Solution Styrene Butadiene Rubber (S-SBR) Market Size, Share, Trends and Forecast, 2028

Solution Styrene Butadiene Rubber (S-SBR) Market By Type (Butadiene Raw Material and Styrene Raw Material), By Application (Tires, Footwear, Polymer Modification, and Adhesives and Sealants), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

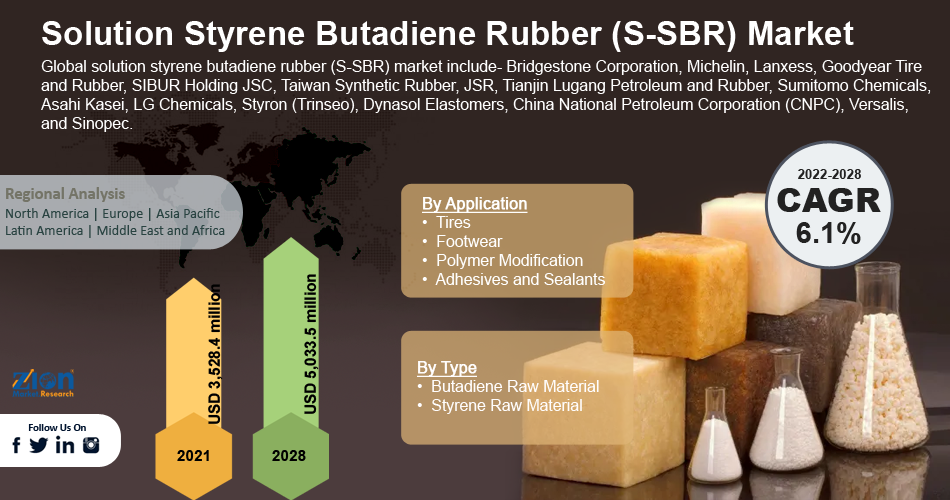

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,528.4 Million | USD 5,033.5 Million | 6.1% | 2021 |

Industry Perspective:

The global solution styrene butadiene rubber (S-SBR) market size was worth USD 3,528.4 million in 2021 and is estimated to grow to USD 5,033.5 million by 2028, with a compound annual growth rate (CAGR) of roughly 6.1 percent over the forecast period. The report analyzes the solution styrene butadiene rubber (S-SBR) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the solution styrene butadiene rubber (S-SBR) market.

Solution Styrene Butadiene Rubber (S-SBR) Mar: Overview

Rubber made from styrene and butadiene copolymer is called styrene butadiene rubber (SBR). The synthetic butadiene rubber sector is expanding due to its production ranking first among all synthetic rubbers and its consumption outpacing all other synthetic rubbers. SBR has largely taken the place of natural rubber in many applications due to the former's economic advantages over the latter.

Excellent abrasion resistance, a better aging feature, and crack resistance are some of the SBR's characteristics. Since oxidation increases the interlinking of polymer chains, SBR, unlike natural rubber, tends to harden over time. These characteristics determine the extensive use of SBR in tire treads. Styrene butadiene rubber was one of the first industrial general-purpose rubbers (SBR). With its universal qualities, it has maintained a dominant position among all synthetic rubber types, accounting for 36–37% of all synthetic rubber usage.

One of the main factors propelling the growth of the global solution styrene butadiene rubber (S-SBR) market is the global demand from the tire-producing industry. Consumers' rising demand for new cars and replacement tires, as well as their preference for synthetic rubber over natural rubber (NR) for various applications, all contribute to the market's rapid expansion. Synthetic rubber also has an inherent advantage over NR regarding stability and physical characteristics. The growth of the global market is most likely to be hampered by fluctuating raw material prices.

COVID-19 Impact:

With the start of the 2020 pandemic that originated in China, the styrene-butadiene rubber industry saw a decline in growth. Lockdowns were implemented worldwide to stop the spread of diseases, which led to the closure of many enterprises owing to a lack of skilled labor and raw supplies and the disruption of international trade. As all industries have resumed regular business operations in the post-pandemic era, the market for styrene-butadiene rubber is steadily recovering. In the post-pandemic era, demand for SBR in the tire industry is anticipated to be a key area of concentration for providers of styrene butadiene rubber.

To know more about this report, request a free sample copy.

Key Insights

- As per the analysis shared by our research analyst, the global solution styrene butadiene rubber (S-SBR) market value is expected to grow at a CAGR of 6.1% over the forecast period.

- In terms of revenue, the global solution styrene butadiene rubber (S-SBR) market size was valued at around USD 3,528.4 million in 2021 and is projected to reach USD 5,033.5 million by 2028.

- Demand for S-SBR should be driven by expanding application prospects in tire manufacturing due to enhanced processability, great wear & grip qualities, and good fuel efficiency.

- By type, the styrene raw material category dominated the market in 2021.

- By application, the tires category dominated the market in 2021.

- North America dominated the global solution styrene butadiene rubber (S-SBR) market in 2021.

Solution Styrene Butadiene Rubber (S-SBR) Market: Growth Drivers

Vehicle sales are increasing, which is boosting use of S-SBR in tire manufacturing

Over the past few years, vehicle sales have expanded significantly over the world, which has therefore raised the demand for tires. Since solution styrene butadiene rubber is a crucial raw ingredient in the production of tires, demand for it is predicted to increase in the coming years. Additionally, the global solution styrene butadiene rubber (S-SBR) market growth is anticipated to be aided by rising demand for lightweight tires for usage in electric vehicles through 2032. Over the next years, it is projected that demand for solution styrene butadiene rubber will play a significant role in driving the growth of the entire industry.

Solution Styrene Butadiene Rubber (S-SBR) Market: Restraints

Stringent regulation for the market will hamper its growth

Rules and consequences govern rubber markets to ensure the business is conducted legally and efficiently. Additionally, exposing rubber waste improperly or carelessly to the environment might harm it, which is why several rules have been implemented to prevent industries from harming the environment. To maintain legal oversight of the solution styrene butadiene rubber, strict norms and regulations are put in place. The solution styrene butadiene rubber's strict regulatory repercussions also act as a brake on the market's expansion.

Solution Styrene Butadiene Rubber (S-SBR) Market: Segmentation

The global solution styrene butadiene rubber (S-SBR) market has been segmented into type and application.

Based on type, the worldwide solution styrene butadiene rubber (S-SBR) market is segmented into butadiene raw material and styrene raw material. In 2021, the styrene raw material segment dominated the market. The styrene market is primarily driven by increased demand from the packaging industry across various geographies. With its moisture resistance, lightweight, and flexibility, the chemical is widely used for packaging consumer goods like milk, fruits, meat, and other packaged food items.

Based on application, the global solution styrene butadiene rubber (S-SBR) market is segmented into tires, footwear, polymer modification, and adhesives and sealants. In 2021, tires accounted for the largest application sector, making for 81.0% of the total volume of the worldwide S-SBR market. Vehicle sales have increased globally, and this trend is anticipated to continue during the forecast period. As the number of cars on the road rises, so make tire sales, which fuel shipments of styrene butadiene rubber. Demand is anticipated to increase during the projection period as S-SBR is increasingly used in producing high-performance tires due to the vehicle's better performance and excellent fuel efficiency.

Recent Developments

- In November 2021, Trinseo, a US-based latex binders and engineered materials producer, had begun exploring the possibility of offloading its styrenics assets and intends to launch a formalized selling process within the first quarter of 2022. The company's businesses in polystyrene and feedstocks will also be up for sale, along with its 50% stake in the joint venture Americas Styrenics. Chevron Phillips Chemical owns the remaining share in the joint venture.

Global Solution Styrene Butadiene Rubber (S-SBR) Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Solution Styrene Butadiene Rubber (S-SBR) Market |

| Market Size in 2021 | USD 3,528.4 Million |

| Market Forecast in 2028 | USD 5,033.5 Million |

| Compound Annual Growth Rate | CAGR of 6.1% |

| Number of Pages | 201 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | Bridgestone Corporation, Michelin, Lanxess, Goodyear Tire and Rubber, SIBUR Holding JSC, Taiwan Synthetic Rubber, JSR, Tianjin Lugang Petroleum and Rubber, Sumitomo Chemicals, Asahi Kasei, LG Chemicals, Styron (Trinseo), Dynasol Elastomers, China National Petroleum Corporation (CNPC), Versalis, and Sinopec. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2018 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Solution Styrene Butadiene Rubber (S-SBR) Market: Regional Landscape

Asia Pacific dominated the solution styrene butadiene rubber (S-SBR) market in 2021

In 2021, Asia Pacific accounted for 39.3% of global solution styrene butadiene rubber (S-SBR) volume, making it the region with the largest solution styrene butadiene rubber market. The growing demand from the tire sector in nations like India, China, and Japan is the main factor behind the Asia Pacific region's supremacy. Since China is the world's largest tire producer, there is a considerable demand for solution-styrene-butadiene rubber there. Solution styrene butadiene rubber demand in the area is anticipated to be led by China, followed by Japan and India, which are also anticipated to present new chances for market players in the future.

Solution Styrene Butadiene Rubber (S-SBR) Market: Competitive Landscape

Some of the main competitors dominating the global solution styrene butadiene rubber (S-SBR) market include:

- Bridgestone Corporation

- Michelin

- Lanxess

- Goodyear Tire and Rubber

- SIBUR Holding JSC

- Taiwan Synthetic Rubber

- JSR

- Tianjin Lugang Petroleum and Rubber

- Sumitomo Chemicals

- Asahi Kasei

- LG Chemicals

- Styron (Trinseo)

- Dynasol Elastomers

- China National Petroleum Corporation (CNPC)

- Versalis, and Sinopec.

Global Solution Styrene Butadiene Rubber (S-SBR) Market is segmented as follows:

By Type

- Butadiene Raw Material

- Styrene Raw Material

By Application

- Tires

- Footwear

- Polymer Modification

- Adhesives and Sealants

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Demand is anticipated to be driven throughout the projection period by S-expanding SBR's use in tire and footwear applications. With the expanding demand in the tire manufacturing business, the market is anticipated to experience considerable expansion.

According to the report, the global solution styrene butadiene rubber (S-SBR) market solution styrene butadiene rubber (S-SBR) market size was worth USD 3,528.4 million in 2021 and is estimated to grow to USD 5,033.5 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.1 percent over the forecast period.

In 2021, Asia Pacific accounted for 39.3% of worldwide volume, making it the region with the largest solution styrene butadiene rubber market. The growing demand from the tire sector in nations like India, China, and Japan is the main factor behind the Asia Pacific region's supremacy.

Some of the main competitors dominating the global solution styrene butadiene rubber (S-SBR) market include- Bridgestone Corporation, Michelin, Lanxess, Goodyear Tire and Rubber, SIBUR Holding JSC, Taiwan Synthetic Rubber, JSR, Tianjin Lugang Petroleum and Rubber, Sumitomo Chemicals, Asahi Kasei, LG Chemicals, Styron (Trinseo), Dynasol Elastomers, China National Petroleum Corporation (CNPC), Versalis, and Sinopec.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed