Global Synthetic Biology Market Size, Share, Analysis, Trends, Growth, Forecasts, 2034

Synthetic Biology Market By Product (Enzymes, Oligonucleotides, Cloning Technologies, Chassis Organisms, and Others), By Technology (Gene Synthesis, Genome Engineering, Sequencing, Bioinformatics, and Others), By Application (Healthcare, Industrial Manufacturing, Food & Agriculture, Environmental Applications, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

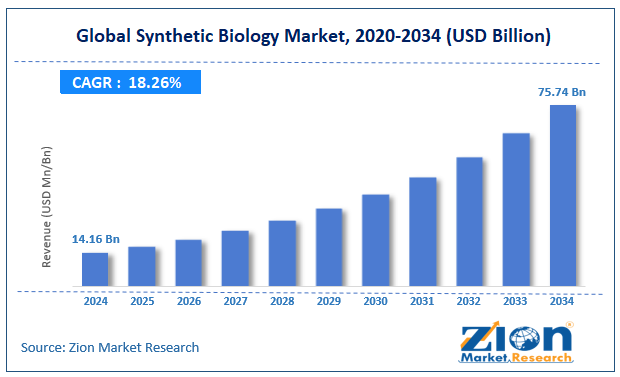

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.16 Billion | USD 75.74 Billion | 18.26% | 2024 |

Synthetic Biology Industry Prospective:

The global synthetic biology market reached approximately USD 14.16 billion in 2024 and is projected to grow to USD 75.74 billion by 2034, with a compound annual growth rate (CAGR) of around 18.26% from 2025 to 2034.

Synthetic Biology Market: Overview

Synthetic biology combines biology, engineering, genetics, chemistry, and computational sciences to design and build new biological components, devices, and systems or to redesign existing natural biological systems. This field allows scientists to create biological functions that are not found in nature by applying engineering concepts to biological parts.

The synthetic biology industry continues to develop rapidly as DNA synthesis and sequencing technologies improve alongside CRISPR-Cas9 gene editing tools and computational design platforms. Applications span across pharmaceuticals, agriculture, manufacturing, and environmental clean-up. Integrating AI and machine learning speeds up biological design processes, allowing for faster prototyping and refinement of synthetic biological systems.

As standards and core technologies mature, synthetic biology is moving from research labs into commercial use, offering sustainable alternatives to traditional industrial processes.

The growing demand for biologically derived products, paired with technological advances and new application areas, is expected to fuel significant market growth over the forecast period.

Key Insights:

- The global synthetic biology market is expected to grow at a CAGR of 18.26% from 2025 to 2034.

- The market was valued at around USD 14.16 billion in 2024 and is forecast to reach USD 75.74 billion by 2034.

- Falling DNA synthesis and sequencing costs, expanding pharmaceutical applications, and increasing investment in bioeconomy initiatives are key drivers of the synthetic biology market.

- In the product segment, enzymes currently lead the market, while oligonucleotides show the fastest growth due to their essential role in gene synthesis and editing.

- Based on technology, the gene synthesis segment represents the largest share, with genome engineering growing rapidly, especially CRISPR-based approaches.

- In applications, healthcare leads the market, while industrial manufacturing shows significant growth potential, particularly in biofuels and specialty chemicals.

- North America currently holds the largest market share, though the Asia-Pacific shows the highest growth rate due to increasing biotechnology investments in China, Japan, and Singapore.

Synthetic Biology Market: Growth Drivers

Falling DNA Synthesis and Sequencing Costs

The dramatic drop in DNA synthesis and sequencing costs is transforming the synthetic biology market. DNA synthesis costs have fallen by nearly 99% over the past decade, making more complex synthetic biology projects feasible. Sequencing costs show similar trends, with next-generation technologies reducing expenses from millions to hundreds of dollars per genome. These cost reductions make essential synthetic biology tools more accessible, speeding up research and commercial applications.

Improved automation in DNA synthesis and assembly processes increases throughput while maintaining accuracy. The availability of affordable, high-quality genetic parts libraries provides essential building blocks for synthetic biology applications across various industries.

Rising Demand for Biopharmaceuticals and Precision Medicine

The pharmaceutical industry increasingly uses synthetic biology to develop new therapeutic approaches and manufacturing platforms. Engineered biological systems allow more efficient production of complex molecules, antibodies, vaccines, and gene therapies than traditional methods.

Synthetic biology tools help develop precision medicine through engineered cell therapies, synthetic gene circuits, and biosensors for personalized diagnostics. For example, CAR-T cell therapies use synthetic biology principles to engineer immune cells for targeted cancer treatment.

Additionally, synthetic biology contributes to drug discovery through engineered cell models, high-throughput screening systems, and new target identification methods.

Synthetic Biology Market: Restraints

Regulatory Uncertainties and Safety Concerns

The synthetic biology industry faces challenges due to evolving regulations and biosafety considerations. Regulatory agencies worldwide are working to develop guidelines that balance innovation with proper risk management. The novel nature of many synthetic biology applications makes classification difficult within existing regulatory frameworks.

Concerns about biosecurity, potential environmental impacts, and unintended consequences of engineered organisms generate public scrutiny and regulatory caution.

Additionally, differences in international regulations complicate global commercialization strategies for synthetic biology products. These regulatory uncertainties extend development timelines, increase compliance costs, and create hesitation among investors.

Synthetic Biology Market: Opportunities

Sustainable Bio-Manufacturing and Circular Bioeconomy

Synthetic biology offers transformative approaches for developing sustainable manufacturing processes and advancing circular bioeconomy principles. Engineered microorganisms can convert renewable raw materials into valuable chemicals, materials, and fuels through optimized metabolic pathways, reducing dependence on petroleum-based production methods. Compared to traditional chemical processes, bio-based manufacturing reduces carbon footprints, waste generation, and resource consumption.

For example, engineered yeast strains now produce compounds like fragrances, flavorings, and pharmaceutical precursors previously derived from petrochemicals or rare natural materials.

Additionally, synthetic biology enables waste conversion by creating organisms capable of transforming agricultural residues, industrial by-products, and atmospheric carbon dioxide into valuable products.

Synthetic Biology Market: Challenges

Intellectual Property Complexity and Access Barriers

The synthetic biology market faces significant intellectual property rights challenges, creating uncertainty and potential innovation barriers. Overlapping patents, cross-licensing requirements, and freedom-to-operate complexities complicate the commercial development of synthetic biology applications.

The foundational nature of many synthetic biology technologies raises questions about appropriate patent scope and potential innovation obstruction through excessive protection. Patent thickets in key technology areas necessitate complex licensing negotiations and increase transaction costs, which are particularly challenging for startups and smaller organizations.

Additionally, concerns regarding equitable access to synthetic biology capabilities across different regions and economic contexts raise ethical and practical challenges.

Synthetic Biology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Synthetic Biology Market |

| Market Size in 2024 | USD 14.16 Billion |

| Market Forecast in 2034 | USD 75.74 Billion |

| Growth Rate | CAGR of 18.26% |

| Number of Pages | 221 |

| Key Companies Covered | Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Agilent Technologies Inc., Novozymes A/S, Ginkgo Bioworks, Amyris Inc., Twist Bioscience Corporation, Genscript Biotech Corporation, Codexis Inc., Synthetic Genomics Inc., New England Biolabs Inc., Eurofins Scientific, Integrated DNA Technologies Inc. (Danaher Corporation), Arzeda Corp., ATUM, and others. |

| Segments Covered | By Product, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Synthetic Biology Market: Segmentation

The global synthetic biology market is segmented based on product, technology, application, and region.

Based on product, the market is divided into enzymes, oligonucleotides, cloning technologies, chassis organisms, and others. Enzymes dominate the market due to their critical role in numerous synthetic biology applications, including DNA assembly, genome editing, and metabolic engineering. Additionally, continuous improvements in enzyme engineering for enhanced specificity, efficiency, and stability further strengthen their market position.

Based on technology, the synthetic biology industry is separated into gene synthesis, NGS technology, PCR technology, genome engineering, sequencing, bioinformatics, and others. Gene synthesis represents the most significant technology segment, providing the fundamental building blocks for virtually all synthetic biology applications.

However, genome engineering, particularly CRISPR-based technologies, shows rapid growth due to its revolutionary impact on precise genetic modification capabilities, expanding application potential across multiple industries.

Based on application, the market is categorized into healthcare, industrial manufacturing, food & agriculture, environmental applications, and others. Healthcare leads the synthetic biology industry due to substantial investment in biopharmaceuticals, diagnostics, and regenerative medicine applications. Industrial manufacturing shows significant growth potential, particularly in biofuels, specialty chemicals, and biomaterials, driven by increasing sustainability pressures and advantages over traditional chemical manufacturing processes.

Synthetic Biology Market: Regional Analysis

North America to Maintain Market Leadership

North America dominates the global synthetic biology market, and the United States has the largest regional market share. The region's leadership position stems from substantial research funding, strong academic-industry collaborations, and a vibrant biotech startup ecosystem. Leading research institutions and synthetic biology centers, particularly in California, Massachusetts, and the Research Triangle, drive continuous innovation and technology commercialization. The presence of major pharmaceutical companies, agricultural corporations, and specialty chemical manufacturers provides diverse application opportunities and market pull.

The region benefits from well-established venture capital networks with specific expertise in biotechnology investment, facilitating startup formation and growth. Supportive regulatory frameworks, particularly for pharmaceutical and industrial applications, create market predictability and investment confidence. Government initiatives like the U.S. National Bio-Economy Blueprint further accelerate synthetic biology adoption across various sectors.

Asia-Pacific to Experience Strongest Growth

The Asia-Pacific region represents the fastest-growing synthetic biology market, driven by substantial government investments, expanding research capabilities, and growing industrial applications. China leads regional growth with ambitious biotechnology development plans, including significant investments in synthetic biology infrastructure, talent development, and commercial applications.

Japan's focus on bio-based manufacturing and alternative protein development creates substantial market opportunities. Singapore's established biomedical hub increasingly incorporates synthetic biology capabilities through strategic initiatives and international partnerships.

Additionally, South Korea's strength in industrial biotechnology provides a foundation for synthetic biology applications in specialty chemicals and materials. The region's accelerating patenting activity, publication output, and startup formation indicate rapidly developing innovation ecosystems.

Recent Market Developments:

- In January 2024, Ginkgo Bioworks announced a significant expansion of its foundry capacity, incorporating advanced automation and AI-driven design tools for accelerated organism engineering.

- In March 2024, Twist Bioscience introduced a next-generation DNA synthesis platform enabling longer sequence production with significantly reduced error rates.

- In July 2024, Zymergen merged with a leading computational biology company to enhance its AI-driven biological design capabilities for specialty material applications.

- In September 2024, Amyris completed commercial-scale production of a novel sustainable aviation fuel using its engineered yeast platform, achieving cost parity with conventional jet fuel.

Synthetic Biology Market: Competitive Analysis

The global synthetic biology market is led by players like:

- Thermo Fisher Scientific Inc.

- Merck KGaA (MilliporeSigma)

- Agilent Technologies Inc.

- Novozymes A/S

- Ginkgo Bioworks

- Amyris Inc.

- Twist Bioscience Corporation

- Genscript Biotech Corporation

- Codexis Inc.

- Synthetic Genomics Inc.

- New England Biolabs Inc.

- Eurofins Scientific

- Integrated DNA Technologies Inc. (Danaher Corporation)

- Arzeda Corp.

- ATUM

The global synthetic biology market is segmented as follows:

By Product

- Enzymes

- Oligonucleotides

- Cloning Technologies

- Chassis Organisms

- Others

By Technology

- Gene Synthesis

- Genome Engineering

- Sequencing

- Bioinformatics

- Others

By Application

- Healthcare

- Industrial Manufacturing

- Food & Agriculture

- Environmental Applications

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Synthetic biology is a field that combines biology, engineering, genetics, chemistry, and computational sciences to design and build new biological parts, devices, and systems or to redesign existing natural biological systems, enabling the creation of novel biological functions not found in nature.

The synthetic biology market is expected to be driven by falling DNA synthesis and sequencing costs, rising demand for biopharmaceuticals and precision medicine, increasing investment in sustainable bio-manufacturing, and growing integration of digital technologies with biological design processes.

According to market research, the global synthetic biology market was valued at approximately USD 14.16 billion in 2024 and is projected to reach around USD 75.74 billion by 2034, driven by expanding applications across healthcare, industrial manufacturing, and agriculture.

The synthetic biology market is expected to grow at a compound annual growth rate (CAGR) of approximately 18.26% from 2025 to 2034, fueled by technological advances, increasing investment, and expanding application areas.

North America dominates the global synthetic biology market due to substantial research funding, strong academic-industry collaborations, and a vibrant biotech startup ecosystem. At the same time, Asia-Pacific represents the fastest-growing regional market.

Key players in the synthetic biology market include Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Agilent Technologies, Inc., Novozymes A/S, Ginkgo Bioworks, Amyris, Inc., Twist Bioscience Corporation, Genscript Biotech Corporation, Codexis, Inc., Synthetic Genomics, Inc., New England Biolabs, Inc., Eurofins Scientific, Integrated DNA Technologies, Inc. (Danaher Corporation), Arzeda Corp., and ATUM.

The report provides a comprehensive analysis of the synthetic biology market, including an in-depth discussion of market drivers, restraints, technological trends, regulatory landscapes, and future growth opportunities. The report also explores competitive dynamics, regional markets, and ongoing innovations in sustainable bio-manufacturing technologies.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed