Self-Storage Market Size, Share, Analysis, Trends, Growth, Forecasts, 2034

Self-Storage Market By Unit (Small, Medium, and Large), By Application (Personal and Business), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

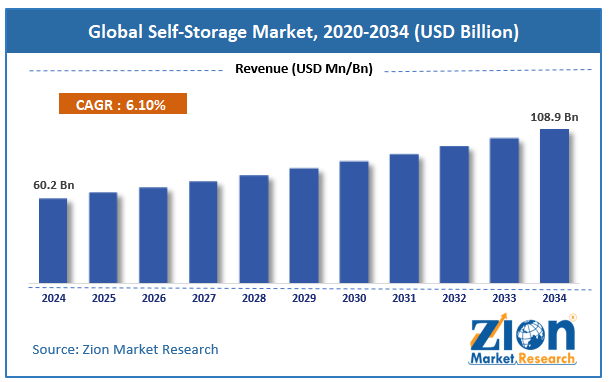

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 60.2 Billion | USD 108.9 Billion | 6.1% | 2024 |

Self-Storage Industry Prospective:

The global self-storage market size was worth around USD 60.2 billion in 2024 and is predicted to grow to around USD 108.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.1% between 2025 and 2034.

Self-Storage Market: Overview

A service called self-storage provides both individuals and companies with a safe, rented area to store their belongings for a brief or extended period. Personal storage for cars, seasonal things, and household goods, as well as commercial storage for equipment, documents, and inventory, are common purposes. The self-storage market has excellent future possibilities due to urbanization, more mobility, and the growth of e-commerce.

As technology develops, it is expected that user experiences will get better due to features like smart storage and enhanced security. The trend of remote work may also increase the market's potential, which may cause more people to search for flexible storage options as they rearrange their living areas.

Key Insights

- As per the analysis shared by our research analyst, the global self-storage market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2025-2034).

- In terms of revenue, the global self-storage market size was valued at around USD 60.2 billion in 2024 and is projected to reach USD 108.9 billion by 2034.

- The growing urbanization is expected to drive the self-storage market over the forecast period.

- Based on the unit, the medium segment is expected to hold the largest market share over the forecast period.

- Based on the application, the personal segment is expected to dominate the market expansion over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Self-Storage Market: Growth Drivers

Rising urbanization and space constraints drive market growth

A pair of the key forces driving the self-storage business is the fast-increasing pace of urbanization and the resulting space constraints in highly populated areas. Based on World Bank estimates, 56% of the world's population—around 4.4 billion people—live in cities. With about seven out of ten people living in cities, the urban population is expected to have more than doubled from its current level by 2050.

As more individuals move to cities in search of better lives and job opportunities, the accessible living and working areas usually get smaller and more expensive.

More room is needed to keep personal items, seasonal goods, or even business inventory, so an immediate problem results. Self-storage facilities are a sensible choice since their variety of unit sizes satisfies different needs. These facilities provide additional storage space for businesses and urban residents, reducing clutter and improving space management in their primary locations.

Self-Storage Market: Restraints

High initial investment and maintenance cost hinders market growth

The significant initial investment and continuing maintenance costs necessary to set up and run a facility constitute some of the biggest barriers to the self-storage industry. This may restrict new competitors and have a major effect on profitability. Land in desirable locations can be expensive to buy or lease, particularly in cities where demand is high.

Additionally, specialist HVAC systems are needed for storage facilities that provide temperature and humidity control (for delicate things like documents, electronics, or antiques), which raises capital expenses.

Self-Storage Market: Opportunities

Growing innovative product launches offer a lucrative opportunity for market growth

Growing innovative product launches offer a lucrative opportunity to the self-storage market during the forecast period. For instance, in July 2024, Vantiva announced the release of the Vantiva Peek, a patent-pending smart camera for self-storage rental units that incorporates motion, humidity, and temperature sensors.

Vantiva's self-storage operator partners are the only ones offering Vantiva Peek, a comprehensive in-unit surveillance solution. Through a monthly service subscription to the Peek app, renters can view archived and real-time camera photos and sensor data, as well as receive automatic alarms.

Self-Storage Market: Challenges

Limited availability of prime locations poses a major challenge to market expansion

One of the primary challenges for the self-storage business is the lack of good sites, especially in cities with the most demand. Obtaining prime locations presents challenges that affect customer accessibility, corporate expansion, and profitability. Building new facilities in highly populated areas is difficult because of the limited availability and great expense of land fit for self-storage.

Furthermore, self-storage companies have few choices since premium sites are usually given top priority for mixed-use, residential, or commercial buildings. The hefty rent and property tax payments firms in popular areas pay could potentially limit profitability.

Self-Storage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Self-Storage Market |

| Market Size in 2024 | USD 60.2 Billion |

| Market Forecast in 2034 | USD 108.9 Billion |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 214 |

| Key Companies Covered | CubeSmart, Metro Storage LLC, SmartStop Self Storage, Life Storage Inc., Safestore, W. P. Carey Inc., Public Storage, Prime Storage, Shurgard Self Storage, Storage Giant, Big Yellow Self Storage Company, and others. |

| Segments Covered | By Unit, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Self-Storage Market: Segmentation

The global self-storage industry is segmented based on unit, application, and region.

Based on the unit, the global self-storage market is bifurcated into small, medium, and large. The medium segment is expected to hold the largest market share over the forecast period. The affordability and adaptability of medium-sized self-storage facilities are credited with the segment's expansion.

Medium-sized units are adaptable for a variety of storage needs since they strike a compromise between price and space. Serving both private and corporate clients, they are perfect for keeping a business inventory, furniture, and household goods.

For consumers who need more room than small units but do not need the vast capacity of large units, medium units offer an affordable storage option. They are, therefore, a desirable choice for a variety of customers.

Based on the application, the global self-storage industry is bifurcated into personal and business. The personal segment is expected to dominate the market expansion over the projected period. The factors fueling the segment's expansion are growing urbanization, fewer living spaces, and lifestyle changes.

Since more people move to cities, living areas are usually smaller, and extra storage space for personal belongings that are too large for tiny homes or apartments is more necessary.

From 52% in 2010 to 57% in 2023, the World Bank Group notes the rising percentage of people living in cities globally. Rising mobility, frequent relocation, and lifestyle changes like downsizing, retirement, or divorce all drive personal storage as well. People usually need temporary storage throughout changes.

Self-Storage Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global self-storage market. The region's market is expanding due to an older population and the increasing use of technology in self-storage facilities.

North America's aging population frequently reduces the size of their living areas, necessitating storage for personal items they want to keep but are unable to fit in retirement communities or smaller residences.

Additionally, the use of technology in self-storage operations—such as digital access controls, online booking platforms, and security upgrades—improves consumer convenience and happiness, which propels market expansion.

Besides, the Asia Pacific is expected to grow at the highest CAGR in the self-storage industry during the projected period. Smaller living spaces resulting from Asia Pacific's biggest cities' fast urbanization and increasing population density demand for outside storage solutions for personal items and household goods.

Among the cities having the densest populations globally are Manila, Philippines; Mumbai, India; and Dhaka, Bangladesh. Furthermore, as local e-commerce expands dramatically, storage space is needed to manage supplies, packing, and inventory.

Self-Storage Market: Competitive Analysis

The global self-storage market is dominated by players like:

- CubeSmart

- Metro Storage LLC

- SmartStop Self Storage

- Life Storage Inc.

- Safestore

- W. P. Carey Inc.

- Public Storage

- Prime Storage

- Shurgard Self Storage

- Storage Giant

- Big Yellow Self Storage Company

The global self-storage market is segmented as follows:

By Unit

- Small

- Medium

- Large

By Application

- Personal

- Business

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A service called self-storage provides both individuals and companies with a safe, rented area to store their belongings for a brief or extended period. Personal storage for cars, seasonal things, household goods, and commercial storage for equipment, documents, and inventory are common purposes.

The self-storage market is driven by several factors, such as fast urbanization, growing e-commerce, an increase in lifestyle transition, growing demand for the real estate market, and others.

According to the report, the global self-storage market size was worth around USD 60.2 billion in 2024 and is predicted to grow to around USD 108.9 billion by 2034.

The global self-storage market is expected to grow at a CAGR of 6.1% during the forecast period.

The global self-storage market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to technological advancements and growing urbanization.

The global self-storage market is dominated by players like CubeSmart, Metro Storage LLC, SmartStop Self Storage, Life Storage Inc., Safestore, W. P. Carey Inc., Public Storage, Prime Storage, Shurgard Self Storage, Storage Giant, and Big Yellow Self Storage Company, among others.

The self-storage market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed