Synthetic Ethanol Market Size & Share, Growth, Forecast Report 2034

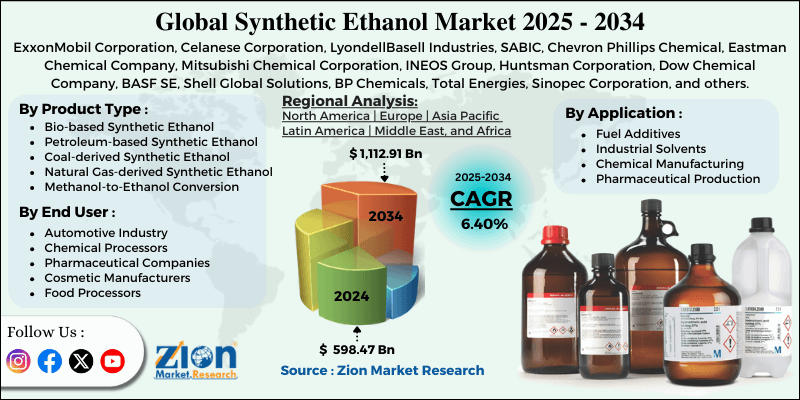

Synthetic Ethanol Market By Application (Fuel Additives, Industrial Solvents, Chemical Manufacturing, Pharmaceutical Production, Personal Care Products, Food and Beverage Processing), By Product Type (Bio-based Synthetic Ethanol, Petroleum-based Synthetic Ethanol, Coal-derived Synthetic Ethanol, Natural Gas-derived Synthetic Ethanol, Methanol-to-Ethanol Conversion, Direct Synthesis Methods), By End-User (Automotive Industry, Chemical Processors, Pharmaceutical Companies, Cosmetic Manufacturers, Food Processors, Industrial Manufacturers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

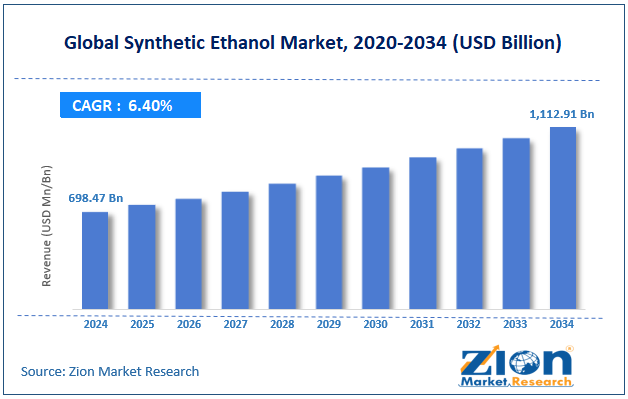

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 598.47 Billion | USD 1,112.91 Billion | 6.40% | 2024 |

Synthetic Ethanol Industry Perspective:

The global synthetic ethanol market size was worth approximately USD 598.47 billion in 2024 and is projected to grow to around USD 1,112.91 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global synthetic ethanol market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2025-2034).

- In terms of revenue, the global synthetic ethanol market size was valued at approximately USD 598.47 billion in 2024 and is projected to reach USD 1,112.91 billion by 2034.

- The synthetic ethanol market is projected to grow significantly due to the expansion of automotive fuel blending requirements and the rise of sustainable chemical production initiatives.

- Based on application, the fuel additives segment is expected to lead the market, while the pharmaceutical production segment is anticipated to experience significant growth.

- Based on product type, the natural gas-derived synthetic ethanol segment is the dominating segment. In contrast, the bio-based synthetic ethanol segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the automotive industry segment is expected to lead the market compared to the cosmetic manufacturers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Synthetic Ethanol Market: Overview

Synthetic ethanol represents a crucial component in the modern chemical industry, produced through various industrial processes rather than traditional fermentation methods. These raw materials are converted into high-purity ethanol using advanced catalytic reactions, high temperatures, controlled pressure, and purification systems. The production process includes high-end methods like steam reforming, catalytic synthesis, and distillation, allowing for efficient production while following environmental rules. Different production methods offer varying benefits in cost, efficiency, and environmental impact. Manufacturers use automated systems, real-time quality checks, and continuous process improvements to ensure reliable output. Strict regulations and quality standards ensure synthetic ethanol meets purity needs across industries such as automotive, pharmaceuticals, and chemicals.

The increasing demand for cleaner fuel alternatives and the growing need for high-purity solvents in industrial applications are expected to drive substantial growth in the synthetic ethanol market throughout the forecast period.

Synthetic Ethanol Market: Growth Drivers

Advancements in production technology and process efficiency

The synthetic ethanol industry is evolving with better technologies that lower production costs and boost output. New catalysts allow better conversion from feedstock to ethanol, improving process efficiency. Innovations like improved reactor designs, waste heat recovery, and automated systems help reduce energy use and increase productivity. These upgrades make synthetic ethanol more competitive, especially in places with limited farming resources. A

s production methods become cleaner and more cost-effective, synthetic ethanol is being adopted across sectors needing consistent, high-purity ethanol. Digital monitoring tools are also helping manufacturers optimize operations in real time. These advancements support long-term growth by increasing scalability and reducing operational risks.

How is the increasing demand for clean fuel alternatives propelling the synthetic ethanol market growth?

The synthetic ethanol market is experiencing significant growth due to rising environmental awareness and stringent emissions regulations worldwide. Many countries require blending ethanol with gasoline to lower carbon levels and improve air quality. This makes synthetic ethanol a key alternative, as it can be produced all year and isn’t tied to crop cycles. The auto industry is using more ethanol blends to meet environmental rules without compromising engine efficiency.

Unlike traditional ethanol, synthetic ethanol provides stable pricing and availability, which is attractive to fuel companies. The growth of flex-fuel vehicles and better ethanol infrastructure also supports long-term demand. As countries aim to cut petroleum use and meet climate targets, synthetic ethanol plays a growing role in the clean fuel transition.

Synthetic Ethanol Market: Restraints

Feedstock price volatility and environmental concerns

The synthetic ethanol market faces a major challenge, which is the volatility in feedstock prices, particularly for petroleum-based and natural gas-derived production methods. Fluctuating energy costs directly impact production economics, making it difficult for manufacturers to maintain consistent pricing and profit margins. This price instability affects long-term supply contracts and can deter potential customers from switching to synthetic ethanol alternatives.

Environmental concerns also pose challenges, as some production methods generate carbon emissions and require careful waste management. Public opinion tends to be more negative toward synthetic products than bio-based alternatives. Concerns over pollution and unclear future regulations make it risky for companies to invest in new facilities or upgrades, slowing market expansion.

Synthetic Ethanol Market: Opportunities

How are pharmaceutical and personal care applications contributing to the growth of the synthetic ethanol market?

The synthetic ethanol market is gaining demand in pharmaceutical and personal care products, where product purity and consistency are important. Drug companies use ultra-pure ethanol for making medicines, cleaning equipment, and carrying out chemical processes. Personal care products like perfumes, sanitizers, and cosmetics benefit from synthetic ethanol’s stable quality and reliable supply. These segments offer higher profit margins than fuel use, improving overall market performance. Companies in these sectors are more willing to pay premium prices for guaranteed purity, especially as regulations and consumer awareness around ingredient quality rise. This shift supports the growth of synthetic ethanol in high-end applications.

Synthetic Ethanol Market: Challenges

How are regulatory compliance and technology investment requirements limiting the growth of the synthetic ethanol market?

The synthetic ethanol industry faces significant challenges related to evolving regulatory frameworks and substantial technology investment requirements. Environmental regulations vary significantly across regions, requiring manufacturers to adapt their processes and invest in emissions control systems.

Technology investments needed to remain competitive are expensive, which can strain smaller manufacturers. Quality certification for different end uses adds complexity and increases costs. The need for specialized technical expertise and trained personnel further increases operational challenges. These factors can delay new project development and limit market participation in emerging economies.

Synthetic Ethanol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Synthetic Ethanol Market |

| Market Size in 2024 | USD 598.47 Billion |

| Market Forecast in 2034 | USD 1,112.91 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 220 |

| Key Companies Covered | ExxonMobil Corporation, Celanese Corporation, LyondellBasell Industries, SABIC, Chevron Phillips Chemical, Eastman Chemical Company, Mitsubishi Chemical Corporation, INEOS Group, Huntsman Corporation, Dow Chemical Company, BASF SE, Shell Global Solutions, BP Chemicals, Total Energies, Sinopec Corporation, and others. |

| Segments Covered | By Application, By Product Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Synthetic Ethanol Market: Segmentation

The global synthetic ethanol market is segmented based on application, product type, end-user, and region.

Based on application, the global synthetic ethanol industry is segmented into fuel additives, industrial solvents, chemical manufacturing, pharmaceutical production, personal care products, and food and beverage processing. Fuel additives lead the market due to widespread adoption in gasoline blending, government mandates for ethanol content, and extensive use in automotive and transportation sectors globally.

Based on product type, the global synthetic ethanol market is segregated into bio-based synthetic ethanol, petroleum-based synthetic ethanol, coal-derived synthetic ethanol, natural gas-derived synthetic ethanol, methanol-to-ethanol conversion, and direct synthesis methods. Natural gas-derived synthetic ethanol is expected to lead the market during the forecast period due to abundant feedstock availability, established production infrastructure, and favorable economics in regions with natural gas resources.

Based on end-user, the global market is divided into the automotive industry, chemical processors, pharmaceutical companies, cosmetic manufacturers, food processors, and industrial manufacturers. The automotive industry holds the largest market share due to high volume requirements, consistent demand patterns, and widespread use of ethanol-blended fuels in transportation applications.

Synthetic Ethanol Market: Regional Analysis

What factors are contributing to North America's dominance in the global market?

North America leads the global synthetic ethanol market due to established petrochemical infrastructure, advanced production technologies, and supportive government policies for alternative fuels. The region accounts for approximately 45% of the global synthetic ethanol supply, with the U.S. at the forefront due to its refining capacity and energy resources. Federal and state-level fuel standards create a steady demand for ethanol. The region also benefits from efficient supply chains, strong R&D, and a skilled workforce. Close relationships between manufacturers and buyers support product development and new applications.

With many auto manufacturers and fuel suppliers in the region, demand for synthetic ethanol remains strong and stable. Ongoing investments in renewable energy integration are further boosting ethanol production capabilities. North America's focus on energy independence and emission reduction is expected to drive continued market leadership. In addition, government funding for clean fuel research and public-private partnerships is helping accelerate innovation across the value chain.

Asia Pacific is expected to show strong growth.

Asia Pacific's synthetic ethanol market is experiencing rapid expansion driven by industrial growth, increasing energy demands, and government initiatives promoting cleaner fuels. The region's large manufacturing base creates demand for industrial solvents, while growing automotive production supports fuel additive applications. Countries like China and India are investing heavily in synthetic fuel technologies to reduce petroleum imports and improve energy security. The region's abundant coal resources and expanding natural gas infrastructure provide feedstock advantages for synthetic ethanol production. Government policies promoting industrial development and environmental protection create favorable conditions for market growth.

As environmental regulations become stricter, demand for cleaner industrial solvents and fuel additives continues to increase. The region's growing pharmaceutical and personal care industries also contribute to market expansion through high-value applications requiring consistent quality and supply reliability. Collaborations with global technology providers are further enhancing production capabilities and knowledge transfer across emerging economies.

Recent Market Developments:

In February 2025, Celanese announced the completion of a new synthetic ethanol facility in Texas, utilizing advanced natural gas conversion technology to produce high-purity ethanol for pharmaceutical and industrial applications.

Synthetic Ethanol Market: Competitive Analysis

The leading players in the global synthetic ethanol market are:

- ExxonMobil Corporation

- Celanese Corporation

- LyondellBasell Industries

- SABIC

- Chevron Phillips Chemical

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- INEOS Group

- Huntsman Corporation

- Dow Chemical Company

- BASF SE

- Shell Global Solutions

- BP Chemicals

- Total Energies

- Sinopec Corporation

The global synthetic ethanol market is segmented as follows:

By Application

- Fuel Additives

- Industrial Solvents

- Chemical Manufacturing

- Pharmaceutical Production

- Personal Care Products

- Food and Beverage Processing

By Product Type

- Bio-based Synthetic Ethanol

- Petroleum-based Synthetic Ethanol

- Coal-derived Synthetic Ethanol

- Natural Gas-derived Synthetic Ethanol

- Methanol-to-Ethanol Conversion

- Direct Synthesis Methods

By End User

- Automotive Industry

- Chemical Processors

- Pharmaceutical Companies

- Cosmetic Manufacturers

- Food Processors

- Industrial Manufacturers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Synthetic ethanol represents a crucial component in the modern chemical industry, produced through various industrial processes rather than traditional fermentation methods.

The global synthetic ethanol market is projected to grow due to increasing demand for clean fuel alternatives, rising adoption of ethanol blending in automotive fuels, and growing requirements for high-purity solvents in pharmaceutical and industrial applications.

According to a study, the global synthetic ethanol market size was worth around USD 598.47 billion in 2024 and is predicted to grow to around USD 1,112.91 billion by 2034.

The CAGR value of the synthetic ethanol market is expected to be around 6.40% during 2025-2034.

North America is expected to lead the global synthetic ethanol market during the forecast period.

The major players profiled in the global synthetic ethanol market include ExxonMobil Corporation, Celanese Corporation, LyondellBasell Industries, SABIC, Chevron Phillips Chemical, Eastman Chemical Company, Mitsubishi Chemical Corporation, INEOS Group, Huntsman Corporation, Dow Chemical Company, BASF SE, Shell Global Solutions, BP Chemicals, Total Energies, and Sinopec Corporation.

The report examines key aspects of the synthetic ethanol market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

Which application areas will offer significant growth opportunities in the synthetic ethanol market?

Pharmaceutical production and personal care products represent the most significant growth opportunities in the synthetic ethanol market. These high-value applications demand ultra-pure ethanol with consistent quality specifications, commanding premium pricing compared to fuel applications. The growing emphasis on product safety, regulatory compliance, and ingredient traceability in these sectors favors synthetic ethanol producers who can demonstrate superior quality control and supply reliability.

The growth of the synthetic ethanol market is impacted by environmental and regulatory factors such as fuel blending mandates, emissions standards, renewable fuel policies, and environmental protection regulations promoting cleaner industrial processes and sustainable chemical production alternatives.

The synthetic ethanol market is expected to reach its peak potential during the late 2020s to early 2030s, coinciding with maximum adoption of ethanol fuel blending mandates and the maturation of clean energy transition policies. However, the market may experience a secondary growth phase in the 2030s as pharmaceutical and specialty chemical applications expand and new production technologies become commercially viable.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed