Temperature Controlled Packaging Market Size, Share, Trends, Growth 2030

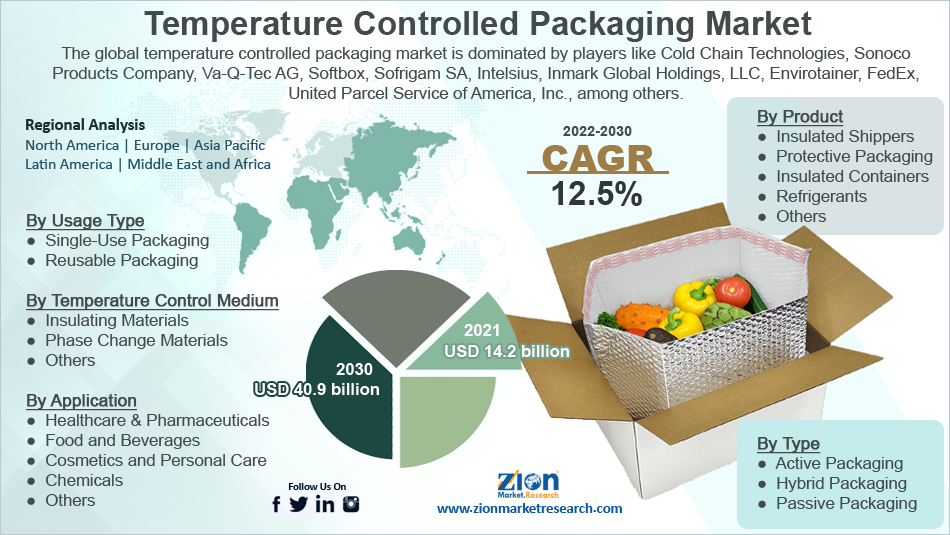

Temperature Controlled Packaging Market By Product (Insulated Shippers, Protective Packaging, Insulated Containers, Refrigerants, and Others), By Type (Active Packaging, Hybrid Packaging, and Passive Packaging), By Usage Type (Single-Use Packaging and Reusable Packaging), By Temperature Control Medium (Insulating Materials, Phase Change Materials, and Others), By Application (Healthcare & Pharmaceuticals, Food and Beverages, Cosmetics and Personal Care, Chemicals and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

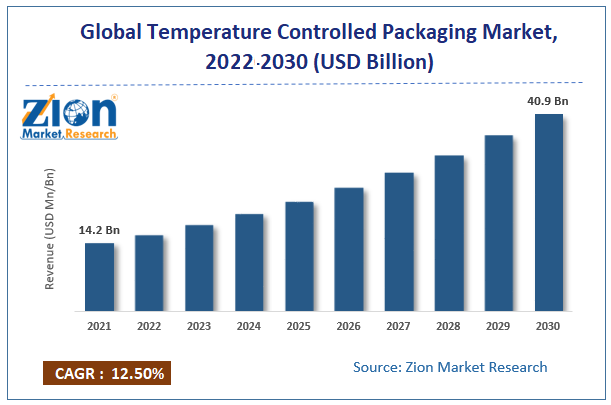

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.2 Billion | USD 40.9 Billion | 12.5% | 2021 |

Temperature Controlled Packaging Industry Prospective:

The global temperature controlled packaging market size was worth around USD 14.2 billion in 2021 and is predicted to grow to around USD 40.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.5% between 2022 and 2030.

The report analyzes the global temperature controlled packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the temperature controlled packaging market.

Temperature Controlled Packaging Market: Overview

Cold chain components include temperature-controlled packaging (TCP). TCP is created and validated by strict requirements to maintain products within a particular temperature range for a predetermined amount of time. For instance, many medications must maintain a temperature between 2 and 8 degrees. Others must maintain a controlled room temperature, such as between 15 and 25°C, while yet others must maintain a frozen state. TCP solutions come in three varieties: hybrid, passive, and active. Refrigerated boxes and pallet shippers are examples of active systems that run on a power source like a lithium battery. A refrigerant, such as wet or dry ice, gel packs or wraps, foam bricks, phase change materials (PCM), or liquid nitrogen, is used in passive systems together with insulated packaging. Additionally, hybrid TCP systems combine components of active and passive systems.

Key Insights

- As per the analysis shared by our research analyst, the global temperature controlled packaging market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2022-2030).

- In terms of revenue, the global temperature controlled packaging market size was valued at around USD 14.2 billion in 2021 and is projected to reach USD 40.9 billion, by 2030.

- The global temperature controlled packaging market is anticipated to grow as a result of the expanding pharmaceutical industry, technological developments in reusable packaging, and rising utilization of temperature control packaging solutions for the transportation of medications, clinical trial distribution products, donor organs, and blood transfers.

- Based on the product, the insulated shippers segment accounted for the largest market share in 2021.

- Based on the application, the food & beverages segment is expected to dominate the market over the forecast period.

- Based on region, North America held the highest market share in 2021.

To know more about this report, request a sample copy.

Temperature Controlled Packaging Market: Growth Drivers

The increasing demand for temperature controlled packaging across various industries to drive the market growth

The increasing demand for temperature controlled packaging across various industries such as pharmaceuticals, food & beverages, chemicals, and others are expected to propel the market growth over the forecast period. In the pharmaceuticals sector, these products are used for the transportation of medicines at a certain temperature which is necessary to protect from damage. For instance, the recommended temperatures for vaccine storage include -80°C (dry ice), -60°C, -20°C, and the more common 2-8°C temperature range. In addition, these products are used in the food & beverages sector to protect the shelf life of frozen foods such as bakery, meat, and others. Thus, the growing adoption of temperature controlled packaging in various sectors drives the global temperature controlled packaging market expansion.

Temperature Controlled Packaging Market: Restraints

Volatility in crude oil prices hampering the market growth

Temperature-controlled packaging is typically produced using a variety of raw materials, including polystyrene, polyurethane, and others. As a result, changes in the price of crude oil affect the cost of raw materials required to produce temperature-controlled packaging. The price of temperature-controlled packaging also rises as a result of the volatility in crude oil prices acts as a significant barrier to market expansion as a result.

Temperature Controlled Packaging Market: Opportunities

Increasing emphasis on producing medicines and treatments for rare diseases in the pharmaceutical industry

The growing use of cutting-edge technologies in the pharmaceutical industry presents a potential for the global temperature controlled packaging market expansion. Additionally, the digital platforms monitor temperature, vibration, and other variables for cold chain payload transfers. The market grows more quickly when information like flight schedules, weather, and the promise of quick delivery of goods is made available.

Additionally, the increasing use of vacuum panel insulation (VPI) with stage modification materials might lengthen the shelf life of pharmaceutical products that are stored and support market expansion. Another potential for market expansion is the growing emphasis on pharmaceutical companies developing medications and treatments for uncommon illnesses. These medications have a limited shelf life and are made of expensive ingredients. They require a stringent temperature-controlled environment as a result. Thus, in the approaching years, this factor will contribute to the market's expansion.

Temperature Controlled Packaging Market: Challenges

High capital investment and lack of awareness act as a major challenge for the market growth

Packaging solutions with passive temperature control are gaining popularity. But factors like higher initial costs for thermally controlled packaging, a lack of knowledge about packaging options in some developing nations, and strict government regulations on the shipment of temperature-sensitive products like drugs and pharmaceutical products are major obstacles to the market's expansion.

Temperature Controlled Packaging Market: Segmentation

The global temperature controlled packaging market is segmented based on product, type, usage type, temperature control medium, application, and region

Based on product, the global market is bifurcated into insulated shippers, protective packaging, insulated containers, refrigerants, and others. The insulated shippers accounted for the largest market share in 2021 and are expected to continue this pattern during the forecast period. Expanded polystyrene (EPS) coolers, reflective bubble mailers, insulated pallet liners, insulated pallet covers, and other thermal shippers are examples of insulated shippers.

The most recent products include sustainable shippers made of cotton and plants, as well as insulated shippers made entirely of renewable materials. Insulated containers account for a sizeable portion of the market. The ideal shipping containers for long-distance transit are those that are insulated to maintain a comfortable and dry inside environment. Since they are inside insulated, the environment is maintained while they are in storage, and they continue to function normally until the container is opened. However, because they guarantee the safe transportation of a variety of temperature-sensitive goods, insulated shippers are mostly utilized as packaging materials. These may transport a payload with a volume ranging from 4 to 100 liters that is temperature-sensitive. Thus, driving the segmental growth over the forecast period.

Based on the application, the global temperature controlled packaging is categorized into healthcare & pharmaceuticals, food and beverages, cosmetics and personal care, chemicals, and others. The food and beverages segment is expected to dominate the market during the forecast period. Food industries are increasingly in need of cost-effective high passive temperature packaging solutions to store and transport huge quantities of perishable, processed, and frozen food due to expanding global food consumption. Fresh produce, dairy products, eggs, and frozen items all need to be packaged and shipped in temperature-controlled containers.

Additionally, solutions for cold chain packaging keep food frozen at the right temperatures, maintain the freshness of produce, and prevent delicate items like chocolates and confections from melting in transportation. Therefore, these factors influence the temperature controlled packaging market during the forecast period.

Recent Developments:

- In March 2022, Packaging Technology Group, LLC, a top supplier of environmentally friendly, curbside-recyclable thermal packaging solutions for the life sciences sector, has been acquired by Cold Chain Technologies, LLC, a portfolio company of Aurora Capital Partners and a leading global provider of thermal packaging solutions for the transportation of temperature-sensitive products. The acquisition of PTG strengthens CCT's dedication to sustainable and eco-friendly packaging solutions. PTG's TRUEtemp Naturals® Line, which was first introduced in 2018, makes use of exclusive design and manufacturing techniques to deliver time-temperature performance at pharmaceutical-grade levels in a solution that is 100% curbside recyclable and environmentally friendly. Customers who use PTG's solutions lower the overall carbon footprint of the life sciences sector by millions of pounds annually and cut back on landfill waste.

- In December 2022, Sonoco ThermoSafe, a division of Sonoco, a producer of temperature assurance cold chain packaging, is extending its Orion Rental packaging program in the United Kingdom as the demand for environmentally friendly packaging for temperature-sensitive pharmaceuticals rises. A growing array of biologics, vaccines, and clinical supplies—as well as other healthcare products that must be transported at specific temperatures—are now available to UK healthcare organizations through the Orion reusable rental packaging initiative.

Temperature Controlled Packaging Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Temperature Controlled Packaging Market Research Report |

| Market Size in 2021 | USD 14.2 Billion |

| Market Forecast in 2030 | USD 40.9 Billion |

| Compound Annual Growth Rate | CAGR of 12.5% |

| Number of Pages | 275 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Cold Chain Technologies, Sonoco Products Company, Va-Q-Tec AG, Pelican BioThermal Limited, Softbox, Sofrigam SA, Intelsius, Inmark Global Holdings, LLC, Envirotainer, FedEx, United Parcel Service of America, Inc., among others. |

| Segments Covered | By Product, By Type, By Usage Type, By Temperature Control Medium, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Temperature Controlled Packaging Market: Regional Analysis

North America held the highest revenue share in 2021

North America held the highest revenue share in 2021 and is expected to hold a significant share in the global temperature controlled packaging market over the forecast period. The growth in the region is attributed to the increasing demand for frozen food and the rise in online retailing platforms, especially in the countries like US and Canada. For instance, The American Frozen Food Institute (AFFI) and FMI estimate that frozen food will generate $65.1 billion in retail sales in 2020, a 21% rise from the previous year.

This makes frozen food a pandemic powerhouse. Sales of frozen foods increased in 2020 in both dollars and units (+21%), with nearly all varieties of frozen foods experiencing double-digit sales growth. In addition, the increasing demand from the healthcare and pharmaceutical industries is one of the key factors that propel the temperature controlled packaging market in the region. In the region, the US holds the dominant position in the pharmaceutical market due to the presence of major companies such as Pfizer, Abbott, Johnson & Johnson, and others. For instance, The Pharmaceutical Research and Manufacturers Association (PhRMA) estimates that U.S. companies do more than half of all pharmaceutical R&D globally ($75 billion). Furthermore, the COVID-19 pandemic has dramatically raised the demand for COVID-19 vaccines, cell and gene treatments, other flu vaccines, and medications.

The market for temperature-controlled packaging is predicted to grow since there is an increase in demand for the shipping of vaccines around the world. Three of the available COVID vaccines are produced in the US: Janssen (Johnson & Johnson), Pfizer-BioNTech (Pfizer), and Moderna (Moderna Inc.). All COVID-19 vaccinations must be stored according to precise guidelines. For instance, the Moderna COVID vaccination must be kept between -25°C and -15°C in the freezer, and once withdrawn, must be kept between 2 and 8°C. Therefore, maintaining a cold chain during the storage of COVID-19 vaccines is crucial. Thus, the aforementioned facts supported the market growth in the region.

Besides, the second-largest market share for temperature controlled packaging is anticipated to come from Europe. Germany, the UK, France, Italy, and Spain are among the nations that dominate the European market. The demand for temperature-controlled packaging is increasing as a result of the region's fast-growing pharmaceutical industry.

The efficacy of the product must remain unmodified and completely intact throughout the pharmaceutical supply chain. To comply with regulations, businesses create high-quality goods, enforce rules, and spend money on temperature-controlled packaging. Moreover, the innovative product launch by the market players in the region is one of the significant reasons that penetrate the market growth in the region. For instance, in January 2019, Softbox, a global pioneer, and manufacturer of temperature control packaging for the life science and logistics industries, announced plans to introduce new pallet and parcel shipping systems at the Temperature Controlled Logistics (IQPC) conference in London.

The new Tempcell ECO, as well as the Tempcell MAX and Silverpod MAX, which are being unveiled in Europe for the first time, are among the cold chain shipping solutions that will be highlighted during the conference. The next-generation recyclable parcel shipper for the life science sector is called the Tempcell ECO by Softbox. It is produced from recycled corrugated paper and is completely kerbside recyclable. It makes use of a ThermafluteTM patent-pending design, is certified for ISTA 7D Summer and Winter profiles, and can control a variety of temperature ranges, including products with a 00C to 300C operating temperature. Thus, these types of product launches support the market expansion in the region over the forecast period.

Temperature Controlled Packaging Market: Competitive Analysis

The global temperature controlled packaging market is dominated by players like:

- Cold Chain Technologies

- Sonoco Products Company

- Va-Q-Tec AG

- Pelican BioThermal Limited

- Softbox

- Sofrigam SA

- Intelsius

- Inmark Global Holdings LLC

- Envirotainer

- FedEx

- United Parcel Service of America Inc.

The global temperature controlled packaging market is segmented as follows:

By Product

- Insulated Shippers

- Protective Packaging

- Insulated Containers

- Refrigerants

- Others

By Type

- Active Packaging

- Hybrid Packaging

- Passive Packaging

By Usage Type

- Single-Use Packaging

- Reusable Packaging

By Temperature Control Medium

- Insulating Materials

- Phase Change Materials

- Others

By Application

- Healthcare & Pharmaceuticals

- Food and Beverages

- Cosmetics and Personal Care

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The growing demand for temperature controlled packaging from the pharmaceutical and food & beverage sector is expected to drive market growth during the forecast period. Moreover, the recent outbreak of the COVID-19 pandemic provides a significant opportunity for market expansion over the forecast period.

According to the report, the global market size was worth around USD 14.2 billion in 2021 and is predicted to grow to around USD 40.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.5% between 2022 and 2030.

The global temperature controlled packaging market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the increasing demand from the pharmaceutical sector and the growing demand for frozen foods.

The global temperature controlled packaging market is dominated by players like Cold Chain Technologies, Sonoco Products Company, Va-Q-Tec AG, Pelican BioThermal Limited, Softbox, Sofrigam SA, Intelsius, Inmark Global Holdings, LLC, Envirotainer, FedEx, United Parcel Service of America, Inc., among others.

Choose License Type

List of Contents

Industry Prospective:OverviewTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesSegmentationRecent Developments:Market Report Scope:Regional AnalysisCompetitive AnalysisThe global temperature controlled packaging market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed