Travel Insurance Market Size, Share, Demand & Trends Analysis by 2032

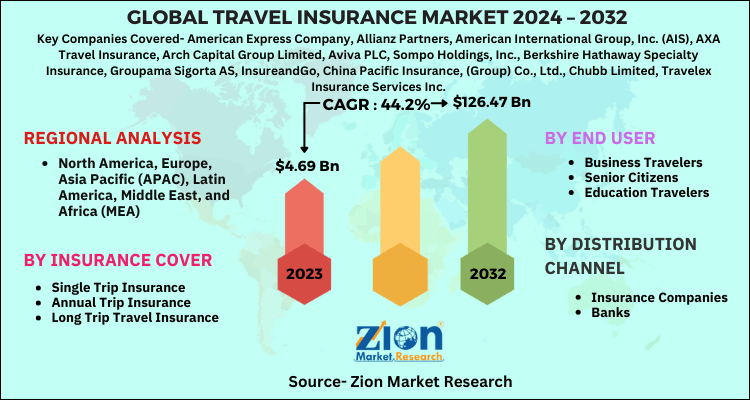

Travel Insurance Market By Insurance Cover (Single Trip Travel Insurance, Annual Trip Travel Insurance, Long Trip Travel Insurance), By End Users (Business Travelers, Senior Citizens, Education Travelers and others), By Distribution Channel (Insurance Companies, Banks and others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

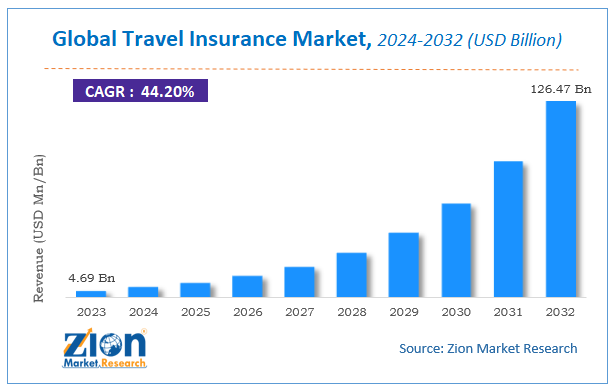

| USD 4.69 Billion | USD 126.47 Billion | 44.2% | 2023 |

Travel Insurance Market Insights

Zion Market Research has published a report on the global Travel Insurance Market, estimating its value at USD 4.69 Billion in 2023, with projections indicating that it will reach USD 126.47 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 44.2% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Travel Insurance Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

The market is primarily driven by increased tourism nationally and internationally over the recent years. These days, many companies have been providing travel insurance with 24/7 emergency services such as cash wire assistance, replacing lost passports and re-booking canceled flights. These companies have also been offering customization options depending on the geographical location and as per the requirements of the individuals.

COVID-19 Impact Analysis

The global impacts of COVID-19 have negatively impacted the travel insurance market. Due to the restricted lockdowns all over the globe, there has been significant dip in the travel industry. As the overall travel rate has taken a significant dip, the number of people buying the travel insurance coverages has also gone considerably down. As the lockdowns are being lifted and people are travelling in some countries, gradually, the travel insurance market is also expected to have considerable demand.

Growth Factors

The increased tourism globally has increased the overall demand for the travel insurance market. The increase in the disposable income, extensive coverage for holidays and easy booking facilities have increased the demand for the market. To mitigate the uncertain occurrences such as canceled flights, accidents, health issues, loss of baggage, theft and natural calamities, travelers opt for the travel insurances.

Also, due to the technological advancements such as geo-location, artificial intelligence, blockchain and big data, there has been considerable opportunities for the insurers in the market. Due to these technological developments, travel insurance platforms are expected to enhance the productivity for providing the coverages seamlessly at the point of purchase. The digital transformation has also enable the companies to create highly personalized experiences to the customers.

Insurance Cover Analysis Preview

The Single trip generally covers a single oversees trip. These trip are suitable for those who are not making more than one trip per year. The demand for single trip insurance is high because it covers the features such as medical cover including repatriation, emergency dental treatment costs, loss of baggage, personal liability cover, trip interruption or cancellation, fire cover, missed flight connection and many more such services. Customers readily opt for single trip travel insurance due to their numerous features.

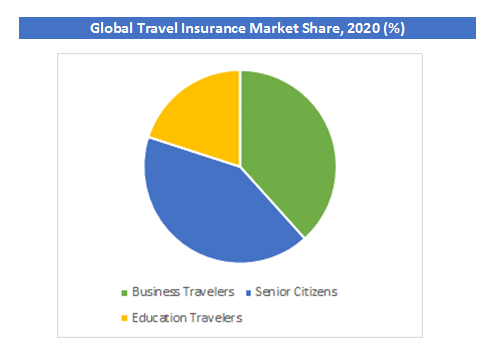

End User Analysis Preview

This is due to the fact that these travelers have to frequently oversee or even nationally due to their business requirements and demands. This business demand occurs for not only the customers who have their own businesses but also for those who work in the companies, and who have their scheduled visits over the specific period in the year. Therefore the overall demand for the travel insurance market is high from the business travelers.

Distribution Channel Analysis Preview

This is due to the fact that for a particular insurance demand, the customers always tend to approach the insurance companies instead of any third party vendor. The insurance companies rightly guide the travelers with the insurance packages as per their travel and help them to choose the right travel package for use. Also, insurance companies act as the trusted source of distributing these packages as they are ones with the authorized set of packages and they can rightly consult the customers about the travel insurance packages.

Travel Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Travel Insurance Market |

| Market Size in 2023 | USD 4.69 Billion |

| Market Forecast in 2032 | USD 126.47 Billion |

| Growth Rate | CAGR of 44.2% |

| Number of Pages | 150 |

| Key Companies Covered | American Express Company, Allianz Partners, American International Group, Inc. (AIS), AXA Travel Insurance, Arch Capital Group Limited, Aviva PLC, Sompo Holdings, Inc., Berkshire Hathaway Specialty Insurance, Groupama Sigorta AS, InsureandGo, China Pacific Insurance, (Group) Co., Ltd., Chubb Limited, Travelex Insurance Services Inc., Generali Group, HanseMerkur Reiseversicherung AG, Ping An Insurance Company of China, Ltd., Seven Corners, Inc., and Zurich Insurance Group AG among others |

| Segments Covered | By Insurance Cover, By End User, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

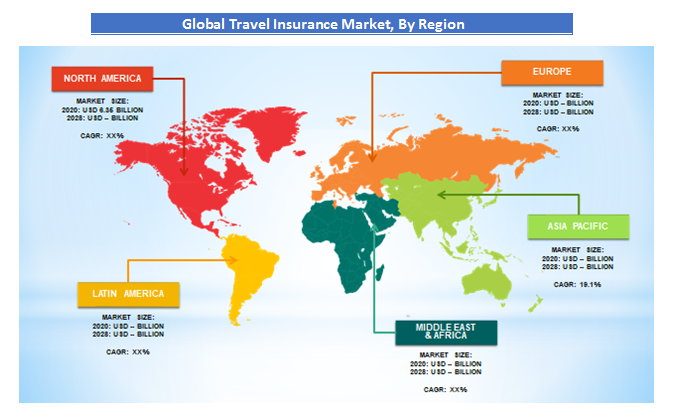

Regional Analysis Preview

North America held a share of 37% in 2020. It is supposed to be one of the highest revenue-generating regions for this market during the forecasted period. This high growth is due to the fact that there has been low dependency ratio, rise in disposable income and increase in travel among the baby boomers. The digitalization of distribution channels has also paved the way for higher demand of travel insurance packages. The rise in the number of outbound travelers in the region have made the high demand for this market in this region.

Asia-Pacific is expected to have the CAGR of 19.1% from 2023 to 2032. This is due to the fact that there has been significant demand for corporate travel insurance from countries such as China, Japan and Korea. The increasing travelers in countries such as India has been providing huge number of opportunities to insurance companies and also the travel agencies to tap into. Increasing awareness among the travelers about the advantages of the travel insurances has been beneficial for the travel insurance companies in the region.

Key Market Players & Competitive Landscape

Some of the key players in the Travel Insurance market include

- American Express Company

- Allianz Partners

- American International Group Inc. (AIS)

- AXA Travel Insurance, Arch Capital Group Limited

- Aviva PLC

- Sompo Holdings Inc.

- Berkshire Hathaway Specialty Insurance

- Groupama Sigorta AS

- InsureandGo

- China Pacific Insurance (Group) Co. Ltd.

- Chubb Limited

- Travelex Insurance Services Inc.

- Generali Group

- HanseMerkur Reiseversicherung AG

- Ping An Insurance Company of China Ltd.

- Seven Corners Inc.

- Zurich Insurance Group AG

The Global Travel Insurance Market is segmented as follows:

By Insurance Cover

- Single Trip Insurance

- Annual Trip Insurance

- Long Trip Travel Insurance

By End User

- Business Travelers

- Senior Citizens

- Education Travelers

By Distribution Channel

- Insurance Companies

- Banks

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Travel Insurance Market was valued at US$ 4.69 Billion in 2023.

The Global Travel Insurance Market is expected to reach US$ 126.47 Billion by 2032, growing at a CAGR of about 44.2% from 2024 to 2032.

Some of the key factors driving the Global Travel Insurance Market growth are the increased tourism globally, the increase in the disposable income, extensive coverage for holidays and easy booking facilities have increased the demand for the market. To mitigate the uncertain occurrences such as canceled flights, accidents, health issues, loss of baggage, theft and natural calamities, travelers opt for the travel insurances.

North America held a share of 37% in 2023. It is supposed to be one of the highest revenue-generating regions for this market during the forecasted period. This high growth is due to the fact that there has been low dependency ratio, rise in disposable income and increase in travel among the baby boomers. The digitalization of distribution channels has also paved the way for higher demand of travel insurance packages. The rise in the number of outbound travelers in the region have made the high demand for this market in this region.

Some of the key players in the Travel Insurance market include American Express Company, Allianz Partners, American International Group, Inc. (AIS), AXA Travel Insurance, Arch Capital Group Limited, Aviva PLC, Sompo Holdings, Inc., Berkshire Hathaway Specialty Insurance, Groupama Sigorta AS, InsureandGo, China Pacific Insurance, (Group) Co., Ltd., Chubb Limited, Travelex Insurance Services Inc., Generali Group, HanseMerkur Reiseversicherung AG, Ping An Insurance Company of China, Ltd., Seven Corners, Inc., and Zurich Insurance Group AG among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed