Process Oil Market Size, Share, Trends, Growth 2028

Process Oil Market By Type (Naphthenic, Paraffinic, Non-carcinogenic, and Aromatic), By Application (Tire & Rubber, Polymer, Personal Care, Textile, Others, Automotive, Adhesives & Sealants, and Defoaming), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2022 - 2028

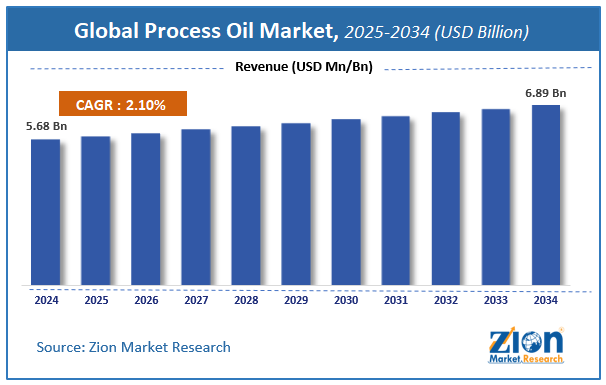

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4515.2 Million | USD 5055.01 Million | 1.9% | 2021 |

Process Oil Market Size And Forecast

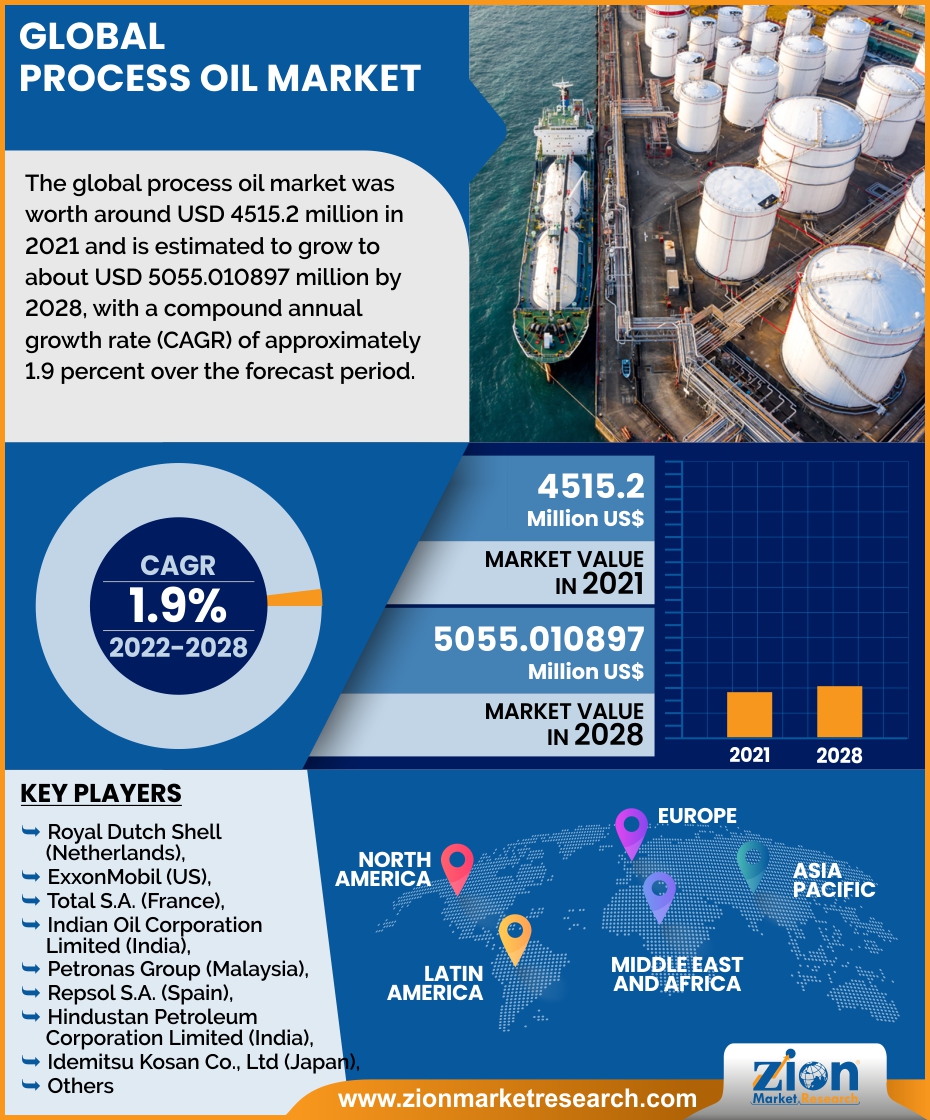

The global process oil market size was worth around USD 4515.2 million in 2021 and is estimated to grow to about USD 5055.010897 million by 2028, with a compound annual growth rate (CAGR) of approximately 1.9 percent over the forecast period. The report analyzes the digital remittance market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the digital remittance market.

Process Oil Market: Overview

Process oils are special oils that are used in a variety of chemical and technical sectors as a raw material component or as a processing aid. It's a mix of diverse processing products like paraffinic, naphthenic, and aromatic chemicals, all of which can have any molecular weight. Process oil is produced by refining techniques such as catalytic dewaxing and advanced hydrocracking. The process oil is colorless after refining, and it has outstanding performance features like high saturation, low volatility, and higher purity and stability. Sulfur, polar compounds, and aromatics are all largely absent. It is primarily employed in the rubber industry, with some other end-user industries following closely behind.

Chemical peptizers, petroleum oil, fatty acid soaps and esters, liquid polymers, partially vulcanized rubber, and waxes are all examples of process oil. Plastics, polymers, rubber, tyres, adhesives, personal care, defoamers, and textiles are just a few of the industries that use process oil. The rising usage of process oil in the personal care and polymer industries, followed by the textile industry, is one of the key drivers of the process oil market. Natural-based products are becoming more popular among personal-care consumers. This is good for the personal care industry. Polymer products utilized in consumer goods, automotive, medical, and industrial uses are made with process oil.

COVID-19 Impact:

Process oil can be found in a variety of industries, including tyre and rubber, polymer, personal care, and textiles. However, industries across the world were affected by the pandemic. During 2019–2020, the industry's expansion has been impeded by a labor shortage, logistical constraints, material shortages, and other constraints. COVID-19 has had a global impact on the tire and rubber sector and its raw materials suppliers, with the industry shutting down for an extended period in 2020. COVID-19 has had a massive economic impact on the major tire and rubber industries in 2020, with most companies reporting significantly lower earnings. The financial impact of the pandemic has prompted several tire manufacturers to perform strategic assessments of their whole operations, thus lowering market demand for process oil.

Process Oil Market: Growth Drivers

Growing tyre manufacturing industry across the globe

Fine tolerances in tyre manufacturing, the use of radial tyres to minimize vehicle fuel consumption, low rolling resistance tyres, and an emphasis on enhancing grip and road performance of tyres to boost vehicle fuel efficiency are among the most recent tyre industry trends. Process oils are one of the most important components in tyre production. The rise of the automobile industry has a direct impact on global tyre usage. Vehicle production has a direct impact on tyre demand around the world. Consequently, the process oil market is likely to be driven by the global automotive industry's expansion over the forecast period.

Process oil is a blend of aromatic compounds, naphthenic, and paraffinic. The molecular weight of process oil varies at different temperatures. It is mainly treated as a raw material that aids in engaging with compounds in various sectors, such as polymers, rubber, and textile. Additionally, process oil is formed by refining procedures, such as catalytic advanced hydrocracking and de-waxing process. After distillation, the obtained process oil is colorless and has features, such as low volatility, high saturation, enhanced stability, and pure. Process oil has its usage in a diverse range of applications in different business sectors, such as plastics, tire, polymer, personal care, rubber, defoamers, adhesives, and textile.

Process Oil Market: Restraints

The fluctuating price of crude oil

The distillation process is used to obtain process oils from crude oil. Heavy distillates are used to make base oils and process oils, whereas light distillates are utilized to make goods like gasoline and diesel. As a result, fluctuations in the price of crude oil have an impact on the profit margins of enterprises that produce process oil. Low margins for its producers and distributors have resulted from fierce competition in the process oil industry and unpredictable crude oil prices.

The process oil market is likely to experience a high rate of growth in the future, due to its usage and application globally. The development of the process oil market can be mainly attributed to the rising industrialization and increasing mechanization, which, in turn, is likely to lead to an increased process oil demand. In addition, the ongoing rapid development and modernization in the automobile and transportation sector are projected to positively impact this market. The utilization of process oils in various end-use industries, such as rubber, polymer, and personal care, is the primary factor likely to boost this market in the upcoming years. However, the presence of carcinogens polycyclic aromatic hydrocarbons (PAH) and polycyclic aromatics (PCA) in process oils might limit this market’s development in the upcoming years.

Process Oil Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Process Oil Market |

| Market Size in 2021 | USD USD 4515.2 Million |

| Market Forecast in 2028 | USD USD 5055.010897 Million |

| Growth Rate | CAGR of 1.9% |

| Number of Pages | 194 |

| Key Companies Covered | Royal Dutch Shell (Netherlands), ExxonMobil (US), Total S.A. (France), Indian Oil Corporation Limited (India), Petronas Group (Malaysia), Repsol S.A. (Spain), Hindustan Petroleum Corporation Limited (India), Idemitsu Kosan Co., Ltd (Japan), Unipetrol Group (Czech Republic), Panama Petrochem Ltd (India), Nynas AB (Sweden), H&R Group (Germany), Apar Industries (India), Gandhar Oil Refinery Limited (India), and Hollyfrontier Refining & Marketing LLC (US). |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Process Oil Market: Segmentation

The global process oil market is segregated based on type and application.

By Type, the market is classified into Naphthenic, Paraffinic, Non-carcinogenic, and Aromatic. In terms of value, the non-carcinogenic kind was the second-largest segment in 2021. Tires using non-carcinogenic process oils have the better abrasion resistance and rolling resistance. For the production of Styrene-Butadiene Rubber, tyre manufacturers employ non-carcinogenic process oils (SBR).

By Application, the market is classified into Tire & Rubber, Polymer, Personal Care, Textile, Others, Automotive, Adhesives & Sealants, and Defoaming. In terms of value, the polymer application was the second-largest segment in 2021. Plasticizing agents, catalyst carriers, extender oils, mold release agents, and pigment-dispersing agents are all examples of process oils used in the polymer sector. These oils improve a plastic's wetting qualities, allowing it to be utilized on a wider range of substrates and making it more flexible.

Recent Developments

- In June 2019, Idemitsu has launched a new lubricant production plant in Huizhou, China, which will be the company's second in the country, with a capacity of 120,000 kiloliters per year.

- In October 2021, Chevron Global Energy Inc, a wholly-owned subsidiary of Chevron Corporation, announced the acquisition of Neste Oyj's "NEXBASE" brand from Neste Oyj. Neste's complete worldwide base oils business, its premium brand NEXBASE, all formulation coverage related to the brand, as well as a global marketing and distribution infrastructure are all covered by the agreement, which is made up of a combination of share and asset purchases. Neste's base oils supply from Porvoo, Finland, will also be off taken on a long-term basis by the parties.

Process Oil Market: Regional Landscape

Asia-Pacific has become an area with immense promise and opportunity due to the increasing demand for textiles and personal care goods in nations like India and China. China has surpassed the United States as the world's largest provider of textiles and apparel since 1994. By focusing on OEM production and processing, the country controls the global low-to-medium end market, while the EU continues to dominate the global upmarket and high-quality textile business. North America will be the second-largest process oil market in terms of value in 2021. The North American process oil business is expected to grow slowly since end-use sectors such as rubber and polymer have reached maturity in the region. However, because the majority of the region's refineries that produce naphthenic products are based in the United States, naphthenic goods are more expensive.

Process Oil Market: Competitive Landscape

Some of the main competitors dominating the global process oil market include -

- Royal Dutch Shell (Netherlands)

- ExxonMobil (US)

- Total S.A. (France)

- Indian Oil Corporation Limited (India)

- Petronas Group (Malaysia)

- Repsol S.A. (Spain)

- Hindustan Petroleum Corporation Limited (India)

- Idemitsu Kosan Co., Ltd (Japan)

- Unipetrol Group (Czech Republic)

- Panama Petrochem Ltd (India)

- Nynas AB (Sweden)

- H&R Group (Germany)

- Apar Industries (India)

- Gandhar Oil Refinery Limited (India)

- Hollyfrontier Refining & Marketing LLC (US).

Global process oil market is segmented as follows:

By Type

- Naphthenic

- Paraffinic

- Non-carcinogenic

- Aromatic

By Application

- Tire & Rubber

- Polymer

- Personal Care

- Textile

- Others

- Automotive

- Adhesives & Sealants

- Defoaming

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fine tolerances in tyre manufacturing, the use of radial tyres to minimize vehicle fuel consumption, low rolling resistance tyres, and an emphasis on enhancing grip and road performance of tyres to boost vehicle fuel efficiency are among the most recent tyre industry trends. Process oils are one of the most important components in tyre production. The rise of the automobile industry has a direct impact on global tyre usage. Vehicle production has a direct impact on tyre demand around the world. Consequently, the process oil market is likely to be driven by the global automotive industry's expansion over the forecast period.

According to the Market Research report, the global process oil market was worth around USD 4515.2 million in 2021 and is estimated to grow to about USD 5055.010897 million by 2028, with a compound annual growth rate (CAGR) of approximately 1.9 percent over the forecast period.

Asia-Pacific has become an area with immense promise and opportunity due to the increasing demand for textiles and personal care goods in nations like India and China. China has surpassed the United States as the world's largest provider of textiles and apparel since 1994. By focusing on OEM production and processing, the country controls the global low-to-medium end market, while the EU continues to dominate the global upmarket and high-quality textile business. North America will be the second-largest process oil market in terms of value in 2021. The North American process oil business is expected to grow slowly since end-use sectors such as rubber and polymer have reached maturity in the region. However, because the majority of the region's refineries that produce naphthenic products are based in the United States, naphthenic goods are more expensive.

Some of the main competitors dominating the global process oil market include - Royal Dutch Shell (Netherlands), ExxonMobil (US), Total S.A. (France), Indian Oil Corporation Limited (India), Petronas Group (Malaysia), Repsol S.A. (Spain), Hindustan Petroleum Corporation Limited (India), Idemitsu Kosan Co., Ltd (Japan), Unipetrol Group (Czech Republic), Panama Petrochem Ltd (India), Nynas AB (Sweden), H&R Group (Germany), Apar Industries (India), Gandhar Oil Refinery Limited (India), and Hollyfrontier Refining & Marketing LLC (US).

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed