Trade Finance Market Size, Share, Trends, Growth 2032

Trade Finance Market By Product Type (Commercial Letters of Credit, Guarantees, and Standby Letters of Credit), By Provider (Banks, Insurance Companies, Fixed POS Terminals, and Others), By Application (International and Domestic), End-User (Traders, Exporters, and Importers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

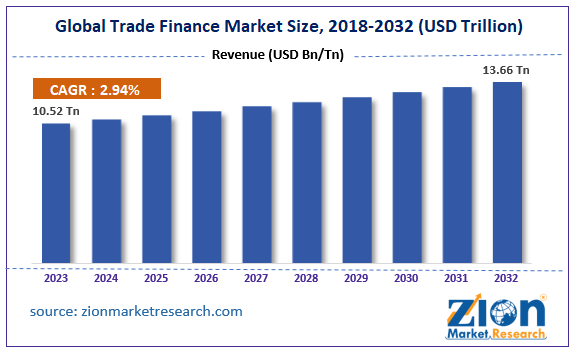

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.52 Trillion | USD 13.66 Trillion | 2.94% | 2023 |

Trade Finance Industry Prospective:

The global trade finance market size was evaluated at $10.52 trillion in 2023 and is slated to hit $13.66 trillion by the end of 2032 with a CAGR of nearly 2.94% between 2024 and 2032.

Trade Finance Market: Overview

Trade finance is a set of methods or financial tools that are utilized for mitigating the risks that occur in global trade activities. Moreover, it ensures payment to exporters along with assuring seamless goods & services delivery to importers. Furthermore, trade finance also represents the financial instruments & products that are utilized by firms to enable global trade & commerce. It facilitates importers and exporters in transacting trade business by acting as an intermediary between them.

Reportedly, trade finance is a term that encompasses many financial products that banks and companies utilize to make trade transactions feasible. Moreover, it also includes receivables & invoice finance, bank guarantees, insurance, and export finance.

Key Insights

- As per the analysis shared by our research analyst, the global trade finance market is projected to expand annually at the annual growth rate of around 2.94% over the forecast timespan (2024-2032)

- In terms of revenue, the global trade finance market size was evaluated at nearly $10.52 trillion in 2023 and is expected to reach $13.66 trillion by 2032.

- The global trade finance market is anticipated to grow rapidly over the forecast timeline owing to a surge in the necessity of safety of trading events along with a rise in the acceptance of trade finance by small & medium enterprises in emerging economies.

- In terms of providers, the banks segment is slated to register the highest CAGR over the forecast period.

- Based on end-users, the exporters segment is predicted to record the fastest growth rate in the years to come.

- Region-wise, the North American trade finance industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Trade Finance Market: Growth Factors

Growing need for safe trading activities to boost global market trends

A surge in the necessity of safety of trading events along with a rise in the acceptance of trade finance by small & medium enterprises in emerging economies will steer the growth of the global trade finance market. In addition to this, growing competition and novel trade deals will embellish the global market trends. Fintech firms are creating blockchain solutions for streamlining & securing trade deals, thereby steering the global market progression.

Governments across the globe are encouraging online trade finance transactions to promote global trade and this will pave the way for humungous growth of the market globally. Digitization of bank guarantees as well as letters of credit is predicted to massively minimize the administrative & operating costs, thereby speeding up the financial transaction process. Rapid expansion in supply chain finance services will spur the size of the global market.

Trade Finance Market: Restraints

Surging trade wars between countries can restrict the global industry surge by 2032

Rise in the trade conflicts and high execution costs can detriment to the expansion of the global trade finance industry.

Trade Finance Market: Opportunities

Rise in penetration of AI in trade finance opened slew of opportunities for the global market

Financial institutes are making use of AI and automated tools for trade finance procedures, thereby minimizing paperwork along reducing processing time. This, in turn, will open new growth avenues for the global trade finance market. Launching of paperless guaranteed services including Paperless Guarantee of Lloyd Bank will pave the way for immense growth of the global market.

Trade Finance Market: Challenges

Complicatedness in trade finance deals to retard the growth of the global industry over 2024-2032

Complexities in trade finance transactions along with higher risks associated with trade finance are predicted to put a challenge to the global trade finance industry surge.

Trade Finance Market: Segmentation

The global trade finance market is divided into product type, provider, application, end-user, and region.

In provider terms, the trade finance market across the globe is segregated into banks, insurance companies, fixed POS terminals, and other segments. Furthermore, the banks segment, which accumulated approximately 50% of the global market revenue in 2023, is expected to record the fastest rate of growth in the forecast timeline. The expansion of the segment in the next eight years can be subject to a rise in the use of blockchain as well as the digitization of finance processes in the banks. Reportedly, banks are joining hands with fintech organizations to improve their trade finance solutions, thereby expanding their business reach

On the basis of end-users, the global trade finance industry is segmented into traders, exporters, and importers segments. Additionally, the exporters segment, which acquired the largest share of the global industry in 2023, is projected to lead the segmental sphere in the years ahead. The segmental expansion from 2024 to 2032 can be a result of globalization along with a prominent increase in trading activities globally.

Based on the product type, the global trade finance market is divided into commercial letters of credit, guarantees, and standby letters of credit segments.

Based on the application, the global trade finance industry is bifurcated into international and domestic segments.

Trade Finance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Trade Finance Market |

| Market Size in 2023 | USD 10.52 Trillion |

| Market Forecast in 2032 | USD 13.66 Trillion |

| Growth Rate | CAGR of 2.94% |

| Number of Pages | 225 |

| Key Companies Covered | Asian Development Bank, The Royal Bank of Scotland Group plc, Bank of America Corporation, Euler Hermes Group, Mitsubishi UFJ Financial Inc., BNP Paribas S.A., JPMorgan Chase & Co, Citigroup Inc., HSBC Holdings PLC, Standard Chartered PLC., and others. |

| Segments Covered | By Product Type, By Provider, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Trade Finance Market: Regional Insights

Asia-Pacific is predicted to maintain the leading position in the global trade finance market in the ensuing years

Asia-Pacific, which accounted for nearly four-fifths of the global trade finance market proceeds in 2023, is expected to dominate the global market in the next decade. Furthermore, the regional market expansion in the next couple of years can be due to a rise in the trade finance activities in countries including India and China. Furthermore, the government as well as banks in Asia promotes trade financing in the countries, thereby driving the regional market trends.

North American trade finance industry is expected to register the fastest CAGR in the forecast timeline. The elevation of the industry in North America over the coming eight years can be credited to a rise in the automation & digitization of trade finance will steer the expansion of the industry in the region. An increase in the innovations in the fintech sector is likely to drive regional industry trends. The presence of key players in the region will drive the growth of the industry in North America.

Key Developments

- In the second half of 2023, the Exim Bank of India set up its new division in Gujarat International Finance Tec-City to highlight trade finance activities. Such moves will push the growth of the trade finance business in Asia.

Trade Finance Market: Competitive Space

The global trade finance market profiles key players such as:

- Asian Development Bank

- The Royal Bank of Scotland Group plc

- Bank of America Corporation

- Euler Hermes Group

- Mitsubishi UFJ Financial Inc.

- BNP Paribas S.A.

- JPMorgan Chase & Co

- Citigroup Inc.

- HSBC Holdings PLC

- Standard Chartered PLC.

The global trade finance market is segmented as follows:

By Product Type

- Commercial Letters of Credit

- Guarantees

- Standby Letters of Credit

By Provider

- Banks

- Insurance Companies

- Fixed POS Terminals

- Others

By Application

- International

- Domestic

By End-User

- Traders,

- Exporters

- Importers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Trade finance is a set of methods or financial tools that are utilized for mitigating the risks that occur in global trade activities. Moreover, it ensures payment to exporters along with assuring seamless goods & services delivery to importers.

The global trade finance market growth over forecast period can be owing to a surge in the growing competition and novel trade deals across the globe.

According to a study, the global trade finance industry size was $10.52 trillion in 2023 and is projected to reach $13.66 trillion by the end of 2032.

The global trade finance market is anticipated to record a CAGR of nearly 2.94% from 2024 to 2032.

The North American trade finance industry is set to register the fastest CAGR over the forecasting timeline owing to a rise in the automation & digitization of trade finance will steer the expansion of the industry in the region. An increase in the innovations in the fintech sector is likely to drive the regional industry trends. The presence of key players in the region will drive the growth of the industry in North America.

The global trade finance market is led by players such as Asian Development Bank, The Royal Bank of Scotland Group plc, Bank of America Corporation, Euler Hermes Group, Mitsubishi UFJ Financial Inc., BNP Paribas S.A., JPMorgan Chase & Co, Citigroup Inc., HSBC Holdings PLC, and Standard Chartered PLC.

The global trade finance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed