Global Pulp and Paper Automation Market Size, Share, Analysis, Trends, Growth, 2032

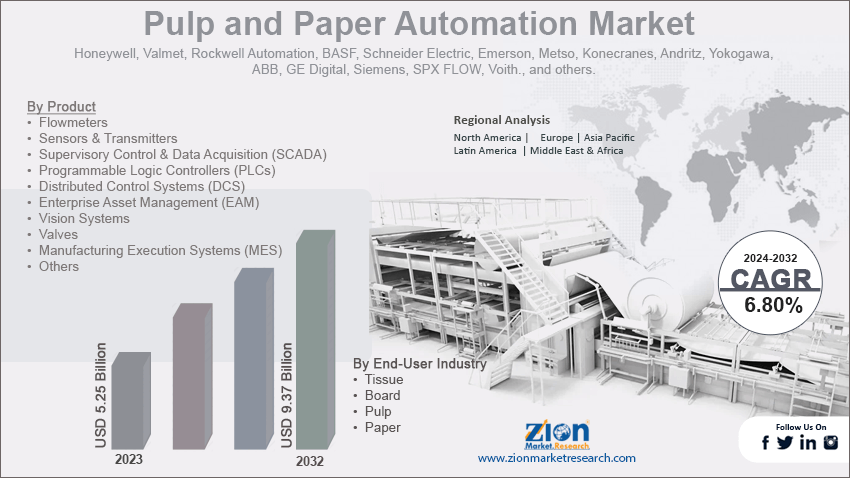

Pulp and Paper Automation Market By Product (Flowmeters, Sensors & Transmitters, Supervisory Control & Data Acquisition (SCADA), Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), Enterprise Asset Management (EAM), Vision Systems, Valves, Manufacturing Execution Systems (MES), and Others), By End-User Industry (Tissue, Board, Pulp, and Paper), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

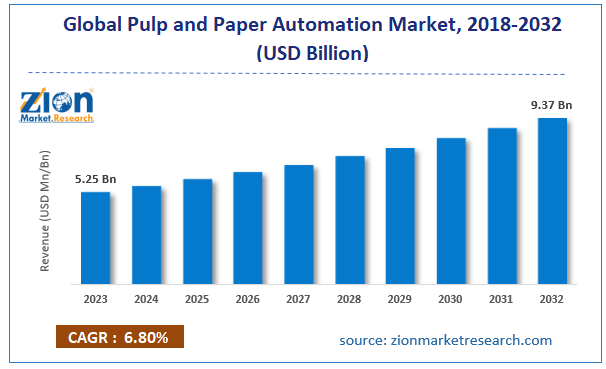

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.25 Billion | USD 9.37 Billion | 6.80% | 2023 |

Pulp and Paper Automation Industry Prospective:

The global pulp and paper automation market size was worth around USD 5.25 billion in 2023 and is predicted to grow to around USD 9.37 billion by 2032, with a compound annual growth rate (CAGR) of roughly 6.80% between 2024 and 2032.

Pulp and Paper Automation Market: Overview

Pulp and paper automation deals with the extensive use of advanced technologies to streamline the paper and paper industry. Automation leverages the advantages of sensors, robotics, control systems, software, and other cutting-edge solutions to improve the paper and pulp production rate. According to market analysts, the growing demand for wood-based products worldwide is expected to promote the adoption of automation solutions during the production and manufacturing of paper or pulp.

Some of the major advantages of automation in the paper and pulp industry include improved overall operational efficiency as well as reduced waste. Industry research indicates that the production of cellulose-based products is a water-intensive process.

Automating the production process of objects derived from wood can help manage water resources more efficiently, thus promoting sustainability. Advanced equipment, sensors, and other technologies have registered applications across various steps involved in the production of wood products.

For instance, automated solutions are used in wood handling or preparation, pulping, bleaching, papermaking, and final packaging. During the forecast period, the industry for pulp and paper automation is expected to register a significant growth rate driven by several favorable factors. However, the high cost of technology, as well as concerns over manual job replacements, will affect the final growth rate in the sector.

Key Insights:

- As per the analysis shared by our research analyst, the global pulp and paper automation market is estimated to grow annually at a CAGR of around 6.80% over the forecast period (2024-2032)

- In terms of revenue, the global pulp and paper automation market size was valued at around USD 5.25 billion in 2023 and is projected to reach USD 9.37 billion by 2032.

- The pulp and paper automation market is projected to grow at a significant rate due to the rising applications of cellulose-based products in the food and healthcare industries.

- Based on product, the flowmeter segment is growing at a high rate and will continue to dominate the global market, as per industry projections.

- Based on end-user industry, the paper segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Pulp and Paper Automation Market: Growth Drivers

Rising applications of cellulose-based products in food and healthcare industries to drive market demand rate

The global pulp and paper automation market is expected to grow due to the growing end-user applications of cellulose-based products across the healthcare and food industries. Extensive market research indicates that the food & beverages (F&B) and healthcare sectors are some of the leading users of paper-based packaging as well as labeling solutions.

For instance, items produced by the pulp and paper sector are used as adhesive paper labels, an essential component of the food packaging industry. In addition to this, they are also used for medical packaging with a special focus on sterile paper packaging. The global healthcare industry is one of the fastest growing sectors driven by an urgent need to improve medical care infrastructure worldwide.

Furthermore, the surge in healthcare expenditure and increased rate of medical devices have resulted in greater application of paper and pulp packaging options, further encouraging industry players to adopt automated systems. In November 2024, Nestle USA announced an investment of USD 150 million for the expansion of the company’s frozen food facility in the country.

Surging pressure on the industry to optimize the application of key resources will promote the use of automated solutions

The global pulp and paper automation market is expected to benefit from the growing pressure on the industry to ensure optimal use of essential resources. The production of pulp and paper is a highly resource-intensive process, especially in terms of water and energy use. For instance, generally, pulp mills utilize around 15,000 gallons of water per ton of pulp produced in case water utilization is not optimal.

However, the growing shortage of clean water worldwide has resulted in increased demand for optimizing industrial processes in the pulp and paper sector, promoting the adoption of automated machines. The industry players are focusing heavily on advanced equipment that can improve water recycling processes, such as closed-loop systems.

Pulp and Paper Automation Market: Restraints

High cost of the technology to limit the industry’s expansion rate

The global pulp and paper automation industry is projected to be restricted due to the high cost of the technology. Automated machines are state-of-the-art engineering tools powered by sophisticated technologies.

In addition to this, they are built after years of intensive research & development, which leads to further increment in the overall cost of the tool. The use of superior-grade components, as well as customization needs and software integration, may contribute to additional expenses associated with pulp and paper automation. The growing economic vitality around the world will discourage the paper and pulp industries from investing in automated solutions on a large scale.

Pulp and Paper Automation Market: Opportunities

Growing rate of technology innovation and strategic partnerships to generate growth opportunities

The global pulp and paper automation market is projected to generate growth opportunities due to the rising rate of technological innovation. In addition to this, the surge in the number of strategic partnerships worldwide is further expected to open new doors for extensive growth.

For instance, in September 2024, Arauco, a leading producer of plywood, composite panels, wood pulp, lumber, and other such products, announced an investment of EUR 1 billion for the security of a highly specialized and fully integrated pulp mill from Valmet. The facility is expected to commence operations in 2027, and according to official reports, it is set to become the largest single-phase pulp mill in the world. On the other hand, in a recent event, ABB, a prominent automation company, announced the launch of a High-Performance infrared reflection (HPIR-R) moisture sensor.

As per company claims, it is the world’s most precise and fastest moisture monitoring tool available in the market. It can take up to 5,000 measurements per second, thus allowing mills to increase output and subsequently reduce operating costs. Furthermore, the growing advancements in Industry 4.0 and the introduction of the 5G network and Internet of Things (IoT) tools will aid further market expansion in the coming years.

Pulp and Paper Automation Market: Challenges

Concerns over human job replacements and skills gap to challenge market expansion

The global industry for pulp and paper automation is projected to be challenged by growing concerns over human job replacements. Automated solutions can impact the demand for manual labor, leading to a loss of job opportunities. In addition, market players face additional problems due to the lack of supply of skilled labor comfortable working with cutting-edge engineering marvels.

Request Free Sample

Request Free Sample

Pulp and Paper Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pulp and Paper Automation Market |

| Market Size in 2023 | USD 5.25 Billion |

| Market Forecast in 2032 | USD 9.37 Billion |

| Growth Rate | CAGR of 6.80% |

| Number of Pages | 227 |

| Key Companies Covered | Honeywell, Valmet, Rockwell Automation, BASF, Schneider Electric, Emerson, Metso, Konecranes, Andritz, Yokogawa, ABB, GE Digital, Siemens, SPX FLOW, Voith., and others. |

| Segments Covered | By Product, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pulp and Paper Automation Market: Segmentation

The global pulp and paper automation market is segmented based on product, end-user industry, and region.

Based on product, the global market segments are flowmeters, sensors & transmitters, supervisory control & data acquisition (SCADA), programmable logic controllers (PLCs), distributed control systems (DCS), enterprise asset management (EAM), vision systems, valves, manufacturing execution systems (MES), and others. In 2023, the highest demand was listed in the flowmeter segment. It is one of the most commonly used automated tools, helping the paper and pulp industry optimize business performance.

Additionally, sensors & transmitters are also among the leading revenue generators in the industry since they help industry players manage critical aspects of business processes such as humidity, temperature, and chemical composition. The average cost of an electromagnetic flowmeter is around USD 2000 for industrial applications.

Based on end-user industry, the global pulp and paper automation industry divisions are tissue, board, pulp, and paper. In 2023, the highest output was observed in the paper segment. The growing end-user demand for paper-based products across major industries is helping the segment thrive.

Furthermore, the rising applications of paper-based packaging as a sustainable alternative to plastic packaging will drive the paper consumption index during the forecast period. According to market research, the world produces more than 400 million tonnes of paper and paperboard every year.

Pulp and Paper Automation Market: Regional Analysis

North America to register the highest growth rate during the forecast period

The global pulp and paper automation market is expected to witness the highest growth in North America during the forecast period. The US is projected to lead the regional revenue rate due to the growing demand for automated solutions across major industries in the country.

Furthermore, the US has significant, well-established paper mills producing large volumes of paper and paperboard. In addition, the growing focus in the North American market for sustainable business practices has helped the region thrive in the last few years. In September 2023, Pratt Industries announced the launch of its 100% recycled paper mill and corrugated box facility worth USD 700 million in the Kentucky area. According to official reports, it is the world’s most environmentally friendly and technologically advanced paper mill.

Furthermore, the facility is projected to save nearly 25,000 trees every day. In August 2022, the WestRock Company paper mill broke ground for the construction of a highly modernized paper mill worth USD 97 million, creating expansion possibilities for paper and pulp automated equipment providers. Regional advancements in technological solutions and lower costs of automated equipment will encourage significant market expansion.

Pulp and Paper Automation Market: Competitive Analysis

The global pulp and paper automation market is led by players like:

- Honeywell

- Valmet

- Rockwell Automation

- BASF

- Schneider Electric

- Emerson

- Metso

- Konecranes

- Andritz

- Yokogawa

- ABB

- GE Digital

- Siemens

- SPX FLOW

- Voith

The global pulp and paper automation market is segmented as follows:

By Product

- Flowmeters

- Sensors & Transmitters

- Supervisory Control & Data Acquisition (SCADA)

- Programmable Logic Controllers (PLCs)

- Distributed Control Systems (DCS)

- Enterprise Asset Management (EAM)

- Vision Systems

- Valves

- Manufacturing Execution Systems (MES)

- Others

By End-User Industry

- Tissue

- Board

- Pulp

- Paper

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pulp and paper automation extensively uses advanced technologies to streamline the paper and paper industry.

The global pulp and paper automation market is expected to grow due to the growing end-user applications of cellulose-based products across the healthcare and food industries.

According to study, the global pulp and paper automation market size was worth around USD 5.25 billion in 2023 and is predicted to grow to around USD 9.37 billion by 2032.

The CAGR value of the pulp and paper automation market is expected to be around 6.80% during 2024-2032.

The global pulp and paper automation market is expected to witness the highest growth in North America during the forecast period.

The global pulp and paper automation market is led by players like Honeywell, Valmet, Rockwell Automation, BASF, Schneider Electric, Emerson, Metso, Konecranes, Andritz, Yokogawa, ABB, GE Digital, Siemens, SPX FLOW and Voith.

The report explores crucial aspects of the pulp and paper automation market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed