Solar PV Supply Chain Market Size, Share, Analysis, Trends, Growth, 2032

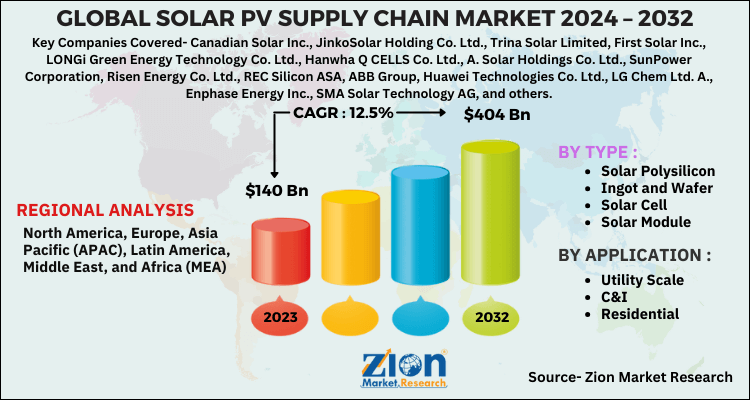

Solar PV Supply Chain Market By Type (Solar Polysilicon, Ingot & Wafer, Solar Cell, and Solar Module), By Application (Utility Scale, C&I, and Residential), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

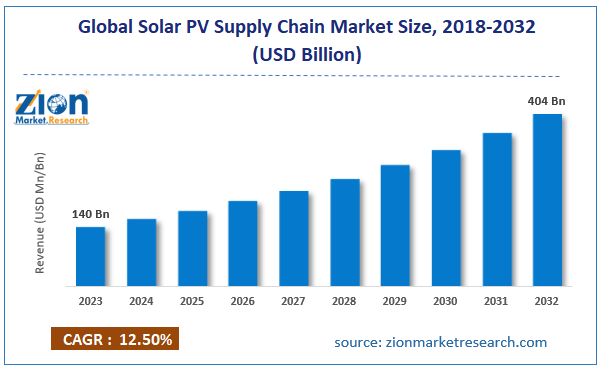

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 140 Billion | USD 404 Billion | 12.5% | 2023 |

Solar PV Supply Chain Industry Prospective:

The global solar PV supply chain market size was worth around USD 140 billion in 2023 and is predicted to grow to around USD 404 billion by 2032 with a compound annual growth rate (CAGR) of roughly 12.5% between 2024 and 2032.

Solar PV Supply Chain Market: Overview

From raw materials to the finished installed product, the solar PV (photovoltaic) supply chain is the series of actions and procedures engaged in the manufacturing and distribution of solar photovoltaic systems.

Raw material procurement, component manufacture, assembly, transportation, solar PV panels, and associated equipment installation comprise this supply chain at several phases.

Ensuring the availability, cost-efficiency, and sustainability of solar energy solutions depends critically on the solar PV supply chain. Efficient supply chains help to lower expenses and increase solar energy's accessibility.

However, challenges include limited manufacturing capacity, raw material shortages, and geopolitics, which may break off the chain and influence solar panel availability and cost.

Key Insights

- As per the analysis shared by our research analyst, the global solar PV supply chain market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2024-2032).

- In terms of revenue, the global solar PV supply chain market size was valued at around USD 140 billion in 2023 and is projected to reach USD 404 billion by 2032.

- The growing demand for clean energy is expected to drive the solar PV supply chain market over the forecast period.

- Based on type, the solar cell segment is expected to capture the largest market share over the forecast period.

- Based on application, the residential segment is expected to grow at the highest CAGR during the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Solar PV Supply Chain Market: Growth Drivers

The rising demand for clean energy drives market growth

Particularly for important components like wafers, cells, and modules, rising demand for clean energy is driving large investments into solar PV production plants.

Globally rising manufacturing facilities as a result enable the solar PV supply chain to grow to satisfy demand. The influx of funds is generating opportunities for new market players and driving current producers to improve output efficiency and innovate.

Solar PV systems may sometimes demand energy storage technologies to maximize energy utilization and control the intermittent character of solar electricity.

As part of the solar PV supply chain, demand for sustainable energy drives expansion in battery manufacture and other storage options.

By allowing solar energy to be stored and used as needed, this growth enables a more reliable solar PV system, hence increasing Solar’s attractiveness.

Thus, the increasing demand for clean energy is expected to drive the solar PV supply chain market during the forecast period.

Solar PV Supply Chain Market: Restraints

The volatile nature of key inputs hindering the market growth

Fundamental to solar PV components are materials including aluminum (for panel frames), silver (for conductive paths), and polysilicon (for solar cells).

Prices for these inputs rise, and production costs follow accordingly, usually resulting in more end-user expenses. This cost increase can make solar projects less financially appealing, so slowing down the rate of adoption and deterring possible solar industry investment.

Particularly when contract periods are long, and prices cannot be changed rapidly, price volatility makes it difficult for manufacturers to keep constant profit margins.

For manufacturers who might not be able to pass these costs on to consumers immediately, sudden increases in input costs can compress margins, therefore affecting their financial stability and maybe limiting their capacity to scale output.

Therefore, the volatile nature of key inputs hinders the solar PV supply chain industry over the forecast period.

Solar PV Supply Chain Market: Opportunities

Growing number of contracts in the sector offers a lucrative opportunity for market growth

The growing number of contracts in the sector is expected to offer a lucrative opportunity to the solar PV supply chain market over the analysis period.

For instance, in September 2023, at the 2023 RE+ conference in Las Vegas, Canadian Solar Inc. declared that it had completed contracts for about 4 GWp of solar modules. Both its expanded Thailand module production and its planned Texas factory are anticipated to support the contracts.

Additionally, the market responded well to the recently released EP Cube Lite, which led to hundreds of additional system orders during RE+.

Both standalone home storage systems and whole residential PV plus storage system packages, which include high-efficiency Canadian Solar residential PV modules, are included in these orders.

By moving the use of less expensive daytime energy to the nighttime, when rates are usually higher, the EP Cube Lite enables homes to reduce their electricity expenses.

Solar PV Supply Chain Market: Challenges

The lack of recycling infrastructure for solar panels poses a major challenge to market expansion

About 25 to 30 years is the lifetime of solar panels; as the initial generations of panels reach their end-of-life, waste is accumulating.

Discarded panels add to landfill buildup without enough recycling facilities, which generates hazards to the environment from cadmium and lead found in some kinds of panels. This problem compromises the sustainability and credibility of the sector since it runs against the environmental objectives that solar energy is supposed to assist.

Moreover, a sustainable solar PV supply chain preferably follows a circular economy model, in which materials are always reused to reduce waste. The absence of recycling facilities breaks off this cycle, so the solar sector finds it challenging to reach circularity.

A more circular method would not only increase resource efficiency but also lower the environmental impact of solar PV manufacture, therefore improving the general market sustainability.

Therefore, the lack of recycling infrastructure for solar panels poses a major challenge for the expansion of the solar PV supply chain industry.

Solar PV Supply Chain Market: Segmentation

The global solar PV supply chain industry is segmented based on type, application, and region.

Based on the type, the global solar PV supply chain market is segmented into solar polysilicon, ingot and wafer, solar cell, and solar module. The solar cell segment is expected to capture the largest market share over the forecast period.

The global demand for solar cells is being driven by the need for renewable energy sources to combat climate change. Particularly in areas with significant solar potential, the adaptability of solar energy in the commercial, industrial, and residential sectors is opening up new markets for solar cells.

The production of solar cells generates revenue as solar use increases and manufacturers expand their operations to keep up with the demand.

Based on application, the global solar PV supply chain industry is bifurcated into utility scale, C&I, and residential. The residential segment is expected to grow at the highest CAGR during the forecast period.

Over the past ten years, improvements in manufacturing techniques, economies of scale, and technology breakthroughs have significantly reduced the cost of solar PV systems.

Homeowners can now afford solar due to these price reductions, which also increase demand and foster expansion in the solar PV supply chain. In the domestic market, lower prices also help manufacturers and installers reach a broader demographic.

Solar PV Supply Chain Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Solar PV Supply Chain Market |

| Market Size in 2023 | USD 140 Billion |

| Market Forecast in 2032 | USD 404 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 223 |

| Key Companies Covered | Canadian Solar Inc., JinkoSolar Holding Co. Ltd., Trina Solar Limited, First Solar Inc., LONGi Green Energy Technology Co. Ltd., Hanwha Q CELLS Co. Ltd., A. Solar Holdings Co. Ltd., SunPower Corporation, Risen Energy Co. Ltd., REC Silicon ASA, ABB Group, Huawei Technologies Co. Ltd., LG Chem Ltd. A., Enphase Energy Inc., SMA Solar Technology AG, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Solar PV Supply Chain Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global solar PV supply chain market during the forecast period. The expansion in the regional market is attributable to the increasing government initiatives.

As they establish high renewable energy objectives and provide incentives to hasten solar adoption, nations throughout Asia Pacific and China want to reach peak carbon emissions by 2030 and carbon neutrality by 2060; India has promised to have 500 GW of renewable energy capacity by 2030.

These regulations increase demand for solar PV projects and encourage manufacturing facility investments throughout the region.

In addition, the adoption of solar cells and PV modules—including bifacial and perovskite cells—is driven by their increasing solar efficiency and durability resulting from technological developments.

Asia Pacific businesses are spending more on R&D to improve PV technologies and lower manufacturing costs, therefore enabling the area to remain competitive. These developments improve performance and efficiency, therefore supporting the expansion of the solar PV supply chain.

Solar PV Supply Chain Market: Competitive Analysis

The global solar PV supply chain market is dominated by players like:

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Limited

- First Solar Inc.

- LONGi Green Energy Technology Co. Ltd.

- Hanwha Q CELLS Co. Ltd.

- A. Solar Holdings Co. Ltd.

- SunPower Corporation

- Risen Energy Co. Ltd.

- REC Silicon ASA

- ABB Group

- Huawei Technologies Co. Ltd.

- LG Chem Ltd. A.

- Enphase Energy Inc.

- SMA Solar Technology AG

The global solar PV supply chain market is segmented as follows:

By Type

- Solar Polysilicon

- Ingot and Wafer

- Solar Cell

- Solar Module

By Application

- Utility Scale

- C&I

- Residential

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

From raw materials to the finished installed product, the solar PV (photovoltaic) supply chain is the series of actions and procedures engaged in the manufacturing and distributing of solar photovoltaic systems. Raw material procurement, component manufacture, assembly, transportation, solar PV panels, and associated equipment installation comprise this supply chain in several phases.

The solar PV supply chain market is being driven by several factors, including increasing adoption of clean energy, rising government initiatives, increasing number of solar contracts, and many others.

According to the report, the global solar PV supply chain market size was worth around USD 140 billion in 2023 and is predicted to grow to around USD 404 billion by 2032.

The global solar PV supply chain market is expected to grow at a CAGR of 12.5% during the forecast period.

The global solar PV supply chain market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the growing adoption of clean energy.

The global solar PV supply chain market is dominated by players like Canadian Solar Inc., JinkoSolar Holding Co. Ltd., Trina Solar Limited, First Solar Inc., LONGi Green Energy Technology Co. Ltd., Hanwha Q CELLS Co. Ltd., A. Solar Holdings Co. Ltd., SunPower Corporation, Risen Energy Co. Ltd., REC Silicon ASA, ABB Group, Huawei Technologies Co. Ltd., LG Chem Ltd. A., Enphase Energy Inc. and SMA Solar Technology AG among others.

The solar PV supply chain market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed