Telecom Analytics Market Size, Growth, Share, Demand Analysis 2024-2032

Telecom Analytics Market By Deployment Model (On-premise, Cloud), By Application (Sales and Marketing Management, Customer Management, Workforce Management and Network Management), By Component (Solutions, Services): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 - 2028-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.79 Billion | USD 15.37 Billion | 10.3% | 2023 |

Description

Telecom Analytics Market Insights

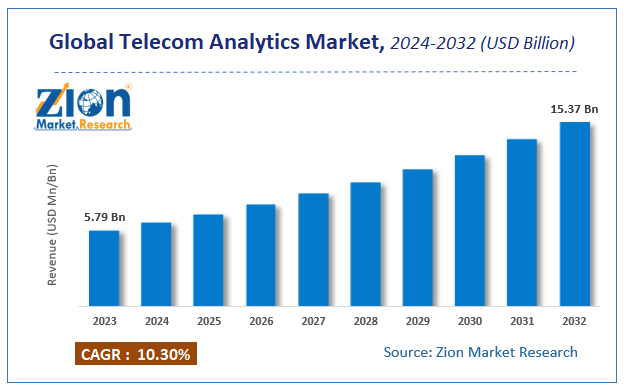

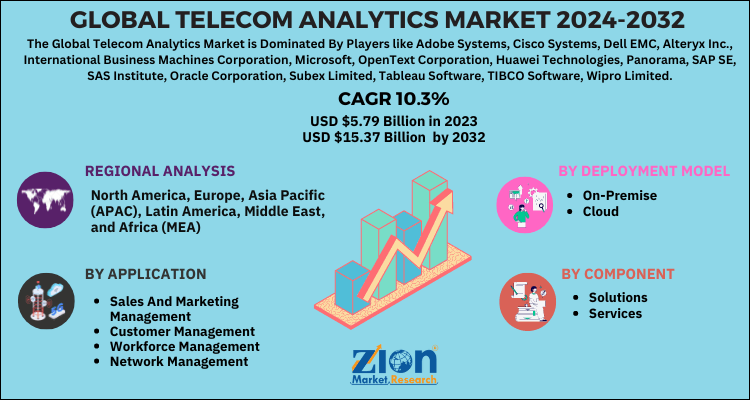

According to the report published by Zion Market Research, the global Telecom Analytics Market size was valued at USD 5.79 Billion in 2023 and is predicted to reach USD 15.37 Billion by the end of 2032. The market is expected to grow with a CAGR of 10.3% during the forecast period. The report analyzes the global Telecom Analytics Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Telecom Analytics industry.

Telecom Analytics Market Size & Industry Analysis

The Global Telecom Analytics Market accounted for USD 2.88 Billion in 2020 and is expected to reach USD 7.81 Billion by 2028, growing at a CAGR of 13.3 % from 2021 to 2028.

Telecom Analytics includes business intelligence (BI) technologies that are packaged to meet the complex requirements of telecom organizations. These activities include reducing fraud and churn, increasing sales, decreasing operational costs and improving risk management. Through telecom analytics communication service providers examine large voluminous data and draw actionable insights. The market is primarily driven by abilities of telecom analytics to reduce churn and improve customer loyalty. The technologies such as IoT, Big Data and data science are offering fascinating opportunities for the data-driven business in order to maximize the revenue, for the cost efficiency and for the customer understanding. The increasing adoption of technologies in the telecom sector is expected to increase the growth prospects of this market in the near future.

COVID-19 Impact Analysis

The global impacts of Covid-19 are have impacted almost each and every industry sector. The telecom market has also been disrupted as it is at the core of the communications required for government, medical and private sector businesses in order to operate seamlessly. But, the sudden disruption of all the business operations has forced the companies to drive their remotely. This shift has demanded for the better network connectivity and improved internet coverage. Telecom operators have been allocating round the clock internet services to the mobile subscribers. The usage of analytics in telecom has also increased as organizations have been harnessing the power of analytics to predict the behavior of consumers and also the demand in the telecom sector in the near future.

Growth Factors

The increasing volumes of telecom data and the concentration towards function specific analytics just as telecom analytics are the factors driving the growth of the telecom market. The growing acceptance and acknowledgements of the analytics solutions in the telecom sector in order to increase the sales and operation visibility and manage the operating expenses in a better way are the reasons for the boost in the telecom analytics market. The factors such as need for effective income management, demand to lessen the churn and recall users and increasing network attacks are also some of the prominent factors that are responsible for the growth of telecom analytics market.

Companies are also highly investing in innovations and digital transformations that is boosting the demand for telecom analytics market. The telecom analytics is also used to build better investor relationships and re-invent new technological applications. The telecom analytics is used to expand the visibility into internal processes, differentiate trends, analyze market trends and create forecasts. It also helps the companies to distinguish their business with competitive plan and help in revenue growth.

Telecom Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Telecom Analytics Market |

| Market Size in 2023 | USD 5.79 Billion |

| Market Forecast in 2032 | USD 15.37 Billion |

| Growth Rate | CAGR of 10.3% |

| Number of Pages | 160 |

| Key Companies Covered | Adobe Systems, Cisco Systems, Dell EMC, Alteryx Inc., International Business Machines Corporation, Microsoft, OpenText Corporation, Huawei Technologies, Panorama, SAP SE, SAS Institute, Oracle Corporation, Subex Limited, Tableau Software, TIBCO Software, Wipro Limited, Teradata Corporation, Sisense Inc. and MicroStrategy among others |

| Segments Covered | By Deployment Model, By Application, By Component And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Deployment Model Analysis Preview

The Cloud segment forms the significant segment of the deployment model of Telecom Analytics Market. This is due to the factors such as low investment cost, agility offered by cloud deployment and scalability of the cloud solutions. The telecom cloud solutions help the telecom operators decrease the administration costs and operational costs and thus deliver feasible solutions. The rise in the need for mobility and the rising adoption of cloud technology by the small businesses is boosting the overall demand for this market.

Application Analysis Preview

The Customer Management segment forms the significant segment of the Application of Telecom Analytics Market. Majority of the companies using analytics in the telecom sector have been finding tremendous usage of analytics in the customer relationship management. They use the analytics to study the market demand and observe the customer behavior. The behavioral attributes are captured using analytics which help the overall segment to come up with new innovative products based on the consumer interests. The analytics enable the telecom providers to make strong decisions based on data obtained, thus leading to customer acquisition, customer retention and satisfaction.

The Workforce Management segment is also one of the significant part of the Application segment. Improving the workforce is always one of the prominent goals of all businesses. The rising potential of technologies and internet have unearthed the potential of telecom industry. With the help of analytics, it becomes possible to track the real time data of the processes and allot the teams accordingly. The analytics also plays a vital role in managing forecasts and budgets, attendance and timings of the workforce and automate various tasks and variables such as vacations, workload and absences.

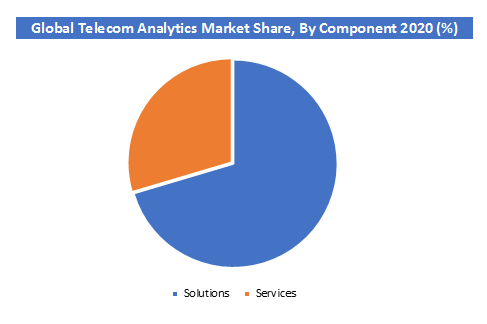

Component Analysis Preview

The solutions segment forms the significant part of the Component segment of the Telecom Analytics market. This is mainly due to the growing adoption of telecom analytics and numerous benefits offered by it. This solution is further divided into customer analytics, subscriber analytics, location analytics, price analytics and service analytics. Through the telecom analytics, the telecom operators are able to obtain insights from subscriber usage statistics in order to know their performance pattern and thus enhance customer experiences. The Telecom companies also get the opportunity for up-selling and cross-selling through analytics. Also, these telecom analytic solutions comprise machine learning, through which carriers can recognize at-risk subscribers or identify the roots of churn that is going to occur in the near future.

Regional Analysis Preview

North America held a share of 38% in 2020. It is supposed to be one of the highest revenue-generating regions for this market during the forecasted period. This is due to the fact that there has been high demand from the telecommunication sector and there has been adoption of new technologies in the market. There has also been digitization and technological advancements which has boosted the demand for this market. The investments over the analytic solutions have also been high and the presence of prominent industry players in the region is also influencing the overall growth of this market. Also, in North America, there is strong penetration of telecom solutions among the population and this high dissemination f telecom industry created huge data which is helping this market.

Asia-Pacific is expected to have the CAGR of 16.1% from 2021 to 2028. This is mainly due to rising investments in the advanced technologies such as IoT and Big Data. The booming telecom industry and the increasing digital transformation has boosted the growth for this market in this region. This has expected to drive significant investments in new and advanced analytical technologies. These are the prominent factors that are driving the market in Asia-Pacific region.

Key Market Players & Competitive Landscape

Some of the key players in the Telecom Analytics market include:

- Adobe Systems

- Cisco Systems

- Dell EMC

- Alteryx Inc.

- International Business Machines Corporation

- Microsoft

- OpenText Corporation

- Huawei Technologies

- Panorama

- SAP SE

- SAS Institute

- Oracle Corporation

- Subex Limited

- Tableau Software

- TIBCO Software

- Wipro Limited

- Teradata Corporation

- Sisense Inc.

- MicroStrategy among others.

In January 2020, Oracle collaborated with Telecom Fiji, which is a provider of fixed-line communication and networking services. Telecom Fiji would deploy Oracle Communications Order and Service Management, Oracle Communications Network Charging and Control and various other solutions under Oracle Digital Experience for Communications.

The Global Telecom Analytics Market is segmented as follows:

By Deployment Model

- On-premise

- Cloud

By Application

- Sales and Marketing Management

- Customer Management

- Workforce Management

- Network Management

By Component

- Solutions

- Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

- Chapter No. 1 Introduction

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. USP & Key Offerings

- 1.2. Key Benefits for Stakehulders

- 1.3. Target Audience

- 1.4. Report Scope

- 1.1. Report Description

- Chapter No. 2 Executive Summary

- 2.1. Key Findings

- 2.1.1. Top Investment Pockets

- 2.1.1.1. Market Attractiveness Analysis, By Deployment Model

- 2.1.1.2. Market Attractiveness Analysis, By Application

- 2.1.1.3. Market Attractiveness Analysis, By Component

- 2.1.1.4. Market Attractiveness Analysis, By Region

- 2.1.1. Top Investment Pockets

- 2.2. Market Snapshot

- 2.3. Global Telecom Analytics Market, 2016 – 2028 (USD Million)

- 2.4. Insights from Primary Respondents

- 2.1. Key Findings

- Chapter No. 3 COVID 19 Impact Analysis

- 3.1. Impact Assessment of COVID-19 Pandemic, By Region

- 3.1.1. North America

- 3.1.2. Europe

- 3.1.3. Asia Pacific

- 3.1.4. Latin America

- 3.1.5. The Middle-East and Africa

- 3.2. Quarterly Market Revenue and Forecast by Region 2020 & 2021

- 3.3. Pre COVID-19 Market Revenue, By Region, 2016-2019 (USD Million)

- 3.4. Post COVID-19 Market Revenue, By Region, 2020-2028 (USD Million)

- 3.5. Key Strategies Undertaken by Companies to Tackle COVID-19

- 3.5.1. Company Quarterly Revenue Analysis, 2019 & 2020

- 3.6. Short Term Dynamics

- 3.7. Long Term Dynamics

- 3.1. Impact Assessment of COVID-19 Pandemic, By Region

- Chapter No. 4 Telecom Analytics Market – Deployment Model Segment Analysis

- 4.1. Overview

- 4.1.1. Market Revenue Share, By Deployment Model, 2020 & 2028

- 4.2. On-premise

- 4.2.1. Market Size and Forecast, By Region (USD Million)

- 4.2.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 4.2.3. Key Market Trends, Growth Factors, & Opportunities

- 4.3. Cloud

- 4.3.1. Market Size and Forecast, By Region (USD Million)

- 4.3.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 4.3.3. Key Market Trends, Growth Factors, & Opportunities

- 4.1. Overview

- Chapter No. 5 Telecom Analytics Market – Application Segment Analysis

- 5.1. Overview

- 5.1.1. Market Revenue Share, By Application, 2020 & 2028

- 5.2. Sales and Marketing Management

- 5.2.1. Market Size and Forecast, By Region (USD Million)

- 5.2.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 5.2.3. Key Market Trends, Growth Factors, & Opportunities

- 5.3. Customer Management

- 5.3.1. Market Size and Forecast, By Region (USD Million)

- 5.3.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 5.3.3. Key Market Trends, Growth Factors, & Opportunities

- 5.4. Workforce Management

- 5.4.1. Market Size and Forecast, By Region (USD Million)

- 5.4.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 5.4.3. Key Market Trends, Growth Factors, & Opportunities

- 5.5. Network Management

- 5.5.1. Market Size and Forecast, By Region (USD Million)

- 5.5.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 5.5.3. Key Market Trends, Growth Factors, & Opportunities

- 5.1. Overview

- Chapter No. 6 Telecom Analytics Market – Component Segment Analysis

- 6.1. Overview

- 6.1.1. Market Revenue Share, By Component, 2020 & 2028

- 6.2. Sulutions

- 6.2.1. Market Size and Forecast, By Region (USD Million)

- 6.2.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 6.2.3. Key Market Trends, Growth Factors, & Opportunities

- 6.3. Services

- 6.3.1. Market Size and Forecast, By Region (USD Million)

- 6.3.2. Comparative Revenue Analysis, By Country, 2020 & 2028

- 6.3.3. Key Market Trends, Growth Factors, & Opportunities

- 6.1. Overview

- Chapter No. 7 Telecom Analytics Market – Regional Analysis

- 7.1. Overview

- 7.1.1. Global Market Revenue Share, By Region, 2020 & 2028

- 7.1.2. Global Market Revenue, By Region, 2016 – 2028 (USD Million)

- 7.2. North America

- 7.2.1. North America Market Revenue, By Country, 2016 – 2028 (USD Million)

- 7.2.2. North America Market Revenue, By Deployment Model, 2016 – 2028

- 7.2.3. North America Market Revenue, By Application, 2016 – 2028

- 7.2.4. North America Market Revenue, By Component, 2016 – 2028

- 7.2.5. U.S.

- 7.2.5.1. U.S. Market Revenue, By Deployment Model, 2016 – 2028

- 7.2.5.2. U.S. Market Revenue, By Application, 2016 – 2028

- 7.2.5.3. U.S. Market Revenue, By Component, 2016 – 2028

- 7.2.6. Canada

- 7.2.6.1. Canada Market Revenue, By Deployment Model, 2016 – 2028

- 7.2.6.2. Canada Market Revenue, By Application, 2016 – 2028

- 7.2.6.3. Canada Market Revenue, By Component, 2016 – 2028

- 7.2.7. Mexico

- 7.2.7.1. Mexico Market Revenue, By Deployment Model, 2016 – 2028

- 7.2.7.2. Mexico Market Revenue, By Application, 2016 – 2028

- 7.2.7.3. Mexico Market Revenue, By Component, 2016 – 2028

- 7.3. Europe

- 7.3.1. Europe Market Revenue, By Country, 2016 – 2028 (USD Million)

- 7.3.2. Europe Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.3. Europe Market Revenue, By Application, 2016 – 2028

- 7.3.4. Europe Market Revenue, By Component, 2016 – 2028

- 7.3.5. Germany

- 7.3.5.1. Germany Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.5.2. Germany Market Revenue, By Application, 2016 – 2028

- 7.3.5.3. Germany Market Revenue, By Component, 2016 – 2028

- 7.3.6. France

- 7.3.6.1. France Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.6.2. France Market Revenue, By Application, 2016 – 2028

- 7.3.6.3. France Market Revenue, By Component, 2016 – 2028

- 7.3.7. U.K.

- 7.3.7.1. U.K. Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.7.2. U.K. Market Revenue, By Application, 2016 – 2028

- 7.3.7.3. U.K. Market Revenue, By Component, 2016 – 2028

- 7.3.8. Italy

- 7.3.8.1. Italy Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.8.2. Italy Market Revenue, By Application, 2016 – 2028

- 7.3.8.3. Italy Market Revenue, By Component, 2016 – 2028

- 7.3.9. Spain

- 7.3.9.1. Spain Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.9.2. Spain Market Revenue, By Application, 2016 – 2028

- 7.3.9.3. Spain Market Revenue, By Component, 2016 – 2028

- 7.3.10. Rest of Europe

- 7.3.10.1. Rest of Europe Market Revenue, By Deployment Model, 2016 – 2028

- 7.3.10.2. Rest of Europe Market Revenue, By Application, 2016 – 2028

- 7.3.10.3. Rest of Europe Market Revenue, By Component, 2016 – 2028

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Market Revenue, By Country, 2016 – 2028 (USD Million)

- 7.4.2. Asia Pacific Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.3. Asia Pacific Market Revenue, By Application, 2016 – 2028

- 7.4.4. Asia Pacific Market Revenue, By Component, 2016 – 2028

- 7.4.5. China

- 7.4.5.1. China Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.5.2. China Market Revenue, By Application, 2016 – 2028

- 7.4.5.3. China Market Revenue, By Component, 2016 – 2028

- 7.4.6. Japan

- 7.4.6.1. Japan Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.6.2. Japan Market Revenue, By Application, 2016 – 2028

- 7.4.6.3. Japan Market Revenue, By Component, 2016 – 2028

- 7.4.7. India

- 7.4.7.1. India Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.7.2. India Market Revenue, By Application, 2016 – 2028

- 7.4.7.3. India Market Revenue, By Component, 2016 – 2028

- 7.4.8. South Korea

- 7.4.8.1. South Korea Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.8.2. South Korea Market Revenue, By Application, 2016 – 2028

- 7.4.8.3. South Korea Market Revenue, By Component, 2016 – 2028

- 7.4.9. South-East Asia

- 7.4.9.1. South-East Asia Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.9.2. South-East Asia Market Revenue, By Application, 2016 – 2028

- 7.4.9.3. South-East Asia Market Revenue, By Component, 2016 – 2028

- 7.4.10. Rest of Asia Pacific

- 7.4.10.1. Rest of Asia Pacific Market Revenue, By Deployment Model, 2016 – 2028

- 7.4.10.2. Rest of Asia Pacific Market Revenue, By Application, 2016 – 2028

- 7.4.10.3. Rest of Asia Pacific Market Revenue, By Component, 2016 – 2028

- 7.5. Latin America

- 7.5.1. Latin America Market Revenue, By Country, 2016 – 2028 (USD Million)

- 7.5.2. Latin America Market Revenue, By Deployment Model, 2016 – 2028

- 7.5.3. Latin America Market Revenue, By Application, 2016 – 2028

- 7.5.4. Latin America Market Revenue, By Component, 2016 – 2028

- 7.5.5. Brazil

- 7.5.5.1. Brazil Market Revenue, By Deployment Model, 2016 – 2028

- 7.5.5.2. Brazil Market Revenue, By Application, 2016 – 2028

- 7.5.5.3. Brazil Market Revenue, By Component, 2016 – 2028

- 7.5.6. Argentina

- 7.5.6.1. Argentina Market Revenue, By Deployment Model, 2016 – 2028

- 7.5.6.2. Argentina Market Revenue, By Application, 2016 – 2028

- 7.5.6.3. Argentina Market Revenue, By Component, 2016 – 2028

- 7.5.7. Rest of Latin America

- 7.5.7.1. Rest of Latin America Market Revenue, By Deployment Model, 2016 – 2028

- 7.5.7.2. Rest of Latin America Market Revenue, By Application, 2016 – 2028

- 7.5.7.3. Rest of Latin America Market Revenue, By Component, 2016 – 2028

- 7.6. The Middle-East and Africa

- 7.6.1. The Middle-East and Africa Market Revenue, By Country, 2016 – 2028 (USD Million)

- 7.6.2. The Middle-East and Africa Market Revenue, By Deployment Model, 2016 – 2028

- 7.6.3. The Middle-East and Africa Market Revenue, By Application, 2016 – 2028

- 7.6.4. The Middle-East and Africa Market Revenue, By Component, 2016 – 2028

- 7.6.5. GCC Countries

- 7.6.5.1. GCC Countries Market Revenue, By Deployment Model, 2016 – 2028

- 7.6.5.2. GCC Countries Market Revenue, By Application, 2016 – 2028

- 7.6.5.3. GCC Countries Market Revenue, By Component, 2016 – 2028

- 7.6.6. South Africa

- 7.6.6.1. South Africa Market Revenue, By Deployment Model, 2016 – 2028

- 7.6.6.2. South Africa Market Revenue, By Application, 2016 – 2028

- 7.6.6.3. South Africa Market Revenue, By Component, 2016 – 2028

- 7.6.7. Rest of Middle-East Africa

- 7.6.7.1. Rest of Middle-East Africa Market Revenue, By Deployment Model, 2016 – 2028

- 7.6.7.2. Rest of Middle-East Africa Market Revenue, By Application, 2016 – 2028

- 7.6.7.3. Rest of Middle-East Africa Market Revenue, By Component, 2016 – 2028

- 7.1. Overview

- Chapter No. 8 Telecom Analytics Market – Industry Analysis

- 8.1. Introduction

- 8.2. Market Drivers

- 8.2.1. Driving Factor 1 Analysis

- 8.2.2. Driving Factor 2 Analysis

- 8.3. Market Restraints

- 8.3.1. Restraining Factor Analysis

- 8.4. Market Opportunities

- 8.4.1. Market Opportunity Analysis

- 8.5. Porter’s Five Forces Analysis

- 8.6. PEST Analysis

- 8.7. Regulatory Landscape

- 8.8. Technology Landscape

- 8.9. Regional Market Trends

- 8.9.1. North America

- 8.9.2. Europe

- 8.9.3. Asia Pacific

- 8.9.4. Latin America

- 8.9.5. The Middle-East and Africa

- 8.10. Pricing Analysis

- 8.11. Value Chain Analysis

- 8.12. Downstream Buyers

- 8.13. Distributors/Traders List

- Chapter No. 9 Competitive Landscape

- 9.1. Company Market Share Analysis – 2019

- 9.1.1. Global Telecom Analytics Market: Company Market Share, 2019

- 9.1.2. Global Telecom Analytics Market, Company Market Revenue, 2016 – 2019 (USD Million)

- 9.1.3. Global Telecom Analytics Market, Company Y-o-Y Growth, 2017 – 2019 (%)

- 9.1.4. Global Telecom Analytics Market: Radar Determinant Chart, 2019

- 9.2. Strategic Developments

- 9.2.1. Acquisitions & Mergers

- 9.2.2. New Product Launch

- 9.2.3. Regional Expansion

- 9.3. Company Strategic Developments – Heat Map Analysis

- 9.1. Company Market Share Analysis – 2019

- Chapter No. 10 Company Profiles

- 10.1. Adobe Systems

- 10.1.1. Company Overview

- 10.1.2. Key Executives

- 10.1.3. Product Portfolio

- 10.1.4. Financial Overview

- 10.1.5. Operating Business Segments

- 10.1.6. Business Performance

- 10.1.7. Recent Developments

- 10.2. Cisco Systems

- 10.3. Dell EMC

- 10.4. Alteryx Inc.

- 10.5. International Business Machines Corporation

- 10.6. Microsoft

- 10.7. OpenText Corporation

- 10.8. Huawei Technulogies

- 10.9. Panorama

- 10.10. SAP SE

- 10.11. SAS Institute

- 10.12. Oracle Corporation

- 10.13. Subex Limited

- 10.14. Tableau Software

- 10.15. TIBCO Software

- 10.16. Wipro Limited

- 10.17. Teradata Corporation

- 10.18. Sisense Inc.,

- 10.19. MicroStrategy

- 10.1. Adobe Systems

- Chapter No. 11 Marketing Strategy Analysis

- 11.1. Marketing Channel

- 11.2. Direct Marketing

- 11.3. Indirect Marketing

- 11.4. Marketing Channel Development Trends

- 11.5. Economic/Pulitical Environmental Change

- Chapter No. 12 Research Methodology

- 12.1. Research Methodology

- 12.2. Phase I - Secondary Research

- 12.3. Phase II - Data Modeling

- 12.3.1. Company Share Analysis Model

- 12.3.2. Revenue Based Modeling

- 12.4. Phase III - Primary Research

- 12.5. Research Limitations

- 12.5.1. Assumptions

List Of Figures

List of Figures

FIG NO. 1. Market Attractiveness Analysis, By Deployment Model

FIG NO. 2. Market Attractiveness Analysis, By Application

FIG NO. 3. Market Attractiveness Analysis, By Component

FIG NO. 4. Market Attractiveness Analysis, By Region

FIG NO. 5. Global Telecom Analytics Market Revenue, 2016 – 2028 (USD Million)

FIG NO. 6. Impact of COVID-19 Pandemic in North America Countries

FIG NO. 7. Market Revenue Share, By Deployment Model, 2020 & 2028

FIG NO. 8. Global Telecom Analytics Market for On-premise, Revenue (USD Million) 2016 – 2028

FIG NO. 9. Comparative Revenue Analysis of Telecom Analytics Market for On-premise, By Country, 2020 & 2028

FIG NO. 10. Global Telecom Analytics Market for Cloud, Revenue (USD Million) 2016 – 2028

FIG NO. 11. Comparative Revenue Analysis of Telecom Analytics Market for Cloud, By Country, 2020 & 2028

FIG NO. 12. Market Revenue Share, By Application, 2020 & 2028

FIG NO. 13. Global Telecom Analytics Market for Sales and Marketing Management, Revenue (USD Million) 2016 – 2028

FIG NO. 14. Comparative Revenue Analysis of Telecom Analytics Market for Sales and Marketing Management, By Country, 2020 & 2028

FIG NO. 15. Global Telecom Analytics Market for Customer Management, Revenue (USD Million) 2016 – 2028

FIG NO. 16. Comparative Revenue Analysis of Telecom Analytics Market for Customer Management, By Country, 2020 & 2028

FIG NO. 17. Global Telecom Analytics Market for Workforce Management, Revenue (USD Million) 2016 – 2028

FIG NO. 18. Comparative Revenue Analysis of Telecom Analytics Market for Workforce Management, By Country, 2020 & 2028

FIG NO. 19. Global Telecom Analytics Market for Network Management, Revenue (USD Million) 2016 – 2028

FIG NO. 20. Comparative Revenue Analysis of Telecom Analytics Market for Network Management, By Country, 2020 & 2028

FIG NO. 21. Market Revenue Share, By Component, 2020 & 2028

FIG NO. 22. Global Telecom Analytics Market for Solutions, Revenue (USD Million) 2016 – 2028

FIG NO. 23. Comparative Revenue Analysis of Telecom Analytics Market for Solutions, By Country, 2020 & 2028

FIG NO. 24. Global Telecom Analytics Market for Services, Revenue (USD Million) 2016 – 2028

FIG NO. 25. Comparative Revenue Analysis of Telecom Analytics Market for Services, By Country, 2020 & 2028

FIG NO. 26. Global Telecom Analytics Market Revenue Share, By Region, 2020 & 2028

FIG NO. 27. North America Telecom Analytics Market Revenue, 2016 - 2028 (USD Million)

FIG NO. 28. Porter’s Five Forces Analysis for Global Telecom Analytics Market

FIG NO. 29. PEST Analysis for Global Telecom Analytics Market

FIG NO. 30. Pricing Analysis for Global Telecom Analytics Market

FIG NO. 31. Value Chain Analysis for Global Telecom Analytics Market

FIG NO. 32. Company Share Analysis, 2019

FIG NO. 33. Radar Determinant Chart, 2019

FIG NO. 34. Company Strategic Developments – Heat Map Analysis

FIG NO. 35. Adobe Systems Business Segment Revenue Share, 2020 (%)

FIG NO. 36. Adobe Systems Geographical Segment Revenue Share, 2020 (%)

FIG NO. 37. Market Channels

FIG NO. 38. Marketing Channel Development Trend

FIG NO. 39. Growth in World Gross Product, 2008-2018

FIG NO. 40. Research Methodology – Detailed View

FIG NO. 41. Research Methodology

Table Of Tables

List of Tables

TABLE NO. 1. Global Telecom Analytics Market: Snapshot

TABLE NO. 2. Quarterly Telecom Analytics Market Revenue by Region, 2020

TABLE NO. 3. Quarterly Telecom Analytics Market Revenue Forecast by Region, 2021

TABLE NO. 4. Pre COVID-19 Market Revenue, By Region, 2016-2019 (USD Million)

TABLE NO. 5. Post COVID-19 Market Revenue, By Region, 2020-2028 (USD Million)

TABLE NO. 6. Global Telecom Analytics Market for On-premise, by Region, 2016 – 2028 (USD Million)

TABLE NO. 7. Global Telecom Analytics Market for Cloud, by Region, 2016 – 2028 (USD Million)

TABLE NO. 8. Global Telecom Analytics Market for Sales and Marketing Management, by Region, 2016 – 2028 (USD Million)

TABLE NO. 9. Global Telecom Analytics Market for Customer Management, by Region, 2016 – 2028 (USD Million)

TABLE NO. 10. Global Telecom Analytics Market for Workforce Management, by Region, 2016 – 2028 (USD Million)

TABLE NO. 11. Global Telecom Analytics Market for Network Management, by Region, 2016 – 2028 (USD Million)

TABLE NO. 12. Global Telecom Analytics Market for Solutions, by Region, 2016 – 2028 (USD Million)

TABLE NO. 13. Global Telecom Analytics Market for Services, by Region, 2016 – 2028 (USD Million)

TABLE NO. 14. Global Telecom Analytics Market Revenue, By Region, 2016 – 2028 (USD Million)

TABLE NO. 15. North America Telecom Analytics Market Revenue, By Country, 2016 – 2028 (USD Million)

TABLE NO. 16. North America Telecom Analytics Market Revenue, By Deployment Model, 2016 – 2028 (USD Million)

TABLE NO. 17. North America Telecom Analytics Market Revenue, By Application, 2016 – 2028 (USD Million)

TABLE NO. 18. North America Telecom Analytics Market Revenue, By Component, 2016 – 2028 (USD Million)

TABLE NO. 19. U.S. Telecom Analytics Market Revenue, By Deployment Model, 2016 – 2028 (USD Million)

TABLE NO. 20. U.S. Telecom Analytics Market Revenue, By Application, 2016 – 2028 (USD Million)

TABLE NO. 21. U.S. Telecom Analytics Market Revenue, By Component, 2016 – 2028 (USD Million)

TABLE NO. 22. Canada Telecom Analytics Market Revenue, By Deployment Model, 2016 – 2028 (USD Million)

TABLE NO. 23. Canada Telecom Analytics Market Revenue, By Application, 2016 – 2028 (USD Million)

TABLE NO. 24. Canada Telecom Analytics Market Revenue, By Component, 2016 – 2028 (USD Million)

TABLE NO. 25. Mexico Telecom Analytics Market Revenue, By Deployment Model, 2016 – 2028 (USD Million)

TABLE NO. 26. Mexico Telecom Analytics Market Revenue, By Application, 2016 – 2028 (USD Million)

TABLE NO. 27. Mexico Telecom Analytics Market Revenue, By Component, 2016 – 2028 (USD Million)

TABLE NO. 28. Drivers for the Telecom Analytics Market: Impact Analysis

TABLE NO. 29. Restraints for the Telecom Analytics Market: Impact Analysis

TABLE NO. 30. Major Buyers of Telecom Analytics

TABLE NO. 31. Distributors/Traders List of Telecom Analytics

TABLE NO. 32. Global Telecom Analytics Market, Company Market Revenue, 2016 – 2019 (USD Million)

TABLE NO. 33. Global Telecom Analytics Market, Company Y-o-Y Growth, 2017 – 2019 (USD Million)

Choose License Type

List of Contents

Market InsightsMarket Size Industry AnalysisCOVID-19 Impact AnalysisGrowth FactorsReport ScopeDeployment Model Analysis PreviewApplication Analysis PreviewComponent Analysis PreviewRegional Analysis PreviewKey Market Players Competitive LandscapeThe Global Market is segmented as follows:-

Published On -11-July-2021 Telecom Analytics Market Increasing at A Phenomenal Pace to reach more than USD 11924 Million by 2028

FrequentlyAsked Questions

The Global Telecom Analytics Market was valued at USD 2.88 Billion in 2020.

The Global Telecom Analytics Market is expected to reach USD 7.81 Billion by 2028, growing at a CAGR of 13.3% between 2021 to 2028.

Some of the key factors driving the Global Telecom Analytics Market growth are the increasing volumes of telecom data and the concentration towards function specific analytics just as telecom analytics. The growing acceptance and acknowledgements of the analytics solutions in the telecom sector in order to increase the sales and operation visibility and manage the operating expenses in a better way are the reasons for the boost in the telecom analytics market. The factors such as need for effective income management, demand to lessen the churn and recall users and increasing network attacks are also some of the prominent factors that are responsible for the growth of telecom analytics market.

North America held a share of 38% in 2020. It is supposed to be one of the highest revenue-generating regions for this market during the forecasted period. This is due to the fact that there has been high demand from the telecommunication sector and there has been adoption of new technologies in the market. There has also been digitization and technological advancements which has boosted the demand for this market. The investments over the analytic solutions have also been high and the presence of prominent industry players in the region is also influencing the overall growth of this market. Also, in North America, there is strong penetration of telecom solutions among the population and this high dissemination f telecom industry created huge data which is helping this market.

Some of the key players in the Telecom Analytics market include Adobe Systems, Cisco Systems, Dell EMC, Alteryx Inc., International Business Machines Corporation, Microsoft, OpenText Corporation, Huawei Technologies, Panorama, SAP SE, SAS Institute, Oracle Corporation, Subex Limited, Tableau Software, TIBCO Software, Wipro Limited, Teradata Corporation, Sisense Inc. and MicroStrategy among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed