Residue Testing Market Size, Share, Trends, Growth and Forecast 2032

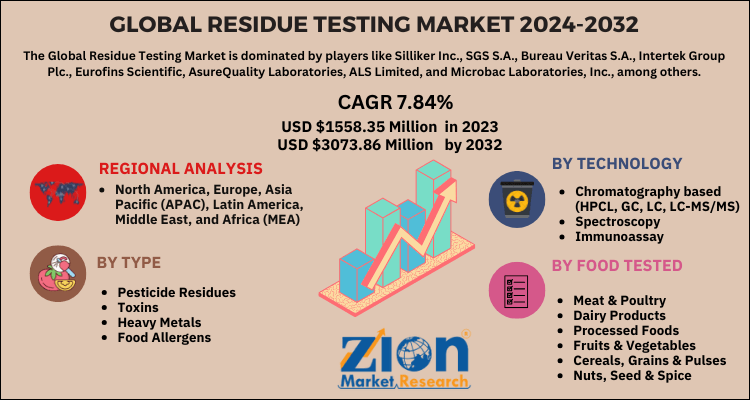

Residue Testing Market - By Type (Pesticides Residues, Toxins, Heavy Metals, Food Allergens, and Others), By Technology (Chromatography, Spectroscopy, Immunoassay, and Others), By Food Tested (Meat & Poultry, Dairy Products, Processed Food, Fruits & Vegetables, Cereals, Grains & Pulses, Nuts, Seed & Spice, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

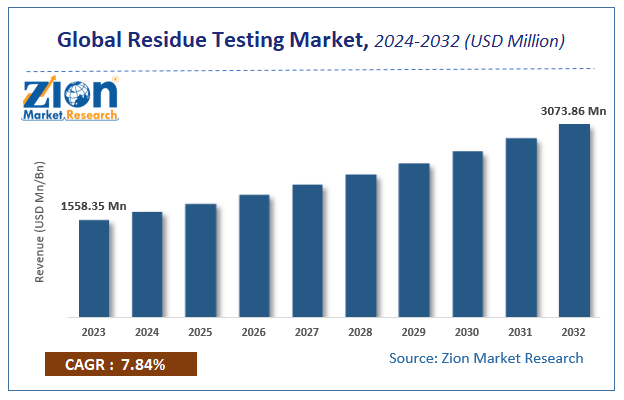

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1558.35 Million | USD 3073.86 Million | 7.84% | 2023 |

Global Residue Testing Market Insights

According to Zion Market Research, the global Residue Testing Market was worth USD 1558.35 Million in 2023. The market is forecast to reach USD 3073.86 Million by 2032, growing at a compound annual growth rate (CAGR) of 7.84% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Residue Testing industry over the next decade.

Residue Testing Market: Definition/ Overview

Residue testing is the process of analyzing and identifying undesired compounds such as pesticides, chemicals, or pollutants found in food, agricultural products, or other materials. The major goal is to ensure that the products meet safety standards and laws and that they are devoid of dangerous residues that could endanger human health. Also, residue testing plays a role in international trade because it helps ensure uniformity and adherence to safety standards throughout global supply chains.

Additionally, this kind of testing plays an important role in many industries, including agriculture and food manufacturing, where it helps to ensure product quality and safety. Manufacturers can ensure that their products meet regulatory standards by conducting residue testing, ensuring consumers’ safety and integrity.

The report covers in-depth analysis of the strategies adopted by major competitors in the global Residue Testing market. To understand the competitive landscape in the global Residue Testing market, an analysis of Porter’s Five Forces model is also included. The research study comprises of market attractiveness analysis, wherein all the segments are benchmarked on the basis of their market size and growth rate.

Will Surge in Foodborne Diseases Create Demand for Residue Testing Solutions?

The rise in the incidences of foodborne illness has shifted the focus of people toward consumer and regulatory concerns, thereby emphasizing the importance of rigorous testing procedures. This increased frequency of foodborne illnesses serves as a major driver for the Residue Testing Market, forcing industry players to invest in improved testing procedures to reduce the health hazards connected with contaminated food.

The need to ensure quality, consistency, and safety across borders is increasingly important as food supply networks are becoming more globalized. As a result, residue testing serves as an essential aspect for aligning testing procedures and ensuring that products fulfill universal safety standards. The globalization of food supply chains, with products moving between regions and countries, is highlighting the importance of residue testing and resulting in the progression of the market over the forecast period.

Furthermore, continuous improvements in analytical technology, particularly chromatography and mass spectrometry, significantly improve the efficiency and accuracy of residue testing. Thus, the adoption of cutting-edge technologies improves testing laboratories’ capabilities, allowing for more exact residue identification and quantification. This technical advancement is resulting in an increase in the dependability of testing outcomes as well as speeds up the entire testing procedure influencing the growth of the market.

What are Limitations Restraining Adoption of Residue Testing Solutions?

The incorporation of innovative residue testing equipment requires significant upfront investments as well as ongoing maintenance costs. This price barrier poses a considerable hurdle, especially for small and medium-sized businesses (SMEs) looking to employ extensive testing techniques. Furthermore, the capital-intensive nature of sophisticated technologies limits accessibility, slower industry adoption, and potentially puts some companies at a disadvantage.

Despite the effectiveness of the traditional residue testing procedures, they are often time-consuming. Delays in obtaining testing outcomes are likely to restrict the timely release of products to the market, particularly in businesses where speed-to-market is critical. This constraint emphasizes the importance of developing and implementing speedier testing approaches that maintain accuracy while speeding up the overall testing process, in line with the pace of modern production and distribution cycles.

Furthermore, the lack of globally defined testing standards presents a significant challenge for organizations operating in multiple locations. Divergent regulatory frameworks and testing criteria contribute to misunderstanding and higher compliance costs.

Category-Wise Acumens

How will the Increase in Application of Pesticide Residue Testing Fair for Overall Market?

According to ZMR analysis, the pesticide residue segment is estimated to hold the largest market share in the global Residue Testing Market during the forecast period. A pool of factors including the growing concerns surrounding crop, and food quality is increasing the use of chemicals, preservatives, and pesticides to enhance the shelf-life of the food items. This increasing use of synthetic products to increase durability and protect from insects is surging the need for pesticide residue testing to avoid its consumption.

The use of pesticides to maximize productivity and quality is proving harmful to human health is the residues left are not monitored or controlled. As a result, the need for thorough testing of pesticide residues has increased, becoming a fundamental component of residue testing methodologies and leading to this segment’s dominance in the market.

Furthermore, gas chromatography and liquid chromatography-mass spectrometry are two techniques that allow laboratories to produce trustworthy results by precisely identifying and quantifying pesticide residues. This technological advancement not only improves the capabilities of testing methodologies but it also contributes to the pesticide residues segment’s domination by ensuring the correctness and reliability of the testing procedure.

Will Precision and Sensitivity of Chromatography-Based Technology Stir up its Sales?

The chromatography-based technology segment is estimated to dominate the Residue Testing Market during the forecast period. The availability of technological advancements and precision in chromatography-based technology is enhancing its application in the food and beverages industry. The demand for high-performance liquid chromatography (HPLC) and gas chromatography (GC) is projected to rise owing to their exceptional precision and sensitivity. These characteristics enable the precise isolation and measurement of a variety of residues, including pesticides and pollutants, even at low levels and significantly influencing the market.

Chromatography’s versatility allows it to be used on a wide range of residue types, providing a comprehensive solution for a variety of testing applications. Thereby, making it a preferred choice for residue testing across diverse industries, providing a versatile and comprehensive analytical platform.

Additionally, chromatography techniques excel at both quantitative and qualitative studies, allowing for residue concentration determination as well as compound identification. This dual functionality serves as vital for regulatory compliance and product safety.

Growing incidences of foodborne disease outbreaks and the rising cases of toxicity and adulteration cases have escalated the threat to food safety. Thus, the demand for residue testing techniques is likely to increase during the forecast period. In addition, the inclination of consumers toward premium quality food has propelled high technological developments, which are, thereby, fuelling the Residue Testing market in developed nations. The advanced surveillance and detection techniques have attributed to the growth of food safety testing scenarios, specifically in the developed countries like the U.S. The consumers trust the Residue Testing market more owing to the safety certifications and agreements undertaken by the food processing firms and food service organizations. Moreover, the increasing awareness among the consumers regarding food safety along with the increasing government initiative programs is also driving the global Residue Testing market.

In addition, the increasing demand for the detection of contaminants such as pesticide residues, food allergens, toxins, pathogens, and heavy metals is predicted to augment the growth of the targeted market. The increasing export of agricultural products by many countries has propelled the adoption of residue testing over the years. Likewise, the food manufacturers and government authorities scan imported foods to check for the permitted maximum residue levels (MRLs) and this task is projected to boost the Residue Testing market.

Global Residue Testing Market: Segmentation

The research study provides a decisive view on the global Residue Testing market based on Type, Technology, Food Tested, and Region. All the segments of the market have been analyzed based on the past, present, and future trends. The market is estimated from 2024-2032.

On the basis of type, the global Residue Testing market is divided into Pesticides Residues, Toxins, Heavy Metals, Food Allergens, and Others.

Based on technology, the market is sectored into Chromatography, Spectroscopy, Immunoassay, and Others.

In terms of food tested, the market for residue testing is segregated into Meat & Poultry, Dairy Products, Processed Food, Fruits & Vegetables, Cereals, Grains & Pulses, Nuts, Seed & Spice, and Others.

The regional segmentation comprises the past, present, and estimated demand for the Middle East & Africa, North America, Asia Pacific, Latin America, and Europe. The regional segment is further split into the U.S., Canada, Mexico, UK, France, Germany, China, Japan, India, South Korea, Brazil, and Argentina among others.

Residue Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Residue Testing Market |

| Market Size in 2023 | USD 1558.35 Million |

| Market Forecast in 2032 | USD 3073.86 Million |

| Growth Rate | CAGR of 7.84% |

| Number of Pages | 110 |

| Key Companies Covered | Silliker Inc., SGS S.A., Bureau Veritas S.A., Intertek Group Plc., Eurofins Scientific, AsureQuality Laboratories, ALS Limited, and Microbac Laboratories, Inc., among others |

| Segments Covered | By Type, By Technology, By Food Tested And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Residue Testing Market: Competitive Players

Some of the key players of the global Residue Testing market include -

- Silliker Inc.

- SGS S.A.

- Bureau Veritas S.A.

- Intertek Group Plc.

- Eurofins Scientific

- AsureQuality Laboratories

- ALS Limited

- Microbac Laboratories

- among others.

Global Residue Testing Market: Segmentation

The report on the global Residue Testing market is divided into:

Global Residue Testing Market: By Type Segmentation Analysis

- Pesticide Residues

- Toxins

- Heavy Metals

- Food Allergens

- Others

Global Residue Testing Market: By Technology Segmentation Analysis:

- Chromatography based (HPCL, GC, LC, LC-MS/MS)

- Spectroscopy

- Immunoassay

- Others

Global Residue Testing Market: By Food Tested Segmentation Analysis

- Meat & Poultry

- Dairy Products

- Processed Foods

- Fruits & Vegetables

- Cereals, Grains & Pulses

- Nuts, Seed & Spice

- Others

Global Residue Testing Market: By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Residue Testing Market was valued at USD 1558.35 Million in 2023.

The Residue Testing Market is expected to reach USD 3073.86 Million by 2032, growing at a CAGR of of 7.84% between 2024 to 2032.

Residue Testing Market players such as Silliker Inc., SGS S.A., Bureau Veritas S.A., Intertek Group Plc., Eurofins Scientific, AsureQuality Laboratories, ALS Limited, and Microbac Laboratories, Inc., among others.

The report covers in-depth analysis of the strategies adopted by major competitors in the global Residue Testing market. To understand the competitive landscape in the global Residue Testing market, an analysis of Porter’s Five Forces model is also included. The research study comprises of market attractiveness analysis, wherein all the segments are benchmarked on the basis of their market size and growth rate.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Choose License Type

List of Contents

Global Market InsightsDefinition/ OverviewWill Surge in Foodborne Diseases Create Demand for Solutions?What are Limitations Restraining Adoption of Solutions?Category-Wise AcumensHow will the Increase in Application of Pesticide Fair for Overall Market?Will Precision and Sensitivity of Chromatography-Based Technology Stir up its Sales?SegmentationReport ScopeCompetitive PlayersSegmentationRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed