Global Sneaker Market Size, Share, Trends, Growth 2034

Sneaker Market By Product Type (Athletic Sneakers, Casual Sneakers, Performance Sneakers, Limited Edition Collectibles, Sustainable Sneakers), By Consumer Group (Men, Women, Children), By Distribution Channel (Brand Stores, Specialty Retailers, Online Platforms, Department Stores, Resale Marketplaces), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

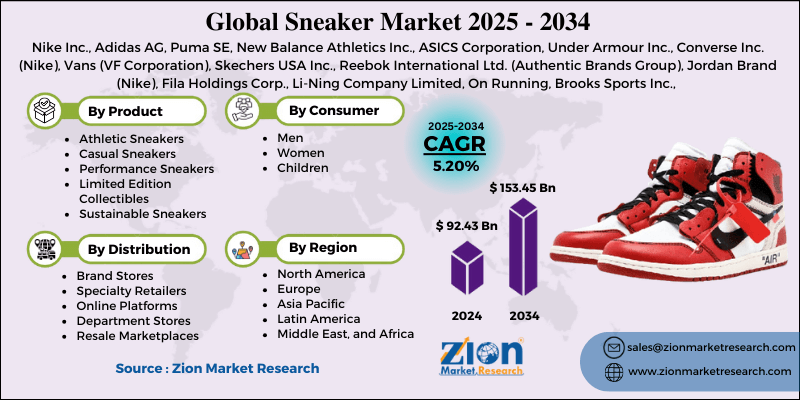

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 92.43 Billion | USD 153.45 Billion | 5.20% | 2024 |

Sneaker Industry Prospective:

The global sneaker market was valued at approximately USD 92.43 billion in 2024 and is expected to reach around USD 153.45 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.20% between 2025 and 2034.

Sneaker Market: Overview

Sneakers are casual, comfortable footwear for sports, exercise, or everyday wear. They typically feature a flexible rubber sole, cushioned insole, and a lightweight, breathable upper made from materials like mesh, leather, or synthetic fabrics.

From athletic footwear to cultural icons that span fashion, sports, art, and technology, the sneaker market serves practical needs and lifestyle statements. This established market includes performance-oriented athletic shoes, fashion-forward casuals, limited edition collectibles, and increasingly sustainable options made from eco-friendly materials.

The modern sneaker industry has footwear for all consumers across all lifestyle segments, from pro athletes to fashionistas to everyday wearers. The athleisure trend, technological innovation in footwear design, and celebrity-endorsed collections have turned sneakers from functional sportswear into fashion essentials with cultural relevance.

The integration of advanced manufacturing techniques, rising consumer demand for personalized products, and shifting retail dynamics toward digital-first experiences are expected to drive substantial growth in the sneaker industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global sneaker market is estimated to grow annually at a CAGR of around 5.20% over the forecast period (2025-2034)

- In terms of revenue, the global sneaker market size was valued at around USD 92.43 billion in 2024 and is projected to reach USD 153.45 billion by 2034.

- The sneaker market is projected to grow significantly due to changing consumer preferences toward comfort-oriented footwear, expanding sneaker culture globally, and increasing adoption of sneakers as acceptable footwear across diverse social and professional settings.

- Based on product type, athletic sneakers lead the segment and will continue to dominate the global market.

- Based on consumer groups, men's sneakers are anticipated to command the largest market share.

- Based on distribution channel, online platforms are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Sneaker Market: Growth Drivers

Athleisure trend and shifting dress code norms

The global fashion landscape has fundamentally transformed as athletic and leisure wear increasingly blend, creating demand for versatile footwear that bridges multiple lifestyle contexts. Sneakers are becoming acceptable in workplaces where formal shoes were once mandatory.

The integration of sneakers into everyday wardrobes accelerated during remote work periods and continued as hybrid work models became permanent. Fashion retailers now consistently feature sneakers as essential components of business casual outfits.

In the sneaker industry, consumer surveys indicate that the average adult now owns more sneakers than any other footwear type, reflecting their versatility across different aspects of modern life.

Digital culture and sneaker community growth

The sneaker market has evolved since social media communities centered around sneaker culture have expanded exponentially. Celebrity collaborations through digital channels generate demand, with limited releases selling out in seconds and achieving immediate market value.

The emergence of virtual sneakers for digital avatars and gaming platforms represents a new market segment with minimal production costs and expanding revenue potential. Brands increasingly leverage AI-driven customization and 3D printing technologies to offer personalized sneaker designs, further enhancing consumer engagement and exclusivity.

Sneaker Market: Restraints

Price sensitivity and market saturation concerns

The sneaker market faces challenges related to consumer price sensitivity as manufacturing costs rise and premium pricing strategies potentially exclude large consumer segments. Inventory management becomes increasingly complex for retailers, balancing regular stock with limited releases. The fast fashion segment's entry into sneaker production with lower-priced alternatives creates margin pressure for established brands.

Consumer research indicates growing hesitation among middle-market consumers to pay premium prices for standard models without special features or collectible status, suggesting potential demand plateaus in specific market segments without significant product innovation.

To maintain engagement across diverse price segments, brands are responding by introducing mid-tier sneaker lines with enhanced value propositions, such as performance-driven materials, modular designs, and customizable elements.

Sneaker Market: Opportunities

Sustainable production and circular economy innovations

Environmental consciousness among consumers presents opportunities for the global sneaker industry. Developing eco-friendly manufacturing processes, materials, and recycling programs addresses growing environmental concerns while creating new market segments. Brands introducing sneakers made from recycled ocean plastic, plant-based materials, and sustainable manufacturing processes have experienced growth rates double the industry average.

Brands with transparent supply chains and verified environmental credentials are capturing market share from traditional manufacturers, particularly among younger demographics who prioritize corporate responsibility alongside product quality.

Additionally, innovations in biodegradable sneaker materials and circular economy initiatives, such as take-back and refurbishing programs, further strengthen consumer engagement in sustainable footwear.

Sneaker Market: Challenges

Counterfeit products and authentication concerns

The sneaker industry faces challenges from counterfeit products that undermine brand value, consumer trust, and market integrity. High-demand limited releases attract sophisticated counterfeiting operations capable of producing convincing replicas that are increasingly difficult to distinguish from authentic products.

Authentication technologies, including blockchain verification, NFC chips, and specialized materials, add production costs while offering incomplete protection against sophisticated forgeries.

The secondary market faces authentication challenges, with resale platforms reporting significant resources dedicated to counterfeit detection. Consumer confidence suffers from publicized cases of undetected fakes, creating hesitation in the premium and collectible segments.

Sneaker Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sneaker Market |

| Market Size in 2024 | USD 92.43 Billion |

| Market Forecast in 2034 | USD 153.45 Billion |

| Growth Rate | CAGR of 5.20% |

| Number of Pages | 214 |

| Key Companies Covered | Nike Inc., Adidas AG, Puma SE, New Balance Athletics Inc., ASICS Corporation, Under Armour Inc., Converse Inc. (Nike), Vans (VF Corporation), Skechers USA Inc., Reebok International Ltd. (Authentic Brands Group), Jordan Brand (Nike), Fila Holdings Corp., Li-Ning Company Limited, On Running, Brooks Sports Inc., HOKA (Deckers Brands), Allbirds Inc., Veja, Stadium Goods (Farfetch), StockX., and others. |

| Segments Covered | By Product Type, By Consumer Group, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sneaker Market: Segmentation

The global sneaker market is segmented into product type, consumer group, distribution channel, and region.

Based on product type, the market is segregated into athletic sneakers, casual sneakers, performance sneakers, limited edition collectibles, and sustainable sneakers. Athletic sneakers lead the market by accounting for the largest share due to their versatility for active and casual wear and consistent innovation in comfort and performance technologies.

Based on consumer groups, the market is divided into men, women, and children. Men's sneakers are expected to lead the market during the forecast period, representing the most significant consumer segment with high average purchase frequency and spending per pair.

Based on distribution channels, the sneaker industry is categorized into brand stores, specialty retailers, online platforms, department stores, and resale marketplaces. Online platforms are expected to lead the market since they offer the broadest product selection, competitive pricing, and convenient shopping experiences for sneaker consumers.

Sneaker Market: Regional Analysis

North America to lead the market

North America is the largest sneaker market due to its strong culture, high disposable income, and being the birthplace of many sneaker brands and trends. The U.S. accounts for around 42% of global sneaker consumption, a mature market and innovation hub. The region has a vast retail infrastructure to support sneaker distribution across price points and market segments.

North American consumers have the highest brand loyalty and collecting behavior, so premium pricing works for established brands. The region leads in digital engagement with sneaker culture through social media, apps, and online communities that shape global trends.

The secondary market for collectible sneakers is most developed in North America, with auction houses and specialized platforms handling high-end transactions. Celebrity influence and sports marketing have created deep cultural associations between athletes, entertainers, and sneaker brands that drive consumer behavior.

Additionally, the region's embrace of casual workplace attire has expanded sneaker-wearing occasions beyond athletic and leisure contexts, further supporting market growth.

Asia Pacific is set to grow significantly.

The Asia Pacific region represents tremendous growth potential in the sneaker industry, fueled by rising disposable incomes, expanding urban middle classes, and increasing adoption of Western fashion influences. Regional sneaker sales have grown at rates exceeding 10% annually over the past five years. Countries like China, Japan, and South Korea are developing distinct sneaker cultures that blend international trends with local aesthetics.

Regional celebrities and influencers are becoming essential marketing channels, sometimes rivaling traditional athletic endorsements in effectiveness. The combination of manufacturing expertise, growing consumer sophistication, and digital retail infrastructure positions Asia Pacific for continued strong growth in the global market.

Additionally, the rise of resale platforms and sneaker investment culture in Asia Pacific drives demand for limited-edition releases, further boosting market expansion. Sneaker collaborations with local designers and brands are also gaining traction, catering to regional tastes and enhancing market appeal.

Recent Market Developments:

- In January 2025, Nike unveiled its most advanced performance running platform featuring adaptive cushioning technology that adjusts to individual biomechanics in real-time using embedded sensors and a proprietary responsive foam compound.

- In February 2025, Adidas launched a fully circular sneaker design with completely separable components that can be individually recycled or replaced, accompanied by a digital tracking system that records each component's environmental impact throughout its lifecycle.

- In March 2025, New Balance introduced a customization platform allowing customers to design personalized sneakers using 3D body scanning technology for precise fit optimization, with manufacturing completed within 48 hours through localized production hubs.

Sneaker Market: Competitive Analysis

The global sneaker market is led by players like:

- Nike Inc.

- Adidas AG

- Puma SE

- New Balance Athletics Inc.

- ASICS Corporation

- Under Armour Inc.

- Converse Inc. (Nike)

- Vans (VF Corporation)

- Skechers USA Inc.

- Reebok International Ltd. (Authentic Brands Group)

- Jordan Brand (Nike)

- Fila Holdings Corp.

- Li-Ning Company Limited

- On Running

- Brooks Sports Inc.

- HOKA (Deckers Brands)

- Allbirds Inc.

- Veja

- Stadium Goods (Farfetch)

- StockX.

The global sneaker market is segmented as follows:

By Product Type

- Athletic Sneakers

- Casual Sneakers

- Performance Sneakers

- Limited Edition Collectibles

- Sustainable Sneakers

By Consumer Group

- Men

- Women

- Children

By Distribution Channel

- Brand Stores

- Specialty Retailers

- Online Platforms

- Department Stores

- Resale Marketplaces

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sneakers are casual, comfortable footwear for sports, exercise, or everyday wear. They typically feature a flexible rubber sole, cushioned insole, and a lightweight, breathable upper made from materials like mesh, leather, or synthetic fabrics.

The sneaker market is expected to be driven by the continued rise of athleisure fashion, technological innovations in materials and manufacturing, growing sneaker culture in emerging markets, integrating digital elements into physical products, and increasing consumer demand for sustainable and ethical production methods.

According to our study, the global sneaker market was worth around USD 92.43 billion in 2024 and is predicted to grow to around USD 153.45 billion by 2034.

The CAGR value of the sneaker market is expected to be around 5.20% during 2025-2034.

The global sneaker market will register the highest growth in North America during the forecast period, with Asia Pacific showing the fastest growth rate.

Key players in the sneaker market include Nike, Inc., Adidas AG, Puma SE, New Balance Athletics, Inc., ASICS Corporation, Under Armour, Inc., Converse Inc., Vans, Skechers USA, Inc., Reebok International Ltd., Jordan Brand, Fila Holdings Corp., Li-Ning Company Limited, On Running, Brooks Sports, Inc., HOKA, Allbirds, Inc., Veja, Stadium Goods, and StockX.

The report comprehensively analyzes the sneaker market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving consumer preferences shaping the sneaker ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed