Radar Systems Market Size Report, Industry Share, Analysis, Growth, 2030

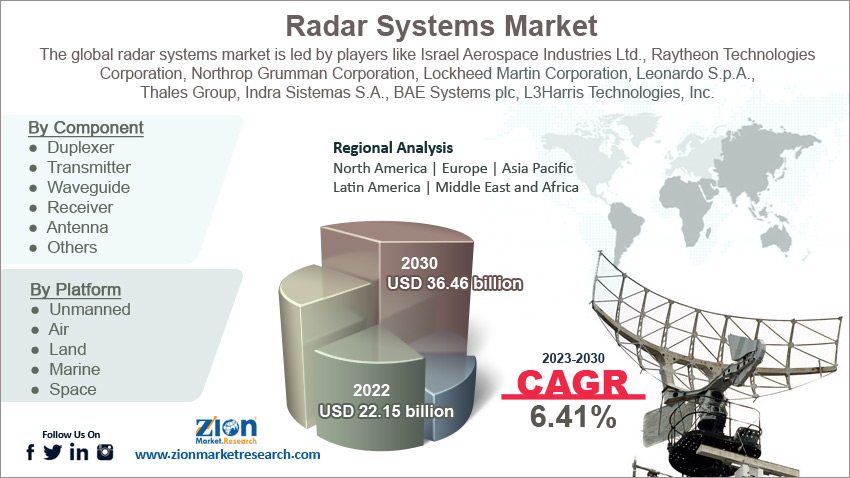

Radar Systems Market By Platform (Unmanned, Air, Land, Marine, and Space), By Application (Defense, National Security, and Commercial), By Type (S-Band and X-Band), By Component (Duplexer, Transmitter, Waveguide, Receiver, Antenna, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

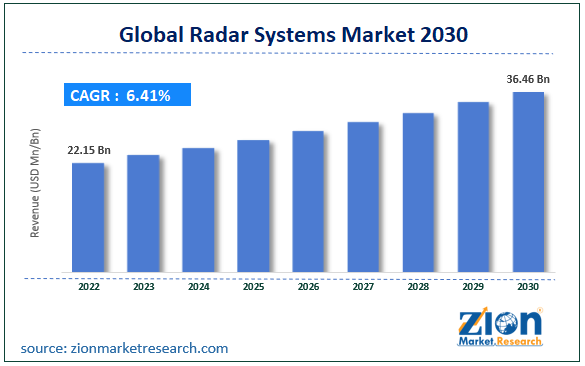

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.15 Billion | USD 36.46 Billion | 6.41% | 2022 |

Radar Systems Industry Prospective:

The global radar systems market size was worth around USD 22.15 billion in 2022 and is predicted to grow to around USD 36.46 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.41% between 2023 and 2030.

The report delves deeper into several crucial aspects of the global radar systems industry. It includes a detailed discussion of existing growth factors and restraints. Future growth opportunities and challenges that impact the radar systems market are comprehensively addressed in the report.

Radar Systems Market: Overview

A radar is defined as an electromagnetic system that assists in the detection, location, tracking, and recognition of almost all forms of objects situated at a certain distance. It operates using electromagnetic energy that it transmits toward the target or the object. It is further able to determine the final distance from the point of observation by registering and analyzing the echoes that return from the target. This includes objects such as astronomical bodies, spacecraft, satellites, rain, insects, ships, and almost all other observable things in the surrounding. One of the key differences between radar systems and other forms of object-sensing technologies such as infrared and optical sensors is the distances at which radar systems can accurately detect objects even in harsh weather conditions. Radar systems are active sensing technologies. It means that they are equipped with their illumination source used for targeting objects. The radar systems industry for radar systems has tremendous growth opportunities during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global radar systems market is estimated to grow annually at a CAGR of around 6.41% over the forecast period (2023-2030)

- In terms of revenue, the global radar systems market size was valued at around USD 22.15 billion in 2022 and is predicted to grow to around USD 36.46 billion, by 2030.

- The radar systems market is projected to grow at a significant rate due to the growing demand for sustainable packaging

- Based on platform segmentation, the marine was predicted to show maximum market share in the year 2022

- Based on component segmentation, the antenna was the leading component in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Radar Systems Market: Growth Drivers

Increased rate of research & development (R&D) in radar systems technology to drive market growth

The global radar systems market is expected to grow due to the growing rate of investments in the research and development of new radar technology. As the demand for advanced systems, especially location-sensing devices, is growing driven by changing geo-political partnerships across the globe, several radar systems manufacturers have increased their investments toward the development of advanced systems to stay ahead of the competition.

This includes technologies such as Digital Bean Forming (DBF) technologies, Multiple Inputs Multiple Output (MIMO) systems, Active Electronically Steered Array (AESA) radar, and Passive Coherent Location Radar (PCLR) Systems to name a few. Each of these technologies has specific applications and advantages. For instance, the DBF system can be used to achieve superior angular resolution without the need to mechanically move radar system parts. Similarly, the MIMO technology has proved its application in the accurate synthesis of several digital receiver beams which in turn contributes to reduced noise figures and improved signal discernment.

Growing strategic international partnerships to drive further growth

There is significant growth scope for companies operating in the radar systems market owing to the rising trend of strategic partnerships across international borders. In March 2023, the Indian Space Research Organization (ISRO) announced that the National Aeronautics and Space Administration (NASA), the US space agency, had delivered the NASA-ISRO SAR (NISAR) satellite which is jointly developed by both countries. NISAR is equipped with the largest radar antenna and along with other components, it is currently regarded as the world’s most advanced radar system.

Radar Systems Market: Restraints

High costs associated with the systems to restrict the market growth

The global radar systems market is expected to register restricted growth driven by the high cost of radar systems which includes costs associated with research, development, installation, and maintenance. For instance, the cost of the most basic entry-level radar system is around USD 14500. The NISAR system is estimated to cost USD 1.5 billion. Multiple reasons contribute to the high expense of the radar systems including several advanced technologies such as large-range signal analysis and mechanical engineering in addition to other systems. Moreover, the maintenance costs are also high which ranges between 5% to 10% of the purchase price, as per the American Meteorological Society.

Radar Systems Market: Opportunities

Growing adoption of unmanned aerial vehicles (UAVs) to provide growth opportunities

The global radar systems market may register higher growth avenues due to the increasing adoption of UAVs for several military and non-military purposes. UAVs offer several advantages including lower flight across directions, comprehensive movement range, and effortless navigation. Moreover, they can be used in situations beyond the access range of manned vehicles. In June 2023, Israel Aerospace Industries (IAI) was reported to be working on the development of a small radar that will help in converting ship-based vertical take-off and landing (VTOL) UAVs into surveillance platforms for maritime monitoring. The company currently offers multiple solutions based on radar systems for maritime surveillance. In November 2022, NewSpace Research and Honeywell announced a partnership for the development of advanced UAVs. Honeywell will be providing its Velocity Aiding Systems (VAS), a radar-based technology, along with the anti-jamming system (GPSdome) to NewSpace in this partnership.

Radar Systems Market: Challenges

Volatility in international trade policies for advanced technologies to challenge market expansion

The current geopolitical state influenced by the Russia-Ukraine war and other factors has increased volatility in the already dynamic international trading policies for advanced technologies especially those used for defense and military purposes. Every nation has strict regulatory policies in place for such trades and every technology provider has to adhere to these rules. There are serious repercussions associated with the failure to comply. In April 2023, the US authorities imposed a fine of USD 300 million on Seagate, a technology giant, for violating rules around export control after the company supplied hard disk drives to Huawei in China. The US is reported to curb the sales of advanced systems and technologies to China. Several other cases show that it is difficult for radar system providers to function in countries with unstable political infrastructure.

Radar Systems Market: Segmentation

The global radar systems market is segmented based on platform, application, type, component, and region.

Based on platform, the global market segments are unmanned, air, land, marine, and space. The industry is expected to witness the highest growth in the marine segment since they are used for tracking maritime activities including offshore patrol vessels, submarines, warships, and others. They are highly effective in detecting any land obstacles thus helping in avoiding collision. Increasing water-based international trade, rising commercial application of marine radars, and growing tensions on offshore borders could create more demand for marine radar systems. The AN/TPS-71 ROTHR (Relocatable Over-the-Horizon Radar), system by the US Navy has a range of 500 to 1,600 nautical miles

Based on application, the radar systems industry segments are defense, national security, and commercial. The highest growth can be expected in the defense sector in 2022 due to growing applications in fields such as perimeter security, air defense, military space asset management & safety, and battlefield surveillance. Regional governments are seeking measures that can help them improve their defense systems as global social and political tensions continue to rise. In December 2022, Japan announced that it will increase its defense budget to USD 55 billion, the country’s highest budget ever allocated for defense purposes in the backdrop of threats posed by North Korea and China.

Based on frequency band, the global market segments are s-band and x-band. Currently, the market is led by the X-band segment. They offer higher target resolution and are used for defense tracking, weather monitoring, and maritime vessel traffic control to name a few. S-band is used in long-range detection and is meant for special purposes. S-bands are used in Wi-Fi networks as they can smoothly operate in severe weather conditions. The frequency range of the S-band is between 2 to 4 Giga Herts (GHz).

Based on component, the radar systems industry is divided into duplexer, transmitter, waveguide, receiver, antenna, and others. The highest market share will be led by the antenna segment since they form the most crucial part of the entire system. The energy generated by the transmitter is broadcasted using the antennas. Parabolic dish antennas are currently the most used form. Growing research, rising investments for the development of advanced broadcasting systems, and increasing use in information broadcasting are expected to help in segmental growth.

Radar Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Radar Systems Market Research Report |

| Market Size in 2022 | USD 22.15 Billion |

| Market Forecast in 2030 | USD 36.46 Billion |

| Growth Rate | CAGR of 6.41% |

| Number of Pages | 221 |

| Key Companies Covered | Israel Aerospace Industries Ltd., Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, Indra Sistemas S.A., BAE Systems plc, L3Harris Technologies Inc., SAAB AB, Rheinmetall AG, HENSOLDT AG, RADA Electronic Industries Ltd., Mitsubishi Electric Corporation, Harris Corporation, Reutech Radar Systems, and Kelvin Hughes Limited. |

| Segments Covered | By Platform, By Application, By Type, By Component, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Radar Systems Market: Regional Analysis

North America is the current market leader with considerable market share

The global radar systems market is currently led by North America with the US acting as the most crucial partner. During the forecast period, the country may continue to hold its dominance primarily due to the presence of a highly advanced defense infrastructure in the US. The country invests heavily in radar-based systems for national security and defense purposes. Moreover, it is one of the largest defense-technology trading partners for several developing nations and is currently working on several projects to become strategic partners with more nations including India. Some of the largest manufacturers of defense and communication systems that supply products globally are located in the US. In October 2022, the US Army successfully managed to generate tracking data using the Q-53 radar developed by Lockheed Martin. The data generated can be used to launch a counter-unmanned aerial system or C-UAS defeat system.

Asia-Pacific is expected to grow at its highest CAGR as compared to the last few years with India and China contributing to the regional growth. The latter has recently invented a new radar system with artificial intelligence (AI). The technology is deemed to be at par with its Western counterparts.

Radar Systems Market: Competitive Analysis

The global radar systems market is led by players like:

- Israel Aerospace Industries Ltd.

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Leonardo S.p.A.

- Thales Group

- Indra Sistemas S.A.

- BAE Systems plc

- L3Harris Technologies Inc.

- SAAB AB

- Rheinmetall AG

- HENSOLDT AG

- RADA Electronic Industries Ltd.

- Mitsubishi Electric Corporation

- Harris Corporation

- Reutech Radar Systems

- Kelvin Hughes Limited.

The global radar systems market is segmented as follows:

By Platform

- Unmanned

- Air

- Land

- Marine

- Space

By Application

- Defense

- National Security

- Commercial

By Type

- S-Band

- X-Band

By Component

- Duplexer

- Transmitter

- Waveguide

- Receiver

- Antenna

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A radar is defined as an electromagnetic system that assists in the detection, location, tracking, and recognition of almost all forms of objects situated at a certain distance.

The global radar systems market is expected to grow due to the growing rate of investments in the research and development of new radar technology.

According to study, the global radar systems market size was worth around USD 22.15 billion in 2022 and is predicted to grow to around USD 36.46 billion by 2030.

The CAGR value of the radar systems market is expected to be around 6.41% during 2023-2030.

The global radar systems market is currently led by North America with the US acting as the most crucial partner

The global radar systems market is led by players like Israel Aerospace Industries Ltd., Raytheon Technologies Corporation, Northrop Grumman Corporation, Lockheed Martin Corporation, Leonardo S.p.A., Thales Group, Indra Sistemas S.A., BAE Systems plc, L3Harris Technologies, Inc., SAAB AB, Rheinmetall AG, HENSOLDT AG, RADA Electronic Industries Ltd., Mitsubishi Electric Corporation, Harris Corporation, Reutech Radar Systems, and Kelvin Hughes Limited.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed