Toy Market Growth, Size, Share, Trends, and Forecast 2030

Toy Market By Age Group (18+ Years, 12 to 18 Years, 5 to Below 12 Years, 3 to Below 5 Years, and 0 to Below 3 Years), By Product Type (Building & Construction Set, Dolls, Infant & Preschool Toys, Outdoor & Sports Toys, Games & Puzzles, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

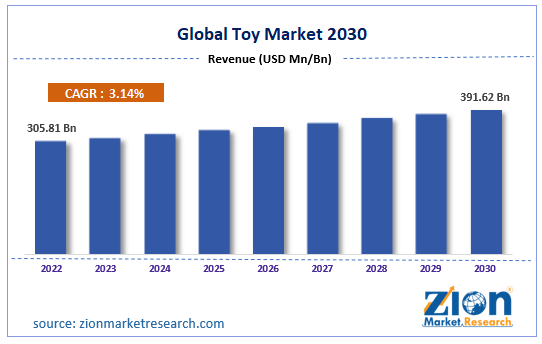

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 305.81 Billion | USD 391.62 Billion | 3.14% | 2022 |

Toy Industry Prospective:

The global toy market size was worth around USD 305.81 billion in 2022 and is predicted to grow to around USD 391.62 billion by 2030 with a compound annual growth rate (CAGR) of roughly 3.14% between 2023 and 2030.

Toy Market: Overview

A toy is defined as an object that is used for the purpose of entertainment. The secondary application of toys is learning, especially cognitive skills at an early stage. While traditionally, toys are often associated with infants and young children, the modern toy industry also supplies toys meant for older children or young adults above the age of 18 years. Toys have a long-standing history in terms of playing objects. In previous times, toys were made of hard materials such as wood and they were long-lasting. However, with the introduction of new and lightweight materials, the industry has undergone significant change.

Additionally, market players continue to introduce new types of toys in the market. Some of them are more scientifically designed while others appear simple in terms of shape and playing tactics; however, exposure to such toys at an early stage can help accelerate a child's learning or understanding curve. Furthermore, toys have been distributed depending on the gender that prefers specific toys. For instance, dolls are most associated with girl children. Conversely, with the growing trend of gender-neutral parenting, these distinctions are slowly fading away thus creating higher growth opportunities for toy designers and manufacturers.

Key Insights:

- As per the analysis shared by our research analyst, the global toy market is estimated to grow annually at a CAGR of around 3.14% over the forecast period (2023-2030)

- In terms of revenue, the global toy market size was valued at around USD 305.81 billion in 2022 and is projected to reach USD 391.62 billion, by 2030.

- The market is projected to grow at a significant rate due to the growing number of online toy sellers

- Based on age group segmentation, 3 to below 5 years was predicted to show maximum market share in the year 2022

- Based on product type segmentation, outdoor & sports toys were the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Toy Market: Growth Drivers

Growing number of online toy sellers to drive market growth

The global toy market is projected to grow owing to the increasing number of toy sellers that are leveraging the extensive consumer reach of online sales platforms. This trend has two aspects. Either toy manufacturers and sellers are launching brand-owned websites or they are collaborating with existing companies in the global e-commerce segment and using their supply chain network to reach potential customers. While online sales are better for companies since they do not have to invest in constructing a physical commercial facility, digital platforms are also beneficial to customers. The increase in online sales has surged to an unprecedented level since COVID-19. It offers benefits such as access to more options, discounted prices, doorstep delivery, and excellent customer service.

In September 2022, the UK division of Toys R US, a leading player in the toy sector, soft-launched its new website in the region thus marking its return to the UK toy industry. The website has been deemed extremely user-friendly and has a list of numerous categories thus offering a comprehensive range of toys for buyers and users across age and price groups.

Increasing the use of simple and complex toys at schools to facilitate learning may drive market revenue

Toys, traditionally considered as entertainment mediums, have been reinvented in recent times. While entertainment remains a key aspect, they are also considered crucial objects that help children improve their learning trajectory while making the entire process more fun and engaging. Several preschools and educational facilities for young children have been using simple and complex toys to help the children learn new topics such as problem-solving, creativity, social skills, language development, and physical dexterity.

In May 2020, Save the Children, NITI Aayog, and the LEGO Group announced a three-way partnership as India is promoting the Learning Through Play concept in the country thus promoting the global toy market adoption rate.

Toy Market: Restraints

Excessive waste generation and consumerism to restrict market growth

The global industry for toys is projected to be restricted in terms of growth as a result of excessive waste that gets generated due to a higher number of toys being discarded as users are introduced to new toys. The toy industry is one of the leading contributors to excessive consumerism.

For instance, toys are designed keeping in view their age group and expectations associated with the toys for the particular age range. Once the child crosses the age, they may not find the toys useful thus getting discarded. The most harmful types are toys made of plastic which leads to severe environmental pollution.

Toy Market: Opportunities

Increasing demand for domestic or locally made toys to create growth opportunities

The global toy market has access to new expansion possibilities due to the growing demand for locally-made toys as opposed to branded products. Regional governments are promoting several domestic toy manufacturers to provide engaging toys to the general population since international brands can be expensive for a large part of the potential consumer group.

In October 2022, the toy industry of Tamil Nadu state of India was valued at INR 600 crore and the regional government was encouraged to invest more in the domestic toy sector which is expected to create around 30,000 jobs in the region. One of the key benefits of developing a robust toy industry in the state is access to comprehensive port connectivity.

In December 2022, India was set to announce a new set of initiatives as the country is expected to soon challenge China’s hold over the toy industry. In November 2020, Amazon’s Indian division announced that it would provide a platform to local toy manufacturers and sellers to sell Indian folk culture-inspired toys thus aligning with the country’s Made in India vision

Higher sales of biodegradable toys to aid better growth momentum

The global toy industry is projected to benefit from the increasing demand and use of biodegradable toys. As consumer awareness about plastic pollution is increasing, they are actively seeking toys that are long-lasting and can be used for many years. In December 2023, Wild Republic announced that it would launch a new line of sustainable toys in 2024. It will design toys for children above 3 years thus contributing to environmental consciousness.

Toy Market: Challenges

Excessive reliance on foreign countries for sourcing raw materials is a key challenge

The global toy market is currently dominated by specific regional segments. Location manufacturers have to rely heavily on international territories for securing raw materials. This is a major challenge mainly due to the current volatile state of the international market as countries continue to engage in political, social, and economic conflict.

Toy Market: Segmentation

The global toy market is segmented based on age group, product type, and region.

Based on age group, the global market is segmented into 18+ years, 12 to 18 years, 5 to below 12 years, 3 to below 5 years, and o to below 3 years. In 2022, the highest growth rate was observed in the 3 to below 5 years segment mainly because parents are willing to spend more money on toys as this is an ideal age group in which a child can play and learn with toys. However, the other age groups are significant segments as the market is filled with toys that are suitable for every age. The official report suggests that 1 in every 20 children can solve a Rubik’s cube.

Based on product type, the global market is divided into building & construction sets, dolls, infant & preschool toys, outdoor & sports toys, games & puzzles, and others. In 2022, the leading revenue generator was the outdoor & sports toys segment. The critical driving factor was the increased investments in the construction of recreation facilities for children. Additionally, higher use of learning-based toys in schools and education facilities further caters to segmental growth. In an official survey by 1000 Hours Outside, around 89% of the children surveyed preferred outdoor sports.

Toy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Toy Market |

| Market Size in 2022 | USD 305.81 Billion |

| Market Forecast in 2030 | USD 391.62 Billion |

| Growth Rate | CAGR of 3.14% |

| Number of Pages | 225 |

| Key Companies Covered | LEGO Group, Hasbro, MGA Entertainment, Mattel, Jakks Pacific, Spin Master, Tomy, Bandai, Playmobil, Fisher-Price (a subsidiary of Mattel), Ravensburger, Funko, WowWee, Moose Toys, VTech, and others. |

| Segments Covered | By Age Group, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Toy Market: Regional Analysis

Asia-Pacific to continue dominating the market during the projection period

The global toy market is currently dominated by Asia-Pacific. China acts as the leading contributor in the regional as well as the global market. As per research, more than 79% of global toy production is handled by China. It has managed to create a thriving ecosystem for toy manufacturers and suppliers. The presence of a robust manufacturing industry as well as the availability of manpower along with favorable policies by the government to promote the rational toy industry have worked coherently to promote China’s growth rate. In addition to this, India has been making significant strides toward replacing China as the toy manufacturing hub.

In July 2023, the president of the Toy Association of India announced that it is drafting new schemes as the country’s manufacturing reached over USD 1.4 billion in 2023. India has systematically worked toward reducing its toy imports and increasing its export rate. Furthermore, the presence of a massive domestic market for regional culture-inspired toys is surging rapidly. North America will act as a key contributor driven by the growing expansion policy of US-based toy manufacturers. The increased investments in emerging economies could deliver exceptional results.

Toy Market: Competitive Analysis

The global toy market is led by players like:

- LEGO Group

- Hasbro

- MGA Entertainment

- Mattel

- Jakks Pacific

- Spin Master

- Tomy

- Bandai

- Playmobil

- Fisher-Price (a subsidiary of Mattel)

- Ravensburger

- Funko

- WowWee

- Moose Toys

- VTech

The global toy market is segmented as follows:

By Age Group

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

By Product Type

- Building & Construction Set

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A toy is defined as an object that is used for the purpose of entertainment. The secondary application of toys is learning, especially cognitive skills at an early stage.

The global toy market is projected to grow owing to the increasing number of toy sellers that are leveraging the extensive consumer reach of online sales platforms.

According to study, the global toy market size was worth around USD 305.81 billion in 2022 and is predicted to grow to around USD 391.62 billion by 2030.

The CAGR value of toy market is expected to be around 3.14% during 2023-2030.

The global toy market is currently dominated by Asia-Pacific.

The global toy market is led by players like LEGO Group, Hasbro, MGA Entertainment, Mattel, Jakks Pacific, Spin Master, Tomy, Bandai, Playmobil, Fisher-Price (a subsidiary of Mattel), Ravensburger, Funko, WowWee, Moose Toys, and VTech.

The report explores crucial aspects of the toy market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed