TOPCon Solar Cells Market Size, Share, Trends, Growth 2030

TOPCon Solar Cells Market By Type (N-Type and P-Type), By Installation (Ground-Mounted and Rooftop), By End-User (Residential, Commercial, Utility, Agriculture, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

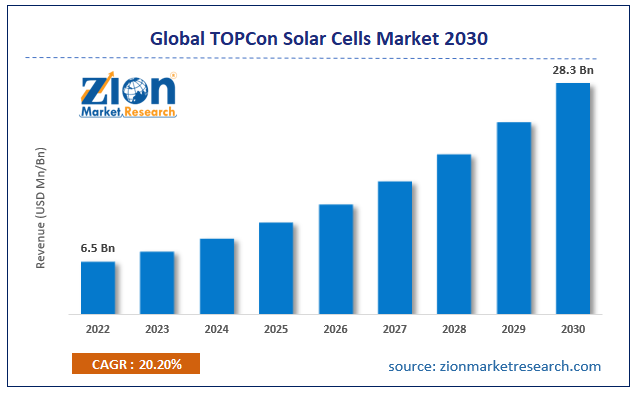

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.5 Billion | USD 28.3 Billion | 20.2% | 2022 |

TOPCon Solar Cells Industry Prospective:

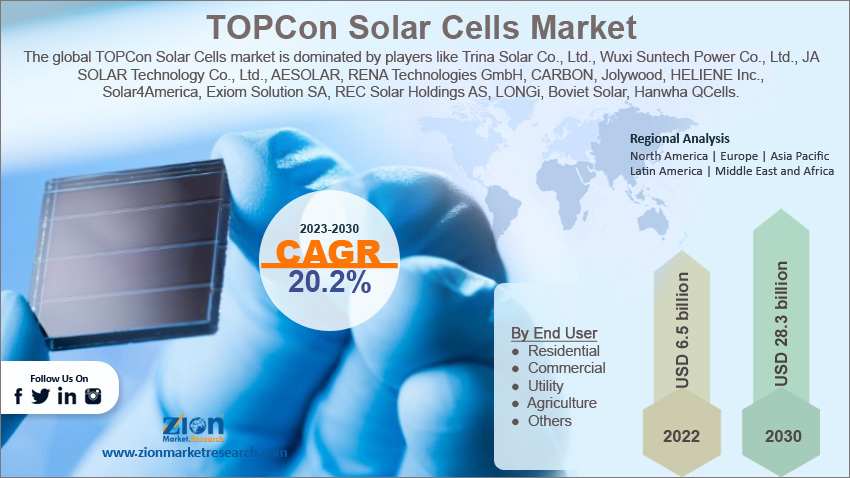

The global TOPCon solar cells market size was worth around USD 6.5 billion in 2022 and is predicted to grow to around USD 28.3 billion by 2030 with a compound annual growth rate (CAGR) of roughly 20.2% between 2023 and 2030.

TOPCon Solar Cells Market: Overview

"Tunnel Oxide Passivated Contact," or TOPCon for a nutshell is a more sophisticated N-type silicon cell technology. In 2014, the German solar research institute Fraunhofer ISE originally put up the idea. 2019 was the first time the technology was scaled. The major solar panel producers in the world, Suntech, Trina Solar, JA Solar, and LONGi Solar, will be using this technology as of January 2022 to produce solar panels with an efficiency higher than 22%. The rising demand for TOPCon solar cells can be attributed to their many advantages, including increased efficiency potential, improved stability, a flexible production method, and the capacity to function well in extremely cold conditions. Furthermore, TOPCon solar cells have environmental benefits including lower carbon emissions, air pollution, and water usage in comparison to other energy sources. They provide long-term fixes that adhere to environmental stewardship principles and support the preservation of the ecosystem for future generations.

Key Insights

- As per the analysis shared by our research analyst, the global TOPCon Solar Cells market is estimated to grow annually at a CAGR of around 20.2% over the forecast period (2023-2030).

- In terms of revenue, the global TOPCon Solar Cells market size was valued at around USD 6.5 billion in 2022 and is projected to reach USD 28.3 billion, by 2030.

- The growing product launches is expected to propel the TOPCon solar cells market growth over the forecast period.

- Based on the type, the N-Type segment is expected to dominate the market over the forecast period.

- Based on the end user, the commercial segment is expected to grow at the highest CAGR over the forecast period.

- Based on region, North America is expected to capture the largest market share over the forecast period.

TOPCon Solar Cells Market: Growth Drivers

Higher efficiency of TOPCon solar cells drives market growth

In comparison to conventional solar cells, TOPCon solar cells are renowned for having a greater conversion efficiency. They are a desirable option for solar projects because of their higher efficiency, which enables them to generate more power from the same amount of the sun. For instance, the maximum theoretical efficiency for TOPCon solar cells, as determined by field studies, is between 28.2% and 28.7%. This is higher than both HJT (27.5%) and PERC cells (24.5%), by a significant margin. At 29.43%, it gets close to the theoretical limit of all solar cells made of crystalline silicon. Therefore, the high efficiency of TOPCon solar cells is expected to propel the global TOPCon solar cells market growth during the forecast period.

Request Free Sample

Request Free Sample

TOPCon Solar Cells Market: Restraints

Higher production cost hampers market expansion

The fact that TOPCon solar cells are more expensive to produce than conventional solar cell technologies is one of their main drawbacks. The initial expenditure for solar panel producers and customers may be greater due to the increased cost of the materials and manufacturing procedures used to create TOPCon cells. Thus, the high production cost of these solar cells is expected to hamper the TOPCon solar cells industry growth over the forecast period.

TOPCon Solar Cells Market: Opportunities

Growing product launches offer a lucrative opportunity for market growth

The growing product launches offer a lucrative opportunity for TOPCon solar cells market growth during the forecast period. For instance, in March 2023, Leading Chinese photovoltaics (PV) company GCL System Integration Technology Co. revealed the release of its most recent solar innovation, the N-type TOPCon and BIPV (GCL SPV) module. PV EXPO 2023, Japan's largest show for the PV industry, took place at Tokyo Big Sight from March 15–17. Global visitors were shown at the booth by GCL SI how the company's new line of products combined with state-of-the-art solar technology is propelling the PV industry's growth and assisting Japan in meeting its decarbonization goals more quickly. Moreover, in September 2023, at RE+ 2023 in Las Vegas, Trina Solar Co., Ltd., a pioneer in smart energy solutions globally, unveiled Vertex N and Vertex S+ with n-type TOPCon Advanced technology, the solar industry's new competitive edge. Trinahub, TrinaTracker, and TrinaStorage, among other vertically integrated technologies, will be showcased by the firm. For solar developers, EPCs, and installers, Trina's n-type TOPCon Advanced technology provides solutions for increased efficiency, long-term reliability, and decreased levelized cost of electricity (LCOE).

TOPCon Solar Cells Market: Challenges

Require large amount of silver pose a challenge to market growth

The fact that TOPCon cells require more silver (Ag) to produce than PERC cells is one of their main disadvantages. During production, silver paste is used by both TOPCon and PERC. Nevertheless, TOPCon covers the cells on both sides with silver paste. This implies that expenses will never be less than PERC. Thus, posing a major challenge to the market growth.

TOPCon Solar Cells Market: Segmentation

The global TOPCon Solar Cells industry is segmented based on type, installation, end-user, and region.

Based on the type, the global market is bifurcated into N-Type and P-Type. The N-Type segment is expected to dominate the market over the forecast period. This can be attributed to the fact that N-type TOPCON cells are constructed on an n-doped crystalline silicon wafer as their base. PV cells are classified into two categories based on their layer structure: negatively charged N-type cells and positively charged P-type cells. The base layer of P-type cells is doped with boron, which contains one less electron than silicon. This results in an electron-hole that is mostly made up of positive charge carriers. Since phosphorus has one extra electron than silicon, it forms free electrons in the N-type cell bottom layer. N-type cells have better efficiency because of these liberated electrons, which help eliminate issues like Light Induced Degradation (LID) and Potential Induced Degradation (PID) and result in incredibly low power losses.

Based on the installation, the global TOPCon Solar Cells industry is bifurcated into ground-mounted and rooftop.

Based on the end user, the global TOPCon solar cells market is segmented into residential, commercial, utility, agriculture, and others. The commercial segment is expected to grow at the highest CAGR over the forecast period because major market participants are engaging in more development. For instance, Commercial n-type TOPCON solar cells with a 25% conversion efficiency are now being produced at large yields, according to JinkoSolar. Tiger Neo TOPCON modules from JinkoSolar improve installed capacity by 3% to 6% when put in the same area as PERC modules. Tiger Neo modules can provide 3% to 5% more power with the same installed capacity. When considering the same land area, this equates to 6% to 10% more electricity generated than with PERC modules. JinkoSolar claims that Tiger Neo's low deterioration, higher facility, and better temperature coefficient are the reasons behind its appeal to consumers throughout the globe.

TOPCon Solar Cells Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | TOPCon Solar Cells Market |

| Market Size in 2022 | USD 6.5 Billion |

| Market Forecast in 2030 | USD 28.3 Billion |

| Growth Rate | CAGR of 20.2 |

| Number of Pages | 219 |

| Key Companies Covered | Trina Solar Co. Ltd., Wuxi Suntech Power Co. Ltd., JA SOLAR Technology Co. Ltd., AESOLAR, RENA Technologies GmbH, CARBON, Jolywood, HELIENE Inc., Solar4America, Exiom Solution SA, REC Solar Holdings AS, LONGi, Boviet Solar, Hanwha QCells, Websol Energy System Limited, Sharp Energy Solutions Corporation, FuturaSun srl, Canadian Solar, SoliTek and LUXOR SOLAR, and others. |

| Segments Covered | By Type, By Installation, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

TOPCon Solar Cells Market: Regional Analysis

North America is expected to capture the largest market share over the forecast period

North America is expected to capture the largest TOPCon solar cells market share over the forecast period because of the growing number of government programs aimed at sustainability. For instance, The USD 370 billion U.S. Inflation Reduction Act of 2022 provides funding for initiatives aimed at mitigating climate change and utilizing renewable energy sources. Over USD 60 billion is included in the package for American manufacturers involved in the supply chain of renewable energy. As per a recent study, to plan for new solar development and investment in manufacturing facilities in the United States, developers, EPC firms, and manufacturers will be seeking clarification from the US Treasury Department and the IRS. Moreover, the presence of key players and their product launches in the region is expected to propel the market growth over the forecast period. For instance, in September 2023, the top PV module maker in North America, Silfab Solar, announced that it would launch a premium line of TOPCon PV modules in the first quarter of 2024 that is specially created and engineered for the domestic and commercial markets in the United States.

TOPCon Solar Cells Market: Competitive Analysis

The global TOPCon Solar Cells market is dominated by players like:

- Trina Solar Co. Ltd.

- Wuxi Suntech Power Co. Ltd.

- JA SOLAR Technology Co. Ltd.

- AESOLAR

- RENA Technologies GmbH

- CARBON

- Jolywood

- HELIENE Inc.

- Solar4America

- Exiom Solution SA

- REC Solar Holdings AS

- LONGi

- Boviet Solar

- Hanwha QCells

- Websol Energy System Limited

- Sharp Energy Solutions Corporation

- FuturaSun srl

- Canadian Solar

- SoliTek and LUXOR SOLAR

The global TOPCon Solar Cells market is segmented as follows:

By Type

- N-Type

- P-Type

By Installation

- Ground-Mounted

- Rooftop

By End User

- Residential

- Commercial

- Utility

- Agriculture

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

"Tunnel Oxide Passivated Contact," or TOPCon for a nutshell is a more sophisticated N-type silicon cell technology. In 2014, the German solar research institute Fraunhofer ISE originally put up the idea. 2019 was the first time the technology was scaled. The major solar panel producers in the world, Suntech, Trina Solar, JA Solar, and LONGi Solar, will be using this technology as of January 2022 to produce solar panels with an efficiency higher than 22%.

The rising demand for TOPCon solar cells can be attributed to their many advantages, including increased efficiency potential, improved stability, a flexible production method, and the capacity to function well in extremely cold conditions. Furthermore, TOPCon solar cells have environmental benefits including lower carbon emissions, air pollution, and water usage in comparison to other energy sources.

According to the report, the global TOPCon solar cells market size was worth around USD 6.5 billion in 2022 and is predicted to grow to around USD 28.3 billion by 2030.

The global TOPCon Solar Cells market is expected to grow at a CAGR of 20.2% during the forecast period.

The global TOPCon Solar Cells market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing government initiatives and the growing product launches in the area.

The global TOPCon Solar Cells market is dominated by players like Trina Solar Co., Ltd., Wuxi Suntech Power Co., Ltd., JA SOLAR Technology Co., Ltd., AESOLAR, RENA Technologies GmbH, CARBON, Jolywood, HELIENE Inc., Solar4America, Exiom Solution SA, REC Solar Holdings AS, LONGi, Boviet Solar, Hanwha QCells, Websol Energy System Limited, Sharp Energy Solutions Corporation, FuturaSun srl, Canadian Solar, SoliTek and LUXOR SOLAR among others.

The TOPCon Solar Cells market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed