Semiconductor Foundry Market Size, Share, Industry Analysis, Trends, Growth, 2032

Semiconductor Foundry Market By Foundry Type (Integrated Device Manufacturers (IDMs), Fabless Semiconductor Companies, and Pure-Play Semiconductor Foundries), By Application (Communication, Consumer Electronics, and Automotive), By Technology Nodes (16/14/ nm and 10/7/5 nm), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

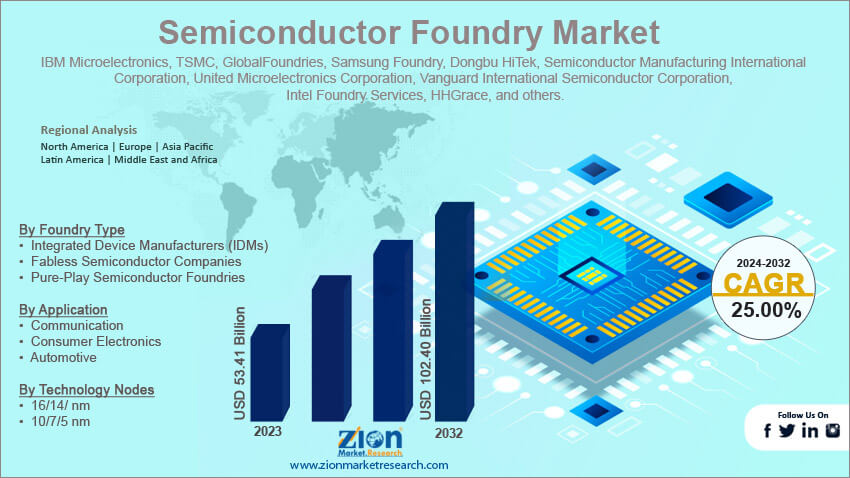

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 53.41 Billion | USD 102.40 Billion | 7.50% | 2023 |

Semiconductor Foundry Industry Prospective:

The global semiconductor foundry market size was worth around USD 53.41 billion in 2023 and is predicted to grow to around USD 102.40 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.50% between 2024 and 2032.

Semiconductor Foundry Market: Overview

A semiconductor foundry is also known as a fab. It is a highly advanced and technologically-rich facility used for the production of silicon wafers or semiconductor devices such as integrated circuits (ICs), diodes, and microprocessors. The emergence of semiconductor foundry was fueled by the growing demand for advanced chips as the modern world is built on semiconductors. They are the backbone and the most essential aspect of all types of electronic devices including smaller units such as smartphones to chips used in space shuttles and the automotive sector. The building of a semiconductor foundry requires massive investments and although they are built across the globe, the majority and the most dominant fabs are located in Asia. As of current times, investments in the semiconductor foundry sector are expanding at an exponential rate driven by the need to constantly develop high-performance and efficient semiconductors. However, the industry is also facing challenges due to the changing global relationships between trading companies, especially driven by the altering trading landscape between China and India. During the forecast period, the market outlook is expected to be positive driven by several factors.

Key Insights:

- As per the analysis shared by our research analyst, the global semiconductor foundry market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2024-2032)

- In terms of revenue, the global semiconductor foundry market size was valued at around USD 53.41 billion in 2023 and is projected to reach USD 102.40 billion, by 2032.

- The market is projected to grow at a significant rate due to the market players seeking measures to expand semiconductor manufacturing base outside Asia

- Based on foundry type segmentation, pure-play semiconductor foundries were predicted to show maximum market share in the year 2023

- Based on technology nodes segmentation, 16/14/ nm was the leading segment in 2023

- On the basis of region, Asia-Pacific was the leading revenue generator in 2023

Request Free Sample

Request Free Sample

Semiconductor Foundry Market: Growth Drivers

Market players seeking measures to expand semiconductor manufacturing base outside Asia to drive market growth

The global semiconductor foundry market is expected to witness high growth due to the increasing measures adopted by technology companies to expand the chip manufacturing base in territories outside Asia. In April 2024, the stocks of Taiwan Semiconductor Manufacturing (TSM) surged at a rapid rate after the company announced plans to invest in a third factory in the US. The company has currently invested USD 65 billion in the construction of the industrial complex. Multiple official reports indicate that chip makers are planning to seek investment options in the US, Europe, and other parts of Asia. In recent times, the European Union has allotted around 15 billion euros to be used by 2030 for private and public semiconductor projects. In 2023, the United States announced the launch of the CHIPS Act. As per the new act, US companies are not allowed to fund recipients if they plan to expand semiconductor manufacturing in China and other countries defined by the country that may pose a national threat. Such measures are expected to create a higher growth scope in other parts of the world.

Increasing the application of semiconductors in space exploration activities will impact the market growth rate

The revenue in the semiconductor factory sector is expected to surge due to the increasing use of advanced chips in space exploration activities including investments from the private sector and national authorities. In January 2024, China was reported to have tested over 100 computer processors simultaneously at the Tiangong space station, China’s extraterrestrial chip program. Modern semiconductors are an important part of the space exploration industry as they are used in almost all electronic parts of a space shuttle. They are used in the designing of onboard computers, sensors, and avionic systems to name a few. As per official reports, more than 2900 satellites were launched in space in 2023 and the number is expected to continue rising during the projection period thus resulting in more investments in the global semiconductor foundry sector.

Semiconductor Foundry Market: Restraints

High initial cost of investment will restrict the market expansion rate

The global industry for semiconductor foundry will be restricted due to the high cost of investments associated with the construction of a fully functional semiconductor fab. The minimum cost of investment ranges between USD 5 billion to USD 15 billion. However, the expense may go even higher depending on the technologies used in building the infrastructure and the offerings of the foundry. Moreover, maintaining the facility to an optimal level leads to further addition in the operational cost. There is zero margin for error in semiconductor boundaries and the slightest mistakes can lead to product failure in the end.

Semiconductor Foundry Market: Opportunities

Growing use of semiconductors in electric vehicles and renewable energy harnessing will create growth opportunities

The global semiconductor foundry market is expected to come across several growth opportunities due to the increasing demand for electric vehicles (EVs) across the globe. The automotive industry is one of the largest consumers of semiconductors. The conventional automotive sector is witnessing a shift in market trends as the demand for EVs is growing rapidly. Electric vehicles offer sustainable means of growth as they are powered by energy-storing battery packs and do not lead to the emission of harmful chemicals or gasses. In addition to this, they do not contribute to sound pollution. Electric vehicles are not limited to passenger cars since governments globally are investing in the deployment of public electric vehicles in the form of buses and other modes of transportation. By the end of 2024, as per market projections, Europe is anticipated to witness a surge of over 40% in EV demand. Similarly, other countries and regions are also registering a rise in investments in the EV sector. The investments toward semiconductor foundry will be further driven by the growing investments in measures and tools that harness renewable power such as solar or wind power. Semiconductors have found applications in tools used for harnessing the energy and this will directly impact the investments in the semiconductor foundry sector.

Rising advancements in semiconductor technology will aid higher revenue in the fab sector

The global semiconductor companies are investing in research & development. They are actively working on improving product performance and making the technology more efficient as the demand for the consumer market is evolving rapidly. Market research suggests that emerging engineering fields such as advanced manufacturing techniques, artificial intelligence, and the Internet of Things, could affect the semiconductor sector thus driving the global semiconductor foundry market.

Semiconductor Foundry Market: Challenges

Global economic volatility and changing market partnerships will challenge the market growth trends

The global semiconductor foundry industry is expected to be challenged due to the existing economic volatility across global platforms. International trade relationships are highly volatile. Additionally, access to raw materials is becoming difficult due to disruptions in the supply chain caused by geopolitical tension. Such activities could disrupt the industry growth rate in the coming years.

Semiconductor Foundry Market: Segmentation

The global semiconductor foundry market is segmented based on foundry type, application, technology nodes, and region.

Based on foundry type, the global market segments are integrated device manufacturers (IDMs), fabless semiconductor companies, and pure-play semiconductor foundries. In 2023, the highest demand was observed in the pure-play semiconductor foundries that are known to assist fabless semiconductor companies produce chips. IDMs are known to design and manufacture semiconductors whereas fabless source their manufacturing role to other companies. As per official research, more than 900 billion chips are produced and sold globally every year.

Based on application, the global semiconductor foundry industry is divided into communication, consumer electronics, and automotive.

Based on technology nodes, the global market segments are 16/14/ nm and 10/7/5 nm. In 2023, the highest demand was witnessed in the 16/14 nm segment. They are highly versatile in terms of energy efficiency and performance. Additionally, they have applications across industries. The 10/7/5 nm segment is flourishing at a rapid rate and may become the driving force in the coming years. The average age of a chip can range between 2 to 20 years.

Semiconductor Foundry Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Semiconductor Foundry Market |

| Market Size in 2023 | USD 53.41 Billion |

| Market Forecast in 2032 | USD 102.40 Billion |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 234 |

| Key Companies Covered | IBM Microelectronics, TSMC, GlobalFoundries, Samsung Foundry, Dongbu HiTek, Semiconductor Manufacturing International Corporation, United Microelectronics Corporation, Vanguard International Semiconductor Corporation, Intel Foundry Services, HHGrace, and others. |

| Segments Covered | By Foundry Type, By Application, By Technology Nodes, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Semiconductor Foundry Market: Regional Analysis

Asia-Pacific to continue leading the market growth rate during the forecast period

The global semiconductor foundry market will be led by Asia-Pacific in the coming years. The region is the most important semiconductor designing and manufacturing location with countries such as Taiwan and China leading the race. More than 40% of exports from Taiwan are related to semiconductors. In April 2024, the global chip-making company Taiwan Semiconductor Manufacturing Co (TSMC) announced that they had restarted working at their semiconductor foundry after being hit by a massive earthquake that shook the entire country. Taiwanese players are quickly expanding into new markets. In February 2024, TSMC launched its first factory in Japan. The company has already invested in a second plant that is expected to become functional by the end of 2024. In March 2024, the Indian government announced the launch of new projects worth INR 1.25 lakh crore. The money will be used for the construction of three new chip manufacturing sites spread across the country. North America is expected to be led by the US since the country plans to de-couple with China in the coming years. The US lags in the semiconductor industry front and plans to compete with Asian counterparts in the future thus driving more investments in the development of semiconductor foundry.

Semiconductor Foundry Market: Competitive Analysis

The global semiconductor foundry market is led by players like:

- IBM Microelectronics

- TSMC

- GlobalFoundries

- Samsung Foundry

- Dongbu HiTek

- Semiconductor Manufacturing International Corporation

- United Microelectronics Corporation

- Vanguard International Semiconductor Corporation

- Intel Foundry Services

- HHGrace

The global semiconductor foundry market is segmented as follows:

By Foundry Type

- Integrated Device Manufacturers (IDMs)

- Fabless Semiconductor Companies

- Pure-Play Semiconductor Foundries

By Application

- Communication

- Consumer Electronics

- Automotive

By Technology Nodes

- 16/14/ nm

- 10/7/5 nm

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A semiconductor foundry is also known as a fab

The global semiconductor foundry market is expected to witness high growth due to the increasing measures adopted by technology companies to expand the chip manufacturing base in territories outside Asia.

According to study, the global semiconductor foundry market size was worth around USD 53.41 billion in 2023 and is predicted to grow to around USD 102.40 billion by 2032

The CAGR value of semiconductor foundry market is expected to be around 7.50% during 2024-2032.

The global semiconductor foundry market will be led by Asia-Pacific in the coming years.

- The global semiconductor foundry market is led by players like IBM Microelectronics, TSMC, GlobalFoundries, Samsung Foundry, Dongbu HiTek, Semiconductor Manufacturing International Corporation, United Microelectronics Corporation, Vanguard International Semiconductor Corporation, Intel Foundry Services, and HHGrace among others.

The report explores crucial aspects of the semiconductor foundry market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed