Thermal Transfer Printer Market Size, Share, Analysis, Trends, Growth, 2032

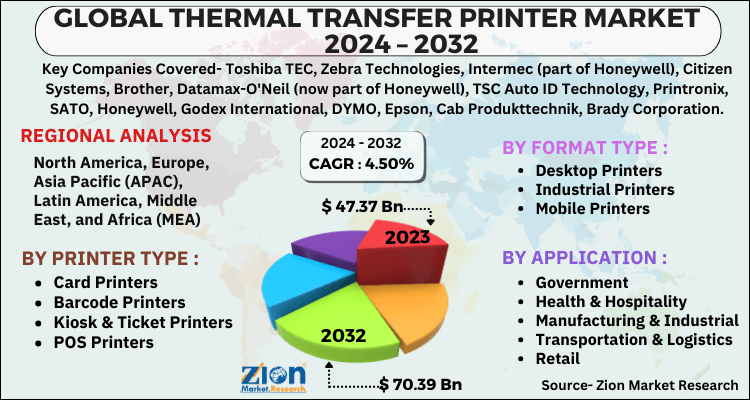

Thermal Transfer Printer Market By Printer Type (Card Printers, Barcode Printers, Kiosk & Ticket Printers, and POS Printers), By Format Type (Desktop Printers, Industrial Printers, and Mobile Printers), By Application (Government, Health & Hospitality, Manufacturing & Industrial, Transportation & Logistics, and Retail), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

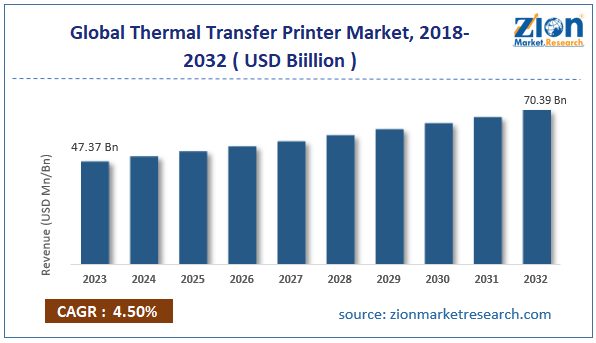

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.37 Billion | USD 70.39 Billion | 4.50% | 2023 |

Thermal Transfer Printer Industry Prospective:

The global thermal transfer printer market size was worth around USD 47.37 billion in 2023 and is predicted to grow to around USD 70.39 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.50% between 2024 and 2032.

Thermal Transfer Printer Market: Overview

A thermal transfer printer uses heat energy to transfer ink from a ribbon onto the printing material. These printers are significantly different from direct thermal printers in which the ink is directly transferred on the substrate instead of a ribbon. One of the major applications of thermal transfer printer in industries and among businesses for printing labels and barcodes.

According to market analysis, thermal transfer printers deliver highly durable and high-resolution printing across external environment conditions. The thermal transfer printer allows the thermal printhead to produce heat which further melts thermal transfer ribbon (TTR) ink. Common materials used for ink in the ribbon are wax-resin compound, resin, or wax.

Furthermore, the type of ribbon chosen for thermal transfer printers generally depends on the end-users since each variant offers a different quality of final output. The demand for thermal transfer printers is projected to grow due to the rising applications across major industries. For instance, they are widely used for printing barcodes for medical equipment.

Additionally, increased applications in the consumer electronics sector and logistics & warehousing industry will further contribute to the overall growth of the industry. During the projection period, an increased innovation rate is likely to generate expansion possibilities. However, the industry market must prepare for specific challenges such as growing competition from alternate solutions and economic volatility.

Key Insights:

- As per the analysis shared by our research analyst, the global thermal transfer printer market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2024-2032)

- In terms of revenue, the global thermal transfer printer market size was valued at around USD 47.37 billion in 2023 and is projected to reach USD 70.39 billion by 2032.

- The market is projected to grow at a significant rate due to the rising applications in the medical equipment and healthcare industries.

- Based on the printer type, the barcode printers segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the transportation & logistics segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Thermal Transfer Printer Market: Growth Drivers

Rising applications in the medical equipment and healthcare industries to drive market demand rate

The global thermal transfer printer is widely used in the medical equipment industry. The printers are used for obtaining high-resolution and durable barcodes that are required for labeling a range of medical devices & equipment. The labels produced using a thermal transfer printer assist in locating, tracking, and identifying medical accessories and samples. They also aid in the development of accurate maintenance or calibration records. Governments across the globe are tightening laws and regulations concerning medical equipment labeling and industry players must comply with the regional framework.

For instance, in a recent event, the European countries launched the In Vitro Diagnostic Regulations (IVD) 2017/746 and the European Medical Device Regulations (MDR) 2017/745. These legal frameworks encourage medical device producers to revisit their labeling protocols and procedures. The EU MDR regulations require that each medical product must be provided with information that promotes device identification along with data on the device manufacturer, performance-based information, and data on precautions or safety.

Furthermore, the growing rate of medical device and accessories production rate driven by the burgeoning pressure on the healthcare sector to meet the medical needs of the general population will further help drive demand for thermal transfer printers.

Growing logistics and warehousing industries to generate market demand rate in the coming years

The global thermal transfer printers market is expected to be further impacted by the rising applications in the logistics and warehousing industries. These sectors have exceptional demand for product-tracking labeling solutions and hence showcase greater usage of thermal transfer printers.

The surge in favorable government policies to support the respective regional logistics industry as well as increased investments in smart warehousing tools will further impact the application of thermal transfer printers. Some of the most essential parameters of a smart warehouse include the use of warehouse management systems, automated inventory control systems, and automated picking tools. Durable labeling will be critical to implementing these technologies.

Thermal Transfer Printer Market: Restraints

Competition from alternate technologies will limit the industry’s expansion rate

The global thermal transfer printer industry is projected to be restricted due to the increasing development of competing technologies. For instance, some of the most common alternate technologies include inkjet printing, direct thermal printing, laser printing, pad printing, and digital label printing. Alternate technology providers are increasingly investing in deploying novel solutions with improved performances leading to extreme market fragmentation.

Thermal Transfer Printer Market: Opportunities

Rising launch of new solutions with advanced functions will generate growth opportunities

The global thermal transfer printing market is expected to generate growth opportunities due to the increasing launch of new solutions. In June 2024, Domino Printing Sciences (Domino) announced the launch of a new thermal inkjet (TIJ) with thermal transfer overprinting (TTO) solutions in the Domino Gx-Series range. The tool is specially designed to provide flexible packaging lines including companies in the food industry.

In October 2024, Dai Nippon Printing Co., Ltd. (DNP) announced the launch of two thermal transfer ink ribbons with applications across industries including food, electrical devices, pharmaceuticals, and medical products. The products are named V670 and R380. The former can be used on paper and plastic-based packages while the latter is highly resistant to alcohol hence offering highly durable printing. The increasing integration of thermal transfer printers with other smart technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) will further guide the industry’s final growth in the long term.

Thermal Transfer Printer Market: Challenges

Downtime associated with ribbon changes will challenge market expansion

The global industry for thermal transfer printer is expected to be challenged by the downtime associated with the use of the printers. Excessive downtime can result in business process disruption. Furthermore, the high cost associated with the replacement of mechanical parts and ribbons may impact the overall revenue in the industry. Some of the other technical challenges include final quality issues caused due to mismatched ribbons, labels, and faulty ribbon adjustments.

Request Free Sample

Request Free Sample

Thermal Transfer Printer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thermal Transfer Printer Market |

| Market Size in 2023 | USD 47.37 Billion |

| Market Forecast in 2032 | USD 70.39 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 213 |

| Key Companies Covered | Toshiba TEC, Zebra Technologies, Intermec (part of Honeywell), Citizen Systems, Brother, Datamax-O'Neil (now part of Honeywell), TSC Auto ID Technology, Printronix, SATO, Honeywell, Godex International, DYMO, Epson, Cab Produkttechnik, Brady Corporation, and others. |

| Segments Covered | By Printer Type, By Format Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thermal Transfer Printer Market: Segmentation

The global thermal transfer printer market is segmented based on printer type, format type, application, and region.

Based on the printer type, the global market segments are card printers, barcode printers, kiosk & ticket printers, and POS printers. In 2023, the highest demand was listed in the barcode printers segment. The growing use of labeling solutions in the form of digital readable barcodes is helping fuel segmental revenue. The global e-commerce industry along with the food & beverages sector will be critical to the overall segmental revenue in the long run. Ribbons used in thermal transfer printers can last for one to two years.

Based on format type, the global thermal transfer printer industry is divided into desktop printers, industrial printers, and mobile printers.

Based on the application, the global market segments are government, health & hospitality, manufacturing & industrial, transportation & logistics, and retail. In 2023, the highest demand was listed in the transportation & logistics segment. Thermal transfer printed barcodes have excessive demand in the logistics sector. The barcodes provide easy access to critical information required for a product including seller details, buyer information, and payment-related data. The global e-commerce industry was valued at over USD 26 trillion in 2023.

Thermal Transfer Printer Market: Regional Analysis

Asia-Pacific to emerge as the fastest-growing market during the projection period

The global thermal transfer printer market will be led by Asia-Pacific during the projection period. The presence of a massive consumer electronics manufacturing industry will help surge the demand for thermal transfer printers in the Asian markets. Countries such as China, India, Singapore, South Korea, and others will be critical to regional market revenue according to industry experts.

In addition to this, the e-commerce and logistics industries across Asia-Pacific are major economic growth drivers for barcode and labeling solutions provided by thermal transfer printers. The presence of favorable government policies, increased domestic and foreign investments, and the existence of an extensive consumer base will fuel revenue in the online commerce and logistic sectors simultaneously impacting the overall demand for thermal transfer printers.

Changing government guidelines in the regional healthcare sector mandating medical equipment makers to use durable and high-quality printers for printing applications will also impact the region’s growth rate. The integration of smart technologies including environmentally-friendly features such as printers with energy efficiency is expected to hold new growth opportunities in the coming years.

Thermal Transfer Printer Market: Competitive Analysis

The global thermal transfer printer market is led by players like:

- Toshiba TEC

- Zebra Technologies

- Intermec (part of Honeywell)

- Citizen Systems

- Brother

- Datamax-O'Neil (now part of Honeywell)

- TSC Auto ID Technology

- Printronix

- SATO

- Honeywell

- Godex International

- DYMO

- Epson

- Cab Produkttechnik

- Brady Corporation

The global thermal transfer printer market is segmented as follows:

By Printer Type

- Card Printers

- Barcode Printers

- Kiosk & Ticket Printers

- POS Printers

By Format Type

- Desktop Printers

- Industrial Printers

- Mobile Printers

By Application

- Government

- Health & Hospitality

- Manufacturing & Industrial

- Transportation & Logistics

- Retail

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A thermal transfer printer uses heat energy to transfer ink from a ribbon onto the printing material.

The global thermal transfer printer is widely used in the medical equipment industry

According to study, the global thermal transfer printer market size was worth around USD 47.37 billion in 2023 and is predicted to grow to around USD 70.39 billion by 2032.

The CAGR value of the thermal transfer printer market is expected to be around 4.50% during 2024-2032.

The global thermal transfer printer market will be led by Asia-Pacific during the projection period.

The global thermal transfer printer market is led by players like Toshiba TEC, Zebra Technologies, Intermec (part of Honeywell), Citizen Systems, Brother, Datamax-O'Neil (now part of Honeywell), TSC Auto ID Technology, Printronix, SATO, Honeywell, Godex International, DYMO, Epson, Cab Produkttechnik and Brady Corporation.

The report explores crucial aspects of the thermal transfer printer market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed