Robotics and Automation Market Size, Share, Analysis, Trends, Growth, 2032

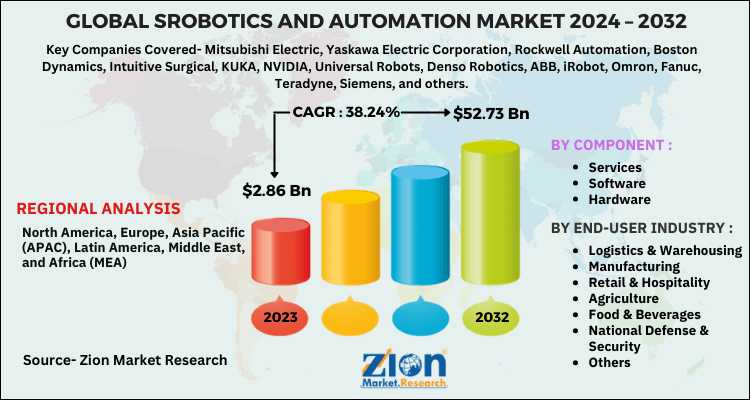

Robotics and Automation Market By Component (Services, Software, and Hardware), By End-User Industry (Logistics & Warehousing, Manufacturing, Retail & Hospitality, Agriculture, Food & Beverages, National Defense & Security, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

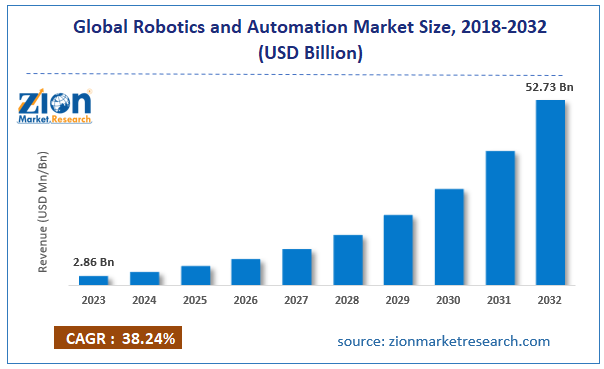

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.86 Billion | USD 52.73 Billion | 38.24% | 2023 |

Robotics and Automation Industry Prospective:

The global robotics and automation market size was worth around USD 2.86 billion in 2023 and is predicted to grow to around USD 52.73 billion by 2032 with a compound annual growth rate (CAGR) of roughly 38.24% between 2024 and 2032.

Robotics and Automation Market: Overview

Robotics and automation are a part of the next-generation technologies expected to assist the industrial revolution, especially focusing on Industry 5.0.

Industrialization, during the forecast period, is expected to enter a new trend in which human intelligence will work alongside advanced technologies such as robotics, sophisticated automation-based processes, and Artificial Intelligence (AI), to name a few.

The rapid expansion of industries worldwide has fueled the demand for automation and robotic solutions across industries. The former deals with using digital applications and services to automate processes with minimal to zero human intervention.

Automation is designed to help companies achieve operational efficiency and reduce the risk of human error. Robotics, on the other hand, deals with the design and application of robots to carry out specific tasks.

Modern robots can either be semi or fully autonomous. During the forecast period, the robotics and automation sector is expected to deliver higher revenues due to surging investments and large-scale applications across industries.

Key Insights:

- As per the analysis shared by our research analyst, the global robotics and automation market is estimated to grow annually at a CAGR of around 38.24% over the forecast period (2024-2032)

- In terms of revenue, the global robotics and automation market size was valued at around USD 2.86 billion in 2023 and is projected to reach USD 52.73 billion by 2032.

- The robotics and automation market is projected to grow at a significant rate due to the rising use of automation in the manufacturing sector.

- Based on components, the hardware segment is growing at a high rate and will continue to dominate the global market, as per industry projections.

- Based on the end-user industry, the logistics & warehousing segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Robotics and Automation Market: Growth Drivers

Rising use of automation in the manufacturing sector to drive market demand rate

The global robotics and automation market is expected to benefit from the growing use of automation technology in the manufacturing industry.

One of the major sector-based growth propellers is the sharp increase in consumerism levels. The change in consumer patterns is influenced by growing disposable income, along with the easy availability of products, especially through e-commerce portals.

In addition, brands have become more aggressive with advertising and marketing policies to reach a broader group of consumers.

For instance, major food giant Nestle invested over USD 2.59 billion in global advertisements in 2021, as per official records. In addition to this, the digital lives of people have severely impacted demand for basic products such as clothes, footwear, and accessories.

The rise of social media-influencing culture has been held responsible for promoting excess consumerism over the years. Manufacturing companies are deploying automation solutions to meet the growing end demand and create a balance between product supply and demand.

Use of robotics in the logistics and warehousing industry is at the forefront, driving market growth trends

One of the leading users of robotics in the modern world is the logistics and warehousing industry. Market players are betting big on semi-autonomous and fully autonomous robots for managing important functions related to inventory warehousing.

In September 2024, popular e-commerce retailer Amazon announced a new strategic partnership with Covariant. The agreement will allow Amazon to use the latter’s robotics models and onboarding some of the key members of Covariant’s workforce.

The move acts as a next step for Amazon to strengthen its focus on AI and robotics implementation for business operations. In March 2024, USA-based LG Business Solutions announced the launch of the LG CLOi CarryBot family of autonomous mobile robots (AMRs), focusing on the warehousing industry.

The new solutions available in the global robotics and automation market are equipped to map out and navigate complex floor plans in warehouses. According to the company claims, robots will help companies manage warehousing inefficiencies effectively.

Robotics and Automation Market: Restraints

High cost of technology innovation and application will impact the market growth rate

The global industry for robotics and automation is expected to be restricted in terms of growth due to the high expenses associated with cutting-edge technologies. The development and use of robotics and automation require high initial capital.

For instance, a robotic arm used in most automation systems can cost over USD 25,000. Additionally, the maintenance and repair expenses are considerably high.

The lack of sufficient repair facilities in some parts of the world may discourage companies from adopting the technologies.

Robotics and Automation Market: Opportunities

Investments in healthcare-based robotics & automation solutions will help the industry thrive

The global robotics and automation market is expected to generate more growth opportunities during the projection period due to rising investments in healthcare-oriented solutions.

Across the globe, medical care facilities and professionals are actively using robotic and automation technologies to conduct surgical procedures and improve patient care.

In November 2023, Johnson & Johnson MedTech announced that it would submit the company-owned OTTAVA robotic surgical system for investigational device exemption (IDE) application.

The appeal will be submitted to the U.S. Food & Drug Administration (FDA) in 2024. The technology has been developed to improve surgical experience.

Similarly, in a recent event, Intuitive Surgical announced the launch of the latest robotic surgical system in the form of da Vinci 5, the next-generation version of the popular robotic solution da Vinci surgical platform.

One of the key features of the tool is allowing medical professionals to reduce the force on tissue by almost 43% thus delivering improved patient care.

Moreover, the sensors in da Vinci 5 are equipped to generate post-operative performance measurements for further analysis and training.

Robotics and Automation Market: Challenges

Ethical implications of deploying the technologies over human job opportunities will challenge future market expansion

The global industry for robotics and automation will be challenged by the ethical implications of technology deployment on job opportunities for human resources.

For instance, companies must ensure that human resources are not deprived of jobs when introducing robotics and automation-based systems.

According to market research, around 2 million jobs have been lost worldwide due to the introduction of automation since 2000.

Robotics and Automation Market: Segmentation

The global robotics and automation market is segmented based on component, end-user industry, and region.

Based on the components, the global market segments are services, software, and hardware. In 2023, the highest growth was witnessed in the hardware segment.

The revenue is influenced by the surging use of state-of-the-art robotic tools across industries such as space exploration, healthcare, manufacturing, and others.

Additionally, robotic systems are expensive, which leads to increased revenue in the hardware segment. The average cost of industrial robots is more than USD 25,000.

The software segment is expected to be fueled by the increasing adoption of AI and machine learning systems in application development.

Based on the end-user industry, the robotics and automation industry divisions are logistics & warehousing, manufacturing, retail & hospitality, agriculture, food & beverages, national defense & security, and others.

In 2023, the logistics & warehousing segment dominated the segmental growth trend. The growing use of automation solutions to manage warehousing operations is fueling segmental revenue.

For instance, Amazon, the e-commerce brand, has deployed more than 750 robots across its warehousing facilities.

Robotics and Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Robotics and Automation Market |

| Market Size in 2023 | USD 2.86 Billion |

| Market Forecast in 2032 | USD 52.73 Billion |

| Growth Rate | CAGR of 38.24% |

| Number of Pages | 223 |

| Key Companies Covered | Mitsubishi Electric, Yaskawa Electric Corporation, Rockwell Automation, Boston Dynamics, Intuitive Surgical, KUKA, NVIDIA, Universal Robots, Denso Robotics, ABB, iRobot, Omron, Fanuc, Teradyne, Siemens, and others. |

| Segments Covered | By Component, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Robotics and Automation Market: Regional Analysis

Asia-Pacific is leading the industry revenue trends according to market research

The global robotics and automation market is dominated by Asia-Pacific. Countries such as Singapore, China, Japan, and South Korea are the highest regional market revenue generators.

For instance, China has invested heavily in developing and deploying robotic and automation solutions in the automotive industry.

According to market research, China-based manufacturing facilities use 12 times more robots than their US counterparts. South Korea, on the other hand, enjoys the benefits of the highest robot density in comparison to the number of people working. The current ratio is over 1000 robots per 10,000 workers.

In June 2024, the current government of South Korea announced an investment of USD 6.94 billion in the Artificial Intelligence sector by 2027. This will help the country’s robotics and automation industry as well.

North America is expected to remain a significant contributor to global revenue, with the US likely to emerge as the leading regional market contributor.

The growing use of robotics in healthcare will be crucial in shaping North America’s revenue in the future. In 2024, America’s total investment in the industrial robots segment grew by around 12.01% as compared to the previous year.

Robotics and Automation Market: Competitive Analysis

The global robotics and automation market is led by players like:

- Mitsubishi Electric

- Yaskawa Electric Corporation

- Rockwell Automation

- Boston Dynamics

- Intuitive Surgical

- KUKA

- NVIDIA

- Universal Robots

- Denso Robotics

- ABB

- iRobot

- Omron

- Fanuc

- Teradyne

- Siemens

The global robotics and automation market is segmented as follows:

By Component

- Services

- Software

- Hardware

By End-User Industry

- Logistics & Warehousing

- Manufacturing

- Retail & Hospitality

- Agriculture

- Food & Beverages

- National Defense & Security

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Robotics and automation are a part of the next-generation technologies.

The global robotics and automation market is expected to benefit from the growing use of automation technology in manufacturing.

According to study, the global robotics and automation market size was worth around USD 2.86 billion in 2023 and is predicted to grow to around USD 52.73 billion by 2032.

The CAGR value of the robotics and automation market is expected to be around 38.24% during 2024-2032.

The global robotics and automation market is dominated by Asia-Pacific.

The global robotics and automation market is led by players like Mitsubishi Electric, Yaskawa Electric Corporation, Rockwell Automation, Boston Dynamics, Intuitive Surgical, KUKA, NVIDIA, Universal Robots, Denso Robotics, ABB, iRobot, Omron, Fanuc, Teradyne, and Siemens.

The report explores crucial aspects of the robotics and automation market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed