Global Sports Trading Card Market Size, Share, Trends, Growth, 2034

Sports Trading Card Market By Card Type (Baseball, Basketball, Football, Soccer, Hockey, and Others), By Card Characteristics (Character Cards, Image Cards, and Autograph Cards), By Sales Channel (Hobby Stores, Mass Market Retailers, Online Platforms, and Auction Houses), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

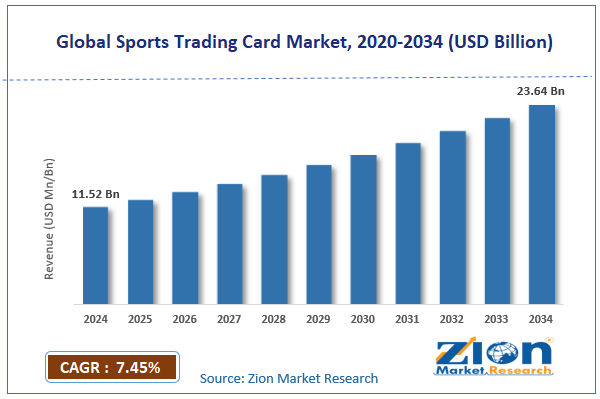

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.52 Billion | USD 23.64 Billion | 7.45% | 2024 |

Sports Trading Card Industry Prospective:

The global sports trading card market was valued at approximately USD 11.52 billion in 2024 and is expected to reach around USD 23.64 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 7.45% between 2025 and 2034.

Sports Trading Card Market: Overview

Sports trading cards are collectible items featuring athletes across various sports, typically printed on cardstock or premium materials with player images, statistics, and authenticated elements like autographs or jersey swatches.

The market has evolved significantly from simple paper cards to high-end collectibles with intricate designs, holographic elements, and limited production runs. Digital transformation has introduced blockchain-based NFT cards alongside traditional physical products, expanding market reach.

The sports trading card industry operates on scarcity principles, with card manufacturers deliberately limiting production quantities of premium cards to enhance value. Grading services play a crucial role in establishing card condition and authenticity, with professional grading often significantly increasing a card's market value.

The market has experienced a remarkable resurgence since 2020, driven by the growing recognition of cards as legitimate investment options, increased digital engagement, and pandemic-induced interest in collectibles.

Key Insights:

- The global sports trading card market is anticipated to grow at a CAGR of 7.45% from 2025 to 2034.

- The market was valued at around USD 11.52 billion in 2024 and is projected to reach USD 23.64 billion by 2034.

- Technology integration through digital cards, blockchain authentication, and direct-to-consumer platforms represents significant growth opportunities for the sports trading card market.

- Based on card type, basketball cards generate the highest revenue, driven by international appeal and record-breaking sales of key players' cards.

- Based on card characteristics, autograph cards are expected to dominate the market during the forecast period.

- Based on sales channels, online platforms have emerged as the dominant distribution method, offering global reach and creating new market dynamics.

- North America continues to dominate the market, followed by emerging strong growth in Asia-Pacific, particularly Japan, South Korea, and China.

Sports Trading Card Market: Growth Drivers

Digital Transformation and Technological Integration

The integration of digital technologies has revolutionized the sports trading card industry, expanding its reach and enhancing card features. Blockchain technology now secures digital cards as NFTs (Non-Fungible Tokens), providing verifiable ownership and scarcity.

Companies like NBA Top Shot have pioneered digital collectibles featuring memorable game moments, with some selling for six figures. Physical cards increasingly incorporate QR codes and NFC technology, creating hybrid physical-digital experiences.

Additionally, advanced printing techniques like Optichrome, Prizm, and Refractor technologies have elevated card aesthetics and collectability. This technological evolution has attracted tech-savvy collectors and investors, substantially expanding the market's demographic reach.

Growing Investment Perspective and Market Legitimization

Sports cards have transcended from hobby status to become recognized as alternative investments like fine art or wine. High-profile sales, such as the T206 Honus Wagner card for $7.25 million and LeBron James rookie cards exceeding $5 million, have attracted serious investors.

Major auction houses like Sotheby's and Christie's now regularly feature premium sports cards, lending institutional credibility to the market. Investment funds targeting high-value sports cards have emerged, while platforms like Rally and Collectable enable fractional ownership of valuable cards.

Sports Trading Card Market: Restraints

Market Volatility and Speculative Bubbles

The sports trading card market experiences significant price volatility influenced by athlete performance, media coverage, and market speculation. Rookie cards of promising athletes often experience price inflation before the player proves long-term value, creating boom-bust cycles.

The rapid price escalation from 2020 to 2022 has raised concerns about unsustainable growth and potential market corrections. Overproduction remains a historical concern despite manufacturers' efforts to create artificial scarcity. The 1980s and early 1990s market collapsed due to oversaturation, influencing collector behavior and market stability.

Sports Trading Card Market: Opportunities

Emerging International Markets and Cross-Sport Expansion

While North America dominates the sports card market, international expansion presents substantial growth opportunities. Following the sport's global growth, basketball cards are gaining popularity in China, Europe, and Australia. Soccer cards show strong potential in European, South American, and emerging Asian markets, capitalizing on the sport's worldwide following.

Cricket and rugby cards are developing niches in countries where these sports dominate, like India, Australia, and New Zealand. Card manufacturers increasingly produce region-specific sets featuring local athletes and leagues to capture these emerging markets.

Sports Trading Card Market: Challenges

Environmental and Sustainability Concerns

The production of trading cards raises environmental questions regarding material sourcing, chemical processes, and packaging waste. Traditional cards use substantial amounts of virgin paper, plastic coatings, and petroleum-based inks with significant carbon footprints. Protective supplies like plastic sleeves, top loaders, and display cases further increase the industry's environmental impact.

The growth of the sports trading card market also increases shipping-related emissions as cards are sent worldwide for grading, trading, and purchasing. Consumer awareness of sustainability issues is growing, potentially affecting purchasing decisions, particularly among younger collectors.

Sports Trading Card Market: Report Scope

0 M , ,

| Report Attributes | Report Details |

|---|---|

| Report Name | Sports Trading Card Market |

| Market Size in 2024 | USD 11.52 Billion |

| Market Forecast in 2034 | USD 23.64 Billion |

| Growth Rate | CAGR of 7.45% |

| Number of Pages | 222 |

| Key Companies Covered | Panini America Inc., Topps Company (Fanatics), Upper Deck Company, Leaf Trading Cards, Futera, Rittenhouse Archives Ltd., Tristar Productions Inc., Sage Products, Press Pass Inc., In The Game Inc., Beckett Media, PSA (Collectors Universe), BGS (Beckett Grading Services), SGC (Sportscard Guaranty Corporation), PWCC Marketplace, StockX, Goldin Auctions, and others. |

| Segments Covered | By Card Type, By Card Characteristics, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sports Trading Card Market: Segmentation

The global sports trading card market is segmented based on card type, card characteristics, sales channel, and region.

Based on card type, the sports trading card industry is categorized into baseball, basketball, football, soccer, hockey, and others. Basketball cards lead the global market due to the sport's international appeal, transcending North American boundaries, unlike baseball or American football. Historic record-breaking sales of cards featuring iconic players like Michael Jordan, LeBron James, and Kobe Bryant have attracted significant investment interest. The NBA's successful global marketing strategy has created worldwide recognition for its stars, driving international demand for their cards.

Based on card characteristics, the market is divided into character cards, image cards, and autograph cards. Autograph cards command the highest market value due to their authentic player signatures, creating unique collectibles with provenance. These cards typically feature on-card signatures or signature stickers, with on-card autographs generally fetching premium prices. Character cards, which showcase player personalities through custom designs, caricatures, or thematic elements, appeal strongly to younger collectors and casual fans seeking emotional connection rather than investment value.

Based on sales channels, the sports trading card industry is divided into hobby stores, mass market retailers, online platforms, and auction houses. Online platforms dominate the distribution landscape by providing global accessibility, eliminating geographical limitations that traditionally constrained collecting to local markets. Direct-to-consumer models and marketplaces like eBay, COMC, and StockX have revolutionized card trading through transparent pricing, real-time market data, and secure transactions. Social media integration enables community building and instant market response to sports events and player news.

Sports Trading Card Market: Regional Analysis

North America to Lead the Market

North America dominates the global sports trading card market due to the deep cultural roots of card collecting, which date back to the early 20th century. The region hosts the major professional sports leagues whose athletes appear on the most valuable cards, including MLB, NBA, NFL, and NHL.

The United States has the most developed ecosystem of card manufacturers, grading services, and specialized retailers supporting the hobby. Major card producers like Topps, Panini, and Upper Deck are headquartered in the region, enabling quicker product distribution and market engagement.

Additionally, North America has established auction houses specializing in sports memorabilia and the most sophisticated card authentication infrastructure. The region's wealthy collector base is willing to invest significantly in premium cards, driving record-breaking sales and market valuations.

Asia-Pacific to Witness Significant Growth

The Asia-Pacific region represents the fastest-growing market for sports trading cards, with particular expansion in Japan, South Korea, China, and Australia. Basketball cards lead regional growth, driven by the NBA's successful marketing campaigns and the popularity of stars with Asian heritage like Yao Ming and Jeremy Lin.

Soccer cards are gaining traction, mainly featuring Asian players in European leagues and national teams competing in World Cup tournaments. Japan's established baseball card market is expanding internationally as Japanese MLB players gain prominence.

Local card manufacturing is increasing, with region-specific releases catering to Asia-Pacific sports preferences and athletes. Rising disposable incomes among the middle class, particularly in China, create new collector demographics with significant purchasing power.

Recent Market Developments:

- In February 2024, Fanatics Collectibles completed its acquisition of Topps, consolidating market power and securing exclusive MLB licensing rights through 2025.

- In April 2024, Panini America introduced its first-ever AI-enhanced cards featuring dynamic statistics that update in real time when scanned with a smartphone app.

- In June 2024, PSA (Professional Sports Authenticator) launched a blockchain-integrated certification for physical cards, creating tamper-proof digital verification for graded cards.

- In August 2024, eBay unveiled dedicated authentication services for sports cards selling above $250, addressing market concerns about counterfeit items.

- In October 2024, NBA Top Shot expanded its platform to include physical card redemptions, bridging the gap between traditional collecting and NFTs.

Sports Trading Card Market: Competitive Analysis

The global sports trading card market is led by players like:

- Panini America Inc.

- Topps Company (Fanatics)

- Upper Deck Company

- Leaf Trading Cards

- Futera

- Rittenhouse Archives Ltd.

- Tristar Productions Inc.

- Sage Products

- Press Pass Inc.

- In The Game Inc.

- Beckett Media

- PSA (Collectors Universe)

- BGS (Beckett Grading Services)

- SGC (Sportscard Guaranty Corporation)

- PWCC Marketplace

- StockX

- Goldin Auctions

The global sports trading card market is segmented as follows:

By Card Type

- Baseball

- Basketball

- Football

- Soccer

- Hockey

- Others (Tennis, Golf, Racing, etc.)

By Card Characteristics

- Character Cards

- Image Cards

- Autograph Cards

By Sales Channel

- Hobby Stores

- Mass Market Retailers

- Online Platforms

- Auction Houses

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sports trading cards are collectible items featuring athletes across various sports, typically printed on cardstock or premium materials with player images, statistics, and authenticated elements like autographs or jersey swatches.

The sports trading card market is expected to be driven by digital transformation and technological integration, growing investment perspectives, emerging international markets, and increased representation of female athletes.

According to market research, the global sports trading card market was valued at approximately USD 11.52 billion in 2024 and is projected to reach around USD 23.64 billion by 2034, driven by technological integration and expanded collector demographics.

The sports trading card market is expected to grow at a compound annual growth rate (CAGR) of approximately 7.45% from 2025 to 2034, fueled by increased legitimization as investment assets and digital innovation.

North America is expected to dominate the global sports trading card market due to its established collecting culture, presence of major sports leagues, and developed ecosystem of manufacturers, graders, and retailers.

Key players in the sports trading card market include Panini America, Inc., Topps Company (Fanatics), Upper Deck Company, Leaf Trading Cards, Futera, Rittenhouse Archives, Ltd., Tristar Productions, Inc., Sage Products, Press Pass, Inc., In The Game, Inc., Beckett Media, PSA (Collectors Universe), BGS (Beckett Grading Services), SGC (Sportscard Guaranty Corporation), PWCC Marketplace, StockX, and Goldin Auctions.

The report provides a comprehensive analysis of the sports trading card market, including an in-depth discussion of market drivers, restraints, technological trends, emerging international markets, and future growth opportunities. It also examines competitive dynamics, regional market performance, and the impact of digital transformation on traditional collecting paradigms.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed