Smart Hospitality Market Size, Share, Analysis, Trends, Growth, 2028

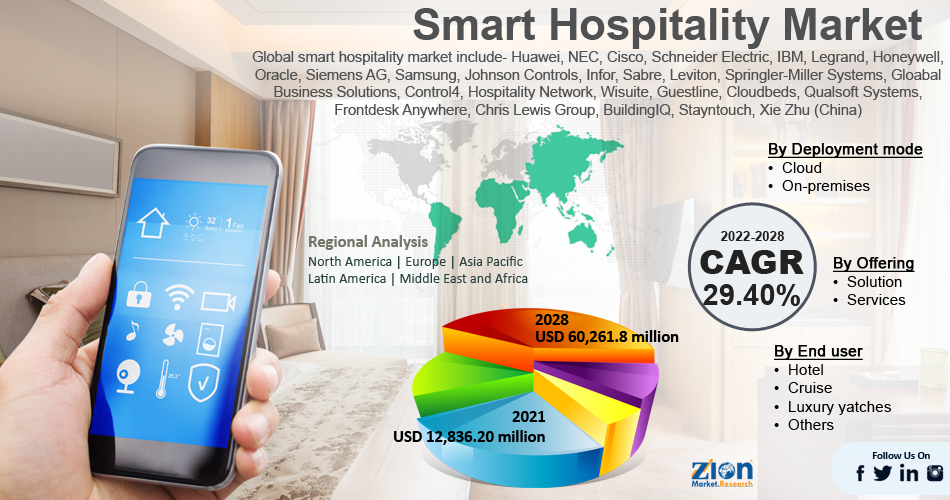

Smart Hospitality Market By Offering (Solution, Services), By Deployment Mode (Cloud, On-Premises), By End User (Hotel, Cruise, Luxury Yatches, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | Growth Rate (in %) | Base Year |

|---|---|---|---|

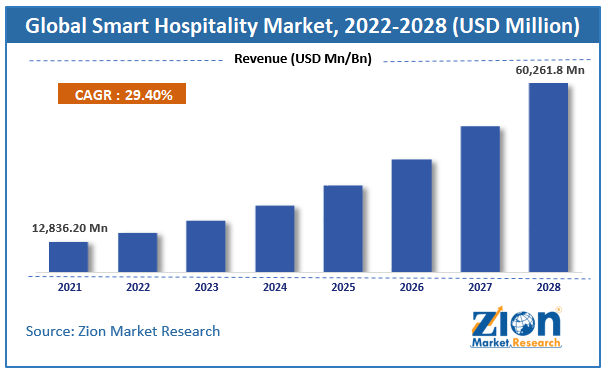

| USD 12,836.20 million | USD 60,261.8 million | CAGR at 29.40% | 2021 |

Smart Hospitality Market Size And Industry Analysis

The global smart hospitality market size was worth USD 12,836.20 million in 2021 and is estimated to grow to USD 60,261.8 million by 2028, with a compound annual growth rate (CAGR) of approximately 29.40 percent over the forecast period. The report analyzes the smart hospitality market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the smart hospitality market.

Smart Hospitality Market: Overview

Modern hardware and software are used in hotels that practice "smart hospitality" to reduce workloads and keep prices down for all properties. Smart hotels typically make use of artificial intelligence and the internet of things. Smart hotels are developed by combining big data and the internet of things, which helps save operating expenses. The power of the IoT for hotels can be seen in the variety of jobs guests may accomplish on their cellphones. In addition to controlling the temperature, smart hotel guests can also check in and out and order room service.

The business's managers also use IoT to discover the most popular services, improve internal processes, and better understand the demands of their customers. Using big data management tools, smart hotels could improve. Smart hotels may improve their services while lowering costs by utilizing big data management systems. They can more effectively handle bookings and cancellations and boost hotel occupancy in line with the tourist season. As there is a growing need for real-time guest experience management, it is driving the market's expansion. Also expected to offer potential chances for the expansion of the smart hospitality market in the upcoming years are the evolving cloud-based IoT systems.

COVID-19 Impact:

The COVID-19 outbreak has significantly impacted the global smart hospitality market. The disease's impacts are already being seen globally, and the smart hotel industry is expected to suffer significantly. Governments all across the world have banned domestic and international travel and shut down international crossings, which has hurt the hospitality sector. The COVID-19 epidemic has made visitors scared. People have postponed their personal and professional trips as a result, which is straining the hospitality sector. However, the easing of travel restrictions is anticipated to have a considerable negative impact on the smart hospitality sector, while the return of flights is anticipated to stimulate market growth.

Key Insights

- As per the analysis shared by our research analyst, the global smart hospitality market value will grow at a CAGR of 29.40% over the forecast period.

- In terms of revenue, the global smart hospitality market size was valued at around USD 12,836.20 million in 2021 and is projected to reach USD 60,261.8 million by 2028.

- The growing technological advancements in the hospitality industry and the growing need for cost-effective solutions are the major factors driving the market's growth.

- By offering, the solution category dominated the market in 2021.

- By deployment mode, the cloud deployment mode dominated the market in 2021.

- Europe dominated the global smart hospitality market in 2021.

Smart Hospitality Market: Growth Drivers

An increase in hospitality technological advancements to drive market growth

New smart hospitality solutions give hoteliers access to data-backed insights and behavior that can create a 360-degree perspective of every visitor and improve their experience through better customer care. Hoteliers can access a dashboard with organized data from all sources, which not only curates a personalized view of each guest but also helps to counterbalance operational load with the aid of integrated digital platforms like Property Management System (PMS) and Customer Relationship Management (CRM). Additionally, this lowers hotel operating expenses and boosts guest retention rates, improving brand positioning. Hotels now also benefit by offering a mobile-centric guest experience that improves the guest's convenience and self-service, hence increasing the global smart hospitality market's demand.

Smart Hospitality Market: Restraints

High expense of implementation, upkeep, and training to hinder market expansion

Most hotels using smart hospitality technologies found that maintaining them was expensive. However, the cost of deployment is typically correlated with difficulty in its application integration. Most property management systems have a straightforward pricing structure with a few exceptions. These exceptions include add-on modules, training fees, and API access. A commission percentage on direct new reservations, setup and maintenance fees, and an interface fee for third-party connections may occasionally be added on top of the monthly price schedule. Pay-per-room is the most often used business model for hotel management software. A greater number of rooms leads to a higher price per tier. Some solution providers may also charge a one-time setup cost; this acts as a restraint for the market growth.

Smart Hospitality Market: Opportunity

5G evolution will change the smart hospitality sector offering growth prospects

With new digital tools and platforms, hotel owners continually look for methods to streamline the guest experience. Operators may be able to completely transform their offers with cutting-edge in-room and cross-facility services thanks to 5G. By providing the fundamental framework for tying together wireless devices, applications, and people, 5G can propel digital transformation in the hospitality sector. Hotel owners should be able to communicate with their customers more effectively and learn more about their journeys thanks to 5G technology. With the use of 5G and ancillary technologies like edge computing, visitors can proactively receive recommendations and travel tips specifically tailored to their tastes; this could be new technology for the global smart hospitality market.

Smart Hospitality Market: Challenges

Challenges to data security and information sharing

Guest preferences and personal information are included in smart hospitality solutions. Any data leaking may have legal repercussions and doubt the hotel brand's integrity. Information exchange across organizations has long been hampered by several obstacles, including intra- and inter-organizational conflicts, technical difficulties, etc. The application of smart hotel big data for the industry might be hampered by inter-organizational problems such as a lack of confidence in the new system and disclosure of corporate data to competitors. Any ecosystem participants' worries may reduce their desire to provide data to the hospitality big data and hence acts as a challenge.

Smart Hospitality Market: Segmentation

The global smart hospitality market has been segmented into the offering, deployment mode, and end user.

Solutions and services are segments of the global smart hospitality market based on offering. This part is further divided into systems for managing emergencies, controlling access, and conducting video surveillance. These technologies aid in improving the hotels' entire security system. The hotel owners are choosing these security solutions to provide the best services possible to their guests because they are essential to enhance their stay by enhancing the overall security of the hospitality industry. Additionally, this has a favorable impact on consumer satisfaction levels. Therefore, during the projected period, these aspects encourage market participants to introduce cutting-edge goods and hotel owners to embrace such solutions.

Based on deployment mode, the market is classified into cloud and on-premises. The move from on-premise to cloud is largely attributed to the growing adoption of IoT and new, creative digital infrastructure solutions in the hospitality industry. The next-generation Oracle Hospitality OPERA Cloud Property Management (PMS) was chosen in May 2021 by Wyndham Hotels & Resorts to speed up the digital transformation of these hotels and resorts. Therefore, the elements above will propel this market's expansion from 2022 to 2027.

Based on end-user, the global smart hospitality market is segmented into hotels, cruises, luxury yatches, and others.

Recent Developments

- May 2022: Oracle and Orient Jakarta worked together to create a property management system in May 2022. Due to travel restrictions, the solution enhanced their online presence in the COVID-19 circumstance and provided staff training remotely using Oracle Digital Learning tools.

- September 2021: Infor Hospitality Management Solution (HMS) version 3.8.4 is a fully cloud-enabled hotel management solution that became available in September 2021. Because Infor HMS is readily available in real-time, hotels can quickly customize a smooth and frictionless experience while still keeping up with modern guests' hectic lifestyles and schedules.

- November 2019: The debut of a new generation of location intelligence technology for hotels, known as Guest IQ, was announced by Arrivals, the top location intelligence platform, in November 2019. By tracking all of the visitors' combined movements in real-world settings, this platform uses a variety of mobile location datasets to add behavioral context to existing insight tools.

Smart Hospitality Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Hospitality Market Research Report |

| Market Size in 2021 | USD 12,836.20 million |

| Market Forecast in 2028 | USD 60,261.8 million |

| Growth Rate | CAGR of 29.40% |

| Number of Pages | 288 |

| Key Companies Covered | Huawei, NEC, Cisco, Schneider Electric, IBM, Legrand, Honeywell, Oracle, Siemens AG, Samsung, Johnson Controls, Infor, Sabre, Leviton, Springler-Miller Systems, Gloabal Business Solutions, Control4, Hospitality Network, Wisuite, Guestline, Cloudbeds, Qualsoft Systems, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Stayntouch, Xie Zhu (China) |

| Segments Covered | By Offering, By Deployment mode, By End user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2018 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Hospitals Market: Regional Landscape

Europe dominated the global smart hospitality market in 2021

According to the TOPHOTELPROJECTS construction database, 42 new hotels will open in the Netherlands over the next few years, including 17 by the end of 2021, 9 by the end of 2022, and 8 by the end of 2023, and another 8 projects by the end of 2024. The hospitality industry's growing demand for contactless solutions and the IoT's high penetration rate incentivizes hotels to use this technology. The Louvre Hotels Group announced the expansion of its technological brand "Smart Inside" throughout Europe in June 2021. This technology delivers over 20 cutting-edge services to hotel guests for a better stay. Such changes will fuel this industry's expansion.

Smart Hospitality Market: Competitive Landscape

Some of the main competitors dominating the global smart hospitality market include-

- Huawei

- NEC

- Cisco

- Schneider Electric

- IBM

- Legrand

- Honeywell

- Oracle

- Siemens AG

- Samsung

- Johnson Controls

- Infor

- Sabre

- Leviton

- Springler-Miller Systems

- Gloabal Business Solutions

- Control4

- Hospitality Network

- Wisuite

- Guestline

- Cloudbeds

- Qualsoft Systems

- Frontdesk Anywhere

- Chris Lewis Group

- BuildingIQ

- Stayntouch

- Xie Zhu (China)

Global Smart Hospitality Market is segmented as follows:

By Offering

- Solution

- Services

By Deployment mode

- Cloud

- On-premises

By End user

- Hotel

- Cruise

- Luxury yatches

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The surge in hotel construction and tourism expansion drives demand for the smart hospitality sector. The market for smart hospitality will also be driven by the rising need for guest-focused, hyperconnected personalization and real-time optimized experiences.

The global smart hospitality market size was worth USD 12,836.20 million in 2021 and is estimated to grow to USD 60,261.8 million by 2028, with a compound annual growth rate (CAGR) of approximately 29.40 percent over the forecast period.

Europe will continue leading the smart hospitality market throughout the projected period. The well-established hospitality infrastructure and growing use of artificial intelligence-based software and equipment in hospitals are credited with this.

Some of the main competitors dominating the global smart hospitality market include - Huawei, NEC, Cisco, Schneider Electric, IBM, Legrand, Honeywell, Oracle, Siemens AG, Samsung, Johnson Controls, Infor, Sabre, Leviton, Springer-Miller Systems, Gloabal Business Solutions, Control4, Hospitality Network, Wisuite, Guestline, Cloudbeds, Qualsoft Systems, Frontdesk Anywhere, Chris Lewis Group, BuildingIQ, Stayntouch, Xie Zhu (China)

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed