Secondary Alkane Sulfonates Market Size, Share, Trends, Growth 2030

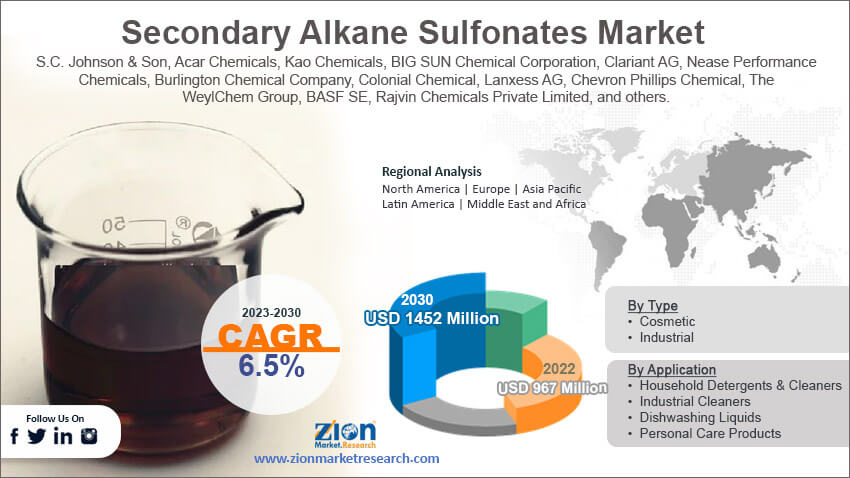

Secondary Alkane Sulfonates Market - By Type (Cosmetic and Industrial), By Application (Household Detergents & Cleaners, Industrial Cleaners, Dishwashing Liquids, and Personal Care Products), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

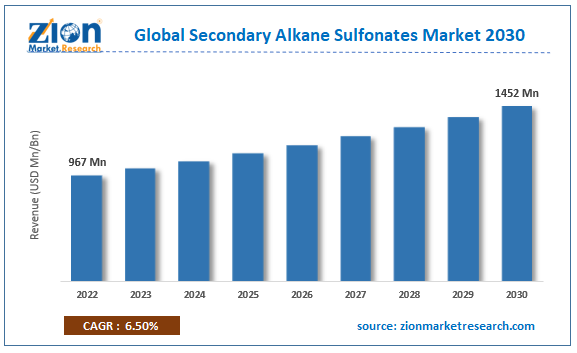

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 967 Million | USD 1452 Million | 6.5% | 2022 |

Secondary Alkane Sulfonates Industry Prospective:

The global secondary alkane sulfonates market size was evaluated at $967 million in 2022 and is slated to hit $1,452 million by the end of 2030 with a CAGR of nearly 6.5% between 2023 and 2030.

Secondary Alkane Sulfonates Market: Overview

Secondary alkane sulfonate, which is also termed paraffin sulfonates, are anionic surfactants synthesized through the reaction of n-paraffins with oxygen and sulfur dioxide with water as a catalytic agent that is exposed to UV light. The chemical reaction helps in forming secondary alkane sulfonates. Reportedly, these compounds find extensive use in the detergent & cleaning sector owing to their outstanding surfactant features. Apart from this, these products can remove oil & grease from a slew of surfaces.

Key Insights

- As per the analysis shared by our research analyst, the global secondary alkane sulfonates market is projected to expand annually at the annual growth rate of around 6.5% over the forecast timespan (2023-2030)

- In terms of revenue, the global secondary alkane sulfonates market size was evaluated at nearly $967 million in 2022 and is expected to reach $1,452 million by 2030.

- The global secondary alkane sulfonates market is anticipated to grow rapidly over the forecast timeline owing to excellent water solubility, notable foaming power, outstanding wetting action, and unique soil & grease dispersing features of the product.

- In terms of type, the cosmetic segment is slated to register the highest CAGR over the forecast period.

- Based on application, the household detergents & cleaners industry segment is expected to dominate the segmental growth in the upcoming years.

- Region-wise, the North American secondary alkane sulfonates industry is projected to register the fastest CAGR during the assessment timeline.

Request Free Sample

Request Free Sample

Secondary Alkane Sulfonates Market: Growth Factors

Beneficial features of the product are predicted to scale up the global market expansion by 2030

Excellent water solubility, notable foaming power, outstanding wetting action, and unique soil & grease dispersing features will steer the expansion of the global secondary alkane sulfonates market. Surging highlights on sustainability in developing environment-friendly secondary alkane sulfonates formulations is a major trend adopted by surfactant manufacturing firms. This, in turn, is one of the key factors steering the global market trends. Humungous use of homecare products can prop up the expansion of the market globally. Improved lifestyle dynamics coupled with a rise in the purchasing capacity of customers will prop up the growth of the market across the globe. Escalating awareness about hygiene products is anticipated to accentuate the expansion of the global market. Swift industrialization globally has favorably impacted the demand for industrial cleaners and this will embellish the expansion of the market across the globe. New product launches are predicted to contribute lucratively towards the global market revenue. Furthermore, in June 2022, BASF SE, a key player in the specialty chemicals sector, introduced VerdessenceTM RiceTouch, a new kind of biopolymer for a smooth & powdery light skin peel. The product can be used in a slew of personal care products. Such strategic initiatives will provide stimulus to the market expansion across the globe.

Secondary Alkane Sulfonates Market: Restraints

Escalating environmental concerns to put brakes on the global industry surge over 2023-2030

Growing environmental issues and the toxic nature of the product are likely to put brakes on the global secondary alkane sulfonates industry. Moreover, surging concerns related to biodegradability and environmental degradation can impede the global industry surge. A high focus on sustainability is predicted to decrease the expansion of the industry across the globe.

Secondary Alkane Sulfonates Market: Opportunities

Huge chemical stability and robust surfactant features open new growth avenues for the global market

The excellent foaming, moisturizing, and emulsifying features of the product will open new avenues of growth for the global secondary alkane sulfonates market. High chemical stability along with strong surfactant features will further spike the expansion of the market globally in the years ahead. Huge product usage in personal care products is predicted to embellish the expansion of the global market.

Secondary Alkane Sulfonates Market: Challenges

Huge costs of raw components can put brakes on the global industry surge over 2023-2030

Strict government laws restricting the use of the product for reducing health hazards will prove to be a huge challenge for the global secondary alkane sulfonates industry expansion. High raw material costs will pose a huge threat to the expansion of the industry across the globe in the years to come. Disruptions in the supply chain activities can further diminish the growth of the industry globally.

Secondary Alkane Sulfonates Market: Segmentation

The secondary alkane sulfonates market is sectored into type, application, and region.

In product type terms, the secondary alkane sulfonates market across the globe is segregated into cosmetic and industrial segments. Furthermore, the cosmetic segment, which acquired nearly 41% of the global market revenue in 2022, is anticipated to record the highest CAGR over the forecast timeline. The expansion of the segment during 2023-2030 can be a result of the growing customer awareness related to personal well-being regarding cosmetic items. In addition to this, an increase in the use of products in cosmetics such as bar soaps, shampoos, and shaving creams owing to their beneficial features such as moisturizing, foaming, and emulsifying features will steer the segmental surge.

Based on the application, the global secondary alkane sulfonates industry is sectored into the industrial cleaners, dishwashing liquids, household detergents & cleaners, and personal care products segments. Additionally, the household detergents & cleaners segment, which amassed the largest chunk of the global industry share in 2022, is projected to lead the industry growth over the forecast timespan. The segmental expansion over 2023-2030 can be due to a surge in the use of household detergents & cleaners for performing routine activities such as washing and cleaning. In addition to this, secondary alkane sulfonates are anionic ones and are a key ingredient in detergents & cleaners, thereby steering the segmental surge.

Secondary Alkane Sulfonates Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Secondary Alkane Sulfonates Market |

| Market Size in 2022 | USD 697 Million |

| Market Forecast in 2030 | USD 1452 Million |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 221 |

| Key Companies Covered | S.C. Johnson & Son, Acar Chemicals, Kao Chemicals, BIG SUN Chemical Corporation, Clariant AG, Nease Performance Chemicals, Burlington Chemical Company, Colonial Chemical, Lanxess AG, Chevron Phillips Chemical, The WeylChem Group, BASF SE, Rajvin Chemicals Private Limited, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Secondary Alkane Sulfonates Market: Regional Insights

Asia-Pacific is predicted to retain its leading position in the global secondary alkane sulfonates market over the forecast timeline

Asia-Pacific, which contributed about 55% of the global secondary alkane sulfonates market revenue in 2022, will be a dominating region over the forecast timeline. Moreover, the regional market elevation over the forecasting period can be subject to a rise in customer spending on personal care products such as moisturizers, lotions, and other cosmetic products. A prominent rise in industrialization in the region owing to favorable government policies is likely to upscale the manufacturing activities in the sub-continent. New investments in the countries of Asia-Pacific will expand the scope of the market surge in the region in the upcoming years. For instance, in December 2022, Clariant AG, a key player in the specialty chemicals sector, declared that it would make investments of nearly CHF 80 million to expand the current production capacity of its Care Chemicals unit in China. The move was aimed at enhancing its support for home care, pharmaceutical, and personal care applications in the Asia-Pacific zone. Such strategic initiatives will embellish the expansion of the market in the sub-continent.

The North American secondary alkane sulfonates industry is set to record the fastest CAGR in the years ahead subject to a rise in the demand for products in personal care products, dishwashing liquid & cleaners, and industrial cleaners. In addition to this, the implementation of strict government laws enforced by the U.S.FDA and EPA pertaining to the use of secondary alkane sulfonates in personal care products & detergents has paved the way for manufacturing eco-friendly products, thereby opening new growth opportunities for the industry in the region. Launching of new products and capacity expansion is predicted to contribute lucratively towards the growth of the industry in the region. For instance, in May 2023, Lanxess AG, a key specialty chemicals firm based in Germany, doubled its production capacity for high-purity benzyl alcohol in North America. Such moves will promote the growth of the industry in the sub-continent.

Secondary Alkane Sulfonates Market: Competitive Space

The global secondary alkane sulfonates market profiles key players such as:

- S.C. Johnson & Son

- Acar Chemicals

- Kao Chemicals

- BIG SUN Chemical Corporation

- Clariant AG

- Nease Performance Chemicals

- Burlington Chemical Company

- Colonial Chemical

- Lanxess AG

- Chevron Phillips Chemical

- The WeylChem Group

- BASF SE

- Rajvin Chemicals Private Limited

The Secondary Alkane Sulfonates market is segmented as follows:

By Type

- Cosmetic

- Industrial

By Application

- Household Detergents & Cleaners

- Industrial Cleaners

- Dishwashing Liquids

- Personal Care Products

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed