Soy-based Surfactants Market Growth, Size, Share, Trends, and Forecast 2030

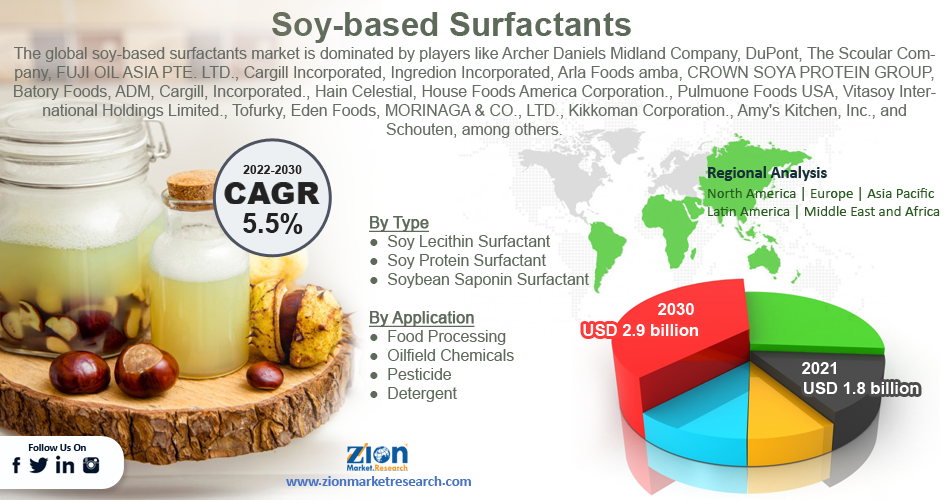

Soy-based Surfactants Market By Type (Soy Lecithin Surfactant, Soy Protein Surfactant, and Soybean Saponin Surfactant), By Application (Food Processing, Oilfield Chemicals, Pesticide, and Detergent), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

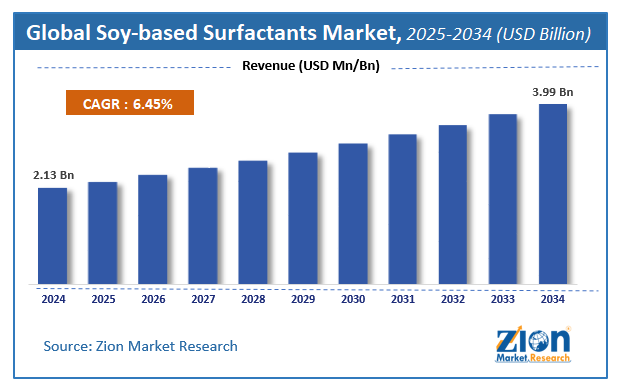

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.8 Billion | USD 2.9 Billion | 5.5% | 2021 |

Soy-based Surfactants Market Size & Industry Prospective:

The global soy-based surfactants market size was worth around USD 1.8 billion in 2021 and is predicted to grow to around USD 2.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2022 and 2030. The report analyzes the global soy-based surfactants market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the soy-based surfactants market.

Soy-based Surfactants Market: Overview

Surfactants are organic compounds that have hydrophilic and hydrophobic ends and allow oil molecules to dissolve in water. They are used in a variety of sectors due to features such as wettability, detergency, emulsion, dispersion stability, and foam/froth formation. Surfactants structure a detergent by acting as wetting agents, emulsifiers, foaming agents, and dispersants. They are present in most toilet cabinets, care items, cosmetics, medications, and a wide range of significant industrial applications, as well as detergent formulations and cleaning homes or workplaces. Soybean is an important source of natural surfactants including soy saponin, soy lecithin, and soy protein. Surfactants are widely used in drinks, food, cosmetics, and detergents.

Key Insights

- As per the analysis shared by our research analyst, the global soy-based surfactants market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2022-2028).

- In terms of revenue, the global soy-based surfactants market size was valued at around USD 1.8 billion in 2021 and is projected to reach USD 2.9 billion, by 2030.

- The increasing demand for soy-based surfactants in various industries such as food, personal care, and others is expected to drive the growth of the market over the forecast period.

- Based on the type, the soy lecithin surfactant segment accounted for the largest market share in 2021.

- Based on the application, the detergent segment held the largest market share in 2021.

- Based on region, Europe is expected to hold the largest market share during the forecast period.

To know more about this report, request a sample copy.

Soy-based Surfactants Market: Growth Drivers

Growing preference for oleochemical-based feedstocks over petrochemical-based surfactants to drive the market growth

The primary factor driving the global market for soy-based surfactants is the rising preference for oleochemical-based feedstocks over petrochemical-based surfactants. The recent modifications to the regulatory and environmental frameworks in developed countries have significantly increased the traction oleo-based surfactants have already attained. Research into the use of plant oils in numerous personal care products has been sparked by concerns about high costs and environmental constraints associated with the usage of surfactants based on petrochemicals.

Businesses have changed their focus to finding fresh, potential oleochemical feedstock sources for their goods, particularly soybean oil, most notably shampoo manufacturers. The market for soy-based surfactants has been expanded due to advances in the enzymatic fermentation techniques used in the production of surfactants.

The possibility for revenue generation has also increased with the introduction of microfluidizer technology to achieve the goal of stable emulsions. Other technological fields have also gained prominence. Growing knowledge of protein-based surfactants is one example. The use of soy-based surfactants in the industrial and personal care industries is being accelerated by this.

Soy-based Surfactants Market: Restraints

Shortage of raw materials limits the market growth

Most anionic surfactants are made from a combination of petrochemical and renewable source ingredients. Detergents and cleaning materials are frequently made with renewable anionic surfactants including palm kernel oil, soy oil, coconut oil, and others. However, the global soy-based surfactant market's expansion is constrained by the scarcity of raw materials. For instance, the Russian invasion of Ukraine cut off significant global exports of goods like sunflower oil, the ongoing effects of Covid-19 supply chain disruptions and labor shortages, and unpredictable weather patterns around the world that have an impact on the production of soybean, canola, and palm oils, restricting the market's growth as a result.

Soy-based Surfactants Market: Opportunities

The rising focus on natural and renewable raw materials provides a lucrative opportunity

Investments in the soy-based surfactant market have been stimulated by the noticeable trend of surfactant manufacturers switching more and more to employing natural and renewable raw materials. Among the many uses in the personal care industry, the creation of shampoos is likely where this tendency is most obvious. Researchers are creating innovative new polymeric surfactant-based shampoo formulations, particularly those based on soybean oil. They have paid some attention to the usage of anionic surfactants in this area. New application opportunities for soy-based surfactant players, particularly in the formulation of personal care products, have been made possible by a growing number of studies on the physicochemical characteristics and performance of such surfactants. Soybean growers have recently made a wave of investments in developed nations to assist personal care manufacturers to capitalize on the expanding demand for soy-based surfactants.

Soy-based Surfactants Market: Challenges

Fluctuations in the price of raw materials act as a major challenge to the market growth

Fluctuations in the price of raw material act as a major challenge for the expansion of the global soy-based surfactant market growth during the forecast period. The soy oil price is subject to volatility in recent years, for instance, during the pandemic the production of soybean was impacted and the processing of soy was halted, which in turn rise in the price of soy oil.

Soy-based Surfactants Market: Segmentation

The global soy-based surfactants market is segmented based on type, application, and region

Based on the type, the global market is bifurcated into soy lecithin surfactant, soy protein surfactant, and soybean saponin surfactant. The soy lecithin surfactant accounted for the largest market share in 2021 and is expected to remain dominant over the forecast period.

The growth in the segment is attributed to the abundant availability and low cost. Moreover, due to its structural and compositional properties, soy lecithin is widely used as an emulsifier, antioxidant, stabilizer, lubricant, wetting agent, and nutritional supplement. Lecithin is also used as a food supplement to improve cardiovascular health as well as to enhance memory and physical endurance. Furthermore, it is used to prevent the degradation of food components, and improve the safety of food products. Thus, driving the segmental growth over the forecast period.

Based on the application, the global market is segmented into food processing, oilfield chemicals, pesticide, and detergent. The detergent segment holds the largest market share during the forecast period owing to the rising demand for homecare products during a pandemic. The population across the globe is more sophisticated for the cleanliness of their environment during a pandemic. For instance, the largest end-use market for soy-based surfactants is household cleaning detergents. The detergents segment (in volume) holds 3500 Mn pounds of market share.

Recent Developments:

- In March 2022, BASF Care Creations developed Plantapon Soy, a bio-based anionic surfactant derived from soy protein that offers sustainability benefits. The ingredient is made from non-GMO soybean sourced from Europe and coconut oil and is suitable for vegan formulations and natural cosmetic standards such as COSMOS. Plantapon Soy is of 100% natural origin and therefore fits the requirements of the ISO 16128 standard. In addition, the active is suitable for formulations that are labeled cruelty-free.

- In March 2021, BASF SE, Allied Carbon Solutions Co. Ltd, and Holiferm Ltd entered an agreement with each other for the expansion of their positions in the active and bio-based surfactants industry. This expansion shall enable BASF to manufacture and develop the potential for personal care, industrial formulators, and home care products.

Soy-based Surfactants Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Soy-based Surfactants Market Research Report |

| Market Size in 2021 | USD 1.8 Billion |

| Market Forecast in 2030 | USD 2.9 Billion |

| Compound Annual Growth Rate | CAGR of 5.5% |

| Number of Pages | 187 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Archer Daniels Midland Company, DuPont, The Scoular Company, FUJI OIL ASIA PTE. LTD., Cargill Incorporated, Ingredion Incorporated, Arla Foods amba, CROWN SOYA PROTEIN GROUP, Batory Foods, ADM, Cargill, Incorporated., Hain Celestial, House Foods America Corporation., Pulmuone Foods USA, Vitasoy International Holdings Limited., Tofurky, Eden Foods, MORINAGA & CO., LTD., Kikkoman Corporation., Amy's Kitchen, Inc., and Schouten, among others. |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Soy-based Surfactants Market: Regional Analysis

Europe is expected to hold the largest market share during the forecast period

Europe is expected to hold the largest global soy-based surfactant market share during the forecast period owing to an Increase in demand for organic products and the implementation of stringent environmental regulations. Moreover, the recent surge in demand from the personal care and home care industries has resulted in major market growth in Europe. Considering as Europe is a key region for the fashion industry, the expanding textile and cosmetics sectors will contribute to market expansion.

The majority of detergents, cleansers, and other goods that employ surfactants as raw materials are produced in Germany. For instance, according to Eurostat, the European Union produced over 12.6 million tonnes of soap and detergents in 2018. Approximately one-fifth (19%) of this was soap and organic surface-active items, while the vast majority (81%) was made up of detergents and washing preparations. Italy, Germany, Spain, France, and Poland were the five EU Member States that produced the most soap and detergents.

Together, these five nations produced 74% of the detergents and 85% of the soap produced in the EU in 2018. Germany shipped the most soap and detergents to non-EU nations among EU Member States (795 500 tonnes, or 25% of extra-EU exports), followed by Italy (416 200 tonnes, or 13%), and Poland (351 200 tonnes, or 11%). Due to a growing economy and increased product accessibility, about 50% of the market shares in Europe are now accounted for by components found in products made from renewable natural resources. Thus, driving the soy-based surfactants market in the region over the forecast period.

On the other hand, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period owing to increasing demand for detergents and soaps. In Asia-Pacific, China was the largest consumer of surfactants, and the country is likely to continue its dominance during the forecast period. Through 2021, it was predicted that China's market for soap, washing powder, and synthetic detergents will expand at an annualized 5.0% rate. The industry's sales were projected to reach $54.2 billion in 2021.

During the projected period, this is anticipated to boost the existing market. India is also one of the world's major producers of soap. Around 800 grams of toilet/bathing soap are used per person each year in the nation. Around 65% of Indians live in rural regions, and as rural markets expand and disposable incomes rise, customers are choosing more expensive goods. The market for soy-based surfactants in the nation is anticipated to grow as a result of this change.

Soy-based Surfactants Market: Competitive Analysis

The global soy-based surfactants market is dominated by players like:

- Archer Daniels Midland Company

- DuPont

- The Scoular Company

- FUJI OIL ASIA PTE. LTD.

- Cargill Incorporated

- Ingredion Incorporated

- Arla Foods amba

- CROWN SOYA PROTEIN GROUP

- Batory Foods

- ADM

- Cargill

- Incorporated.

- Hain Celestial

- House Foods America Corporation.

- Pulmuone Foods USA

- Vitasoy International Holdings Limited.

- Tofurky

- Eden Foods

- MORINAGA & CO. LTD.

- Kikkoman Corporation.

- Amy's Kitchen Inc.

- Schouten

The global soy-based surfactants market is segmented as follows:

By Type

- Soy Lecithin Surfactant

- Soy Protein Surfactant

- Soybean Saponin Surfactant

By Application

- Food Processing

- Oilfield Chemicals

- Pesticide

- Detergent

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The rise in interest & awareness in renewable-based products by end-users & consumers, the increase in regulatory & environmental pressure on regulatory pressure on petrochemicals, and continuous changes in feedstock pricing supporting oleochemicals are the primary factors that are fueling the growth of the global soy-based surfactants market.

According to the report, the global soy-based surfactants market size was worth around USD 1.8 billion in 2021 and is predicted to grow to around USD 2.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.5% between 2022 and 2030.

The global soy-based surfactants market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market due to the consumer inclination towards bio-based products as well as stringent regulations derived by the government.

The global soy-based surfactants market is dominated by players like Archer Daniels Midland Company, DuPont, The Scoular Company, FUJI OIL ASIA PTE. LTD., Cargill Incorporated, Ingredion Incorporated, Arla Foods amba, CROWN SOYA PROTEIN GROUP, Batory Foods, ADM, Cargill, Incorporated., Hain Celestial, House Foods America Corporation., Pulmuone Foods USA, Vitasoy International Holdings Limited., Tofurky, Eden Foods, MORINAGA & CO., LTD., Kikkoman Corporation., Amy's Kitchen, Inc., and Schouten, among others.

Choose License Type

List of Contents

MarketSize Industry Prospective:OverviewTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesSegmentationRecent Developments:Market Report Scope:Regional AnalysisCompetitive AnalysisThe global soy-based surfactants market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed