Reactive Hot Melt Adhesive Market Size, Share, Trends, Growth 2032

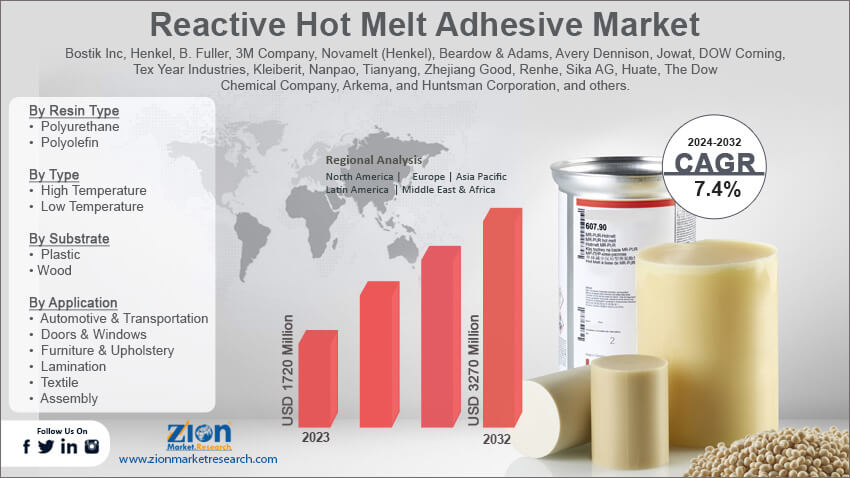

Reactive Hot Melt Adhesive Market By Resin Type (Polyurethane, Polyolefin, and Others), By Type (High Temperature and Low Temperature), By Substrate (Plastic, Wood, and Others), By Application (Automotive & Transportation, Doors & Windows, Furniture & Upholstery, Lamination, Textile, Assembly, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

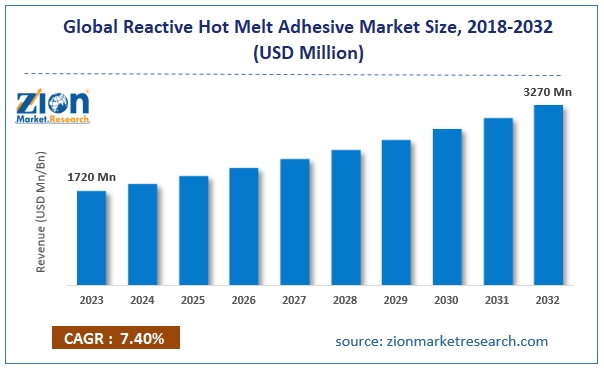

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1720 Million | USD 3270 Million | 7.4% | 2023 |

Reactive Hot Melt Adhesive Industry Prospective:

The global reactive hot melt adhesive market size was worth around USD 1,720 million in 2023 and is predicted to grow to around USD 3,270 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.4% between 2024 and 2032.

Reactive Hot Melt Adhesive Market: Overview

Final isocyanate prepolymers are reactive (RHM) adhesives. Reactive hot melts, as opposed to the more widely recognized thermoplastic hot melts, cannot be remelted and, once cured, are no longer suitable for use in glue equipment. Pure MDI and extremely crystalline and/or amorphous polyester polyols are used to create these reactive PUR hot melts.

Reactive PUR adhesives have the advantage of combining the strength of a reactive system with the speed of a traditional hot melt achieved by rapid cooling. Solvents are not used in reactive hotmelt adhesives. The primary uses for reactive hot melts are in textile, woodworking, and construction.

Key Insights

- As per the analysis shared by our research analyst, the global reactive hot melt adhesive market is estimated to grow annually at a CAGR of around 7.4% over the forecast period (2024-2032).

- In terms of revenue, the global reactive hot melt adhesive market size was valued at around USD 1,720 million in 2023 and is projected to reach USD 3,270 million by 2032.

- The increasing demand from the end-use sector is expected to drive the reactive hot melt adhesive industry over the forecast period.

- Based on the resin type, the polyurethane segment is expected to dominate the market over the forecast period.

- Based on the application, the automotive & transportation segment is expected to grow at a rapid rate over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Reactive Hot Melt Adhesive Market: Growth Drivers

Increasing demand from the furniture sector drives market growth

Due to the growing global need for high-quality, long-lasting furniture, major players are providing pieces that can endure normal wear and tear over an extended length of time. Wood, veneer, and laminate are among the several furniture components that are assembled and bonded using reactive hot melt adhesives.

The structural stability of furniture items depends on the strong and long-lasting bonding provided by these adhesives. They also enable quick and effective manufacturing procedures in the furniture industry. The quick setting times of reactive hot melt adhesives help to shorten production cycle times and streamline assembly lines. Furthermore, these adhesives increase production by doing away with the requirement for a curing phase. Thus, the increasing demand from the furniture sector propels the reactive hot melt adhesives market.

Reactive Hot Melt Adhesive Market: Restraints

High initial cost hinders market growth

The high initial costs of reactive hot melt adhesives pose a significant barrier to the reactive hot melt adhesive market. Reactive hot melt adhesives are more expensive to manufacture than conventional hot melts because they comprise sophisticated chemical components like moisture-curing urethanes or silane-modified polyolefins.

In addition to increasing production costs, the specialized manufacturing process used to guarantee constant quality and reactivity raises the final product's price point.

Moreover, specific dispensing equipment that ensures exact temperature and ambient conditions is frequently needed for the application of RHMA. When a company adopts RHMA for the first time, it has to purchase this equipment, which raises the setup expenses. This investment may serve as a major disincentive for manufacturers who are smaller or have financial limitations.

Reactive Hot Melt Adhesive Market: Opportunities

Rising application in the construction sector offers a lucrative opportunity for market growth

Because of its excellent bonding properties, longevity, and resilience to environmental influences, reactive hot melt adhesives, or RHMA, are being utilized more and more in the construction industry.

For applications including metal and wood frameworks, wall panels, flooring, and ceilings, RHMA offers strong initial tack and long-lasting bonding. The chemical bond formed during the curing process gives the structure the resilience it needs to be stable, especially when subjected to high loads or frequent movement.

Additionally, since they offer a robust bond that resists foot traffic, impacts, and general wear, they are utilized in the installation of wood, vinyl, and laminate floors. To prevent cracks or other bond failures, it provides flexibility that can adapt to minor changes in flooring materials. Therefore, this application drives the reactive hot melt adhesives market.

Reactive Hot Melt Adhesive Market: Challenges

Competition from alternative adhesives poses a major challenge to market expansion

Numerous alternative adhesives pose a serious threat to the market for reactive hot melt adhesives, which could hinder its expansion and market share. Conventional hot melt adhesives are frequently used for less demanding applications where high bonding strength and durability are not necessary because they are typically less expensive, easier to apply, and more widely utilized.

Because of this, they are well-liked in sectors like packaging where less expensive solutions are desired. Conventional hot melts may be more desirable than reactive alternatives for companies that value affordability over sophisticated bonding qualities.

Similar to RHMA, polyurethane adhesives offer excellent bonding strength, flexibility, and durability, but they are frequently less expensive. They are widely used in furniture, transportation, and construction because of their adaptability in bonding different materials. Thus, the presence of numerous alternatives poses a major challenge for the reactive hot melt market expansion.

Reactive Hot Melt Adhesive Market: Segmentation

The global reactive hot melt adhesive industry is segmented based on the resin type, type, substrate, application, and region.

Based on the resin type, the global reactive hot melt adhesive market is segmented into polyurethane, polyolefin and others. The polyurethane segment is expected to dominate the market over the forecast period. The need for polyurethane adhesives is rising in sectors including construction, electronics, and automotive where strong, dependable bonding is crucial.

For instance, these adhesives are used in the automotive industry to connect parts under stress and temperature changes, especially as EVs become more popular. Since polyurethane adhesives must fulfil strict standards for chemical and heat resistance, this industry alone accounts for a sizable portion of the adhesives' revenue growth.

Based on the type, the global reactive hot melt adhesive industry is bifurcated into high temperature and low temperature.

Based on the substrate, the global reactive hot melt adhesive market is bifurcated into plastic, wood, and others.

Based on the application, the global reactive hot melt adhesive market is bifurcated into automotive & transportation, doors & windows, furniture & upholstery, lamination, textile, assembly and others. The automotive & transportation segment is expected to grow at a rapid rate over the forecast period.

Lightweight materials like aluminum, composites, and polymers are being used by automakers more and more to reduce emissions and increase fuel economy. These materials are best bonded with reactive hot melt adhesives because they offer strong bindings without increasing weight, enabling vehicles to be lighter without sacrificing structural integrity. The automotive industry's need for RHMA is being driven by this change, particularly in applications like lightweight components, interior panels, and body-in-white assemblies.

Reactive Hot Melt Adhesive Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Reactive Hot Melt Adhesive Market |

| Market Size in 2023 | USD 1,720 Million |

| Market Forecast in 2032 | USD 3,270 Million |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 225 |

| Key Companies Covered | Bostik Inc, Henkel, B. Fuller, 3M Company, Novamelt (Henkel), Beardow & Adams, Avery Dennison, Jowat, DOW Corning, Tex Year Industries, Kleiberit, Nanpao, Tianyang, Zhejiang Good, Renhe, Sika AG, Huate, The Dow Chemical Company, Arkema, and Huntsman Corporation, and others. |

| Segments Covered | By Resin Type, By Type, By Substrate, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reactive Hot Melt Adhesive Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to lead the global reactive hot melt adhesive market growth. Both conventional and electric vehicle (EV) manufacturers are part of the well-established automotive manufacturing sector in North America, especially in the United States and Mexico.

To fulfil stricter emissions regulations and increase fuel efficiency, the region's automakers are increasingly employing RHMAs for incorporating lightweight materials like composites and plastics. RHMAs are also utilized for battery assembly, electronic component bonding, and thermal management as EV production increases, which raises demand in the automotive industry. Moreover, the increasing construction industry in the region also drives industry expansion.

Reactive Hot Melt Adhesive Market: Competitive Analysis

The global reactive hot melt adhesive market is dominated by players like:

- Bostik Inc

- Henkel

- B. Fuller

- 3M Company

- Novamelt (Henkel)

- Beardow & Adams

- Avery Dennison

- Jowat

- DOW Corning

- Tex Year Industries

- Kleiberit

- Nanpao

- Tianyang

- Zhejiang Good

- Renhe

- Sika AG

- Huate

- The Dow Chemical Company

- Arkema

- and Huntsman Corporation

The global reactive hot melt adhesive market is segmented as follows:

By Resin Type

- Polyurethane

- Polyolefin

- Others

By Type

- High Temperature

- Low Temperature

By Substrate

- Plastic

- Wood

- Others

By Application

- Automotive & Transportation

- Doors & Windows

- Furniture & Upholstery

- Lamination

- Textile

- Assembly

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Final isocyanate prepolymers are reactive (RHM) adhesives. Reactive hot melts, as opposed to the more widely recognized thermoplastic hot melts, cannot be remelted and, once cured, are no longer suitable for use in glue equipment. Pure MDI and extremely crystalline and/or amorphous polyester polyols are used to create these reactive PUR hot melts. Reactive PUR adhesives have the advantage of combining the strength of a reactive system with the speed of a traditional hot melt achieved by rapid cooling. Solvents are not used in reactive hot melt adhesives. The primary uses for reactive hot melts are in textile, woodworking, and construction.

The reactive hot melt adhesive market is driven by several factors, such as increasing stringent environmental regulation, growing focus on sustainability, technological advancements, and increasing demand from the end-use industry.

According to the report, the global reactive hot melt adhesive market size was worth around USD 1,720 million in 2023 and is predicted to grow to around USD 3,270 million by 2032.

The global reactive hot melt adhesive market is expected to grow at a CAGR of 7.4% during the forecast period.

The global reactive hot melt adhesive market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing stringent regulations.

The global reactive hot melt adhesive market is dominated by players like Bostik Inc, Henkel, B. Fuller, 3M Company, Novamelt (Henkel), Beardow & Adams, Avery Dennison, Jowat, DOW Corning, Tex Year Industries, Kleiberit, Nanpao, Tianyang, Zhejiang Good, Renhe, Sika AG, Huate, The Dow Chemical Company, Arkema and Huntsman Corporation among others.

The reactive hot melt adhesive market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed