Refurbished Sneaker Market Size, Share, Trends, Growth and Forecast 2034

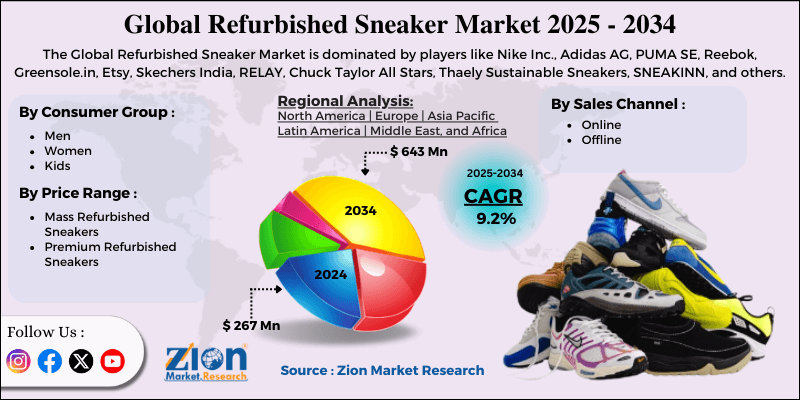

Refurbished Sneaker Market By Consumer Group (Men, Women, and Kids), By Price Range (Mass Refurbished Sneakers and Premium Refurbished Sneakers), Sales Channel (Online and Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

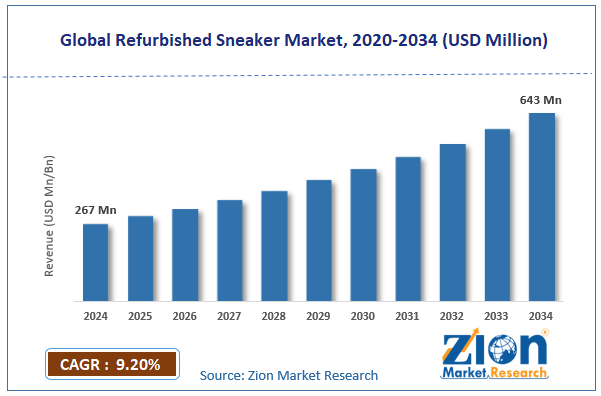

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 267 Million | USD 643 Million | 9.2% | 2024 |

Refurbished Sneaker Industry Prospective:

The global refurbished sneaker market size was worth around USD 267 million in 2024 and is predicted to grow to around USD 643 million by 2034, with a compound annual growth rate (CAGR) of roughly 9.2% between 2025 and 2034.

Refurbished Sneaker Market: Overview

After being owned or used previously, refurbished sneakers that have been professionally cleaned, repaired, and restored to their best possible condition undergo deep cleaning, replacement of worn-out components, repairs, and quality tests to guarantee that appearance and functionality are maintained in this procedure. Sometimes, refurbished shoes are less costly than new ones since they encourage reuse and cut waste, and help the movement sustainably.

Fans of sneakers, environmentally conscious buyers, and everyone else searching for premium, reasonably priced shoes all enjoy them. The refurbished sneaker market is driven by several factors such as increasing focus on environmental sustainability, cost-effectiveness, the influence of sneaker culture, and others.

However, the limited availability of high-demand models and the lack of standardized refurbished processes hamper the industry expansion.

Key Insights

- As per the analysis shared by our research analyst, the global refurbished sneaker market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2025-2034).

- In terms of revenue, the global refurbished sneaker market size was valued at around USD 267 million in 2024 and is projected to reach USD 643 million by 2034.

- The growing e-commerce industry is expected to drive the refurbished sneaker market over the forecast period.

- Based on the consumer group, the men segment is expected to hold the largest market share over the forecast period.

- Based on the price range, the mass refurbished sneakers segment is expected to dominate the market expansion over the projected period.

- Based on the sales channel, the offline segment is expected to capture the largest revenue share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Refurbished Sneaker Market: Growth Drivers

The cost-effective nature of refurbished sneakers drives market growth

Cost-effectiveness is one of the key elements driving the demand for refurbished shoes. Usually 20–60% less expensive than their new counterparts, refurbished shoes provide luxury brands and limited editions at a fraction of the original price. This might be intriguing to both budget-conscious shoppers and sneakerheads.

Furthermore, refurbished shoes promise excellent design and workmanship without going over budget by offering authenticity and affordability compared to low-end or counterfeit models.Since they use fewer resources and generate less waste for landfills, refurbished shoes are also more affordable from the perspective of ecologically concerned consumers.

Refurbished Sneaker Market: Restraints

Perceived quality concern hinders market growth

One of the main reasons the market is limited is the belief that refurbished sneakers are of worse quality. For cautious or first-time purchasers, especially, these problems could affect consumer trust and buying choices. Hygienic issues are often of concern to consumers, particularly when buying used shoes.

Should the criteria for renovation not be clear-cut, buyers could be deterred by issues with smell, germs, or blatant decay. Particularly in terms of sole grip, cushioning, and general structure, sportsmen are mostly concerned about refurbished sneakers, perhaps not lasting as long as brand-new ones.

Moreover, some customers in resale markets for luxury brands like Nike, Jordan, or Yeezy are reluctant to buy reconditioned sneakers out of worry that they might be fake or illegal replicas sold as genuine. Thus, the aforementioned facts hamper the refurbished sneakers market.

Refurbished Sneaker Market: Opportunities

Growing awareness regarding sustainable fashion offers a lucrative opportunity for market growth

One of the key drivers pushing the demand for refurbished sneakers is increasing knowledge of sustainable fashion. As consumers become more ecologically sensitive, refurbished shoes are becoming sensible, stylish, and responsible choices.

The fashion business accounts for roughly 10% of the carbon emissions worldwide and a notable volume of textile waste. This is mostly related to trainers, which are usually made of rubber, leather, and plastic. Refurbished shoes cut landfill waste and carbon footprints.

Furthermore, the circular economy is becoming increasingly popular among consumers, which stresses recycling, repair, and reuse above ongoing consumption. Renovating sneakers helps this model be sustained since it extends the lifetime of the product.

Refurbished Sneaker Market: Challenges

Low awareness in emerging economies poses a major challenge to market expansion

While the refurbished sneakers market is rapidly growing in developed countries like North America and Europe, inadequate consumer awareness in developing nations is a main obstacle. Many developing countries’ consumers are not familiar with the concept of renovation, especially with fashion or footwear. Many see "used" as a synonym with "inferior.

" Furthermore, in many countries, such as Asia, Africa, and Latin America, new products are a symbol of status, confidence, and cleanliness. Particularly for popular items like shoes, secondhand or refurbished goods may carry societal humiliation. Thus, the low awareness in the emerging economy hampers the refurbished sneaker sector expansion.

Refurbished Sneaker Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Refurbished Sneaker Market |

| Market Size in 2024 | USD 267 Million |

| Market Forecast in 2034 | USD 643 Million |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 216 |

| Key Companies Covered | Nike Inc., Adidas AG, PUMA SE, Reebok, Greensole.in, Etsy, Skechers India, RELAY, Chuck Taylor All Stars, Thaely Sustainable Sneakers, SNEAKINN, and others. |

| Segments Covered | By Consumer Group, By Price Range, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Refurbished Sneaker Market: Segmentation

The global refurbished sneaker industry is segmented based on consumer group, price range, sales channel, and region.

Based on the consumer group, the global refurbished sneaker market is bifurcated into men, women, and kids. The men segment is expected to hold the largest market share over the forecast period. Men are very involved in streetwear, sneaker collecting, and resale culture, especially in Gen Z and Millennial groups.

A more cost-effective way to get high-end designs like Jordans, Yeezys, or Air Max is to use refurbished shoes. Furthermore, especially in difficult economic times, men are increasingly using refurbished shoes as a method to possess expensive or limited-edition sneakers at a reduced cost.

Additionally, male shoppers are growing more conscious of ecological fashion options, particularly in cities. Refurbished sneakers provide a mix of fashion, brand recognition, and environmental responsibility.

Based on the price range, the global refurbished sneaker industry is bifurcated into mass refurbished sneakers and premium refurbished sneakers. The mass refurbished sneakers segment is expected to dominate the market expansion over the projected period. The market is changing from informal resale to formal retail due to mass-refurbished sneakers, which enable scalability, uniformity, and long-term growth. For refurbished shoes to become popular and available to a larger customer base, this trend is essential.

Based on the sales channel, the global refurbished sneaker market is bifurcated into online and offline. The offline segment is expected to capture the largest revenue share over the projected period. Local sneakerheads frequently use offline resale shops as cultural centers, holding launch parties, swap meets, and refurb shows that increase sales and brand recognition.

To validate the channel and introduce used products to consumers who might not otherwise look for them online, companies like Nike and Decathlon are also starting to carry refurbished products in their physical stores.

Furthermore, offline retailers offer instant access to products, which is a significant benefit during periods of high demand for refurb drops or time-sensitive purchases (like gifts). Thus, driving the market growth.

Refurbished Sneaker Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global refurbished sneaker market. Sneaker trends around the world have historically been centered in North America. The demand for rare and vintage styles is fueled by brands like Converse, Jordan, Nike, and New Balance, which makes reconditioned sneakers a worthwhile and affordable substitute.

Refurbished sneakers also fit the circular fashion and waste reduction ideals of Gen Z and Millennials, especially those interested in sustainable fashion in the US and Canada. Customers in this area also prioritize value and style over price, having more disposable income to spend on refurbished luxury or premium sneakers than in many other areas.

On the other side, the Asia Pacific is expected to grow at the highest CAGR over the forecast period. The market for circular fashion items like repurposed sneakers is driven by the growth of environmentally concerned metropolitan customers, particularly in places like Seoul, Tokyo, and Melbourne.

Refurbished Sneaker Market: Competitive Analysis

The global refurbished sneaker market is dominated by players like:

- Nike Inc.

- Adidas AG

- PUMA SE

- Reebok

- Greensole.in

- Etsy

- Skechers India

- RELAY

- Chuck Taylor All Stars

- Thaely Sustainable Sneakers

- SNEAKINN

The global refurbished sneaker market is segmented as follows:

By Consumer Group

- Men

- Women

- Kids

By Price Range

- Mass Refurbished Sneakers

- Premium Refurbished Sneakers

By Sales Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

After being owned or used previously, refurbished sneakers that have been professionally cleaned, repaired, and restored to their best possible condition are Deep cleaning, replacement of worn-out components, repairs, and quality tests to guarantee appearance and functionality are prevalent in this procedure.

The refurbished sneaker market is driven by several factors such as increasing focus on environmental sustainability, cost-effectiveness, the influence of sneaker culture, and others.

According to the report, the global refurbished sneaker market size was worth around USD 267 million in 2024 and is predicted to grow to around USD 643 million by 2034.

The global refurbished sneaker market is expected to grow at a CAGR of 9.2% during the forecast period.

The global refurbished sneaker market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing e-commerce industry and the presence of major players.

The global refurbished sneaker market is dominated by players like Nike Inc., Adidas AG, PUMA SE, Reebok, Greensole.in, Etsy, Skechers India, RELAY, Chuck Taylor All Stars, Thaely Sustainable Sneakers, and SNEAKINN, among others.

The refurbished sneaker market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed