Textile Machinery Market Size, Share, Growth, Trends, and Forecast, 2030

Textile Machinery Market By Machinery Type (Spinning Machinery, Weaving Machinery, Knitting Machinery, Textile Processing Machinery, Finishing Machinery, and Other Machinery), By End-Use Industry (Garments & Apparel, Household & Home Textiles, Protective Textiles, Medical, Automotive, and Other End-Use Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1965 million | USD 5725 million | 14.30% | 2022 |

Textile Machinery Industry Prospective:

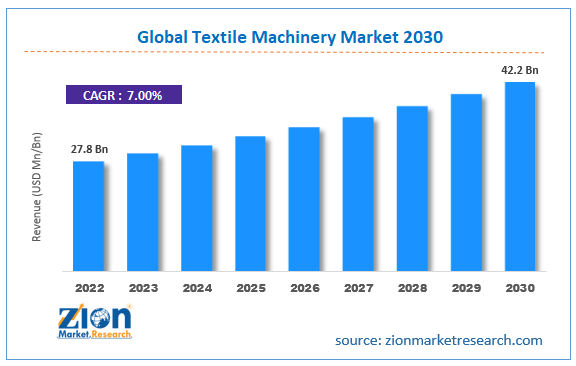

The global textile machinery market size was worth around USD 27.8 billion in 2022 and is predicted to grow to around USD 42.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 7% between 2023 and 2030.

Textile Machinery Market: Overview

Textile machinery refers to a broad category of industrial equipment designed specifically for the production and processing of textiles, which encompass a wide range of materials including fibers, yarns, fabrics, and finished goods. These machines play a crucial role in automating and optimizing various stages of textile production, from the initial processing of raw materials to the final stages of fabric finishing. Textile machinery encompasses a diverse array of equipment, including spinning machines, looms, knitting machines, digital dyeing & printing machinery, and finishing equipment. Efficient and advanced textile machinery is essential for meeting the demands of a rapidly growing global textile industry. Continuous innovations in this sector have led to the development of highly specialized machines that can handle a wide variety of materials, ensuring high-quality and cost-effective production. Additionally, modern textile machinery often incorporates advanced technologies such as automation, computerized control systems, and robotics, leading to increased precision, productivity, and sustainability in the textile manufacturing process. As a result, the textile machinery industry plays a pivotal role in shaping the competitiveness and sustainability of the broader textile and apparel sector worldwide.

Key Insights

- As per the analysis shared by our research analyst, the global textile machinery industry is estimated to grow annually at a CAGR of around 7% over the forecast period (2023-2030).

- In terms of revenue, the global textile machinery market size was valued at around USD 27.8 billion in 2022 and is projected to reach USD 42.2 billion, by 2030.

- The global textile machinery market is projected to grow at a significant rate due to the growing demand for automated and technologically advanced equipment in the textile industry.

- Based on machinery type segmentation, spinning machinery was predicted to hold maximum market share in the year 2022.

- Based on end-use industry segmentation, garments and apparels were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Textile Machinery Market: Growth Drivers

Growing demand for automated and technologically advanced equipment to boost the market growth.

The textile industry is experiencing a transformative shift with an increasing emphasis on automation and technological advancements in machinery. This shift is driving substantial growth in the global textile machinery market. As manufacturers seek to enhance productivity and efficiency, there is a rising demand for state-of-the-art equipment that can streamline operations. Automated machinery offers precision, speed, and integration capabilities that not only optimize production processes but also reduce reliance on manual labor. This trend is reshaping the landscape of textile manufacturing, making it more efficient, competitive, and aligned with the demands of today's rapidly evolving market. Moreover, the surge in demand for automated and technologically advanced textile machinery is spurred by a broader global trend toward sustainable and eco-friendly practices. Manufacturers are developing machinery with eco-conscious features, aligning with the industry's commitment to reducing environmental impact. This not only addresses the growing environmental concerns but also positions the textile industry as a responsible player in the broader sustainability landscape. In essence, the convergence of automation and technology in textile machinery is driving not only growth but also a positive shift towards a more sustainable and efficient future for the industry.

Textile Machinery Market: Restraints

High initial capital investment required for acquiring and implementing advanced automated equipment may hinder market growth.

The textile machinery industry is facing a notable constraint in the form of a substantial initial capital investment needed to acquire and implement advanced automated equipment. The sophisticated technology and precision engineering inherent in modern textile machinery come at a considerable cost, which can be a significant hurdle for both established manufacturers and potential entrants. This financial barrier may particularly affect smaller or emerging businesses, limiting their ability to adopt cutting-edge technology and stay competitive. Moreover, regions or economies with limited access to capital may find it especially challenging to invest in these high-tech solutions, potentially leading to disparities in technological advancement within the industry. Furthermore, the capital-intensive nature of the textile machinery market can also impact innovation and research & development efforts. Manufacturers may face constraints in allocating resources towards the development of new and improved machinery, as a substantial portion of their budgets may be allocated to covering initial equipment costs. This could potentially slow down the pace of technological advancements within the industry, impacting its overall growth potential and capacity to meet evolving market demands.

Textile Machinery Market: Opportunities

Growing demand for sustainable and eco-friendly manufacturing processes to provide growth opportunities

The textile machinery industry is presented with a significant growth opportunity through the rising demand for sustainable and eco-friendly manufacturing practices. With increasing environmental awareness and regulatory pressures, there is a growing need for textile machinery that supports greener production processes. Manufacturers have the chance to innovate and develop equipment that minimizes resource consumption, reduces waste, and incorporates eco-conscious materials. By meeting this demand, companies can not only contribute positively to environmental preservation but also position themselves as leaders in responsible manufacturing. This shift towards sustainability not only addresses critical global concerns but also opens up new markets and enhances the industry's long-term viability and competitiveness. Moreover, embracing sustainable manufacturing practices in textile machinery can lead to cost savings and operational efficiencies for businesses. Investments in eco-friendly technologies can result in reduced energy and water consumption, lowering operational expenses over time. Additionally, companies that proactively adopt green technologies may find themselves better positioned to navigate increasingly stringent environmental regulations, potentially gaining a competitive edge in the market. This transition towards sustainable practices represents a strategic business opportunity that aligns economic growth with environmental stewardship.

Textile Machinery Market: Challenges

The need to address sustainability concerns throughout the entire product lifecycle to challenge market growth

The textile machinery industry is confronted with a substantial challenge: the imperative to address sustainability concerns across the entire product lifecycle. This encompasses not only the manufacturing process but also the operational phase and eventual disposal or recycling of machinery. Manufacturers are under mounting pressure to design and produce equipment that minimizes environmental impact, from the selection of materials to end-of-life considerations. This necessitates significant investments in research & development, the integration of eco-friendly technologies, and strict adherence to environmental regulations. Failure to meet these sustainability demands can not only lead to reputational risks but may also hinder market acceptance, particularly in an industry where environmental consciousness is becoming a paramount factor in purchasing decisions. Moreover, as global awareness of environmental issues continues to rise, there is a growing expectation for industries to adopt sustainable practices. Textile machinery manufacturers that proactively address these concerns not only demonstrate corporate responsibility but also position themselves as leaders in an increasingly eco-conscious market. Embracing sustainability throughout the product lifecycle presents an opportunity not only to mitigate environmental impact but also to foster innovation, enhance competitiveness, and meet the evolving needs of customers who prioritize eco-friendly solutions.

Textile Machinery Market: Segmentation

The global textile machinery market is segmented based on machinery type, end-use industry, and region.

Based on machinery type, the global market segments are spinning machinery, weaving machinery, knitting machinery, textile processing machinery, finishing machinery, and other machinery. At present, the global market is dominated by the spinning machinery segment due to its fundamental role in converting raw fibers into yarn. It serves as a foundational material for a wide range of textile products. This segment benefits from continuous and widespread demand for yarn across various industries, including fashion, apparel, and home textiles. Technological advancements, established market players, and a global presence further solidify the leading position of spinning machinery in the textile machinery market, while ongoing innovation ensures its competitiveness in meeting the evolving needs of the industry.

Based on end-use industry the global textile machinery market is categorized as garments & apparels, household & home textiles, protective textiles, medical, automotive, and other end-use industries. Out of these, in 2020, garments and apparels was the largest shareholding segment in the global market. This is primarily due to the substantial demand for clothing and fashion-related products worldwide. The garments and apparels industry is a cornerstone of the textile sector, with a diverse range of products including clothing, accessories, and fashion items. This sector's significant market share is driven by consumer preferences, fashion trends, and the constant need for new and stylish clothing options. However, please note that market dynamics can change over time, so for the most current information on market leadership, I recommend consulting recent industry reports and market research studies related to the textile machinery industry.

Textile Machinery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Textile Machinery Market |

| Market Size in 2022 | USD 27.8 Billion |

| Market Forecast in 2030 | USD 42.2 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 209 |

| Key Companies Covered | A.T.E. Private Limited, Benninger AG (Jakob Müller AG), Camozzi Group S.p.A., Itema S.p.A., Lakshmi Machine Works Limited, Murata Machinery Ltd., OC Oerlikon Management AG, Rieter, Santex Rimar Group, Santoni S.P.A., Saurer Intelligent Technology AG, Toyota Industries Corporation, Trützschler Group SE., and others. |

| Segments Covered | By Machinery Type, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Textile Machinery Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to take the lead in the global textile machinery market during the forecast period. This region boasts a robust and dynamic textile industry, with countries like China, India, and Bangladesh serving as major textile manufacturing hubs. The availability of skilled labor, cost-effective production, and a well-established supply chain network contribute to Asia Pacific's dominance in the market. Furthermore, the region's growing population and rising disposable incomes are driving the demand for textiles, thereby bolstering the need for advanced machinery. Rapid industrialization and urbanization in countries across the Asia Pacific also play a pivotal role in propelling the textile machinery market forward. Moreover, governmental initiatives and investments in the textile sector, particularly in countries like China and India, are fostering technological advancements and innovation in textile machinery. This creates a conducive environment for manufacturers and positions Asia Pacific as a global leader in textile machinery production and innovation. Additionally, the region's strategic location and trade partnerships with various countries further enhance its position as a key player in the global textile machinery industry.

Key Developments

In 2023, Rieter Group acquired SSM Schärer Schweiter Mettler AG, a leading manufacturer of winding and twisting machines. This acquisition strengthened Rieter's position as a leading provider of textile machinery solutions for a wide range of industries.

In 2023, Oerlikon Textile and Siemens Digital Industries partnered to develop new digital solutions for the textile industry. This partnership leverages Oerlikon's expertise in textile machinery and Siemens' expertise in digital manufacturing.

In 2023, Stäubli launched a new family of smart weaving machines that use artificial intelligence to optimize production efficiency and quality. These new weaving machines offer improved performance and reduced downtime.

Textile Machinery Market: Competitive Analysis

The global textile machinery market is dominated by players like:

- A.T.E. Private Limited

- Benninger AG (Jakob Müller AG)

- Camozzi Group S.p.A.

- Itema S.p.A.

- Lakshmi Machine Works Limited

- Murata Machinery Ltd.

- OC Oerlikon Management AG

- Rieter

- Santex Rimar Group

- Santoni S.P.A.

- Saurer Intelligent Technology AG

- Toyota Industries Corporation

- Trützschler Group SE

The global textile machinery market is segmented as follows:

By Machinery Type

- Spinning Machinery

- Weaving Machinery

- Knitting Machinery

- Textile Processing Machinery

- Finishing Machinery

- Other Machineries

By End-Use Industry

- Garments and Apparels

- Household and Home Textiles

- Protective Textiles

- Medical

- Automotive

- Other End Use Industries

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Textile machinery refers to a broad category of industrial equipment designed specifically for the production and processing of textiles, which encompass a wide range of materials including fibers, yarns, fabrics, and finished goods.

The global textile machinery market cap may grow owing to the growing demand for automated and technologically advanced equipment in the textile industry.

According to study, the global Textile Machinery market size was worth around USD 27.8 billion in 2022 and is predicted to grow to around USD 42.2 billion by 2030.

The CAGR value of the textile machinery market is expected to be around 7% during 2023-2030.

The global textile machinery market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the rapid industrialization and booming textile sector.

The global textile machinery market is led by players like A.T.E. Private Limited, Benninger AG (Jakob Müller AG), Camozzi Group S.p.A., Itema S.p.A., Lakshmi Machine Works Limited, Murata Machinery Ltd., OC Oerlikon Management AG, Rieter, Santex Rimar Group, Santoni S.P.A., Saurer Intelligent Technology AG, Toyota Industries Corporation, and Trützschler Group SE.

The report analyzes the global textile machinery market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the textile machinery industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed