Sports Apparel Market Size, Share, Growth, Trends, and Forecast 2034

Sports Apparel Market By End-User (Professional and Amateur), By Material (Synthetic and Natural), By Sports (Cricket, Football, Baseball, Basketball, Hockey, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 256.90 Billion | USD 320.46 Billion | 6.58% | 2024 |

Sports Apparel Industry Perspective:

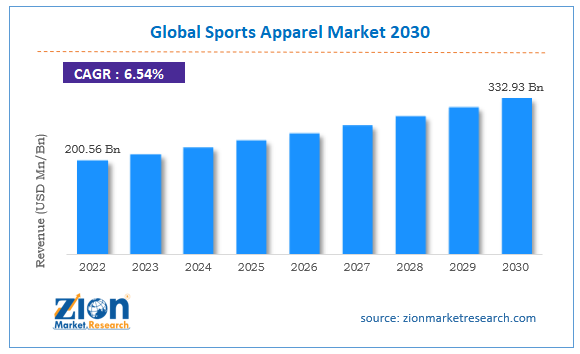

The global sports apparel market size was worth around USD 256.90 Billion in 2024 and is predicted to grow to around USD 320.46 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.58% between 2025 and 2034.

Sports Apparel Market: Overview

Sports apparel is clothing items that are worn by sports personnel during a sports event. These are specially designed clothing products depending on the sports being played and the rules governing the sports segment that also define the type of apparel that must be worn when the players are playing the specific sport. The type of sports apparel is determined by various factors. One crucial parameter is that the apparel must ensure that it provides the required support to the players and not hinder their performance in any form. Furthermore, the layers of sports apparel may be layered to prevent any form of injury.

For instance, for ice hockey, which consists of playing on ice skates in an ice ring specifically made for the sport, the participating teams must push the puck across the goal line and into the net. It is guarded by a goalkeeper. In this sport, players are expected to wear a helmet for protection, facemask, jersey, shin pads, pants, shoulder pads, elbow pads, and a stick. This format of clothing gives the players enough flexibility while also protecting them against injury. The quality of the product may vary depending on the manufacturer, type of manufacturing process, and raw materials used during production.

Key Insights:

- As per the analysis shared by our research analyst, the global sports apparel market is estimated to grow annually at a CAGR of around 6.58% over the forecast period (2025-2034)

- In terms of revenue, the global sports apparel market size was valued at around USD 256.90 Billion in 2024 and is projected to reach USD 320.46 Billion, by 2034.

- The sports apparel market is projected to grow at a significant rate due to the increasing investments in the sports sector

- Based on end-user segmentation, amateur was predicted to show maximum market share in the year 2024

- Based on sports segmentation, football was the leading segment in 2024

- On the basis of region, North America was the leading revenue generator in 2024

Sports Apparel Market: Growth Drivers

Increasing investments in the sports sector to drive market growth

The global sports apparel industry is expected to grow owing to the rising investments in the global sports industry. In the last 2 decades, sports events have gained a massive fan following. Avid sports followers across the globe are increasing since sports held at a grand scale are considered as events that generate a sense of community among the viewers. In addition to this, the sports sector has undergone commercialization at a rapid rate as regional government and private companies have entered the thriving business sector.

For instance, the Gulf region is witnessing a sudden surge in investments particularly directed toward the sports industry as the regional governments seek ways to expand their economic portfolio. They are trying to diversify their offerings since the oil sector is steadily witnessing a dip in its growth trajectory.

For instance, in 2024, the Qatar region hosted one of the world’s most popular sporting events called FIFA World Cup. The country is estimated to have spent nearly USD 220 billion on the event. Saudi Arabia is considered the leading country in terms of sports investment. Such factors are likely to create higher demand for sports apparel.

Increasing adoption of sports across educational institutes and launch of new sports facilities to promote market growth

While professional sports play a crucial role in shaping the regional economy, its effects can be registered at a more regional or local level. Since sports are important for the overall and comprehensive development of children, educational institutes are increasingly adopting sports and recreational events in their curriculum. In addition to this, the regional governments are encouraging the development of state-funded sports facilities specifically aiming to train underprivileged but talented athletes.

In December 2025, it was reported that the Bega Valley Shire Council in Australia was holding talks with Monarch Building Solutions for the construction of a new sports complex thus directly affecting the global sports apparel market.

Sports Apparel Market: Restraints

High cost of superior-grade sports apparel to restrict market growth

The industry for sports apparel is projected to be restricted due to the high cost that is often related to the quality of the product. High-grade and performance sports apparel are expensive whereas low-quality substitutes tend to lose their structure after some time especially if they have been used in harsh conditions.

For instance, the cost of a football jersey for a particular club may cost more than USD 100 depending on the club's popularity. These prices are the common populations. Sports apparel made for professional players is more expensive.

Sports Apparel Market: Opportunities

Technology innovation observed in sports apparel production could create more growth opportunities

The global sports apparel market players must continue to invest in new manufacturing technologies that can help them produce more effective sports apparel. The current trend of incorporating an innovation-oriented vision extends beyond manufacturing. It also entails the type of printing technology used for printing information including brand logos, designing process, integrating advanced sensor technology within the apparel fabric, and the marketing or advertising technique.

In November 2025, Nike, the world’s leading sports apparel manufacturer and supplier, announced the launch of Nike ReactX technology which is being used to produce the company’s first Infinity React shoe series. The foam used in the shoes has been refined for around 5 years and is expected to optimize energy return for the players to improve their performance.

In November 2024, Asics, a leading sports apparel brand, launched ASICS x Solana UI Collection in a bid to promote the Web3 community. The collection consists of customized GT-2000™ 11 running shoes and the customers will receive ASICS Badge non-fungible token (NFT).

Sports Apparel Market: Challenges

Environmental pollution caused by the sports sector restrict market expansion

The apparel industry, in general, is a leading contributor to the rising environmental pollution. The global sports apparel market is a significant shareholder in terms of textile-based pollution as well as resource exploitation caused by increasing consumerism. The rising frequent purchases of sports apparel leads to mounting wastage especially if the items are discarded.

As per the latest reports, an average of 11 million tons of textile waste is generated every year in the US. Managing waste and creating a circular economy must remain as a priority for the industry players.

Sports Apparel Market: Segmentation

The global sports apparel market is segmented based on end-user, material, sports, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on end-user type, the global market is divided into professional and amateur. In 2024, the highest growth was observed in the amateur segment as it comprises a large range of consumer base. Buyers from across the field including upcoming sports athletes, participants at school or college level, and general sports enthusiasts contribute to the segmental growth. The increasing focus on physical health among the general population is a leading region for higher commercial sales of sports apparel. As of May 2025, Nike owned more than 1020 stores worldwide. The professional segment is a significant contributor since sports apparel for professionals tends to have high production costs.

Based on material, the global sports apparel industry is divided into synthetic and natural.

Based on sports, the global market is segmented into cricket, football, baseball, basketball, hockey, and others. In 2024, the football segment was the leading revenue generator owing to the extreme popularity of football across the globe. The sports format enjoys huge popularity across several continents and is steadily witnessing a surge in the number of followers. As per recent reports, it is widely followed by more than 3.49 billion followers worldwide. The sports apparel belonging to football clubs such as Manchester United and Barcelona are some of the highest-selling jerseys as compared to other options.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Sports Apparel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sports Apparel Market |

| Market Size in 2024 | USD 256.90 Billion |

| Market Forecast in 2034 | USD 320.46 Billion |

| Growth Rate | CAGR of 6.58% |

| Number of Pages | 227 |

| Key Companies Covered | The North Face, Nike, New Balance, Puma, Umbro, Adidas, ASICS, Reebok, Under Armour, Skechers, Columbia Sportswear, Russell Athletic, FILA, Converse, Lululemon Athletica, Mizuno, Salomon, Champion, Li-Ning, Anta Sports, and others. |

| Segments Covered | By End-User, By Material, By Sports, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sports Apparel Market: Regional Analysis

North America to generate high revenue during the forecast period

The global sports apparel market will be dominated by North America in the coming years. The general population in these countries is increasingly becoming more health conscious. The prevalence of several sports facilities for recreational purposes aids the regional market growth rate. In March 2025, Swim Melbourne officials announced that people will be offered swimming training facilities at its new swimming center in the US worth USD 4.5 million. In addition to such development projects, the US is home to some of the largest sports apparel manufacturing companies. Nike, for instance, is the most valued sports apparel manufacturing brand.

In 2021, the brand was valued at USD 31 billion. Furthermore, the growing investments in technology innovation and the rising focus of US-based companies in emerging markets could help the region grow at a substantial rate. These companies are also reinventing themselves by working toward reducing carbon footprint and producing apparel made of reused plastic waste thus creating a more sustainable ecosystem.

As per company reports, Under Armour produced more than 300 products using recycled polyester in the recent fiscal year. Asia-Pacific is a fast-emerging market driven by the sheer volume of the consumer base. Additionally, the growing state-funded sports-related initiatives further fuel the regional market growth rate.

Sports Apparel Market: Competitive Analysis

The global sports apparel market is led by players like:

- The North Face

- Nike

- New Balance

- Puma

- Umbro

- Adidas

- ASICS

- Reebok

- Under Armour

- Skechers

- Columbia Sportswear

- Russell Athletic

- FILA

- Converse

- Lululemon Athletica

- Mizuno

- Salomon

- Champion

- Li-Ning

- Anta Sports

The global sports apparel market is segmented as follows:

By End-User

- Professional

- Amateur

By Material

- Synthetic

- Natural

By Sports

- Cricket

- Football

- Baseball

- Basketball

- Hockey

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sports apparel are clothing items that are worn by sports personnel during a sports event.

The global sports apparel industry is expected to grow owing to the rising investments in the global sports industry.

According to study, the global sports apparel market size was worth around USD 256.90 Billion in 2024 and is predicted to grow to around USD 320.46 Billion by 2034.

The CAGR value of sports apparel market is expected to be around 6.58% during 2025-2034.

The global sports apparel market will be dominated by North America in the coming years.

The global sports apparel market is led by players like The North Face, Nike, New Balance, Puma, Umbro, Adidas, ASICS, Reebok, Under Armour, Skechers, Columbia Sportswear, Russell Athletic, FILA, Converse, Lululemon Athletica, Mizuno, Salomon, Champion, Li-Ning, and Anta Sports among others.

The report explores crucial aspects of the sports apparel market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed