Sports Drink Market Size, Share, Trends, Growth and Forecast 2034

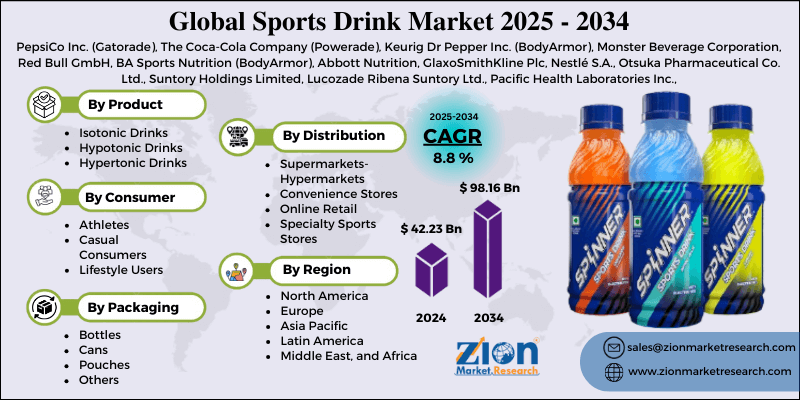

Sports Drink Market By Product Type (Isotonic, Hypotonic, and Hypertonic), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Sports Stores), By Packaging (Bottles, Cans, Pouches, and Others), By Consumer Group (Athletes, Casual Consumers, and Lifestyle Users), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.23 Billion | USD 98.16 Billion | 8.80% | 2024 |

Sports Drink Industry Prospective:

The global sports drink market was valued at approximately USD 42.23 billion in 2024 and is expected to reach around USD 98.16 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 8.80% between 2025 and 2034.

Sports Drink Market: Overview

Sports drinks are designed to help athletes and active people rehydrate, replenish electrolytes, and provide carbohydrates for energy during and after exercise. They contain water, electrolytes (sodium, potassium, calcium, magnesium), carbohydrates (sugars and glucose polymers), and often vitamins and flavorings.

The market includes various products, from traditional electrolyte replacement to newer functional variants with added protein, amino acids, or plant-based ingredients.

Modern sports drinks have come a long way from their early, simple formulations. They now include advanced ingredient technologies, personalized hydration profiles, and special formulations for different exercise intensities, durations, and recovery needs.

Growing health and fitness awareness among consumers, increasing participation in sports, and the growing demographic of lifestyle users drive growth in the sports drink market. Product innovation on natural ingredients, reduced sugar, and functional benefits, plus expansion of distribution channels and partnerships with sports leagues and fitness influencers, is the opportunity for growth over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global sports drink market is estimated to grow annually at a CAGR of around 8.80% over the forecast period (2025-2034)

- In terms of revenue, the global sports drink market size was valued at around USD 42.23 billion in 2024 and is projected to reach USD 98.16 billion by 2034.

- The sports drink market is projected to grow significantly due to rising urbanization, organized sports events, expanding e-commerce access, and athlete-driven branding.

- Based on product type, isotonic drinks lead the segment and will continue to lead the global market.

- Based on consumer groups, casual consumers represent the largest segment.

- Based on the distribution channel, supermarkets/hypermarkets continue to lead sales.

- Based on packaging, bottles accounted for the largest consumer segment.

- Based on region, North America dominates the global market during the forecast period.

Sports Drink Market: Growth Drivers

Expanding fitness culture and active lifestyle adoption

Fitness and health participation is growing globally, with gym memberships, fitness classes, and recreational sports seeing increased participation globally. The casual athlete segment has grown, with people participating in activities like running, cycling, and high-intensity interval training (HIIT), which demand functional hydration products. Major sporting events and fitness challenges have raised awareness around proper hydration and nutrition during physical activity.

Health education programs highlight the importance of electrolyte replacement during exercise, especially in hot climates or prolonged activity. Research shows that regular exercisers consume sports drinks 3-4 times more than non-exercisers, and there is a strong correlation between activity levels and product consumption.

Product innovation and expanding functional benefits

Manufacturing innovation is changing the sports drink industry with formulations that target specific exercise needs, recovery functions, and consumer preferences. Leading brands have introduced reduced sugar and natural sweetener formulations that maintain palatability while addressing health concerns around traditional high-sugar options.

Functional additions like branched-chain amino acids (BCAAs), protein, vitamins, and antioxidants have created premium segments for consumers looking for recovery and performance benefits. Plant-based and organic sports drink variants are growing among environmentally conscious consumers looking for clean-label hydration options.

Advanced electrolyte profiles that match human sweat composition more precisely have created products that appeal to serious athletes and exercise enthusiasts looking for optimized hydration.

Sports Drink Market: Restraints

Health concerns about traditional formulations

The sports drink market faces growing scrutiny regarding the high sugar content in traditional formulations, which health professionals and consumers increasingly view as problematic despite the functional benefits.

Pediatric health organizations have issued cautions about children's consumption of sports drinks outside of intense athletic activities, potentially limiting casual usage in an important demographic. Medical research linking excessive sugar consumption to various health issues is creating perception challenges for traditional sports drink formulas.

Some consumers are moving towards natural alternatives like coconut water or flavored water as they want fewer artificial ingredients and less sugar. Negative media coverage about sports drinks' calories and questionable need for casual exercisers impacts consumer perception and purchase decisions.

Sports Drink Market: Opportunities

Personalized nutrition and targeted formulations

The demand for personalized nutrition is growing and presents big opportunities in the sports drink market as consumers are looking for products tailored to their activity level, body composition, and performance goals. Advances in nutrition science have allowed the development of specialized formulas for different exercise intensities, durations, and environmental conditions so that products can be more targeted.

Gender-specific sports drinks addressing the physiological differences in male and female hydration and nutritional needs are emerging as a segment. Sport-specific formulas for endurance, strength, team, or high-intensity activities create new product categories.

Direct-to-consumer business models enabled by e-commerce and subscription services are making personalized products more accessible to individual consumers who can now customize their hydration solutions to their needs.

Sports Drink Market: Challenges

Increasing competition from alternative beverages

The sports drink industry faces challenges from expanding functional beverage categories that offer hydration plus additional benefits, threatening to erode market share and pricing power. Enhanced waters, energy drinks, and recovery shakes increasingly market hydration features alongside their primary benefits, creating category overlap and consumer confusion.

Natural alternatives like coconut water are gaining traction by positioning themselves as "nature's sports drink" with organic electrolytes and fewer artificial ingredients. Ready-to-drink protein beverages now incorporate electrolyte formulas, competing directly with sports drinks in recovery. Consumers are rethinking the need for specialized sports drinks for moderate exercise and are choosing water or other simpler options.

Sports Drink Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sports Drink Market |

| Market Size in 2024 | USD 42.23 Billion |

| Market Forecast in 2034 | USD 98.16 Billion |

| Growth Rate | CAGR of 8.80% |

| Number of Pages | 211 |

| Key Companies Covered | PepsiCo Inc. (Gatorade), The Coca-Cola Company (Powerade), Keurig Dr Pepper Inc. (BodyArmor), Monster Beverage Corporation, Red Bull GmbH, BA Sports Nutrition (BodyArmor), Abbott Nutrition, GlaxoSmithKline Plc, Nestlé S.A., Otsuka Pharmaceutical Co. Ltd., Suntory Holdings Limited, Lucozade Ribena Suntory Ltd., Pacific Health Laboratories Inc., PacificHealth Laboratories Inc., Britvic PLC, J Donohoe Beverages Ltd. (Lucozade Sport), Herbalife Nutrition Ltd., Arizona Beverages USA, SCIFIT, and others. |

| Segments Covered | By Product Type, By Consumer Group, By Distribution Channel, By Packaging, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sports Drink Market: Segmentation

The global sports drink market is segmented into product type, consumer group, distribution channel, and region.

Based on product type, the market is segregated into isotonic, hypotonic, and hypertonic drinks. Isotonic drinks lead the market due to their balanced formulation that matches body fluid composition, making them suitable for most exercise situations.

Based on consumer groups, the sports drink industry is divided into athletes, casual consumers, and lifestyle users. Casual consumers are expected to lead the market during the forecast period due to the mainstream adoption of fitness activities and the broadening appeal of sports drinks beyond traditional athletic contexts.

Based on the packaging, the industry is classified into bottles, cans, pouches, and others. Of these, the bottles lead the market since they offer portability, ease of use, and resealability, making them the preferred choice for on-the-go consumption and widespread retail availability.

Based on distribution channels, the sports drink industry is categorized into supermarkets/hypermarkets, convenience stores, online retail, and specialty sports stores. Supermarkets/hypermarkets are expected to lead the market during the forecast period due to their wide product selection, promotional opportunities, and consumer shopping patterns.

Sports Drink Market: Regional Analysis

North America to lead the market

North America leads the global sports drink market due to the region's established fitness culture, high disposable income, and the presence of major sports drink brands, which have shaped consumer preferences over the decades. The U.S. has extensive sports participation across professional, collegiate, and recreational levels, which creates a consistent demand for performance hydration products.

North American consumers demonstrate sophisticated product knowledge and brand loyalty, supporting premium and specialized product segments. The region hosts major professional sports leagues and fitness trends influencing global hydration practices and creating big marketing opportunities for sports drink brands. Strong retail infrastructure in convenience and grocery channels provides good regional distribution.

North American manufacturers and brands have significant global market share and established marketing expertise that has expanded the category beyond elite athletes to mainstream consumers.

Asia Pacific is set to grow rapidly.

Asia Pacific is the fastest-growing region for the sports drink market, with an expanding middle class, increasing health consciousness, and a rapidly developing sports and fitness culture that creates new consumer segments. China, Japan, India, and Australia are the biggest growth drivers in the region, with increasing participation in both traditional and Western sports creating demand for functional hydration products.

Rising disposable income has made premium sports nutrition products that were once luxury items in many markets more accessible. Growing awareness of exercise science and nutrition principles drives the adoption of specialized hydration products among serious athletes and casual exercisers.

Recent Market Developments:

- In February 2025, PepsiCo (Gatorade) launched a personalized hydration system that combines smart bottle technology with customized electrolyte concentrates based on individual sweat profiles and activity monitoring.

- In March 2025, The Coca-Cola Company (Powerade) introduced a plant-based sports drink line featuring natural electrolytes derived from coconut water and sea salt with no artificial ingredients or preservatives.

Sports Drink Market: Competitive Analysis

Players lead the global sports drink market like:

- PepsiCo Inc. (Gatorade)

- The Coca-Cola Company (Powerade)

- Keurig Dr Pepper Inc. (BodyArmor)

- Monster Beverage Corporation

- Red Bull GmbH

- BA Sports Nutrition (BodyArmor)

- Abbott Nutrition

- GlaxoSmithKline Plc

- Nestlé S.A.

- Otsuka Pharmaceutical Co. Ltd.

- Suntory Holdings Limited

- Lucozade Ribena Suntory Ltd.

- Pacific Health Laboratories Inc.

- PacificHealth Laboratories Inc.

- Britvic PLC

- J Donohoe Beverages Ltd. (Lucozade Sport)

- Herbalife Nutrition Ltd.

- Arizona Beverages USA

- SCIFIT

The global sports drink market is segmented as follows:

By Product Type

- Isotonic Drinks

- Hypotonic Drinks

- Hypertonic Drinks

By Consumer Group

- Athletes

- Casual Consumers

- Lifestyle Users

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Sports Stores

By Packaging

- Bottles

- Cans

- Pouches

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sports drinks are designed to help athletes and active people rehydrate, replenish electrolytes, and provide carbohydrates for energy during and after exercise.

The sports drink market is expected to be driven by increasing health and fitness consciousness, product innovations focusing on natural ingredients and reduced sugar content, growing participation in athletic activities across demographics, expansion of distribution channels, and strategic marketing partnerships with sports leagues and fitness influencers.

According to our study, the global sports drink market was worth around USD 42.23 billion in 2024 and is predicted to grow to around USD 98.16 billion by 2034.

The CAGR value of the sports drink market is expected to be around 8.80% during 2025-2034.

The global sports drink market will register the highest value in North America during the forecast period.

Key players in the sports drink market include PepsiCo, Inc. (Gatorade), The Coca-Cola Company (Powerade), Keurig Dr Pepper Inc. (BodyArmor), Monster Beverage Corporation, Red Bull GmbH, BA Sports Nutrition (BodyArmor), Abbott Nutrition, GlaxoSmithKline Plc, Nestlé S.A., Otsuka Pharmaceutical Co., Ltd., Suntory Holdings Limited, Lucozade Ribena Suntory Ltd., Pacific Health Laboratories, Inc., PacificHealth Laboratories, Inc., Britvic PLC, J Donohoe Beverages Ltd. (Lucozade Sport), Herbalife Nutrition Ltd., Arizona Beverages USA, and SCIFIT.

The report comprehensively analyzes the sports drink market, including a detailed examination of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, product innovations, and the evolving consumer preferences shaping the sports drink industry worldwide.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed