Seed Market Size, Share, Trends, Growth 2030

Seed Market By Trait (Herbicide-tolerance, Insect-resistance, and Others), By Type (Conventional and Genetically Modified), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

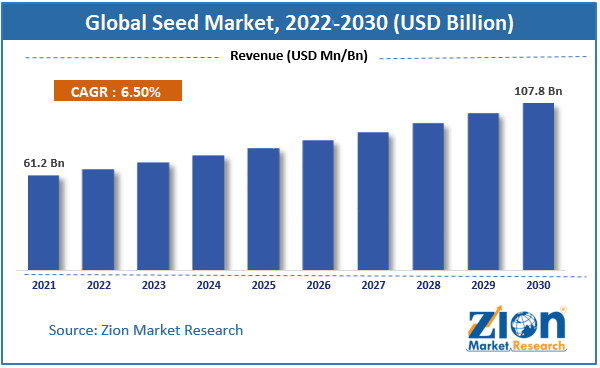

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 61.2 Billion | USD 107.8 Billion | 6.5% | 2021 |

Seed Industry Prospective:

The global seed market size was worth around USD 61.2 billion in 2021 and is predicted to grow to around USD 107.8 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.5% between 2022 and 2030.

The report analyzes the global seed market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the seed market.

Seed Market: Overview

Seed firms manufacture and sell seeds for flowers, vegetables, and fruits to amateur growers. The two basic categories of seeds accessible in the global seed market are commercial seeds and genetically modified seeds. Genetically modified seeds have better genetic material, are more resistant to diseases and pests, and produce a higher yield. The primary goal of the seed market is to meet the needs of farmers by providing better varieties of seeds and high-quality seeds at reasonable costs. The seed market is expanding due to the rising population and technological improvements.

Key Insights

- As per the analysis shared by our research analyst, the global seed market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2022-2030).

- In terms of revenue, the global seed market size was valued at around USD 61.2 billion in 2021 and is projected to reach USD 107.8 billion, by 2030.

- The increasing knowledge associated with the benefits of consuming vegetables is expected to fuel the market growth during the forecast period.

- Based on the trait, the herbicide-tolerance segment is expected to grow significantly during the forecast period.

- Based on the type, the genetically modified segment is expected to be a rapidly growing category in the seed market over the forecast period.

- Based on region, North America is expected to hold a significant market share during the forecast period.

To know more about this report, request a sample copy.

Seed Market: Growth Drivers

Increasing knowledge associated with the benefits of vegetable consumption to drive the market expansion

The increasing knowledge associated with the benefits of vegetable consumption across the globe is expected to drive the growth of the global seed market during the forecast period. For instance, according to the World Health Organization, a lack of fruit and vegetable consumption causes approximately 1.7 million deaths worldwide. In addition, a lack of fruits and vegetables is one of the top ten risk factors for world mortality. Thus, adding fruits and vegetables to the daily diet may aid in the prevention of major non-communicable diseases. Growers all around the world are focusing on expanding vegetable production through the use of diverse agricultural inputs, including high-quality vegetable planting seeds.

Seed Market: Restraints

Changing climate conditions to limit the market growth

A major global concern for agriculture productivity is climate change. Crop output is strongly impacted by climatic changes, and crops are vulnerable to pests and disease. This has an impact on crop health and changes how farming is done. The seasonal effects of temperature, precipitation, and humidity on disease and their formation and growth on seed material, which causes significant crop loss, have also been demonstrated by decades of research. Thus, the changing climatic condition is a major restraining factor for the market growth.

Seed Market: Opportunities

Increasing demand for organic seeds provides a lucrative opportunity for the market expansion

The increasing demand for organic seeds is expected to provide a lucrative opportunity for global seed market expansion during the forecast period owing to the various advantages of organic products. Expanding organic seed systems has the potential to provide economic prospects for farmers who effectively grow organic seed on their farms. The economic benefits include being able to sell organic seed commercially, becoming more seed self-sufficient and lowering input costs, and lowering financial risks by having seed that is better suited to their farm. For instance, according to the International Federation of Organic Agriculture Movements (IFOAM), the global organic food sector is valued at approximately USD 112 billion. The global organic food seeds market was worth $355 million in 2020 and is predicted to expand to $480 million by 2025, at a 6.2% CAGR.

Seed Market: Challenges

Commercialization of fake hybrid seeds acts as a major challenge for the market growth

The commercialization of fake hybrid seeds acts as a major challenge for the market expansion over the forecast period. For instance, the International Seed Federation claims that unlawful seed practices, such as the use of counterfeit seeds, counterfeit seeds, false seed labels, stolen intellectual property, and regulatory violations, have increased. Thus, acting as a major challenging factor for market growth.

Seed Market: Segmentation

The global seed market is segmented based on the trait, type, crop type, and region

Based on the trait, the global market is bifurcated into herbicide-tolerance, insect-resistance, and others. The herbicide-tolerance segment is expected to grow significantly during the forecast period owing to its various advantages such as excellent weed control, flexibility (possible to control weeds later in the plant growth), low toxicity, and others. For instance, according to an ASA study on tillage frequency on soybean fields, a large percentage of farmers implemented the "no-tillage" or "reduced tillage" practice after planting herbicide-tolerant soybean varieties. This basic weed management strategy saved over 234 million gallons of fuel while preserving 247 million tons of valuable topsoil. Moreover, according to a recent USDA analysis, herbicide use on GE corn jumped from around 1.5 pounds per planted acre in 2001 to more than 2.0 pounds per planted acre in 2010. During the same period, herbicide use on non-GMO corn remained largely stable. Thus, these facts support the market growth over the projected period.

Based on the type, the global seed is categorized into conventional and genetically modified. The genetically modified segment is expected to be a rapidly growing category in the seed market over the forecast period. Genetically modified seeds enable farmers to reduce their running costs significantly, for example, agrochemicals treatments, while guaranteeing a much more abundant harvest. They are therefore sold at a significantly higher price than conventional seeds. However, the conventional segment is expected to grow at a steady rate during the forecast period.

Recent Developments:

- In September 2021, Bayer announced that it would add organically produced seeds to its variety of vegetable seeds under the new Vegetables by Bayer brand. The launch will center on the production of three essential greenhouse and glasshouse crops—tomato, sweet pepper, and cucumber—that are certified organic. In 2023, tomato rootstock variants will come next. Varieties will be offered for sale under the vegetable seed labels Seminis and De Ruiter.

- In February 2021, Kalera, one of the fastest-growing U.S. vertical farming companies in the world and a leader in plant science for producing high-quality products in controlled environments, announced the acquisition of Vindara Inc., the first company to develop seeds specifically designed for use in vertical indoor farm environments as well as other controlled environment agriculture (CEA) farming methods. The acquisition of Vindara complements Kalera's overall science-driven and innovation-leading value proposition.

Seed Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Seed Market Research Report |

| Market Size in 2021 | USD 61.2 Billion |

| Market Forecast in 2030 | USD 107.8 Billion |

| Compound Annual Growth Rate | CAGR of 6.5% |

| Number of Pages | 195 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Monsanto Co., Syngenta Int. AG, Bayer CropScience AG, Vilmorin & Cie SA, Dow AgroSciences, KWS SAAT AG, Sakata Seed Corp., Takii & Co. Ltd., AgReliant Genetics LLC, DLF-Trifolium, Groupe Limagrain, Land O’Lakes, Inc., Rallis India Limited, and E. I. du Pont de Nemours and Company among others. |

| Segments Covered | By Trait, By Type, By Crop Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Seed Market: Regional Analysis

North America is expected to hold the largest market share over the forecast period

North America is expected to hold the largest global seed market share over the forecast period. The growth in the region is attributable to the presence of leading biotech companies and high investment in research and development. For instance, according to the US Department of Agriculture, From $5.6 billion in 1994 to $11 billion in 2010, the aggregate total of private R&D spending in the seven agricultural input industries (crop chemicals, crop seeds & biotech traits, fertilizer, farm machinery, food animal health, animal nutrition, and animal genetics) climbed by an average annual growth rate of 3.6 percent (or, in inflation-adjusted dollars, by 1.4 percent per year). Between 1994 and 2010, R&D spending increased mostly due to improvements in crops, whereas spending on animal-related inputs remained practically steady after accounting for inflation. Crop seed and biotechnology traits experienced the fastest growth in agricultural R&D between 1994 and 2010. Spending on seed-biotechnology research expanded very quickly in the 1990s and between 2007 and 2010. In addition to this, the largest seed market is in the United States, where corn contributes significantly and accounts for 22.5% of that market. The use of biotech crops is primarily accountable for this. Thus, this will drive market growth over the projected period.

Besides, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. Among important crops like rice, maize, and vegetables, the adoption of hybrids has increased, and seed replacement rates have risen. The region's hybrid rice still has excellent growth prospects. One of the biggest producers of rice worldwide is China. It recently began supplying foreign nations with rice seeds. For instance, in 2020 it helped Pakistan assure its grain supply by exporting 500 metric tons of hybrid rice seeds from a seed firm in Jiangsu province, east China. These seeds will be dispersed over an area of around 33,333 acres. Moreover, one of the most developed seed industries in the region is of India. Both the public and private sectors are crucial to the distribution and manufacturing of seeds. Growing R&D expenditures, accelerated adoption of hybrid seeds enhanced with various technology elements, such as seed treatments, and expanding international trade are the main drivers of India's private sector expansion. Corn (60%) and cotton (90%) are the two crops with the highest hybrid seed penetration in the nation. However, key grains like paddy and wheat still have relatively low penetration (less than 5%). Furthermore, vegetable seed production is boosted by the rising demand for processed vegetables in both residential households and the foodservice sector. India is renowned throughout the world as one of the top exporters of vegetable seeds.

Seed Market: Competitive Analysis

The global seed market is dominated by players like

- Monsanto Co.

- Syngenta Int. AG

- Bayer CropScience AG

- Vilmorin & Cie SA

- Dow AgroSciences

- KWS SAAT AG

- Sakata Seed Corp.

- Takii & Co. Ltd.

- AgReliant Genetics LLC

- DLF-Trifolium

- Groupe Limagrain

- Land O’Lakes Inc.

- Rallis India Limited

- E. I. du Pont de Nemours

The global seed market is segmented as follows:

By Trait

- Herbicide-tolerance

- Insect-resistance

- Others

By Type

- Conventional

- Genetically Modified

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Global population growth has led to an enormous increase in food demand, which has led to a demand for efficient ways to increase agricultural productivity. The market patterns are then likely to be influenced by this.

According to the report, the global market size was worth around USD 61.2 billion in 2021 and is predicted to grow to around USD 107.8 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.5% between 2022 and 2030.

The global seed market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major biotech companies and increasing R&D investment.

The global seed market is dominated by players like Monsanto Co., Syngenta Int. AG, Bayer CropScience AG, Vilmorin & Cie SA, Dow AgroSciences, KWS SAAT AG, Sakata Seed Corp., Takii & Co. Ltd., AgReliant Genetics LLC, DLF-Trifolium, Groupe Limagrain, Land O’Lakes, Inc., Rallis India Limited, and E. I. du Pont de Nemours and Company among others.

Choose License Type

List of Contents

Industry Prospective:OverviewKey InsightsTo know more about this report,request a sample copy.Growth DriversChanging climate conditions to limit the market growthOpportunitiesChallengesSegmentationRecent Developments:MarketReport Scope:Regional AnalysisNorth America is expected to hold the largest market share over the forecast periodCompetitive AnalysisThe global seed market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed