Stainless Steel Pipes and Tubes Market Size, Share, Trends, Growth 2030

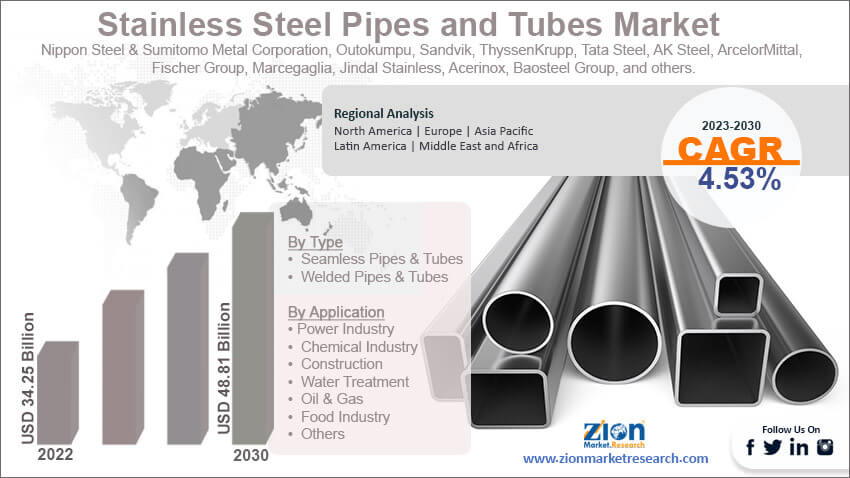

Stainless Steel Pipes and Tubes Market By Type (Seamless Pipes & Tubes and Welded Pipes & Tubes), By Application (Power Industry, Chemical Industry, Construction, Water Treatment, Oil & Gas, Food Industry, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

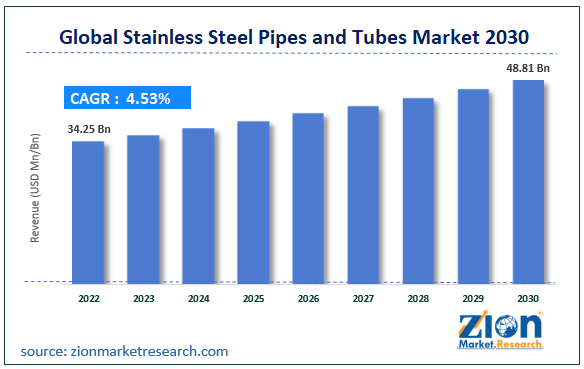

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 34.25 Billion | USD 48.81 Billion | 4.53% | 2022 |

Stainless Steel Pipes and Tubes Industry Prospective:

The global stainless steel pipes and tubes market size was worth around USD 34.25 billion in 2022 and is predicted to grow to around USD 48.81 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.53% between 2023 and 2030.

Stainless Steel Pipes and Tubes Market: Overview

Stainless steel pipes and tubes are cylindrical structures used for transporting liquids, gasses, and other materials in a leak-proof and safe environment. These variants of pipes and tubes are made of stainless steel also known as inox. It comprises corrosion-resistant steel (CRES) and exists as an iron alloy with extreme resistance to corrosion and rusting. Due to these essential properties, the demand for pipes and tubes made of stainless steel has increased tremendously in the last few years, especially in applications that involve corrosive fluids, high temperatures, and high levels of contaminants. Some of the advantages offered by CRES pipes and tubes include ease of cleaning and low maintenance over time. In its most basic form, stainless steel contains at least 10.5% of chromium content which is also responsible for imparting the final products with corrosion resistance properties. Additionally, elements such as nickel also play crucial roles during the production of pipes or tubes made of stainless steel. The market end-user verticals include growing industries such as construction, oil & gas, aerospace, automobile, and food & beverages. The stainless steel pipes and tubes industry is expected to grow at a steady pace during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global stainless steel pipes and tubes market is estimated to grow annually at a CAGR of around 4.53% over the forecast period (2023-2030)

- In terms of revenue, the global stainless steel pipes and tubes market size was valued at around USD 34.25 billion in 2022 and is projected to reach USD 48.81 billion, by 2030.

- The stainless steel pipes and tubes market is projected to grow at a significant rate due to its instrumental role in encouraging growth in the oil & gas sector

- Based on type segmentation, seamless pipes & tubes was predicted to show maximum market share in the year 2022

- Based on application segmentation, chemical industry was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Stainless Steel Pipes and Tubes Market: Growth Drivers

Instrumental role in encouraging growth in the oil & gas sector may drive market revenue

The global stainless steel pipes and tubes market is projected to grow due to the instrumental role the metal products play in encouraging revenue in the oil & gas sector. Pipes and tubes made of stainless steel are used in several oil or gas extraction and transportation procedures. Since these pipes offer higher durability and resistance to harsh chemicals or extreme temperatures, they act as crucial connectors in transporting oil & gas from the reservoir to store units on the surface. The increasing demand for oil and natural gas led by growing residential, commercial, and industrial applications is likely to impact the usage level of stainless steel pipes and tubes simultaneously. In addition to this, ongoing and increasing investments in offshore oil facilities will assist in shaping market growth during the forecast period. For instance, in October 2022, the Indian government opened bidding options for 26 blocks of oil exploration in a bid to reduce its oil import which currently stands at 85% of total oil requirements. Most of these blocks are present in deep waters and offshore sites. The country is expected to attract international companies in the coming years for these projects.

Growing international and domestic collaboration for the supply of stainless steel may push market growth trends

The industry for stainless steel pipes and tubes is projected to gain momentum due to the increasing number of strategic collaborations between users and suppliers of stainless steel. The partnerships can be witnessed not only at the domestic market but also at the international level especially between existing superpowers and emerging nations thus creating an excellent scope for further growth. A prime example is the June 2023 partnership announcement between Outokumpu, a global supplier of stainless steel, and Norway-based Nordic Steel. The companies will work toward producing sustainable stainless steel in the Norwegian market. Circle Green manufactured by Outokumpu produces up to 92% lower carbon footprint as compared to rivals.

Stainless Steel Pipes and Tubes Market: Restraints

High cost of initial investment and dominance held by larger players to restrict market growth

The stainless steel pipes and tubes industry size will be limited due to the high cost associated with initial investment in the production of stainless steel pipes and tubes as compared to pipes made of other metals. Primary reasons for high cost include the requirement of specialized raw materials along with the high complexity of the alloy itself. The corrosion resistance property of stainless steel is imparted due to the use of advanced materials and sophisticated manufacturing processes. In addition to this, the process of stainless steel pipes or tube production is highly energy-intensive leading to added costs. While maintenance and replacement cost in the market is significantly low, the starting expense is too high for new players to enter the sector.

Stainless Steel Pipes and Tubes Market: Opportunities

Increasing research and investment in environmentally friendly and advanced options may create growth opportunities

The global stainless steel pipes and tubes market is projected to be impacted by the increasing research, development, and investment in eco-friendly options. Companies are focusing on improving product application, durability, and longevity. Furthermore, efforts are being directed toward developing products that can survive the changing and dynamic requirements of end-user verticals as new chemicals, contaminants, and other materials are introduced into the ecosystem. In February 2022, Rhinox, a leading manufacturer of stainless steel tubes and pipes, announced the launch of the world’s most hygienic and 100%leak-proof stainless steel fittings. The offerings consist of a Double O-ring along with VV-shaped grooves and 5-stage pressing. The products intend to provide advanced safety functions by leveraging its double-edge mechanism and some of the associated benefits include less maintenance, a high level of hygiene, and leak-proof plumbing. On the other hand, in July 2023, Wuppermann AG, a leading metal processing company from Europe, announced that it would be investing an additional €40 million toward the expansion of pipe plant production capacity in its Austria-based plant. The company is expected to construct two pipe welding lines and integrated automated warehousing.

Stainless Steel Pipes and Tubes Market: Challenges

Intense competition from alternate metals will challenge market growth trajectory

The global stainless steel pipes and tubes market growth prospects will be challenged by the existence of a growing market for alternate metals including composite materials. These alternatives may offer high-performance results or cost-effectiveness. Furthermore, they may be considered more suitable depending on the final intended results. The market will further be impacted by the supply chain disruption caused by social, political, or environmental factors.

Stainless Steel Pipes and Tubes Market: Segmentation

The global stainless steel pipes and tubes market is segmented based on type, application, and region.

Based on type, the global stainless steel pipes and tubes market is divided into seamless pipes & tubes and welded pipes & tubes. In 2022, the highest growth was observed in the seamless pipes & tubes segment. These variants are produced from a single sheet of stainless steel and are considered more suitable for harsh conditions. They have registered high applications in the oil & gas industry. Welded pipes & tubes are mostly used in industries such as food processing, construction, and automobiles. Products made of stainless steel mostly have a life expectancy of over 50 years.

Based on application, the stainless steel pipes and tubes industry divisions are power industry, chemical industry, construction, water treatment, oil & gas, food industry, and others. In 2022, the highest growth was observed in the chemical industry sector due to the increasing demand for chemicals and materials across consumer groups. In 2022, the global chemical industry was valued at more than USD 4 trillion and is projected to grow at a steady pace driven by research and innovation.

Stainless Steel Pipes and Tubes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Stainless Steel Pipes and Tubes Market |

| Market Size in 2022 | USD 34.25 Billion |

| Market Forecast in 2030 | USD 48.81 Billion |

| Growth Rate | CAGR of 4.53% |

| Number of Pages | 225 |

| Key Companies Covered | Nippon Steel & Sumitomo Metal Corporation, Outokumpu, Sandvik, ThyssenKrupp, Tata Steel, AK Steel, ArcelorMittal, Fischer Group, Marcegaglia, Jindal Stainless, Acerinox, Baosteel Group, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Stainless Steel Pipes and Tubes Market: Regional Analysis

Asia-Pacific to act as the largest supplier in the market

The global stainless steel pipes and tubes market will be dominated by Asia-Pacific during the forecast period. India, China, Indonesia, and other Asian countries are some of the largest suppliers of steel-based products on a global scale. These regions are home to a robust stainless steel pipes and tubes manufacturing ecosystem and have consistently laid efforts to improve regional market export rate. In a recent development, India announced that it will be developing new quality standards for regulating the sale of stainless steel pipes and tubes. The move is expected to help the country meet the changing demand from end-user verticals and integrate novel technologies with the manufacturing process. China, on the other hand, continues to witness high domestic demand for stainless steel pipes and tubes as the consumption rate in the construction and food industry is growing steadily. The rising number of infrastructure development projects, especially in urban residential areas, could act as a critical regional growth driver. Europe is projected to register a high growth rate. The presence of key stainless steel pipes and tube manufacturers will deliver high revenue.

Stainless Steel Pipes and Tubes Market: Competitive Analysis

The global stainless steel pipes and tubes market is led by players like:

- Nippon Steel & Sumitomo Metal Corporation

- Outokumpu

- Sandvik

- ThyssenKrupp

- Tata Steel

- AK Steel

- ArcelorMittal

- Fischer Group

- Marcegaglia

- Jindal Stainless

- Acerinox

- Baosteel Group

The global stainless steel pipes and tubes market is segmented as follows:

By Type

- Seamless Pipes & Tubes

- Welded Pipes & Tubes

By Application

- Power Industry

- Chemical Industry

- Construction

- Water Treatment

- Oil & Gas

- Food Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Stainless steel pipes and tubes are cylindrical structures used for transporting liquids, gasses, and other materials in a leak-proof and safe environment.

The global stainless steel pipes and tubes market is projected to grow due to the instrumental role the metal products play in encouraging revenue in the oil & gas sector.

According to the study, the global stainless steel pipes and tubes market size was worth around USD 34.25 billion in 2022 and is predicted to grow to around USD 48.81 billion by 2030.

The CAGR value of stainless steel pipes and tubes market is expected to be around 4.53% during 2023-2030.

The global stainless steel pipes and tubes market will be dominated by Asia-Pacific during the forecast period.

The global stainless steel pipes and tubes market is led by players like Nippon Steel & Sumitomo Metal Corporation, Outokumpu, Sandvik, ThyssenKrupp, Tata Steel, AK Steel, ArcelorMittal, Fischer Group, Marcegaglia, Jindal Stainless, Acerinox, and Baosteel Group among others.

The report explores crucial aspects of the stainless steel pipes and tubes market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed