Renewable Energy Investments Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Renewable Energy Investments Market By Industry (Solar Energy Industry, Hydro Energy Industry, Wind Energy Industry, and Others), By Sector (Private Sector and Public Sector), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

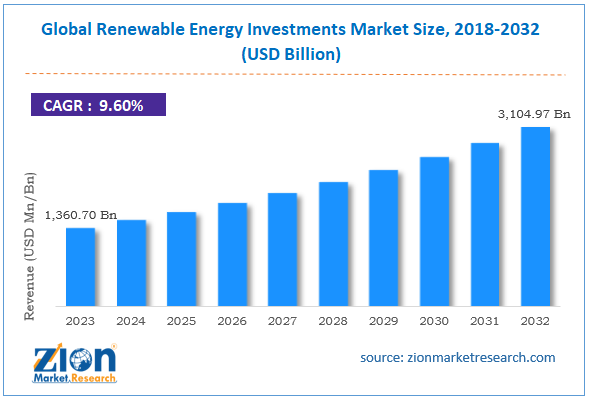

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1360.70 Billion | USD 3,104.97 Billion | 9.60% | 2023 |

Renewable Energy Investments Industry Prospective:

The global renewable energy investments market size was worth around USD 1360.70 billion in 2023 and is predicted to grow to around USD 3,104.97 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.60% between 2024 and 2032.

Renewable Energy Investments Market: Overview

Renewable energy investments aim to promote the development of technology and infrastructure that supports clean energy production and consumption. In recent times, public and private sector investments toward sustainable or renewable energy have risen rapidly. These investments are diversified toward companies, projects, or technologies used for generating green energy, including biomass, wind, solar, bioenergy, hydropower, ocean, and geothermal energy.

Each segment of renewable power offers specific investment opportunities and challenges. The primary factor influencing the market growth rate is the shift of government policies toward reducing dependence on non-renewable energy caused by depleting sources and rising environmental pollution.

In addition, the private sector is expected to play a crucial role in the renewable energy investments market’s growth rate during the forecast period. However, the high cost of investment as well as several technical or regulatory growth limitations will impact the market growth rate according to industry study. Solar energy investments are likely to register the highest CAGR during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global renewable energy investments market is estimated to grow annually at a CAGR of around 9.60% over the forecast period (2024-2032)

- In terms of revenue, the global renewable energy investments market size was valued at around USD 1360.70 billion in 2023 and is projected to reach USD 3,104.97 billion by 2032.

- The renewable energy investments market is projected to grow at a significant rate due to the rising energy demand worldwide.

- Based on the industry, the solar energy segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the sector, the public sector segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Renewable Energy Investments Market: Growth Drivers

Rising energy demand worldwide will drive the market growth rate

The global renewable energy investment market is expected to grow due to the rising demand for energy worldwide. Urbanization, globalization, and industrialization are the main reasons driving the energy consumption rate globally. For instance, the rising population density in urban areas has fueled the energy demand rate in heavily populated areas. In addition, modern industries and businesses are supported by a constant supply of electricity and other forms of energy. According to the NYC Mayor’s Office of Climate and Environmental Justice, New York uses 5,500 megawatts of power.

Energy demand increases to 10,000 megawatts during summertime. Developing nations, on the other hand, are also recording an increase in energy consumption as infrastructure development projects are on the rise. Market research suggests that India’s energy consumption rate has increased by more than 6% since 2020, which has been influenced by several factors. Traditional means of power generation are not sufficient to meet the current and future energy needs of the global population. This, in turn, will shift focus toward investments in generating renewable energy.

Increases in efforts toward mitigating climate change will impact demand for renewable energy investments

The expenditure for renewable energy is expected to improve further due to the rising efforts by private companies, government bodies, and environmental welfare organizations to mitigate the impact of climate change. Excessive consumption of nonrenewable energy is a leading cause of global warming.

In addition, rising global temperatures, increases in sea levels, and changes in agricultural output are some of the most evident impacts of changes in climate conditions. Studies and research have proven the positive impact of the shift toward renewable energy in slowing and ultimately curbing changes in climate conditions. The use of renewable energy will reduce the amount of greenhouse and carbon dioxide gasses released in the environment, ultimately limiting the rate of climate change. The United Nations predicts that cheap electricity generated using renewable sources can decarbonize 90% of the global power sector by 2050. Such statistics are expected to promote the global renewable energy investments market.

Renewable Energy Investments Market: Restraints

Intense rate of high initial investment will limit the industry’s growth rate

The global industry for renewable energy investments is expected to be limited due to the high rate of initial investment. Harnessing renewable energy requires extensive and sophisticated infrastructure. The channeling of green energy is facilitated by state-of-the-art technologies, skilled manpower, and abundant resources causing the total investment cost to increase. For instance, the cost of new nuclear facilities can range between USD 6 and USD 9 billion for one 1,100-megawatt plant.

Renewable Energy Investments Market: Opportunities

Favorable government policies and initiatives by international environmental organizations to generate massive growth opportunities

The global renewable energy investments market is expected to generate more growth opportunities due to the favorable changes in government policies worldwide. The favorable policies are reflected in tax subsidies and additional assistance provided by regional government bodies to attract higher investments. For instance, in February 2024, the European Parliament and the Council of the EU announced a provisional version of the Net-Zero Industry Act (NZIA). The new law favors the Green Deal Industrial Plan for the Net-Zero Age Plan of Europe to achieve net zero by 2050.

Some of the key features of the NZIA include improved accessibility to sufficient funding, a simplified & predictable regulatory environment, and open trade for resilient supply chains. According to official research, India’s tax subsidies for renewable energy investments in 2022 were more than INR 6700 crore. Governments are encouraging more research & innovation in renewable energy fields by providing 100% financial support. Apart from creating a favorable investment-oriented environment, the governments are also keen on drafting and spending heavily on projects for green energy, opening doors for new growth avenues.

Renewable Energy Investments Market: Challenges

Legacy energy storage infrastructure and other technical challenges to impact market growth rate

The renewable energy investments industry is expected to be challenged by the existence of an aging infrastructure for energy storage. The legacy systems may be unable to store massive energy generated using renewable sources. In addition to this, a lack of consistent regulatory procedures along with inconsistent energy production rates due to changes in weather conditions may discourage the entry of new players. Some of the other technical challenges include economic volatility and concerns about space requirements.

Renewable Energy Investments Market: Segmentation

The global renewable energy investments market is segmented based on industry, sector, and region.

Based on the industry, the global market segments are the solar energy industry, hydro energy industry, wind energy industry, and others. In 2023, the highest demand was observed in the solar energy industry. The decrease in upfront costs associated with the development of solar power plants and other infrastructure projects is fueling segmental growth. According to market research, more than 60% of total investments in renewable energy in 2023 were directed to solar power. The wind energy segment is also a critical market growth driver due to the higher interest of industry players.

Based on the sector, the renewable energy investment industry divisions are the private sector and the public sector. In 2023, the highest growth was observed in the public sector segment. This includes government entities and international or domestic organizations working for the welfare of the environment. Between 2010 and 2022, the African government invested more than USD 50 billion in renewable energy. During the projection period, the private sector emerged as the fastest-growing segment, driven by the rise in the number of private players.

Renewable Energy Investments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Renewable Energy Investments Market |

| Market Size in 2023 | USD 1,360.70 Billion |

| Market Forecast in 2032 | USD 3,104.97 Billion |

| Growth Rate | CAGR of 9.60% |

| Number of Pages | 221 |

| Key Companies Covered | Renewable Energy Group (USA), NextEra Energy (USA), Invenergy (USA), JinkoSolar (China), Iberdrola (Spain), Ormat Technologies (USA/Israel), First Solar (USA), SunPower Corporation (USA), Vestas Wind Systems (Denmark), Canadian Solar (Canada), Brookfield Renewable Partners (Canada), EDF Renewables (France), Ørsted (Denmark), Siemens Gamesa Renewable Energy (Germany/Spain), Enel Green Power (Italy), and others. |

| Segments Covered | By Industry, By Sector, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Renewable Energy Investments Market: Regional Analysis

Europe is expected to emerge as the business leader during the forecast period

The global renewable energy investments market is expected to be led by Europe during the projection period. European nations are currently some of the leading countries with a higher focus on replacing non-renewable energy sources with sustainable solutions. In September 2024, Germany, in collaboration with India, announced the launch of a new platform at the RE-invest event in 2024. The platform aims to bolster investments in the renewable energy sector. Europe aims to achieve net zero by 2050, as per official records. According to the International Energy Association, France is expected to invest EUR 34 million in the France 2030 project. Out of the 10 objectives of the initiatives, the majority aim at improving nuclear energy projects by the end of the decade.

North America is projected to emerge as a leading region in the renewable energy investment industry with higher investment. The growth in the number of government-backed renewable energy plans is fueling the regional growth rate. Additionally, North American countries such as the US and Canada are investing in infrastructure development projects for mass deployment of renewable energy initiatives.

Renewable Energy Investments Market: Competitive Analysis

The global renewable energy investments market is led by players like:

- Renewable Energy Group (USA)

- NextEra Energy (USA)

- Invenergy (USA)

- JinkoSolar (China)

- Iberdrola (Spain)

- Ormat Technologies (USA/Israel)

- First Solar (USA)

- SunPower Corporation (USA)

- Vestas Wind Systems (Denmark)

- Canadian Solar (Canada)

- Brookfield Renewable Partners (Canada)

- EDF Renewables (France)

- Ørsted (Denmark)

- Siemens Gamesa Renewable Energy (Germany/Spain)

- Enel Green Power (Italy)

The global renewable energy investments market is segmented as follows:

By Industry

- Solar Energy Industry

- Hydro Energy Industry

- Wind Energy Industry

- Others

By Sector

- Private Sector

- Public Sector

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Renewable energy investments aim to promote the development of technology and infrastructure that supports clean energy production and consumption.

The global renewable energy investments market is expected to grow due to the rising demand for energy worldwide.

According to study, the global renewable energy investments market size was worth around USD 1360.70 billion in 2023 and is predicted to grow to around USD 3,104.97 billion by 2032.

The CAGR value of the renewable energy investments market is expected to be around 9.60% during 2024-2032.

The global renewable energy investments market is expected to be led by Europe during the projection period.

The global renewable energy investments market is led by players like Renewable Energy Group (USA), NextEra Energy (USA), Invenergy (USA), JinkoSolar (China), Iberdrola (Spain), Ormat Technologies (USA/Israel), First Solar (USA), SunPower Corporation (USA), Vestas Wind Systems (Denmark), Canadian Solar (Canada), Brookfield Renewable Partners (Canada), EDF Renewables (France), Ørsted (Denmark), Siemens Gamesa Renewable Energy (Germany/Spain) and Enel Green Power (Italy).

The report explores crucial aspects of the renewable energy investments market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed