Third-Party Optical Transceivers Market Size, Share, Growth, Trends, and Forecast 2030

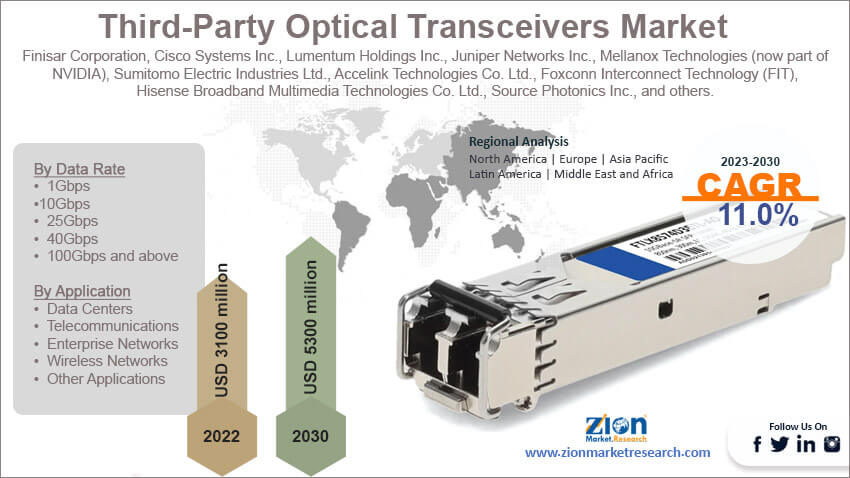

Third-Party Optical Transceivers Market by Transceiver (Single-Mode and Multi-Mode Transceivers), By Data Rate (1gbps, 10gbps, 25gbps, 40gbps, and 100gbps and Above), By Application (Data Centers, Telecommunications, Enterprise Networks, Wireless Networks, and Other Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

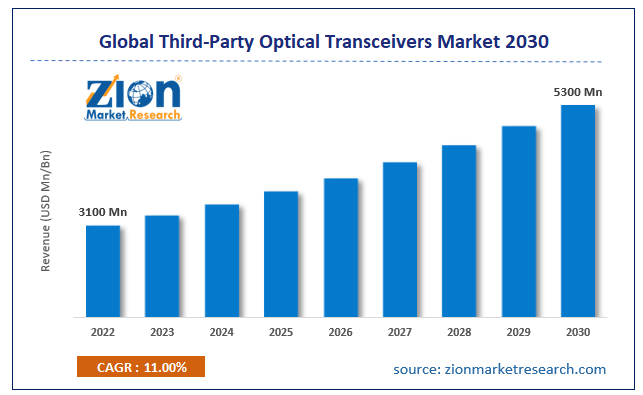

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3100 million | USD 5300 million | 11% | 2022 |

Third-Party Optical Transceivers Industry Prospective:

The global third-party optical transceivers market size was worth around USD 3100 million in 2022 and is predicted to grow to around USD 5300 million by 2030 with a compound annual growth rate (CAGR) of roughly 11% between 2023 and 2030.

Third-Party Optical Transceivers Market: Overview

Third-party optical transceivers refer to optical communication devices manufactured by companies independent of the original equipment manufacturer (OEM) of the networking equipment. These transceivers are designed to be compatible with a wide range of networking devices such as switches, routers, and other network equipment. They play a crucial role in modern data centers and telecommunications networks by enabling the transmission of data over optical fibers. One of the primary advantages of using third-party optical transceivers is cost-effectiveness. They often offer a more budget-friendly alternative to the transceivers provided by the OEMs, without compromising on performance or quality. This cost savings can be substantial, especially in large-scale deployments where numerous transceivers are required.

Additionally, third-party transceivers provide a greater degree of flexibility and choice for network operators, allowing them to select the most suitable transceiver for their specific needs, rather than being limited to the options provided by a single manufacturer. Despite some concerns about compatibility or warranty issues, reputable third-party vendors often provide warranties and support services, giving network administrator’s confidence in their use. Overall, third-party optical transceivers offer a practical and cost-efficient solution for enhancing and expanding optical networks.

Key Insights

- As per the analysis shared by our research analyst, the global third-party optical transceivers industry is estimated to grow annually at a CAGR of around 11% over the forecast period (2023-2030).

- In terms of revenue, the global third-party optical transceivers market size was valued at around USD 3100 million in 2022 and is projected to reach USD 5300 million, by 2030.

- The global third-party optical transceivers market is projected to grow at a significant rate due to relentless demand for higher bandwidth and faster data transmission speeds.

- Based on transceiver segmentation, multi-mode transceivers was predicted to hold maximum market share in the year 2022.

- Based on data rate segmentation, 10Gbps was the leading revenue generator in 2022.

- Based on application segmentation, data centers were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Third-Party Optical Transceivers Market: Growth Drivers

The relentless demand for higher bandwidth and faster data transmission speeds is boosting the market growth.

The relentless demand for higher bandwidth and faster data transmission speeds is a pivotal factor propelling the growth of the third-party optical transceivers market. In an era characterized by a proliferation of data-driven applications and technologies, such as 4K/8K video streaming, augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT), there is an insatiable need for networks that can handle immense data volumes with minimal latency. This has led to a fundamental shift in networking infrastructure requirements, necessitating the deployment of advanced optical communication solutions. Third-party optical transceivers offer a cost-effective and highly competitive alternative to the transceivers provided by original equipment manufacturers (OEMs). They not only meet the stringent performance standards required for high-speed data transmission but also provide a more budget-friendly option for businesses seeking to upgrade their network capabilities. This cost advantage becomes particularly significant in large-scale deployments, where the procurement of numerous transceivers can constitute a substantial portion of the overall project budget. As a result, businesses are increasingly turning to third-party transceivers to maximize their network performance while optimizing cost efficiency. This surge in demand is driving innovation and competition within the third-party optical transceivers market, fostering a dynamic and rapidly evolving industry landscape.

Third-Party Optical Transceivers Market: Restraints

The potential risk of compatibility issues and warranty concerns is restraining the growth of the third-party optical transceivers market

The potential risk of compatibility issues and warranty concerns stands as a significant restraint in the growth of the third-party optical transceivers market. Network administrators and decision-makers often tread cautiously when considering the adoption of third-party transceivers, as they must carefully evaluate the compatibility of these devices with their existing networking equipment. Incompatibility issues can lead to operational inefficiencies, network instability, and potentially costly troubleshooting efforts. This concern is particularly pronounced in complex, mission-critical environments where any disruptions in network performance can have severe consequences for business operations. Moreover, warranty and support considerations play a pivotal role in the procurement decision-making process. Many organizations rely on the assurances provided by original equipment manufacturers (OEMs) regarding warranty coverage and access to technical support. The use of third-party transceivers may raise questions about whether they will receive the same level of support and coverage. This uncertainty can be a significant deterrent for companies looking to adopt third-party solutions, especially in industries where reliability and uptime are paramount. To overcome this restraint, third-party transceiver manufacturers need to proactively address compatibility issues and provide robust warranty and support offerings, instilling confidence in their products among potential customers.

Third-Party Optical Transceivers Market: Opportunities

The snowballing demand for customized and specialized transceiver solutions to provide growth opportunities

The escalating demand for customized and specialized transceiver solutions represents a burgeoning growth opportunity within the optical transceiver industry. As industries become increasingly reliant on advanced networking technologies, there is a pressing need for transceivers tailored to specific applications and environments. For instance, industries such as telecommunications, healthcare, and defense may require transceivers optimized for unique wavelength ranges, data rates, or transmission distances. Companies that can offer a diverse range of customizable transceivers stand to capture a significant share of this specialized market. By providing solutions that precisely address the distinct requirements of various industries, these companies can establish themselves as trusted partners in the rapidly evolving world of optical communication.

Moreover, the proliferation of emerging technologies like 5G, IoT, and edge computing is driving the demand for specialized transceivers. These technologies have distinct networking needs that may not be fully met by standard off-the-shelf transceivers. For instance, 5G networks require transceivers capable of handling ultra-low latency and high bandwidth demands. Similarly, IoT devices often operate on specific frequency bands, necessitating transceivers designed for those frequencies. Companies that can innovate and deliver specialized transceivers tailored to these emerging technologies will find themselves at the forefront of a rapidly expanding market. This presents a compelling opportunity for manufacturers to not only meet current demands but also to shape the future of optical communication technology.

Third-Party Optical Transceivers Market: Challenges

The swelling sophistication and complexity of networking equipment to challenge market growth

The escalating sophistication and complexity of networking equipment pose a formidable challenge to the growth of the third-party optical transceivers industry. As technology continues to advance, networking devices are becoming increasingly intricate, often with highly specific technical requirements. This makes it progressively more challenging for third-party transceiver manufacturers to produce devices that seamlessly integrate with a diverse array of equipment from various original equipment manufacturers (OEMs). Achieving compatibility across this wide spectrum of devices demands extensive research, development, and rigorous testing. Any shortcomings in meeting these compatibility standards can lead to operational disruptions and erode trust in third-party transceiver vendors.

Furthermore, the continuous evolution of networking technology means that third-party transceiver manufacturers must stay ahead of the curve. They must invest significantly in research and development to keep pace with the latest advancements and ensure their products remain relevant and compatible with the newest networking equipment. This requires a substantial commitment of resources and expertise to navigate the ever-changing landscape of networking technology. Overcoming these challenges will necessitate a combination of technical prowess, adaptability, and a keen understanding of market trends to deliver transceivers that meet the exacting demands of modern networking environments.

Third-Party Optical Transceivers Market: Segmentation

The global third-party optical transceivers market is segmented based on transceiver, data rate, application, and region.

Based on transceiver, the global market segments are single-mode and multi-mode transceivers. Currently, the global market is dominated by the multi-mode transceivers segment. The dominance of the multi-mode transceivers segment in the global market can be attributed to its widespread use in short-distance applications, particularly within data centers and enterprise networks. Multi-mode transceivers are known for their cost-effectiveness and efficient data transmission over relatively shorter distances, making them a preferred choice for environments where high bandwidth is needed within confined spaces. Additionally, the demand for multi-mode transceivers has been fueled by the proliferation of data-intensive applications and the rapid expansion of cloud computing services, further solidifying their market dominance.

Based on data rate the global third-party optical transceivers industry is categorized as 1Gbps, 10Gbps, 25Gbps, 40Gbps, and 100Gbps and above. Out of these, 10Gbps was the largest shareholding segment in the global market in 2022. This data rate is widely adopted across various applications, including data centers, enterprise networks, and telecommunications, reflecting its significant presence in the market. The 10Gbps transceivers are favored for their versatile use cases and ability to handle a broad range of networking needs.

Based on application the global third-party optical transceivers market is categorized as data centers, telecommunications, enterprise networks, wireless networks, and other applications. Among these, the data centers segment was the largest shareholding segment in the global market. This reflects the critical role that optical transceivers play in enabling high-speed data transmission within the data center environment, which is at the core of modern computing and cloud services. The demand for efficient and high-capacity transceivers in data centers has been a key driver for this segment's prominence in the global market.

Third-Party Optical Transceivers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Third-Party Optical Transceivers Market |

| Market Size in 2022 | USD 3100 Million |

| Market Forecast in 2030 | USD 5300 Million |

| Growth Rate | CAGR of 11% |

| Number of Pages | 207 |

| Key Companies Covered | Finisar Corporation, Cisco Systems Inc., Lumentum Holdings Inc., Juniper Networks Inc., Mellanox Technologies (now part of NVIDIA), Sumitomo Electric Industries Ltd., Accelink Technologies Co. Ltd., Foxconn Interconnect Technology (FIT), Hisense Broadband Multimedia Technologies Co. Ltd., Source Photonics Inc., and others. |

| Segments Covered | By Transceiver, By Data Rate, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Third-Party Optical Transceivers Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is poised to take the lead in the global third-party optical transceivers market during the forecast period. This is primarily attributed to the region's rapid technological advancements, expanding telecommunications infrastructure, and burgeoning data center ecosystem. Countries like China, Japan, South Korea, and India are witnessing substantial investments in 5G networks, which rely heavily on high-performance optical transceivers. Additionally, the surge in internet penetration, coupled with the proliferation of e-commerce, cloud computing, and digital services, is driving the demand for robust optical communication solutions. As a result, Asia Pacific stands at the forefront of market growth, with a robust ecosystem of manufacturers, suppliers, and consumers, making it a pivotal player in the global third-party optical transceivers market. Furthermore, favorable government policies and initiatives supporting the development of digital infrastructure are contributing to the region's leadership in this market. Governments in countries like China and India are actively promoting initiatives to bolster their digital economies, which necessitates a robust optical communication network. The presence of major technology hubs and manufacturing centers in the region further bolsters Asia Pacific's position as the frontrunner in the global third-party optical transceivers market.

Key Development

In 2023, Amphenol ICC acquired Finisar Corporation, a leading manufacturer of optical components and modules. This acquisition strengthened Amphenol ICC's position as a leading provider of third-party optical transceivers.

In 2023, FS.com Inc. partnered with Microsoft to develop new optical transceivers for cloud computing applications. This partnership leverages FS.com's expertise in optical transceivers and Microsoft's expertise in cloud computing.

In 2023, CBO GmbH launched a new series of 800G optical transceivers for data center applications. These new transceivers offer high performance and density, making them ideal for use in high-speed networks.

In 2022, ETU-Link Technology Co., Ltd. launched a new family of 400G optical transceivers for telecom applications. These new transceivers offer high reliability and scalability, making them ideal for use in 5G networks and other high-performance telecom applications.

Third-Party Optical Transceivers Market: Competitive Analysis

The global third-party optical transceivers market is dominated by players like:

- Finisar Corporation

- Cisco Systems, Inc.

- Lumentum Holdings Inc.

- Juniper Networks, Inc.

- Mellanox Technologies (now part of NVIDIA)

- Sumitomo Electric Industries, Ltd.

- Accelink Technologies Co., Ltd.

- Foxconn Interconnect Technology (FIT)

- Hisense Broadband Multimedia Technologies Co., Ltd.

- Source Photonics, Inc.

The global third-party optical transceivers market is segmented as follows:

By Transceiver

- Single-Mode Transceivers

- Multi-Mode Transceivers

By Data Rate

- 1Gbps

- 10Gbps

- 25Gbps

- 40Gbps

- 100Gbps and above

By Application

- Data Centers

- Telecommunications

- Enterprise Networks

- Wireless Networks

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Third-party optical transceivers refer to optical communication devices manufactured by companies independent of the original equipment manufacturer (OEM) of the networking equipment. These transceivers are designed to be compatible with a wide range of networking devices such as switches, routers, and other network equipment.

The global third-party optical transceivers market cap may grow owing to the relentless demand for higher bandwidth and faster data transmission speeds.

According to study, the global third-party optical transceivers market size was worth around USD 3100 million in 2022 and is predicted to grow to around USD 5300 million by 2030.

The CAGR value of the third-party optical transceivers market is expected to be around 11% during 2023-2030.

The global third-party optical transceivers market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the telecommunications infrastructure and booming digital infrastructure.

The global third-party optical transceivers market is led by players like Finisar Corporation, Cisco Systems, Inc., Lumentum Holdings Inc., Juniper Networks, Inc., Mellanox Technologies (now part of NVIDIA), Sumitomo Electric Industries, Ltd., Accelink Technologies Co., Ltd., Foxconn Interconnect Technology (FIT), Hisense Broadband Multimedia Technologies Co., Ltd., and Source Photonics, Inc.

The report analyzes the global third-party optical transceivers market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Third-Party Optical Transceivers industry.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed