Regulatory Reporting Solutions Market Size, Share, Growth Report 2032

Regulatory Reporting Solutions Market By Industry (Wealth & Asset Management, Banks, Securities & Investments, and Insurance), By Solution (Services and Regulatory Reporting Software), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

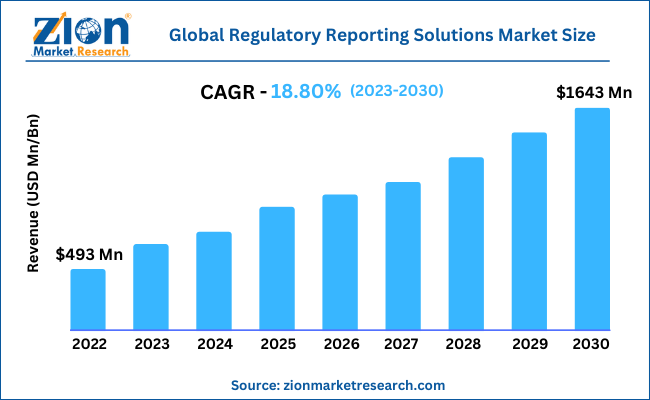

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 493 Million | USD 1643 Million | 18.801% | 2022 |

Industry Prospective:

The global regulatory reporting solutions market size was worth around USD 493 Million in 2022 and is predicted to grow to around USD 1643 Million by 2030 with a compound annual growth rate (CAGR) of roughly 18.801% between 2023 and 2030.

The report analyzes the global regulatory reporting solutions market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the regulatory reporting solutions industry.

Regulatory Reporting Solutions Market: Overview

The regulatory reporting solutions market is a part of the larger financial technology (FinTech) industry that deals with providing software solutions to financial agencies that ensures compliance with regulatory requirements imposed on the entity. The solutions are responsible for automating the process of data collection, analysis, and submission to the concerned regulatory authority or agencies.

This software is programmed to ensure that financial entities are not at risk of errors or penalties and other legal concerns. The industry includes various software providers along with service-related companies and caters to the needs of units such as banking, insurance, and other financial industries. During the forecast period, the market is expected to grow at a high CAGR mainly due to the rising complexities involved in financial dealings and the dynamic nature of the regulatory measures.

Key Insights:

- As per the analysis shared by our research analyst, the global regulatory reporting solutions market is estimated to grow annually at a CAGR of around 18.801% over the forecast period (2023-2030)

- In terms of revenue, the global regulatory reporting solutions market size was valued at around USD 493 Million in 2022 and is projected to reach USD 1643 Million, by 2030.

- The regulatory reporting solutions market is projected to grow at a significant rate due to the growing regulatory compliance requirements

- Based on industry segmentation, banks were predicted to show maximum market share in the year 2022

- Based on solution segmentation, regulatory reporting software was the leading solution in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Regulatory Reporting Solutions Market: Growth Drivers

Growing regulatory compliance requirements to propel market growth

The global regulatory reporting solutions market is projected to grow owing to the increasing requirements of regulatory compliance across the world. Regional governments and the respective regulatory bodies are getting strict in terms of ensuring that financial companies operating the economy meet all the necessary compliance needs stated by the law. Several countries have initiated implementation programs to ensure that finance companies meet the rules and regulations of the economy they are operational. This is due to the growing complexities in business operations and companies taking certain rules slightly especially in politically weak nations. In addition to this, the growing investment toward technological advancements such as the use of artificial intelligence (AI), machine learning (ML), and big data analytics can assist in improved performance and thus lead to more consumers in the industry.

Regulatory Reporting Solutions Market: Restraints

High complexity of regulatory requirements

In most cases, regulatory requirements are extremely complex. Furthermore, these rules may keep changing as the nation witnesses higher growth and a larger influx of international businesses. This means that companies dealing in developing regulatory reporting solutions may find it difficult to keep up with the dynamic landscape. Furthermore, the implementation and operational cost of such solutions is extremely high as it requires intensive information technology (IT) infrastructure.

Regulatory Reporting Solutions Market: Opportunities

Growing integration with other technologies to provide growth opportunities

The global regulatory reporting solutions market is projected to come across more growth opportunities due to the growing integration of regulatory reporting solutions with other essential technologies such as blockchain. This can drastically improve the overall performance of the program and ensure better safety against cyber-crimes, which is a leading cause of concern in the market. Additionally, the growing research on improving data analytics systems could work in the favor of the market since it will help identify patterns, trends, and insights that can transform business decisions and strategies.

Regulatory Reporting Solutions Market: Challenges

Vendor consolidation to challenge the market expansion

The global regulatory reporting solutions industry is highly competitive due to the recent emergence of multiple smaller players along with the rising number of existing players. This has led to a severe lack of vendor consolidation which can effectively limit the choices available to financial institutions causing a rise in the involved cost. Moreover, constant changes in the regulatory framework could pose an additional roadblock in the industry.

Regulatory Reporting Solutions Market: Segmentation

The global regulatory reporting solutions market is segmented based on industry, solution, and region.

Based on industry, the global market segments are wealth & asset management, banks, securities & investments, and insurance. The industry witnessed the highest growth in the bank segment as the banking industry is one of the largest consumers of regulatory reporting solutions. Banks, in general, are subject to a wide range of dynamic regulations that requires them to collect data on several aspects of business operations including capital adequacy, liquidity, risk management, and anti-money laundering. The data thus collected has to be analyzed and reported to the regulatory agencies on time to ensure receiving penalties or any other legal action. In 2020, the New York State Department of Financial Services fined Deutsche Bank USD 150 million for failing to properly monitor its relationship with convicted sex offender Jeffrey Epstein.

Based on solution, the global regulatory reporting solutions industry segments are services and regulatory reporting software. In 2022, the industry witnessed high growth in the regulatory reporting software segment since it provides companies with more flexibility and customization options. The services segment is generally provided by a third party and involves the outsourcing of the entire regulatory reporting process. This includes data collection, validation, and reporting. It is a beneficial approach for smaller institutes as they do not have to spend on developing supporting infrastructure and reduce the burden of regulatory reporting. As per reports, the majority of Indian banks spend more than 51%of their time preparing regulatory reports.

Recent Developments:

- In April 2021, eflow Global, a UK-based regulatory technology company, announced major updates for its regulatory reporting platform called TZTR. The new version will be working along with trade surveillance developed by eflow and its most efficient execution software TZ to provide more holistic solutions to its clients

- In March 2023, ICICI Bank announced the launch of a range of digital solutions for its customers in the capital market along with clients from the custody services sector. These new solutions will allow foreign portfolio investors (FPIs), stock brokers, foreign direct investors, portfolio management service (PMS) providers, and alternative investment funds (AIF) to meet all the necessary banking requirements

Regulatory Reporting Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Regulatory Reporting Solutions Market Research Report |

| Market Size in 2022 | USD 493 Million |

| Market Forecast in 2030 | USD 1643 Million |

| Growth Rate | CAGR of 18.80% |

| Number of Pages | 212 |

| Key Companies Covered | Accenture, AxiomSL, Bloomberg, Broadridge, Calypso Technology, Cognizant, Deloitte, FIS, Fiserv, Genpact, IBM, Infosys, KPMG, MSCI, Moody's Analytics, NICE Actimize, PwC, SAP, SimCorp, SS&C Technologies, State Street, Synechron, TCS, Temenos, and Wolters Kluwer. |

| Segments Covered | By Industry, By Solution, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regulatory Reporting Solutions Market: Regional Analysis

North America to witness the highest growth

The global regulatory reporting solutions market is expected to witness the highest growth in North America mainly due to the presence of several service and solution providers. The US has an extremely advanced and mature banking industry, which is also the largest contributor to the regional market. Furthermore, the economy is home to some of the world’s most sought-after wealth management companies with clients across the world worth billions of dollars.

This has led to more financial units undertaking the assistance of regulatory reporting solutions to meet the complex compliance regulation of the US and other countries that these companies have a presence in. Furthermore, the US government has one of the toughest implementation laws ensuring complete compliance for domestic entities as well as foreign companies. The European region could be the second-leading region as national governments are ensuring data and money protection for the financial units operating in the countries.

Regulatory Reporting Solutions Market: Competitive Analysis

The global regulatory reporting solutions market is led by players like:

- Accenture

- AxiomSL

- Bloomberg

- Broadridge

- Calypso Technology

- Cognizant

- Deloitte

- FIS

- Fiserv

- Genpact

- IBM

- Infosys

- KPMG

- MSCI

- Moody's Analytics

- NICE Actimize

- PwC

- SAP

- SimCorp

- SS&C Technologies

- State Street

- Synechron

- TCS

- Temenos

- Wolters Kluwer.

The global regulatory reporting solutions market is segmented as follows:

By Industry

- Wealth & Asset Management

- Banks

- Securities & Investments

- Insurance

By Solution

- Services

- Regulatory Reporting Software

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The regulatory reporting solutions market is a part of the larger financial technology (FinTech) industry that deals with providing software solutions to financial agencies that ensures compliance with regulatory requirements imposed on the entity.

The global regulatory reporting solutions market is projected to grow owing to the increasing requirements of regulatory compliance across the world.

According to study, the global regulatory reporting solutions market size was worth around USD 0.493 billion in 2022 and is predicted to grow to around USD 1.643 billion by 2030.

The CAGR value of the regulatory reporting solutions market is expected to be around 18.801% during 2023-2030.

The global regulatory reporting solutions market is expected to witness the highest growth in North America mainly due to the presence of several service and solution providers.

The global regulatory reporting solutions market is led by players like Accenture, AxiomSL, Bloomberg, Broadridge, Calypso Technology, Cognizant, Deloitte, FIS, Fiserv, Genpact, IBM, Infosys, KPMG, MSCI, Moody's Analytics, NICE Actimize, PwC, SAP, SimCorp, SS&C Technologies, State Street, Synechron, TCS, Temenos, and Wolters Kluwer

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed