Smart Contract Platforms Market Size, Share, Analysis, Trends, Growth, 2032

Smart Contract Platforms Market By Enterprise Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Platform (BNB Smart Chain, Solano, Cardano, Ethereum, and Others), By End-Users (Transportation & Logistics, Real Estate, Healthcare, Transportation, BFSI, Government & Public, and Others), By Blockchain Type (Hybrid, Private, and Public), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

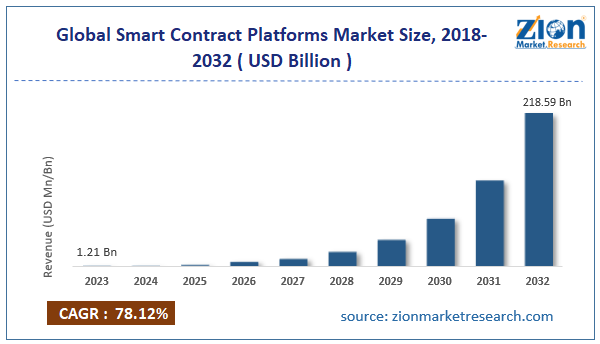

| USD 1.21 Billion | USD 218.59 Billion | 78.12% | 2023 |

Smart Contract Platforms Industry Prospective:

The global smart contract platforms market size was worth around USD 1.21 billion in 2023 and is predicted to grow to around USD 218.59 billion by 2032 with a compound annual growth rate (CAGR) of roughly 78.12% between 2024 and 2032.

Smart Contract Platforms Market: Overview

Smart contract platforms are digital tools that enable the execution of a contract using a decentralized ledger or blockchain technology. Smart contracts are rapidly replacing the traditional form of executing a contract, which generally requires an intermediary to conduct a transaction or execute a process.

Smart contract platform providers are focusing on delivering comprehensive and secure solutions to enable greater confidence in using blockchain contracts. Agreements signed using smart contract platforms are immutable, meaning the contractual conditions cannot be altered once the final draft is authorized. This attribute promotes transparency and higher confidence in contracts generated using the enabling platforms.

Moreover, partnering companies can significantly reduce unnecessary expenses since single-contract platforms eliminate the need for third-party involvement. During the projection period, rising awareness around smart contract platforms, along with the increased introduction of new solutions, is likely to promote market growth rate. However, regulatory challenges continue to remain key obstacles for future market growth trends.

Key Insights:

- As per the analysis shared by our research analyst, the global smart contract platforms market is estimated to grow annually at a CAGR of around 78.12% over the forecast period (2024-2032)

- In terms of revenue, the global smart contract platforms market size was valued at around USD 1.21 billion in 2023 and is projected to reach USD 218.59 billion by 2032.

- The smart contract platforms market is projected to grow at a significant rate due to the rising awareness among consumers.

- Based on enterprise size, the large enterprise segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on end-users, the BFSI segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Smart Contract Platforms Market: Growth Drivers

Rising awareness among consumers will drive the market demand rate during the projection period

The global smart contract platforms market is expected to grow due to rising consumer awareness. The popularity of leading platforms enabling contracts has improved due to increasing discussions over blockchain technology and its advantages. According to market research, Ethereum, a leading smart contract platform, has assisted in generating over 60.9 million smart contracts.

Similarly, other platforms have recorded an increased consumer base over the years. Blockchain technology is a modern method of storing, managing, and sharing data. It is powered by the technology’s decentralized attribute. The investments surrounding the development and promotion of blockchain have been significant in the last 5 years.

For instance, in September 2024, the Indian Ministry of Electronics and Information Technology (MeitY) announced the launch of the Vishvasya-Blockchain Technology Stack. The new solution is designed to provide Blockchain-as-a-Service (BaaS) using a geographically distributed setup. The technology is expected to support a large number of permissioned blockchain applications.

Rising use of the platforms in the banking and finance sector will promote higher return on investment (ROI)

The global Banking, Financial Services, and Insurance (BFSI) industry is one of the largest demand drivers for smart contract platforms. The rising incidents related to financial frauds and scams in the BFSI industry worldwide have fueled the need to seek solutions that allow only authorized transactions in a transparent format.

The solutions available in the global smart contract platforms industry deliver the expected results. BFSI companies can leverage smart contract platforms to automate several processes including loan management, processing of insurance claims, and compliance with regulatory provisions.

Smart Contract Platforms Market: Restraints

Evolving regulatory frameworks governing the industry will limit the industry’s expansion rate

The global industry for smart contract platforms is expected to be restricted due to the dynamic regulatory environment around the use of smart contracts and solutions enabling the execution of such agreements. For instance, India does not have specific regulations addressing the several aspects of smart contracts.

However, existing agreement-related laws in the country can be interpreted in ways that allow the execution of smart contracts. Additionally, the cost of developing blockchain technology for smart contract platforms is significantly high leading to only a limited number of players currently operating in the market.

Smart Contract Platforms Market: Opportunities

Continued investments in research & development to fuel strength in market growth momentum

The global smart contract platforms market is expected to generate more growth opportunities during the projection period due to continued investments in research & development (R&D). Market players are focusing on providing more comprehensive solutions with advanced safety features.

In March 2024, the Stellar Development Foundation (SDF which is the nonprofit organization of the Stellar Network in the US, announced the launch of Soroban on the company’s mainnet. The platform is a smart contract-enabling solution that is expected to allow anyone to deploy, build, or interact with decentralized applications (dApps) based on Stellar. SDF is expected to invest over USD 100 million into the company’s smart contract platform-based projects.

In April 2024, Docusign, an American software firm, launched Docusign Intelligent Agreement Management (IAM). The company is expected to strengthen its foothold in the Software-as-a-Service (SaaS) sector with the launch of the new tool. Docusign IAM will transform all essential business-related agreement information into key insights promoting informed decision-making.

Smart Contract Platforms Market: Challenges

Technical complexity associated with the platforms is a key challenge for the industry consumers

The global smart contract platforms industry is expected to be challenged by the complexity of digital solutions. Drafting and managing smart contracts using the platforms can be tedious and technically challenging. This is especially applicable to people who show hesitancy in adopting modern technologies for business operations.

In addition, the lack of scalability of smart contract platforms to manage the growing amount of data on the Internet could further inhibit the industry’s expansion trend.

Smart Contract Platforms Market: Segmentation

The global smart contract platforms market is segmented based on enterprise size, platform, end-users, blockchain type, and region.

Based on the enterprise size, the global market segments are small & medium enterprises (SMEs) and large enterprises. In 2023, the highest growth was witnessed in the large enterprises segment. Businesses with massive investments tend to partner with several stakeholders.

Contractual needs of large enterprises can be easily managed using smart contracts, thus allowing improved business efficiency and reducing the risk of errors. The cost of simple, smart contracts can reach over USD 15000, while advanced versions are more expensive.

Based on the platform, the global smart contract platforms industry divisions are BNB smart chain, Solano, Cardano, Ethereum, and others.

Based on the end-users, the global market divisions are transportation & logistics, real estate, healthcare, transportation, BFSI, government & public, and others. In 2023, the highest demand was registered in the BFSI segment due to the large volumes of financial information the institutes deal with.

Moreover, rising cases of financial fraud have encouraged demand for smart contracts in the BFSI industry. According to the Reserve Bank of India (RBI), the country registered more than 36000 banking frauds in fiscal year 2023-2024.

Based on blockchain type, the global market is divided into hybrid, private, and public.

Smart Contract Platforms Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Contract Platforms Market |

| Market Size in 2023 | USD 1.21 Billion |

| Market Forecast in 2032 | USD 218.59 Billion |

| Growth Rate | CAGR of 78.12% |

| Number of Pages | 219 |

| Key Companies Covered | Cardano, Binance Smart Chain (BNB Chain), Elrond (MultiversX), Ethereum, Near Protocol, Harmony, Avalanche, VeChain, Fantom, Cosmos, Algorand, Solana, Polkadot, Tezos, Tron., and others. |

| Segments Covered | By Enterprise Size, By Platform, By End-Users, By Blockchain Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Contract Platforms Market: Regional Analysis

North America to maintain its dominance in the market during the projection period

The global smart contract platforms market is expected to be led by North America during the projection period. The US is expected to succeed in the regional market due to higher penetration of smart contracts across industries in the country. Blockchain technology in the US has registered higher investments over the years.

For instance, in September 2024, a San Francisco-based blockchain startup, Story Protocol, announced that it had raised USD 80 million in Series B funding, thus bringing the total evaluation of the company to USD 2.25 billion in just two years. Moreover, the greater availability of highly advanced smart contract platforms across the US has helped the region stay ahead.

In September 2024, the Linux Foundation Decentralized Trust announced the launch of Hyperledger Fabric 3.0, the next-generation version of the existing smart contract platform Hyperledger Fabric. The newly introduced tool is an enterprise-grade, modular blockchain framework optimized for privacy, speed, and performance.

Europe has high growth potential in the smart contract platforms industry over the forecast period. The growing use of the platform across the logistics and transportation industry, along with the BFSI sector, will fuel higher regional revenue.

Ethereum, one of the world’s most prominent smart contract platforms, was launched by a Swiss company called Ethereum Switzerland GmbH (EthSuisse). The daily active users on the platform as of 2024 are more than 440,000.

Smart Contract Platforms Market: Competitive Analysis

The global smart contract platforms market is led by players like:

- Cardano

- Binance Smart Chain (BNB Chain)

- Elrond (MultiversX)

- Ethereum

- Near Protocol

- Harmony

- Avalanche

- VeChain

- Fantom

- Cosmos

- Algorand

- Solana

- Polkadot

- Tezos

- Tron.

The global smart contract platforms market is segmented as follows:

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Platform

- BNB Smart Chain

- Solano

- Cardano

- Ethereum

- Others

By End-Users

- Transportation & Logistics

- Real Estate

- Healthcare

- Transportation

- BFSI

- Government & Public

- Others

By Blockchain Type

- Hybrid

- Private

- Public

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Smart contract platforms are digital tools that enable the execution of a contract using a decentralized ledger or blockchain technology.

The global smart contract platforms market is expected to grow due to rising consumer awareness.

According to study, the global smart contract platforms market size was worth around USD 1.21 billion in 2023 and is predicted to grow to around USD 218.59 billion by 2032.

The CAGR value of the smart contract platforms market is expected to be around 78.12% during 2024-2032.

The global smart contract platforms market is expected to be led by North America during the projection period.

The global smart contract platforms market is led by players like Cardano, Binance Smart Chain (BNB Chain), Elrond (MultiversX), Ethereum, Near Protocol, Harmony, Avalanche, VeChain, Fantom, Cosmos, Algorand, Solana, Polkadot, Tezos and Tron.

The report explores crucial aspects of the smart contract platforms market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed