of-purchase display technique. Brands must perpetually stay updated with recent trends, which can be time and resource-consuming. In addition, the industry lacks an objective means of measuring return on investment (ROI) value and defining the exact impact of POP displays on business profits.

POP Display Market: Opportunities

Innovations in display technology to generate new expansion possibilities for industry players

The global POP display market is projected to generate growth opportunities due to the rising rate of display technology-based innovations. For instance, in November 2024, South Korea-based LG Display announced the launch of the world’s first stretchable display. It can expand by up to 50% and includes innovative features such as a 12-inch screen stretching up to 18 inches. The display will continue to deliver a high resolution of 100 ppi even when stretched to the limit.

Furthermore, POP display manufacturers are actively working on developing more interactive displays offering creative visuals. These displays aim to engage consumers instead of just displaying product information. The growing use of motion sensor technology in improving the overall performance of POP displays is a fine example of technology integration in display technology.

Furthermore, the surge in efforts to reduce the impact of POP displays on the environment can open new doors for future growth for market leaders. The use of sustainable business practices, such as incorporating recycled paper or cardboard to create POP displays, will attract environmentally conscious buyers. For instance, in June 2024, Tesco and Mars Wrigley launched a trial of a new display made using recycled paper and waste cocoa bean shells, thus eliminating the use of virgin tree fibers.

POP Display Market: Challenges

High upfront cost and over-competitiveness to challenge market expansion trends

The global POP display industry is expected to be challenged by the high cost of initial investment required to install superior-grade point-of-purchase displays. In addition, if each brand starts using POP displays in a retail outlet, consumers may find it overwhelming, leading to a loss of interest. POP displays can occupy more space in a retail setting, leading to limited space for consumers to move.

Request Free Sample

Request Free Sample

POP Display Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | POP Display Market |

| Market Size in 2023 | USD 13.71 Billion |

| Market Forecast in 2032 | USD 28.72 Billion |

| Growth Rate | CAGR of 8.56% |

| Number of Pages | 220 |

| Key Companies Covered | M&M Merchandisers, Georgia-Pacific, Lantech, Smurfit Kappa, Packaging Corporation of America, Pop Displays USA, Display Wizard, Creative Displays Now, Menasha Packaging, Boxtopia, International Paper, Franklin Display, The O'Hara Company, U.S. Corrugated, Quad/Graphics, and others. |

| Segments Covered | By Sales Channel, By Material, By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

POP Display Market: Segmentation

The global POP display market is segmented based on sales channel, material, product, application, and region.

Based on sales channel, the global market segments are departmental stores, hypermarkets & supermarkets, convenience stores, specialty stores, and others. In 2023, the highest growth was listed in the hypermarkets & supermarkets segment. These facilities offer an excellent range of products and solutions, thus attracting larger consumer footfall.

Additionally, the surging expansion of popular supermarket chains in other markets will create future growth opportunities for POP display providers. Walmart, a highly influential player in the supermarket sector originating in the US, announced its plans to launch nearly 150 more stores by 2028.

Based on material, the global POP display industry is divided into glass, plastic sheet, foam board, corrugated board, and metal.

Based on the product type, the global market divisions are clip strips, dump bin display, pallet display, gravity feed display, floor display, counter display, and others. In 2023, the highest revenue was generated by the counter display segment due to its extensive use in displaying and marketing commonly purchased products. It is often used to showcase items that may be a part of impulse buying, such as snacks and cosmetics.

According to market research, more than 83% of regular shoppers have indulged in some form of impulse buying in the last few shopping experiences.

Based on application, the global market divisions are automotive, electronics, printing & stationery, pharmaceuticals, cosmetics & personal care, food & beverages, and others.

POP Display Market: Regional Analysis

Asia-Pacific to generate the highest revenue during the forecast period

The global POP display market will be dominated by Asia-Pacific during the forecast period. The primary reason for higher regional ROI is the presence of a massive consumer group across major Asian countries, including South Korea, India, and China. Asia-Pacific is witnessing an increase in consumer lifestyle and purchasing power, resulting in greater demand for everyday essentials, personal care items, and food & beverages.

In June 2024, SPAR China announced the launch of a new supermarket store in Zhanjiang World Trade Center. The supermarket is spread across a 4,000m2 area and offers competitive prices on all types of products. Additionally, Asia-Pacific is also registering an influx of international brands entering the regional market.

North America is a prominent market for POP displays. The presence of massive supermarkets and retail stores across North American countries helps the region thrive. Some of the leading supermarket brands include Costco, Walmart, Whole Foods Market, and Target. In addition, higher purchasing power, along with the increasing trend of impulse buying among the North American population, further aids growth in regional revenue.

POP Display Market: Competitive Analysis

The global POP display market is led by players like:

- M&M Merchandisers

- Georgia-Pacific

- Lantech

- Smurfit Kappa

- Packaging Corporation of America

- Pop Displays USA

- Display Wizard

- Creative Displays Now

- Menasha Packaging

- Boxtopia

- International Paper

- Franklin Display

- The O'Hara Company

- U.S. Corrugated

- Quad/Graphics

The global POP display market is segmented as follows:

By Sales Channel

- Departmental Stores

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Others

By Material

- Glass

- Plastic Sheet

- Foam Board

- Corrugated Board

- Metal

By Product Type

- Clip Strip

- Dump Bin Display

- Pallet Display

- Gravity Feed Display

- Floor Display

- Counter Display

- Others

By Application

- Automotive

- Electronics

- Printing & Stationery

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A point-of-purchase (POP) display is a marketing technique that focuses on encouraging customers to make more purchases.

The global POP display market is expected to grow due to the rising number of hypermarkets, supermarkets, and convenience stores around the globe.

According to study, the global POP display market size was worth around USD 13.71 billion in 2023 and is predicted to grow to around USD 28.72 billion by 2032.

The CAGR value of the POP display market is expected to be around 8.56% during 2024-2032.

The global POP display market will be dominated by Asia-Pacific during the forecast period.

The global POP display market is led by players like M&M Merchandisers, Georgia-Pacific, Lantech, Smurfit Kappa, Packaging Corporation of America, Pop Displays USA, Display Wizard, Creative Displays Now, Menasha Packaging, Boxtopia, International Paper, Franklin Display, The O'Hara Company, U.S. Corrugated and Quad/Graphics.

The report explores crucial aspects of the POP display market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed