Seeds Processing Equipment Market Size, Share, Analysis, Trends, Growth, 2032

Seeds Processing Equipment Market By Type (Polishers, Separators, Graders, Dryers, Pre-Cleaners, Coaters, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

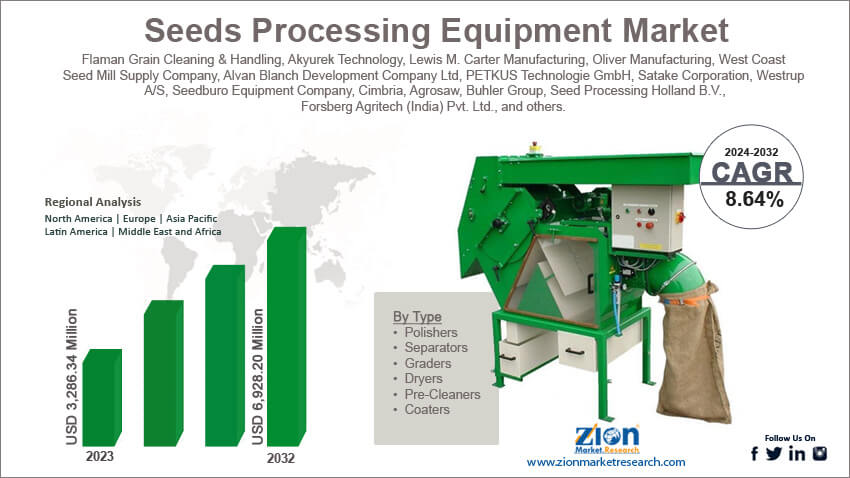

| USD 3,286.34 Million | USD 6,928.20 Million | 8.64% | 2023 |

Seeds Processing Equipment Industry Prospective:

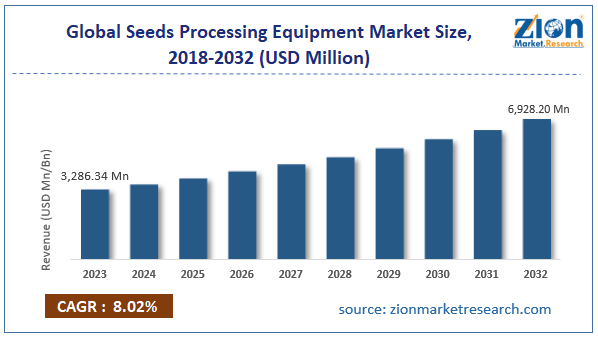

The global seed processing equipment market size was worth around USD 3,286.34 million in 2023 and is predicted to grow to around USD 6,928.20 million by 2032 with a compound annual growth rate (CAGR) of roughly 8.64% between 2024 and 2032.

Seeds Processing Equipment Market: Overview

Seeds processing equipment consists of machines and tools used during processes of seed conditioning. This equipment is used across several steps involved in ensuring that the quality of the seeds available for sale on plantations remains uncompromised. Machines for seed processing are used for seed-related procedures such as threshing, harvesting, cleaning, grading, drying, conditioning, treating, and packaging. Additional steps include testing and storing.

The increasing seed production rate across the globe is encouraging higher adoption of seed processing equipment for cleaning and sorting seeds before they are added to the crop economy. Seeds processing equipment is a form of automation in the agricultural sector as it reduces the need for manual labor in strenuous seed-related activities. They are also used for removing contaminants from the seeds thus improving their usability for further processes. Seed processing equipment are expensive tools that limit the technology adoption among crop producers with limited budgets. The growing rate of innovation in improving seed processing machine performance may generate lucrative expansion opportunities for the seed processing equipment market players.

Key Insights:

- As per the analysis shared by our research analyst, the global seeds processing equipment market is estimated to grow annually at a CAGR of around 8.64% over the forecast period (2024-2032)

- In terms of revenue, the global seeds processing equipment market size was valued at around USD 3,286.34 million in 2023 and is projected to reach USD 6,928.20 million, by 2032.

- The seed processing equipment market is projected to grow at a significant rate due to the growing investments by governments to promote regional agricultural sector

- Based on the type, the pre-cleaners segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on region, Europe is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Seeds Processing Equipment Market: Growth Drivers

Growing investments by governments to promote regional agricultural sector will drive the market demand rate

The global seeds processing equipment market is expected to grow due to the rising investments by regional governments to promote the domestic agricultural sector. The global food demand has reached its peak and continues to move toward higher peaks with the rise in the number of end-consumers. However, the agricultural sector is unable to keep up with the drastically changing end demands from consumer ends. Environmental and non-environmental factors come into play stopping the agricultural sector from reaching its true potential. Governments and officials across the globe are working toward improving the agricultural yield by launching new investment plans and initiatives in the form of loans, tax incentives, and education programs.

In September 2023, the United States Agency for International Development (USAID) along with the Norwegian Ministry of International Development announced the launch of a new multi-donor fund designed to generate millions in financing directed to be used by small and medium-sized agricultural enterprises in the African region. USAID is expected to provide an initial funding of USD 35 million and as per official claims, it can support more than 500 enterprises. In March 2024, officials from the Canadian Agriculture and Agri-Food Ministry, in association with the agriculture minister of Saskatchewan announced detailed information on the Saskatchewan Crop Insurance Corporation (SCIC)-administered the 2024 Crop Insurance Program.

Expansion of the global food & beverages (F&B) industry may generate higher market revenue

The F&B industry is witnessing rapid growth driven by factors such as a growing population, changing consumer eating preferences, higher disposable income, and improved accessibility to global food items through online stores and brick-and-mortar facilities. The investments in the global food & beverages industry have escalated in the last decade. In 2020, Nestle announced its plan to invest in the largest food development facility in Bük, a region in Hungary. The investment is worth EUR 140 million and will help the company improve its production capacity by 30%. In April 2024, another giant in the F&B sector, PepsiCo announced an investment of USD 157 million for the construction of a new flavor manufacturing site in the Indian market. Such investments are likely to impact the global seed processing equipment industry.

Seeds Processing Equipment Market: Restraints

High cost of equipment may limit the market expansion rate

The global industry for seed processing equipment is expected to be restricted due to the high cost of the machines. These devices are specialized tools that run on highly precise systems. Furthermore, the machines are made using superior-grade materials that lead to an increase in the overall cost of developing seed processing tools. The overall complex design of seed processing equipment limits the market’s growth rate. The machines, if maintained well over time, run efficiently for extensive time and hence have a longer replacement rate which limits the number of buyers in the industry.

Seeds Processing Equipment Market: Opportunities

Rising launch of new solutions with improved features may generate high-growth opportunities

The global seeds processing equipment market is projected to generate growth opportunities during the projection period led by the rising launch of new solutions in the commercial world. Seed processing equipment makers are researching on developing more advanced technologies that can help the equipment perform better and deliver exceptional results. For instance, the latest offering by Buhler Group under the brand name SORTEX J Spectra Vision is an innovative tool used for sorting seeds, plastics, and grains electronically. It offers an improved user interface as compared to its older counterparts and is equipped with full-color cameras for optical sorting. Buhler has invested heavily in developing optical sorters designed for optimizing seed germination. The equipment is developed to detect and sort unwanted colors, size & shape defects, subtle discoloration, and the presence of foreign materials thus providing a holistic application. The ongoing efforts to integrate artificial intelligence (AI) and machine learning (ML) along with sophisticated communication systems such as the Internet of Things (IoT) may help the market players tap into new consumer groups during the projection period.

High demand for quality seeds especially in the growing organic farming segment holds a higher revenue potential

The organic farming industry is currently one of the most influential segments of the agriculture sector across the globe. Organic farming deals with chemical-free feedstock for crop plantation and harvesting. The industry is one of the largest consumers of high-quality seeds and thus subsequently a crucial driver for the global seeds processing equipment market. In June 2024, Organic Valley, a US-based player in the organic farming segment, announced that it would add 100 more farms in 2024.

Seeds Processing Equipment Market: Challenges

Alternate seed processing solutions may challenge the market expansion rate

The global seeds processing equipment industry will be challenged by the presence of alternate seed processing solutions especially among farmers dealing with limited agricultural land and crop quantity. For instance, the traditional form of hand-sorting crops is widely common in certain parts of the world. The use of biological seed treatment processes is less expensive and delivers significant results.

Seeds Processing Equipment Market: Segmentation

The global seeds processing equipment market is segmented based on type and region.

Based on the type, the global market segments are polishers, separators, graders, dryers, pre-cleaners, coaters, and others. In 2023, the highest demand was observed in the pre-cleaners segment since the tool is used at the early stages of seed processing. They are used for improving seed quality. Additionally, seed separators have found extensive consumers in the market. These tools are used for separating seeds based on several factors such as color, size, weight, and other traits that determine the overall value of the seeds. Dryers play a vital role in drying seeds before they are processed further. These tools reduce the amount of moisture in the seeds thus preventing them from deteriorating in the longer process. The cost of a seed processing separator can range between USD 10,000 and USD 100,000.

Seeds Processing Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Seeds Processing Equipment Market |

| Market Size in 2023 | USD 3,286.34 Million |

| Market Forecast in 2032 | USD 6,928.20 Million |

| Growth Rate | CAGR of 8.64% |

| Number of Pages | 227 |

| Key Companies Covered | Flaman Grain Cleaning & Handling, Akyurek Technology, Lewis M. Carter Manufacturing, Oliver Manufacturing, West Coast Seed Mill Supply Company, Alvan Blanch Development Company Ltd, PETKUS Technologie GmbH, Satake Corporation, Westrup A/S, Seedburo Equipment Company, Cimbria, Agrosaw, Buhler Group, Seed Processing Holland B.V., Forsberg Agritech (India) Pvt. Ltd., and others. |

| Segments Covered | By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Seeds Processing Equipment Market: Regional Analysis

Europe to lead with the highest growth rate during the projection period

The global seeds processing equipment market is projected to be dominated by Europe during the projection period. The regional market is impacted by the existence of several key players developing highly advanced and efficient seed processing equipment. Some of the leading regional brands include companies such as Buhler, Westrup A/S, Alvan Blanch Development Company, and others. These companies are expanding their reach in international markets and hence, may generate tremendous growth during the forecast period. For instance, in a recent move, Alvan Blanch Development Company partnered with THE SACK FILLING & ROBOT PALLETISING COMPANY in the African and Middle East markets.

The company offers highly versatile seed processors and treaters that can be used in farms and processing plants. The rising constriction of new seed and food processing facilities in Europe may further promote the adoption of seed processing machines. In May 2024, Cimbria, a leading developer of an extensive range of products to be installed in processing lines, completed a turnkey project in the form of a new seed and food processing facility in Austria.

The North American region will be led by the US in the global seed processing equipment industry during the projection period. The rising demand for top-quality seeds in the organic farming segment will fuel the regional market growth rate.

Seeds Processing Equipment Market: Competitive Analysis

The global seeds processing equipment market is led by players like:

- Flaman Grain Cleaning & Handling

- Akyurek Technology

- Lewis M. Carter Manufacturing

- Oliver Manufacturing

- West Coast Seed Mill Supply Company

- Alvan Blanch Development Company Ltd

- PETKUS Technologie GmbH

- Satake Corporation

- Westrup A/S

- Seedburo Equipment Company

- Cimbria

- Agrosaw

- Buhler Group

- Seed Processing Holland B.V.

- Forsberg Agritech (India) Pvt. Ltd.

The global seeds processing equipment market is segmented as follows:

By Type

- Polishers

- Separators

- Graders

- Dryers

- Pre-Cleaners

- Coaters

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Seeds processing equipment consists of machines and tools used during processes used during seed conditioning.

The global seeds processing equipment market is expected to grow due to the rising investments by regional governments to promote the domestic agricultural sector.

According to study, the global seeds processing equipment market size was worth around USD 3,286.34 million in 2023 and is predicted to grow to around USD 6,928.20 million by 2032.

The CAGR value of the seeds processing equipment market is expected to be around 8.64% during 2024-2032.

The global seeds processing equipment market is projected to be dominated by Europe during the projection period.

The global seeds processing equipment market is led by players like Flaman Grain Cleaning & Handling, Akyurek Technology, Lewis M. Carter Manufacturing, Oliver Manufacturing, West Coast Seed Mill Supply Company, Alvan Blanch Development Company Ltd, PETKUS Technologie GmbH, Satake Corporation, Westrup A/S, Seedburo Equipment Company, Cimbria, Agrosaw, Buhler Group, Seed Processing Holland B.V. and Forsberg Agritech (India) Pvt. Ltd.

The report explores crucial aspects of the seeds processing equipment market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Seeds Processing EquipmentIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesSegmentationThe global seeds processing equipment market is segmented based on type and region.Report ScopeRegional AnalysisCompetitive AnalysisThe global seeds processing equipment market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed