Steam Turbine MRO Market Size, Share, Analysis, Trends, Growth, 2032

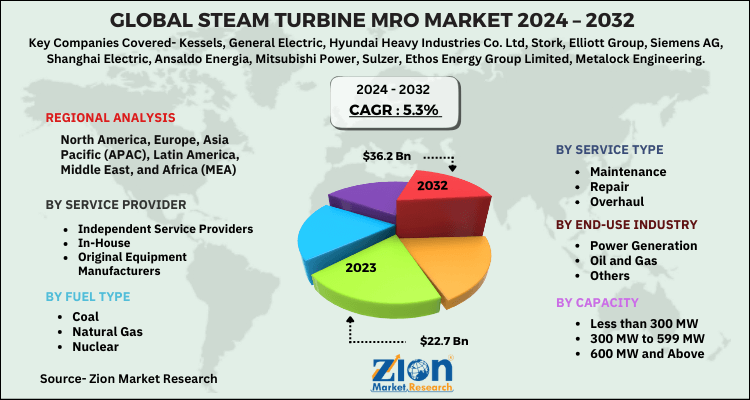

Steam Turbine MRO Market By Capacity (Less than 300 MW, 300 MW to 599 MW, and 600 MW and Above), By End-Use Industry (Power Generation, Oil & Gas, and Others), By Service Type (Maintenance, Repair, and Overhaul), By Service Provider (Independent Service Providers, In-House and Original Equipment Manufacturers), By Fuel Type (Coal, Natural Gas, and Nuclear), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.7 Billion | USD 36.2 Billion | 5.3% | 2023 |

Steam Turbine MRO Industry Prospective:

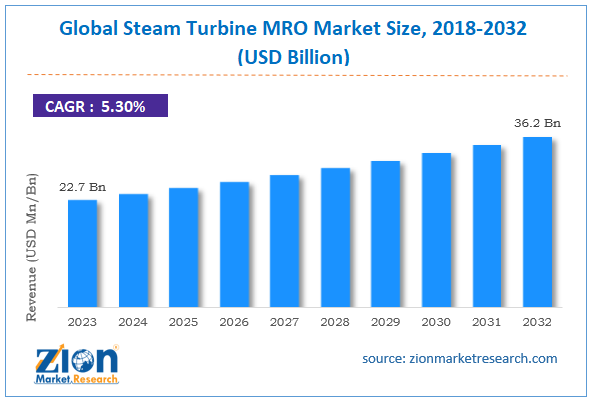

The global steam turbine MRO market size was worth around USD 22.7 billion in 2023 and is predicted to grow to around USD 36.2 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.3% between 2024 and 2032.

Steam Turbine MRO Market: Overview

Within the larger sector of power generation, the steam turbine MRO business stands as a unique economic niche. It includes original equipment manufacturers (OEMs), independent service providers (ISPs), and in-house maintenance teams of power plant operators among companies engaged in MRO services for steam turbines.

The market covers revenue earned from MRO projects, including steam turbine retrofit projects, engineering services, maintenance contracts, and spare part sales.

Rising global demand for electricity and reliance on steam turbines for power generation are likely to drive notable expansion in the steam turbine MRO industry.

To lower equipment failure risk, increase efficiency, and extend steam turbine lifetime, regular inspections, preventative maintenance, and required repairs are vital.

More complicated and sophisticated equipment resulting from technological developments and new materials and processes used in steam turbine design make MRO services essential.

Key Insights

- As per the analysis shared by our research analyst, the global steam turbine MRO market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2024-2032).

- In terms of revenue, the global steam turbine MRO market size was valued at around USD 22.7 billion in 2023 and is projected to reach USD 36.2 billion by 2032.

- The rising power demand is expected to drive the steam turbine MRO market over the forecast period.

- Based on end-use industry, the power generation segment is expected to dominate the market over the forecast period.

- Based on service type, the maintenance segment is expected to dominate the steam turbine MRO market over the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Steam Turbine MRO Market: Growth Drivers

Increasing power demand drives market growth

Many times, running steam turbines at almost maximum capacity helps power facilities satisfy the high demand for energy by increasing component wear and tear.

This high use increases the necessity of regular maintenance, repairs, and overhauls to keep turbines functioning effectively, hence preventing breakdowns and optimizing uptime.

Furthermore, fueling power demand includes fast urbanization and the business sector, especially in developing nations. Energy demand is on the rise in areas including Asia-Pacific and Africa, which strains current turbines and drives the need for MRO services to prevent disruptions in power supplies.

As the United Nations estimates, the urban population in Asia will grow by 50% in the year 2050. Thus, the aforementioned stats are driving the steam turbine MRO market during the forecast period.

Steam Turbine MRO Market: Restraints

The high cost of MRO services hinders market growth

The high cost of steam turbine MRO is a major impeding factor for the steam turbine MRO industry growth during the forecast period. Steam turbines include complicated components, including rotors, blades, and seals; thus, specialized steam turbine repair and maintenance experts are essential.

Particularly in areas where such knowledge is rare, high demand for these specialist talents combined with a restricted workforce pushes up labor expenses.

Furthermore, particularly older types, steam turbines need premium spare parts that are sometimes expensive and could take time to get.

Precision-engineered components, including bearings, rotors, seals, and blades, make manufacturing and replacement costly. Lead times for certain components might potentially cause expenses by extending downtime.

Steam Turbine MRO Market: Opportunities

Growth in the steam turbine sector offers a lucrative opportunity for market growth

Meeting the demand and guaranteeing the quality and reliability of maintenance services depend on efforts to equip a trained staff in steam turbine MRO.

The Central Electricity Authority India projects that in 2025, India's demand for thermal, hydro, and nuclear plant electricity generation will rise by 9.83%.

In 2026–2027, the total generation from thermal, hydro, and nuclear facilities is predicted to be 1,874 BU. Steam turbines contribute to the generation of power, so their demand is expected to rise significantly as demand for power rises.

This element will probably help the steam turbine sector to expand. The steam turbine MRO market should benefit from the expansion in the steam turbine sector.

Steam Turbine MRO Market: Challenges

Shift towards renewable energy sources poses a major challenge to market expansion

Traditional steam turbines, especially those in coal and natural gas plants, see reduced running hours as power generation moves to renewable energy sources. Reduced frequency and need for MRO maintenance follow from lower use, implying less wear and tear on equipment.

For instance, as of 2023, India was rated fourth in wind power capacity and solar power capacity as per the India Brand Equity Foundation. With a CAGR of 15.4% between FY16 and FY23, installed renewable power generating capacity has swiftly surged during the previous several years.

For FY23, India boasts 125.15 GW of renewable energy capacity. India is the market with the fastest increase in renewable energy; new capacity additions by 2026 will double.

Steam Turbine MRO Market: Segmentation

The global steam turbine MRO industry is segmented based on capacity, end-use industry, service type, service provider, fuel type, and region.

Based on capacity, the global steam turbine MRO market is segmented into less than 300 mw, 300 mw to 599 mw, and 600 mw & above.

Based on the end-use industry, the global steam turbine MRO industry is bifurcated into power generation, oil & gas, and others. The power generation segment is expected to dominate the market over the forecast period.

The need for reliable power generation from a variety of sources, including nuclear and fossil fuels, is fueled by the growing demand for electricity worldwide, especially in areas that are industrializing quickly.

These energy sources rely heavily on steam turbines, whose efficiency must be maintained by MRO services. MRO providers report consistent revenue growth as a result of this demand as utilities look to reduce operational interruptions and increase energy production.

Based on service type, the global steam turbine MRO market is bifurcated into maintenance, repair, and overhaul. The maintenance segment is expected to dominate the steam turbine MRO market over the forecast period.

The growing use of predictive and preventive maintenance is one of the main factors propelling revenue development in the steam turbine MRO industry.

Avoiding unscheduled downtime and lowering the chance of catastrophic failures are priorities for power plants. Early problem detection is made possible by predictive maintenance solutions that make use of data analytics, vibration monitoring, and other sensor-based technologies.

Due to this tendency, there is a greater need for sophisticated maintenance services, which brings in additional revenue for MRO companies that provide them.

Based on service provider, the global steam turbine MRO industry is bifurcated into independent service providers, in-house and original equipment manufacturers.

Based on fuel type, the global steam turbine MRO market is bifurcated into coal, natural gas, and nuclear.

Steam Turbine MRO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Steam Turbine MRO Market |

| Market Size in 2023 | USD 22.7 Billion |

| Market Forecast in 2032 | USD 36.2 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 224 |

| Key Companies Covered | Kessels, General Electric, Hyundai Heavy Industries Co. Ltd, Stork, Elliott Group, Siemens AG, Shanghai Electric, Ansaldo Energia, Mitsubishi Power, Sulzer, Ethos Energy Group Limited, Metalock Engineering, and others. |

| Segments Covered | By Capacity, By End-Use Industry, By Service Type, By Service Provider, By Fuel Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Steam Turbine MRO Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global steam turbine MRO market during the forecast period. The steam turbine MRO market in the Asia Pacific is changing due to the adoption of digital technologies, including condition monitoring, predictive maintenance, and IoT-enabled solutions.

Power plants can reduce downtime, better schedule maintenance, and predict failures by integrating real-time monitoring. Because it lowers long-term expenses and boosts operational efficiency, this maintenance technology breakthrough is a major market driver.

Furthermore, there is a growing need for efficient power generation as nations like China, India, and Japan are under increasing pressure to lower emissions and adhere to stricter environmental standards.

For steam turbines to function legally and meet efficiency requirements, maintenance and repair (MRO) services are essential. The need for specialist MRO services is driven by the demand for efficiency improvements and emission-reduction technology.

Steam Turbine MRO Market: Competitive Analysis

The global steam turbine MRO market is dominated by players like:

- Kessels

- General Electric

- Hyundai Heavy Industries Co. Ltd

- Stork

- Elliott Group

- Siemens AG

- Shanghai Electric

- Ansaldo Energia

- Mitsubishi Power

- Sulzer

- Ethos Energy Group Limited

- Metalock Engineering

The global steam turbine MRO market is segmented as follows:

By Capacity

- Less than 300 MW

- 300 MW to 599 MW

- 600 MW and Above

By End-Use Industry

- Power Generation

- Oil and Gas

- Others

By Service Type

- Maintenance

- Repair

- Overhaul

By Service Provider

- Independent Service Providers

- In-House

- Original Equipment Manufacturers

By Fuel Type

- Coal

- Natural Gas

- Nuclear

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Within the larger sector of power generation, the steam turbine MRO business stands as a unique economic niche. It includes original equipment manufacturers (OEMs), independent service providers (ISPs), and in-house maintenance teams of power plant operators among companies engaged in MRO services for steam turbines. The market covers revenue earned from MRO projects, including steam turbine retrofit projects, engineering services, maintenance contracts, and spare part sales.

Rising global demand for electricity and reliance on steam turbines for power generation are likely to drive notable expansion in the steam turbine MRO industry.

According to the report, the global steam turbine MRO market size was worth around USD 22.7 billion in 2023 and is predicted to grow to around USD 36.2 billion by 2032.

The global steam turbine MRO market is expected to grow at a CAGR of 5.3% during the forecast period.

The global steam turbine MRO market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the growing power demand.

The global steam turbine MRO market is dominated by players like Kessels, General Electric, Hyundai Heavy Industries Co., Ltd, Stork, Elliott Group, Siemens AG, Shanghai Electric, Ansaldo Energia, Mitsubishi Power, Sulzer, Ethos Energy Group Limited and Metalock Engineering among others.

The steam turbine MRO market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed