Seed Coating Materials Market Size, Share, Trends, Growth and Forecast 2032

Seed Coating Materials Market By Product (Polymers, Pellets, Colorants, Minerals/Pumice, and Others), By Crop Type (Cereals & Grains, Vegetables, Oilseeds & Pulses, Flowers & Ornamentals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

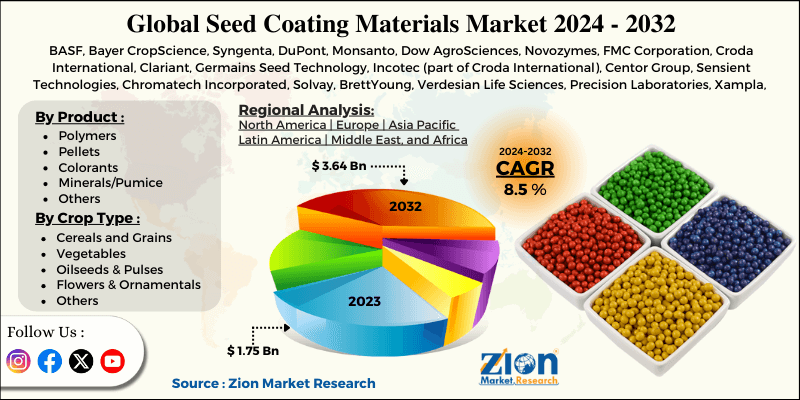

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.75 Billion | USD 3.64 Billion | 8.5% | 2023 |

Seed Coating Materials Industry Prospective:

The global seed coating materials market size was worth around USD 1.75 billion in 2023 and is predicted to grow to around USD 3.64 billion by 2032, with a compound annual growth rate (CAGR) of roughly 8.5% between 2024 and 2032.

Seed Coating Materials Market: Overview

Applied to seeds to enhance their physical and biological characteristics, seed coating materials are specialized compounds meant to increase germination, seedling development, and protection. Polymers, binders, colorants, and other additives that coat the seed surface and create a thin layer can all be among these components.

In addition to enhancing seed handling, planting efficiency, and nutrient delivery, seed coatings protect seeds from pests, diseases, and environmental stresses, and so help.

In agriculture, horticulture, and forestry, seed coatings have extensive applications in raising crop yields and general plant health. The seed coating materials industry is driven by several factors, such as increasing demand for high-quality seeds, rising awareness of sustainable agriculture, technological advancements, growth in the organic farming sector, growing focus on food security, and increasing government initiatives.

Key Insights

- As per the analysis shared by our research analyst, the global seed coating materials market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2024-2032).

- In terms of revenue, the global seed coating materials market size was valued at around USD 1.75 billion in 2023 and is projected to reach USD 3.64 billion by 2032.

- The growing collaboration among the key players is expected to drive the seed coating materials market over the forecast period.

- Based on product, the polymers segment is expected to dominate the market during the forecast period.

- Based on crop type, the cereals and grains segment dominates the market.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Seed Coating Materials Market: Growth Drivers

Increasing demand for high-quality seeds drives market growth

The growing demand for high-quality seeds is a significant driver of the seed coating materials industry. With the world's population expected to increase dramatically, there is a growing need to produce more food on limited arable land. High-quality seeds, along with improved coatings, can increase agricultural yields per hectare, helping meet these production targets.

Furthermore, coating materials containing fungicides, insecticides, and biological agents create a protective barrier against infections and pests from the moment seeds are planted. This protection promotes improved seedling establishment and lowers crop loss, making high-quality coated seeds beneficial to farmers.

Also, the growing popularity of specialty and hybrid crops, which frequently have unique requirements and higher market value, is driving the use of high-quality, coated seeds.

Seed Coating Materials Market: Restraints

The high cost of coating materials hinders market growth

The high cost of coating materials is a significant constraint to the growth of the seed coating materials market. Many seed coverings incorporate high-quality polymers, bio-based materials, and active chemicals such as insecticides or micronutrients, which can be expensive. Furthermore, bio-based or eco-friendly coatings—often recommended for sustainable agriculture—are more expensive due to complex sourcing and production methods.

In addition, producing sophisticated, effective seed barriers necessitates significant expenditure in R&D. This expense is frequently passed on to customers as corporations seek to make up their investments in producing specific coatings that improve seed quality, robustness, and performance.

Seed Coating Materials Market: Opportunities

Growing collaboration offers a lucrative opportunity for market growth

The increasing collaboration among the key players is expected to offer a lucrative opportunity for the seed coating materials market. For instance, in November 2023, expanding on its dedication to creativity and cooperation within the European innovation ecosystem, BIOWEG, a trailblazing German biotech and material science business substituting alternative fuels for fossil fuels, announced a joint venture with Bayer.

The development and testing of sustainable formulation materials for seed coatings, as well as the encapsulation of bio-based, bio-degradable controlled-release plant protection products, will be the main areas of focus of this cooperation.

Bayer and BIOWEG signed a Memorandum of Understanding outlining specific additional actions along the path between the two companies. This emphasizes the will of both sides to forward environmentally friendly agriculture solutions.

Seed Coating Materials Market: Challenges

Environmental concern poses a major challenge to market expansion

Environmental issues are a major impediment in the seed coating materials market. Many seed coverings contain synthetic compounds like insecticides and fungicides. The potential for these compounds to seep into soil and water systems raises concerns about their effects on non-target animals such as beneficial insects, soil bacteria, and aquatic ecosystems.

Furthermore, some typical seed coatings contain non-biodegradable polymers and plastics, which can pollute soil and the environment.

As people become more conscious of plastic pollution, there is a greater demand for eco-friendly, biodegradable alternatives, putting pressure on producers to adjust their formulations. In addition, the long-term consequences of particular seed coatings on soil health are not well recognized. Coatings that influence soil microbial communities or nitrogen cycling may damage soil fertility, raising concerns about sustainable farming.

Seed Coating Materials Market: Segmentation

The global seed coating materials industry is segmented based on product, crop type, and region.

Based on the product, the global seed coating materials market is segmented into polymers, pellets, colorants, minerals/pumice, and others. The polymers segment is expected to dominate the market during the forecast period. Polymers used in seed coats boost germination rates, protect seeds from pests and diseases, and improve nutrient delivery. This leads to healthier plants and higher yields, which are crucial to satisfying global food demand.

Furthermore, advances in polymer science, such as the development of biodegradable and environmentally friendly polymers, are propelling expansion. These innovations meet rising consumer demand for sustainable agriculture techniques and products, hence expanding the market.

Based on crop type, the global seed coating materials industry is bifurcated into cereals and grains, vegetables, oilseeds & pulses, flowers & ornamentals, and others. The cereals and grains segment dominates the market.

With the global population expected to exceed 9 billion by 2050, there is an increasing demand for more food production, particularly in staple crops such as rice, wheat, corn, and barley. Seed coverings that promote germination and plant health are critical to reaching this goal.

Furthermore, as agriculture moves toward more sustainable practices, coated seeds manufactured from biodegradable and environmentally friendly compounds are becoming more popular. This trend is especially relevant for cereal crops, as farmers seek to reduce their environmental effects while increasing yields.

Seed Coating Materials Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Seed Coating Materials Market |

| Market Size in 2023 | USD 1.75 Billion |

| Market Forecast in 2032 | USD 3.64 Billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 223 |

| Key Companies Covered | BASF, Bayer CropScience, Syngenta, DuPont, Monsanto, Dow AgroSciences, Novozymes, FMC Corporation, Croda International, Clariant, Germains Seed Technology, Incotec (part of Croda International), Centor Group, Sensient Technologies, Chromatech Incorporated, Solvay, BrettYoung, Verdesian Life Sciences, Precision Laboratories, Xampla, and others. |

| Segments Covered | By Product, By Crop Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Seed Coating Materials Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global seed coating materials market during the forecast period. Effective seed coating protects seeds from pests and improves germination. These protective coatings are applied to high-value crops such as hybrid vegetables, wheat, and cotton. The market for seed coating products in North America is growing together with the acreage planted for these crops.

For instance, according to FAOSTAT, the area harvested for wheat in North America grew from 24,231,110 hectares in 2021 to 24,440,300 hectares in 2022. The United States is a prominent player in the seed coating business in North America. Regulations requiring treated seeds to be colored and the growing desire for greater yields are to blame for this.

Additionally, the need for seed coating materials is greatly increased by elements like growing farm sizes, less crop rotation, and increased awareness of bioproducts.

Seed Coating Materials Market: Competitive Analysis

The global seed coating materials market is dominated by players like:

- BASF

- Bayer CropScience

- Syngenta

- DuPont

- Monsanto

- Dow AgroSciences

- Novozymes

- FMC Corporation

- Croda International

- Clariant

- Germains Seed Technology

- Incotec (part of Croda International)

- Centor Group

- Sensient Technologies

- Chromatech Incorporated

- Solvay

- BrettYoung

- Verdesian Life Sciences

- Precision Laboratories

- Xampla

The global seed coating materials market is segmented as follows:

By Product

- Polymers

- Pellets

- Colorants

- Minerals/Pumice

- Others

By Crop Type

- Cereals and Grains

- Vegetables

- Oilseeds & Pulses

- Flowers & Ornamentals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Applied to seeds to enhance their physical and biological characteristics, seed coating materials are specialized compounds meant to increase germination, seedling development, and protection. Polymers, binders, colorants, and other additives that coat the seed surface and create a thin layer can all be among these components. In addition to enhancing seed handling, planting efficiency, and nutrient delivery, seed coating coatings protect seeds from pests, diseases, & environmental stresses, and so help in agriculture, horticulture, and forestry; seed coatings find extensive application to raise crop yields and general plant health.

The seed coating materials industry is driven by several factors, such as increasing demand for high-quality seeds, rising awareness of sustainable agriculture, technological advancements, growth in the organic farming sector, growing focus on food security, and increasing government initiatives.

According to the report, the global seed coating materials market size was worth around USD 1.75 billion in 2023 and is predicted to grow to around USD 3.64 billion by 2032.

The global seed coating materials market is expected to grow at a CAGR of 8.5% during the forecast period.

The global seed coating materials market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players.

The global seed coating materials market is dominated by players like BASF, Bayer CropScience, Syngenta, DuPont, Monsanto, Dow AgroSciences, Novozymes, FMC Corporation, Croda International, Clariant, Germains Seed Technology, Incotec (part of Croda International), Centor Group, Sensient Technologies, Chromatech Incorporated, Solvay, BrettYoung, Verdesian Life Sciences, Precision Laboratories, and Xampla among others.

The seed coating materials market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed