Solvent Recovery and Recycling Market Size, Share, Trends, Growth 2032

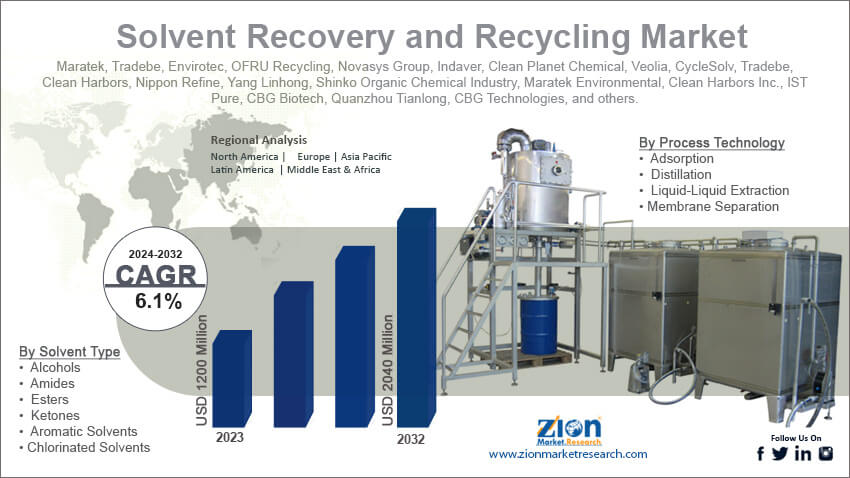

Solvent Recovery and Recycling Market By Product Type (On-site Solvent Recycling and Off-site Solvent Recycling), By Solvent Type (Alcohols, Amides, Esters, Ketones, Aromatic Solvents, and Chlorinated Solvents), By Process Technology (Adsorption, Distillation, Liquid-Liquid Extraction, and Membrane Separation), By Application (Paints & Coatings, Printing, Chemicals, Electronics, and Pharmaceuticals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

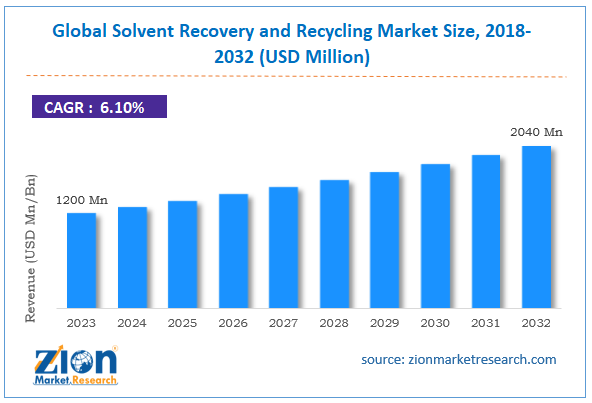

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1200 Million | USD 2040 Million | 6.1% | 2023 |

Solvent Recovery and Recycling Industry Prospective:

The global solvent recovery and recycling market size was worth around USD 1,200 million in 2023 and is predicted to grow to around USD 2,040 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.1% between 2024 and 2032.

Solvent Recovery and Recycling Market: Overview

The act of collecting, purifying, and reusing solvents from industrial waste or byproducts is known as solvent recovery and recycling. This method is frequently employed in solvent-dependent industries, including paints, coatings, chemicals, and medicines, where solvents are necessary for production but can become expensive or dangerous when wasted.

Industries can establish a closed-loop system that encourages sustainable production and lowers operational carbon footprint by combining solvent recovery and recycling systems. The solvent recovery and recycling market is driven by several factors, such as increasing stringent environmental regulation, growing focus on sustainability, technological advancements, increasing demand from the end-use industry, and rising government initiatives.

Key Insights

- As per the analysis shared by our research analyst, the global solvent recovery and recycling market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2024-2032).

- In terms of revenue, the global solvent recovery and recycling market size was valued at around USD 1,200 million in 2023 and is projected to reach USD 2,040 million by 2032.

- The increasing demand from the end-use sector is expected to drive the solvent recovery and recycling industry over the forecast period.

- Based on the solvent type, the alcohol segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Solvent Recovery and Recycling Market: Growth Drivers

Increasing demand for green solvents drives market growth

New growth prospects for market participants are being created by the growing demand for green solvents across a variety of industries. Green solvents are being used gradually by industry due to increased sustainability consciousness and strict regulatory requirements to lower emissions and reduce environmental effects.

Green solvents come from sources that are either environmentally friendly or renewable. The reusability of green solvents is facilitated by solvent recovery and recycling. Solvent recovery from waste streams is made possible by these technologies, which also allow for its purification and reintroduction into manufacturing processes.

This also helps them last longer and reduces their reliance on virgin solvents. The demand for sophisticated solutions for solvent recovery and recycling is rising along with the demand for green solvents, which is propelling the solvent recovery and recycling market's growth.

Solvent Recovery and Recycling Market: Restraints

High initial investment cost hinders market growth

One major barrier to the solvent recovery and recycling market is the high initial investment costs. A significant financial investment is usually required to set up an effective solvent recovery and recycling system, which can be difficult for many businesses, particularly small and medium-sized firms (SMEs).

Distillation columns, filtration systems, and separation units are examples of the extremely specialized and costly equipment needed for solvent recovery. Advanced systems that manage a variety of solvent types and guarantee high purity levels can be even more expensive, making them inaccessible to businesses with fewer resources.

Furthermore, solvent recovery systems have components that deteriorate over time from continuous chemical exposure, so they can be difficult to maintain. Regular maintenance and, occasionally, the replacement of essential components are necessary to ensure smooth operations, which adds to long-term costs.

Solvent Recovery and Recycling Market: Opportunities

Technological advancement offers a lucrative opportunity for market growth

The rising need is providing a positive market outlook for solvent recyclers to effectively, easily, and economically recycle large volumes of solvents. Accordingly, the solvent recovery and recycling industry is expanding due to several technological developments in the recycling process that improve solvent performance.

Automation and process optimization technologies are opening up new growth opportunities for the sector. Robotic equipment, sensors, and controls make up automated solvent recovery systems, which simplify recycling and increase operational effectiveness by reducing human error.

Solvent recyclers can further reduce downtime and operating expenses by evaluating process optimization data to maximize the efficiency of their machinery. The dynamics of the global market are being completely transformed by developments in solvent recovery methods such as supercritical fluid extraction (SFE), membrane filtering, adsorption, and advanced distillation (vacuum and fractional).

Solvent Recovery and Recycling Market: Challenges

The availability of cheap solvents poses a major challenge to market expansion

Businesses may discover that buying fresh solvents is more cost-effective in some situations than investing in systems for solvent recovery and recycling. The incentive to use recycling procedures may be diminished by the availability of cheap virgin solvents.

Companies may believe that solvent recovery and recycling systems have an uncertain or overly long-term return on investment. If short-term financial advantages are prioritized, this perception may deter investment. Adoption of new technology may be hampered by industry resistance to change. Traditional solvent disposal techniques and established habits may be deeply embedded, making the transition to more sustainable options challenging.

Solvent Recovery and Recycling Market: Segmentation

The global solvent recovery and recycling industry is segmented based on the product type, solvent type, process technology, application, and region.

Based on the product type, the global solvent recovery and recycling market is segmented into on-site solvent recycling and off-site solvent recycling.

Based on the solvent type, the global solvent recovery and recycling industry is bifurcated into alcohols, amides, esters, ketones, aromatic solvents, and chlorinated solvents. The alcohol segment is expected to capture the largest market share over the projected period. Alcohols are essential solvents in a variety of industries, including coatings, personal care, and medicines.

The requirement for affordable recovery and recycling solutions grows along with the demand in these industries, which propels market expansion. Furthermore, more stringent regulations governing solvent emissions and disposal are being enforced by governments and regulatory agencies around the globe. Businesses can cut waste and adhere to these requirements by recycling and recovering alcohol, which boosts market revenue for the alcohol recycling industry.

Based on the process technology, the global solvent recovery and recycling market is bifurcated into adsorption, distillation, liquid-liquid extraction, and membrane separation.

Based on the application, the global solvent recovery and recycling market is bifurcated into paints & coatings, printing, chemicals, electronics, and pharmaceuticals.

Solvent Recovery and Recycling Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Solvent Recovery and Recycling Market |

| Market Size in 2023 | USD 1,200 Million |

| Market Forecast in 2032 | USD 2,040 Million |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 224 |

| Key Companies Covered | Maratek, Tradebe, Envirotec, OFRU Recycling, Novasys Group, Indaver, Clean Planet Chemical, Veolia, CycleSolv, Tradebe, Clean Harbors, Nippon Refine, Yang Linhong, Shinko Organic Chemical Industry, Maratek Environmental, Clean Harbors Inc., IST Pure, CBG Biotech, Quanzhou Tianlong, CBG Technologies, and others. |

| Segments Covered | By Product Type, By Solvent Type, By Process Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Solvent Recovery And Recycling Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to lead the global solvent recovery and recycling market growth. Advanced technological skills, a strong industrial infrastructure, and a greater focus on sustainable practices are the reasons behind North America's market dominance.

Companies are encouraged to implement recycling methods by the Environment Protection Agency (EPA) of North America, which imposes stringent rules on solvent emissions and waste disposal. Leading businesses like Veolia, Clean Harbors, and Renew Life Inc. are based in the area and are always developing innovative and effective solvent recovery and recycling technology. However, the Asia Pacific is growing at a rapid rate over the forecast period owing to the increasing government support and demand for green solvents.

Solvent Recovery and Recycling Market: Competitive Analysis

The global solvent recovery and recycling market is dominated by players like:

- Maratek

- Tradebe

- Envirotec

- OFRU Recycling

- Novasys Group

- Indaver

- Clean Planet Chemical

- Veolia

- CycleSolv

- Tradebe

- Clean Harbors

- Nippon Refine

- Yang Linhong

- Shinko Organic Chemical Industry

- Maratek Environmental

- Clean Harbors Inc.

- IST Pure

- CBG Biotech

- Quanzhou Tianlong

- CBG Technologies

The global solvent recovery and recycling market is segmented as follows:

By Product Type

- On-site Solvent Recycling

- Off-site Solvent Recycling

By Solvent Type

- Alcohols

- Amides

- Esters

- Ketones

- Aromatic Solvents

- Chlorinated Solvents

By Process Technology

- Adsorption

- Distillation

- Liquid-Liquid Extraction

- Membrane Separation

By Application

- Paints & Coatings

- Printing

- Chemicals

- Electronics

- Pharmaceuticals

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The act of collecting, purifying, and reusing solvents from industrial waste or byproducts is known as solvent recovery and recycling. This method is frequently employed in solvent-dependent industries, including paints, coatings, chemicals, and medicines, where solvents are necessary for production but can become expensive or dangerous when wasted. Industries can establish a closed-loop system that encourages sustainable production and lowers their operational carbon footprint by combining solvent recovery and recycling systems.

The solvent recovery and recycling market is driven by several factors, such as increasing stringent environmental regulation, growing focus on sustainability, technological advancements, increasing demand from the end-use industry, and rising government initiatives.

According to the report, the global solvent recovery and recycling market size was worth around USD 1,200 million in 2023 and is predicted to grow to around USD 2,040 million by 2032.

The global solvent recovery and recycling market is expected to grow at a CAGR of 6.1% during the forecast period.

The global solvent recovery and recycling market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing stringent regulations.

The global solvent recovery and recycling market is dominated by players like Maratek, Tradebe, Envirotec, OFRU Recycling, Novasys Group, Indaver, Clean Planet Chemical, Veolia, CycleSolv, Tradebe, Clean Harbors, Nippon Refine, Yang Linhong, Shinko Organic Chemical Industry, Maratek Environmental, Clean Harbors Inc., IST Pure, CBG Biotech, Quanzhou Tianlong and CBG Technologies among others.

The solvent recovery and recycling market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed