Thermal Paper Market Size, Share, Trends and Forecast, 2030

Thermal Paper Market By Type (Top Coated and Non-Top Coated), By Technology (Direct Thermal, Thermal Transfer, and Others), By Thickness (60-80 Microns and 80-90 Microns), By Width (2.25”, 3.125” and Others), By Application (POS Receipts, Lottery and Gaming Tickets, Labels & Tags, and Others), End-user (Retail Industry, Healthcare, Packaging & Labeling, Printing & Publishing, Entertainment & Transit, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022-2030-

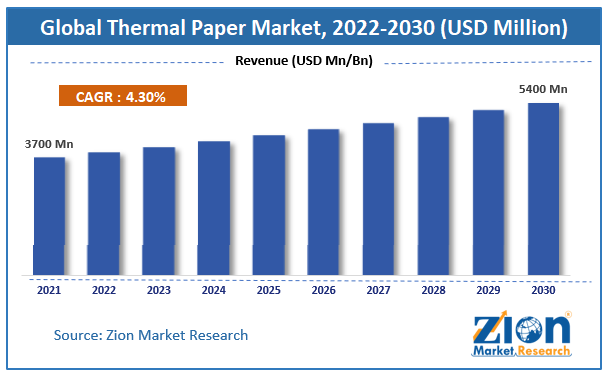

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3700 million | USD 5400 million | 4.3% | 2021 |

Thermal Paper Market Size & Industry Analysis:

The global thermal paper market size was worth around USD 3.7 billion in 2021 and is predicted to grow to around USD 5.4 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.3% between 2022 and 2030. The report analyzes the global thermal paper market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the thermal paper market.

Thermal Paper Market: Overview

Thermal paper is a specialty paper utilized in copying and digital printing. Its coating is made of materials that change color on heating. Such papers are specifically used for thermal printers, and low-cost & light-weighted devices like credit card terminals, cash registers, and adding machines. Thermal paper is considered a recording media that is printed with the help of a thermal printer through heat.

Key Insights

- As per the analysis shared by our research analyst, the global thermal paper market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2022-2030).

- In terms of revenue, the global thermal paper market size was valued at around USD 3.7 billion in 2021 and is projected to reach USD 5.4 billion, by 2030.

- The market demand is expected to be driven by the rising use of POS terminals in warehouses and retail stores.

- Based on the type, the top coated segment accounted for the largest market share in 2021.

- Based on the application, the direct thermal segment is expected to dominate the market over the forecast period.

- Based on region, the Asia Pacific held the largest revenue share in 2021.

To know more about this report, request a sample copy.

Thermal Paper Market: Growth Drivers

Thermal paper is used in ATM transactions to drive the market growth

Transactional information is typically printed on thermal paper in ATMs for the user. Everybody can see and understand what is printed on thermal paper since it is made of materials that make printing on it straightforward. Thermal paper-based ATMs are also more likely to please users by giving them the details and services they need. Thermal paper is given a process that makes it resistant to both normal wear & tear and water damage. Customers won't have to worry if their receipts accidentally get wet because they won't lose any crucial information. Point-of-Sale systems that use thermal paper rolls can assist in addressing the shifting needs of customers while also affordably capturing transactions for accounting needs. Thermal sheets are becoming more often used in ATM transactions, which is propelling the global thermal paper market's revenue expansion.

Thermal Paper Market: Restraints

Growth in paperless e-transaction to restrict market expansion

A significant number of retail stores and businesses are doing their transactions online, making paperless electronic transactions more practical. The ability to use digital receipts for post-purchase marketing is one of their most important benefits. Sharing individualized product promos and recommendations via e-receipts is a fantastic idea. They also give firms a long-term plan for expanding their email lists and accumulating more client information. Additionally, paper receipts are anticipated to be replaced by electronic receipts as the use of financial transaction systems like the Unified Payments Interface (UPI), bank cards, and PayPal increases daily purchases, which would impede the market's ability to grow its revenue.

Thermal Paper Market: Opportunities

Rising product demand from label manufacturers for applications in e-commerce and logistics industries

With e-commerce firmly entrenched in established economies and rapidly growing in rising economic powerhouses like China and India, the need for the transportation of commodities and products has increased significantly in recent years. For instance, the US parcel volume increased by 6% in 2021 to a record high of 21.5 billion, up from 20.3 billion in 2020, according to Pitney Bowes Inc. Labels made of thermal paper are used by transportation and logistics firms to mark packages with tracking QR-codes, barcodes, and descriptions of the consignor and recipient. Thus, the rising demand from e-commerce and logistics industries is expected to provide a lucrative opportunity for the global thermal paper market expansion.

Thermal Paper Market: Challenges

Fluctuations in the price of products

The fluctuations in the price of the products act as a major challenge for the market growth over the forecast period. For instance, on February 2022, The world's biggest thermal paper providers, including Koehler Paper, Appvion, and Kanzaki Specialty Papers, reported 7-15% price increases in February and April due to rising energy, chemical, and logistics expenses.

Thermal Paper Market: Segmentation

The global thermal paper market is segmented based on type, technology, thickness, width, application, end user, and region

Based on the type, the global market is bifurcated into top coated and non-top coated. The top coated segment accounted for the largest market share in 2021 and is expected to maintain its dominance over the projected period. The growth in the segment is attributable to its easy printing and better imaging capabilities. For the top-coated sheet to meet the print head and generate an unfaded and more accurate image, the thermal printing method necessitates full and smooth contact between the print head and paper dye. Maps and labels for accounts, operating logs, different types of purchase orders, price quotes, contract documentation, incident data, and a history of customer requests are all examples of transactional papers.

Transactional papers must be robust, readable, and present a professional appearance—except in harsh environmental and rough handling situations. Due to the quick adoption of top-coated thermal sheets, the produced images can be viewed for 20 to 25 years when stored properly. Stored fresh and frozen products frequently have top-coated grades. They are typically used for pre-packaged cheese and meat products that need unique barcodes and labels.

Based on the technology, the global market is segmented into direct thermal, thermal transfer, and others. The direct thermal segment is expected to dominate the market during the forecast period. Approval certificates, shipping labels, receipts, kiosk cards, coupons for parking tickets, and tourist identification have all witnessed a considerable increase in the use of direct thermal technology. The crucial industrial metric for demand in the industry is wide adoption in the printing and packaging industries because of its high mobility, maximum graphics capabilities, and noise reduction.

The graphics or text produced by direct heat submitting technology makes this method the most popular way to print in commerce. This printing technique uses a heat-sensitive medium that is chemically engineered to darken as it travels through the printhead. In comparison to laser, thermal transfer, and inkjet printers, the effortless printer design increases its lifetime, use, and cost-effectiveness. This technology offers a long enough lifetime for many barcode applications, including those for printed tickets, package POS, labels & tags, and RFID identification.

Recent Developments:

- In March 2022, to meet the rising demand for thermal paper in the e-commerce, food application, and label markets, Oji Holdings intends to increase thermal paper production at the Kanzan thermal and inkjet paper plant in Duren, Germany, by January 2024.

- In November 2021, with the introduction of a whole line of paper label solutions created with 100% recycled fibers for food, retail, and logistics labeling applications, UPM Raflatac is paving the way. First Complete Phenol Free thermal paper labels manufactured entirely of recycled fibers are part of the product line. These labels add to the overall sustainability of the package and are an excellent option for logistics and retail labeling applications.

Thermal Paper Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermal Paper Market Research Report |

| Market Size in 2021 | USD 3.7 Billion |

| Market Forecast in 2030 | USD 5.4 Billion |

| Compound Annual Growth Rate | CAGR of 4.3% |

| Number of Pages | 148 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Jiangsu Wampolet Paper Co., Ltd., Hansol Paper Co Ltd, Guangdong Guanhao High-Tech Co., Ltd., PM Company L.L.C., Henan Province JiangHe Paper Co., Ltd., Shandong Chenming Paper Holdings Ltd, Ricoh Company, Ltd., Jujo Thermal Ltd., Siam Paper Public Company Limited, Nakagawa Manufacturing (USA), Inc., Koehler Paper Group, Oji Holdings Corporation, Mitsubishi Paper Mills Limited, Appvion Incorporated, Kanzaki Specialty Papers Inc., Domtar Corporation, Lecta Group, SIAM EXPORT LTD PARTNERSHIP, Iconex LLC, Twin Rivers Paper Company, Rotolificio Bergamasco Srl, Thermal Solutions International, Inc., GOLD HUASHENG PAPER CO., Papierfabrik August Koehler SE, and Ricoh Company Ltd., among others. |

| Segments Covered | By Type, By Technology, By Thickness, By Width, By Application, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thermal Paper Market: Regional Analysis

The Asia Pacific held the largest revenue share in 2021

The Asia Pacific region held the largest revenue share of more than 35% in 2021 and is expected to remain dominant over the forecast period. The growth in the region is attributed to the rapid expansion of retail chains owing to the increasing consumer preference for easily accessible consumer goods.

The demand for FMCG products is growing in developing nations, which has resulted in increased production capacity. The quantity of transactions at retail stores has increased as a result of this. The market for thermal paper has been boosted as a result of the large rise in demand for the material used to make labels, tags, and POS receipts. For instance, the National Bureau of Statistics of China estimates that in 2021, China's consumer goods industry had total retail sales of about USD 6.3 trillion. Retail sales in China's cities totaled USD 5.5 trillion while they totaled USD 0.8 trillion in the country's rural areas. Thus, the aforementioned facts supported the market growth in the Asia Pacific region.

On the other hand, Europe is expected to hold a significant market share over the forecast period. The region's market is anticipated to develop as a result of the region's growing use of thermal paper for a variety of end uses, including the gaming sector and supplement packaging and labeling. In addition, the manufacturers turn their attention to more sustainable production techniques, and the production and consumption of thermal paper in Europe are anticipated to change. Additionally, the rules established by European regulatory bodies will aid in the use of environmentally friendly coatings like powder and waterborne in the manufacture of thermal paper. Thus, this will create a lucrative opportunity for market expansion in the region.

Thermal Paper Market: Competitive Analysis

The global thermal paper market is dominated by players like:

- Jiangsu Wampolet Paper Co. Ltd.

- Hansol Paper Co Ltd

- Guangdong Guanhao High-Tech Co. Ltd.

- PM Company L.L.C.

- Henan Province JiangHe Paper Co. Ltd.

- Shandong Chenming Paper Holdings Ltd

- Ricoh Company Ltd.

- Jujo Thermal Ltd.

- Siam Paper Public Company Limited

- Nakagawa Manufacturing (USA) Inc.

- Koehler Paper Group

- Oji Holdings Corporation

- Mitsubishi Paper Mills Limited

- Appvion Incorporated

- Kanzaki Specialty Papers Inc.

- Domtar Corporation

- Lecta Group

- SIAM EXPORT LTD PARTNERSHIP

- Iconex LLC

- Twin Rivers Paper Company

- Rotolificio Bergamasco Srl

- Thermal Solutions International Inc.

- GOLD HUASHENG PAPER CO.

- Papierfabrik August Koehler SE

- Ricoh Company Ltd.

The global thermal paper market is segmented as follows:

By Type

- Top Coated

- Non-Top Coated

By Technology

- Direct Thermal

- Thermal Transfer

- Others

By Thickness

- 60-80 Microns

- 80-90 Microns

By Width

- 2.25”

- 3.125”

- Others

By Application

- POS Receipts

- Lottery and Gaming Tickets

- Labels and Tags

- Others

By End User

- Retail Industry

- Healthcare

- Packaging and Labelling

- Printing and Publishing

- Entertainment and Transit

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The increasing demand for labelling to provide a complete and detailed description of products, especially in the food & beverage sector is the major factor fueling the demand for the global thermal paper market.

According to the report, the global thermal paper market size was worth around USD 3.7 billion in 2021 and is predicted to grow to around USD 5.4 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.3% between 2022 and 2030.

The global thermal paper market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market owing to the rapid expansion of retail chains owing to the increasing consumer preference for easily accessible consumer goods.

The global thermal paper market is dominated by players like Jiangsu Wampolet Paper Co., Ltd., Hansol Paper Co Ltd, Guangdong Guanhao High-Tech Co., Ltd., PM Company L.L.C., Henan Province JiangHe Paper Co., Ltd., Shandong Chenming Paper Holdings Ltd, Ricoh Company, Ltd., Jujo Thermal Ltd., Siam Paper Public Company Limited, Nakagawa Manufacturing (USA), Inc., Koehler Paper Group, Oji Holdings Corporation, Mitsubishi Paper Mills Limited, Appvion Incorporated, Kanzaki Specialty Papers Inc., Domtar Corporation, Lecta Group, SIAM EXPORT LTD PARTNERSHIP, Iconex LLC, Twin Rivers Paper Company, Rotolificio Bergamasco Srl, Thermal Solutions International, Inc., GOLD HUASHENG PAPER CO., Papierfabrik August Koehler SE, and Ricoh Company Ltd., among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed