Sugarcane Based PET Bottles Market Size, Share, Analysis, Trends, Growth, 2032

Sugarcane Based PET Bottles Market By End-Use Application (Food Packaging, Beverages, Personal Care, and Other Industrial Applications), By Production Technology (Injection Stretch Blow Molding, Extrusion Blow Molding, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

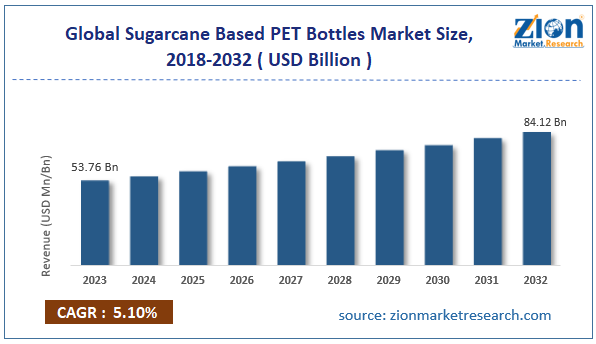

| USD 53.76 Billion | USD 84.12 Billion | 5.10% | 2023 |

Sugarcane-Based PET Bottles Industry Prospective:

The global sugarcane-based PET bottles market size was worth around USD 53.76 billion in 2023 and is predicted to grow to around USD 84.12 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.10% between 2024 and 2032.

Sugarcane-Based PET Bottles Market: Overview

Sugarcane-based PET bottles are environmentally friendly plastic bottles. They are made using polyethylene terephthalate (PET) and sugarcane-based components. Traditionally, the most widely used material for bottle production is PET. Bottles made of polyethylene terephthalate are recyclable, resistant, and durable, making PET one of the most popular raw materials for bottle production. However, these products contain petroleum-based raw materials. Sugarcane-based PET bottles use a significant quantity of bio content thus effectively reducing the carbon footprint of the PET bottles. The global packaging industry is one of the largest contributors to environmental pollution.

The industry players have been recommended and urged by regional authorities and international environment welfare bodies to reduce carbon emissions. The use of sugarcane-based PET bottles is one of the leading measures adopted by the packaging sector to deliver efficient packaging solutions without impacting the operational efficiency of the product. During the forecast period, the surge in demand for sustainable household products is projected to drive the market growth rate. However, competition from alternate solutions and uncertainty in raw material supply could limit the sugarcane-based PET bottles industry’s growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the global sugarcane based PET bottles market is estimated to grow annually at a CAGR of around 5.10% over the forecast period (2024-2032)

- In terms of revenue, the global sugarcane based PET bottles market size was valued at around USD 53.76 billion in 2023 and is projected to reach USD 84.12 billion by 2032.

- The sugarcane-based PET bottle market is projected to grow at a significant rate due to the growing consumer demand for sustainable packaging solutions

- Based on the end-use application, the beverages segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the production technology, the injection stretch blow molding segment is anticipated to command the largest market share

- Based on region, Europe is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Sugarcane-Based PET Bottles Market: Growth Drivers

Growing consumer demand for sustainable packaging solutions will drive the market demand rate

The global sugarcane based PET bottle market is expected to be driven by the changes in consumer choices. Modern buyers are actively seeking products and brands that show environmental consciousness. Consumers prefer companies that take responsibility for the environmental impact of business operations. According to market research, over 70% of the US population considers ecological sustainability an important factor affecting shopping choices. Additionally, around 50% of American citizens are actively reducing shopping activities to promote sustainability. Businesses across the globe are trying to meet consumer expectations by steadily shifting toward environmentally friendly packaging. For instance, in January 2024, Pringles, a leading food brand, announced the launch of a 100% recyclable packaging solution for its products in the European market. The company invested around £86 million in novel technology to develop sustainable packaging options.

Active measures by regional government against the environmental impact of business operations will promote a market growth rate

Regional governments globally are highlighting the importance of holding companies accountable for business operations. The governments along with regional and international welfare agencies are drafting and implementing new laws that prevent or reduce the environmental impact of business processes, especially packaging solutions. In November 2023, New York state of the United States sued PepsiCo for plastic pollution. As per the lawsuit, the company is the single largest plastic polluter in the region currently identified. In July 2024, the Central Pollution Control Board of India launched a national audit of around 800 plastic-waste recyclers across the region. As per reports, around 4 firms across major cities had issued more than 600,000 fake certificates under the Extended Producer Responsibility (EPR) scheme. The agency estimated that the firms would be liable to pay hundreds of crore if they failed to pass the audit. Such measures are likely to drive demand in the global sugarcane based PET bottles market.

Sugarcane-Based PET Bottles Market: Restraints

Competition from alternate solutions will limit the industry’s expansion rate

The global industry for sugarcane-based PET bottles is projected to be restricted due to the competition the industry players face from alternate solutions. For instance, the most abundantly available and highly popular environmentally friendly bottles are made of biodegradable plastics. Furthermore, several food packaging companies are focusing on leveraging the benefits of plant-based plastic solutions for storing, transporting, and distributing food or beverages. Apart from sustainable solutions, the global packaging sector continues to be dominated by glass-based or aluminum-based bottles since they offer several key advantages.

Sugarcane-Based PET Bottles Market: Opportunities

Increasing investments in research and development activities will generate more growth opportunities

The global sugarcane based PET bottle market is expected to generate more growth opportunities due to the surge in investments for research purposes. In June 2024, the UK-based technology and sustainable materials facilitator Centre for Process Innovation (CPI) announced an investment worth GBP 250 million. The funds are directed toward Floreon, which is a producer of bioplastics. The company produces proprietary compounds derived using polylactic acid bioresin (PLA), which consists of over 70% plant-based raw materials such as sugarcane and corn. The development of advanced technologies that can improve PET bottle production rate made using sugarcane will also prove beneficial for the industry.

Personal care industry holds extensive expansion opportunities for the industry players

The sugarcane based PET bottle industry has high growth potential in the personal care industry. The surging population rate, increased disposable income, higher access to customers through e-commerce sales channels, and other factors are driving the personal care industry. It is also one of the largest consumers of packaging solutions. Companies in the market should focus on tapping into the potential of the personal care industry for future growth.

Sugarcane-Based PET Bottles Market: Challenges

Fluctuating production of sugarcane is a major challenge for the market players

The global sugarcane based PET bottles industry is projected to be challenged by the fluctuating production of sugarcane. Agricultural growth of the raw material depends on weather conditions. However, the increasing rate of global warming along with the lack of water supply is affecting global sugarcane production rate. The changing global trade relationships and rising social-political tension among trading nations may impact the sugarcane supply chain resulting in PET bottle production complications.

Sugarcane-Based PET Bottles Market: Segmentation

The global sugarcane-based PET bottle market is segmented based on end-user application, production technology, and region.

Based on the end-use application, the global market divisions are food packaging, beverages, personal care, and other industrial applications. In 2023, the highest growth was witnessed in the beverages segment. The rising plastic pollution caused by the beverage segment of the global food & beverages industry will result in greater adoption of sugarcane-derived PET bottles. According to the International Union for Conservation of Nature, around 20 million metric tons of plastic waste is generated annually.

Based on the production technology, the global market divisions are injection stretch blow molding, extrusion blow molding, and others. In 2023, the highest demand was registered in the injection stretch blow molding segment of the sugarcane-based PET bottles industry. The bottle production method results in highly durable PET bottles. It also allows companies to control various production variables such as bottle thickness and design. On average, an injection stretch blow molding machine can produce over 2000 small to mid-size bottles per hour per cavity.

Sugarcane Based PET Bottles Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sugarcane Based PET Bottles Market |

| Market Size in 2023 | USD 53.76 Billion |

| Market Forecast in 2032 | USD 84.12 Billion |

| Growth Rate | CAGR of 5.10% |

| Number of Pages | 232 |

| Key Companies Covered | Avantium, Braskem, Coca-Cola, Procter & Gamble, Danone, Alpla, Carbios, Ecover, Tetra Pak, Nestlé, Unilever, PepsiCo, Toyota Tsusho, Amcor, L'Oréal., and others. |

| Segments Covered | By End-Use Application, By Production Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sugarcane-Based PET Bottles Market: Regional Analysis

Europe to witness the highest growth during the forecast period

The global sugarcane based PET bottles market is expected to be led by Europe during the projection period. The European Union is at the forefront of reducing environmental pollution by steadily substituting plastic-based packaging solutions with safer alternatives. In 2019, the region banned the use of single-use plastics. Additionally, during the same year, the region adopted a new set of rules. One of the targets in the rules includes achieving 25% recycled content in plastic bottles by the end of 2025. In December 2022, Water-to-Go, a British company, announced the launch of sugarcane-based water filter bottles. The regional demand is further promoted by a surge in consumer awareness and changing buying patterns.

Asia-Pacific is an important and growing region in the sugarcane-based PET bottles industry. The presence of an extensive consumer group with rising disposable income and higher product demand will drive the regional market revenue. In June 2024, India witnessed the launch of Greenevon Bio Bottles, an emerging company producing sugarcane-based plastic time products. The regional market will be further strengthened by the growing production of sugarcane in Asian countries such as India, Pakistan, Bangladesh, and others.

Sugarcane-Based PET Bottles Market: Competitive Analysis

The global sugarcane based PET bottles market is led by players like:

- Avantium

- Braskem

- Coca-Cola

- Procter & Gamble

- Danone

- Alpla

- Carbios

- Ecover

- Tetra Pak

- Nestlé

- Unilever

- PepsiCo

- Toyota Tsusho

- Amcor

- L'Oréal.

The global sugarcane based PET bottles market is segmented as follows:

By End-Use Application

- Food Packaging

- Beverages

- Personal Care

- Other Industrial Applications

By Production Technology

- Injection Stretch Blow Molding

- Extrusion Blow Molding

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Sugarcane based PET bottles are environmentally-friendly plastic bottles. They are made using polyethylene terephthalate (PET) and sugarcane-based components.

The global sugarcane based PET bottles market is expected to be driven by changes in consumer choices.

According to study, the global sugarcane based PET bottles market size was worth around USD 53.76 billion in 2023 and is predicted to grow to around USD 84.12 billion by 2032.

The CAGR value of the sugarcane based PET bottles market is expected to be around 5.10% during 2024-2032.

The global sugarcane based PET bottles market is expected to be led by Europe during the projection period.

The global sugarcane based PET bottles market is led by players like Avantium, Braskem, Coca-Cola, Procter & Gamble, Danone, Alpla, Carbios, Ecover, Tetra Pak, Nestlé, Unilever, PepsiCo, Toyota Tsusho, Amcor and L'Oréal.

The report explores crucial aspects of the sugarcane based PET bottles market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Sugarcane-Based PET BottlesIndustry Prospective:Sugarcane-Based PET Bottles OverviewKey Insights:Sugarcane-Based PET Bottles Growth DriversSugarcane-Based PET Bottles RestraintsSugarcane-Based PET Bottles OpportunitiesSugarcane-Based PET Bottles ChallengesSugarcane-Based PET Bottles SegmentationReport ScopeSugarcane-Based PET Bottles Regional AnalysisSugarcane-Based PET Bottles Competitive AnalysisThe global sugarcane based PET bottles market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed