RegTech Market By Size, Share, Growth, Analysis, and Forecast 2032

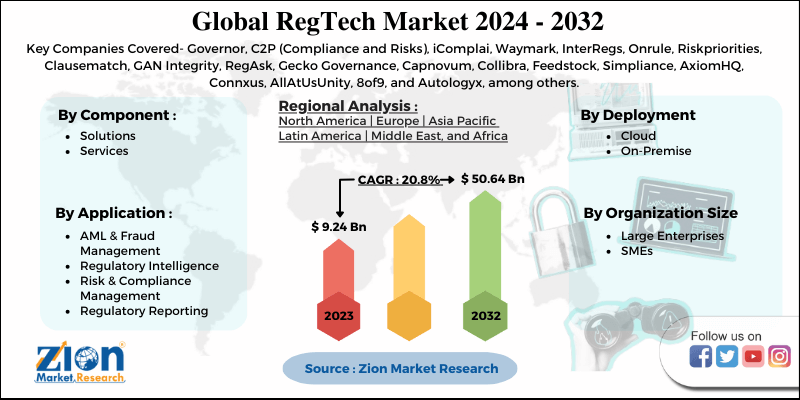

RegTech Market by Component (Solution, and Services), by Deployment Type (On-Premises, and Cloud), by Organization Size (Large Enterprises, and Small & Medium Enterprises), by Application (AML & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

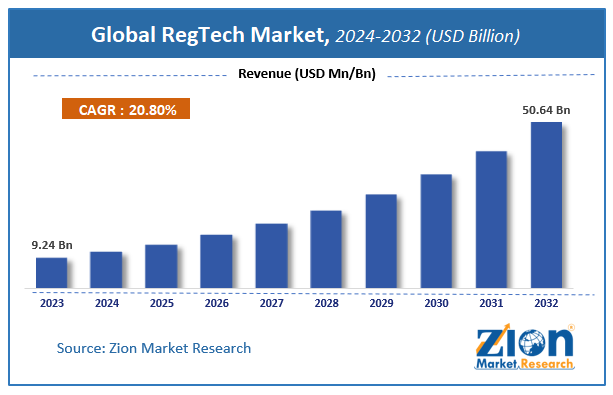

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.24 Billion | USD 50.64 Billion | 20.8% | 2023 |

RegTech Market Insights

According to a report from Zion Market Research, the global RegTech Market was valued at USD 9.24 Billion in 2023 and is projected to hit USD 50.64 Billion by 2032, with a compound annual growth rate (CAGR) of 20.8% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the RegTech Market industry over the next decade.

Global RegTech Market: Overview

In heavily regulated industries, such as financial services, health care and insurance, “RegTech” is all the rage. Every major consulting firm has released a white paper on the subject. Over just the past two years, Google searches for the term have increased sevenfold. RegTech involves in usage of advance technologies such as machine learning, biometrics, cloud computing, big data, and blockchain to the regulatory segment to fit quickly in the growing tectonic changes in the financial environment. It simply means a technology which ensures that companies to act in accordance with their regulatory requirements. Moreover, main functions of RegTech include data analytics, regulatory monitoring, risk management, reporting, regulatory compliance, and fraud detection.

Global RegTech Market: Growth Factors

The growing instances of financial crimes such as money laundering are one of the major driving factors of the market. The crimes themselves, detected and undetected, have become more numerous and costly than ever. Risks for banks arise from diverse factors, including vulnerabilities to fraud and financial crime inherent in automation and digitization, massive growth in transaction volumes, and the greater integration of financial systems within countries and internationally. Risk functions and regulators are catching on as well. AML, while now mainly addressed as a regulatory issue, is seen as being on the next horizon for integration. Through integration, the anti-fraud potential of the bank’s data, automation, and analytics can be more fully realized.

Moreover, rising demand for RegTech from the rapidly growing insurance industry is another major driving factor for the RegTech market. RegTech promotes smart data management for efficient customer onboarding by using advanced technologies including cognitive computing and machine learning. RegTech is also helping insurance companies deal with large data sets to gain better insights in key business processes such as regulatory compliance, complex reporting requirements, and financial risk management. Furthermore, RegTech enhances customer experience through the automation of key functions under customer service management processes.

All these factors are expected to drive the RegTech market demand in the upcoming years. However, lack of data standardization and collaboration is the restraint for the regTech market. For RegTech to be successful, digitization of regulation requires a new level of collaboration between not only regulators and the industry, but also between large and small firms, and between buyers and vendors. Building this collaborative federation will enable the industry to move in steps towards establishing a common basis for RegTech development that is efficient and resilient enough to provide a solid foundation for future investment while not compromising the participants. However, increasing regulations in the financial services industry is bringing new opportunities for the entire RegTech market.

Global RegTech Market: Segmentation

Based on components, the RegTech market is segmented into solutions, and services.

Based on the deployment type, the RegTech market is segmented into the on-premises and cloud.

Cloud deployment is high in demand and dominates the entire market with the largest share.

Based on the organization size, the RegTech market is segmented into large enterprises and small & medium enterprises.

Based on application, the market is segmented into AML & fraud management, regulatory intelligence, risk & compliance management, and regulatory reporting.

RegTech Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | RegTech Market |

| Market Size in 2023 | USD 9.24 Billion |

| Market Forecast in 2032 | USD 50.64 Billion |

| Growth Rate | CAGR of 20.8% |

| Number of Pages | 110 |

| Key Companies Covered | Governor, C2P (Compliance and Risks), iComplai, Waymark, InterRegs, Onrule, Riskpriorities, Clausematch, GAN Integrity, RegAsk, Gecko Governance, Capnovum, Collibra, Feedstock, Simpliance, AxiomHQ, Connxus, AllAtUsUnity, 8of9, and Autologyx, among others |

| Segments Covered | By Component, By Deployment Type, By Organization Size, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global RegTech Market: Regional Analysis

Based on regions, the global RegTech market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The North American region held a notable share in 2019.

The Asia Pacific region is one of the most lucrative regions for market players. This surge is due to the increasing adoption of RegTech in developing economies such as India, China, etc.

Global RegTech Market: Competitive Players

Some of key players in the RegTech market are

- Governor

- C2P (Compliance and Risks)

- iComplai

- Waymark

- InterRegs

- Onrule

- Riskpriorities

- Clausematch

- GAN Integrity

- RegAsk

- Gecko Governance

- Capnovum

- Collibra

- Feedstock

- Simpliance

- AxiomHQ

- Connxus

- AllAtUsUnity

- 8of9

- Autologyx

- among others.

The RegTech market is segmented as follows:

By Component

- Solution

- Services

By Deployment Type

- On-Premises

- Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- AML & Fraud Management

- Regulatory Intelligence

- Risk & Compliance Management

- Regulatory Reporting

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global RegTech market was valued at USD 9.24 Billion in 2023.

The global RegTech market is expected to reach USD 50.64 Billion by 2026, growing at a CAGR of 20.8% between 2024 to 2032.

Some of the key factors driving the global RegTech market growth are the Rising demand for RegTech from the rapidly growing insurance industry. Moreover, growing instances of financial crimes such as money laundering are further driving the importance of RegTech around the globe.

North America region is anticipated to hold a substantial share in the RegTech market. This is attributable to the presence of major players in the region. Asia Pacific region is projected to grow at a significant rate owing to the rising demand for RegTech in developing economies such as China and India.

Some of the major companies operating in the RegTech market are Governor, C2P (Compliance and Risks), iComplai, Waymark, InterRegs, Onrule, Riskpriorities, Clausematch, GAN Integrity, RegAsk, Gecko Governance, Capnovum, Collibra, Feedstock, Simpliance, AxiomHQ, Connxus, AllAtUsUnity, 8of9, and Autologyx among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed