Treasury Software Market Size, Share, Trends, Growth 2032

Treasury Software Market By Deployment (Cloud-Based and On-Premises), By Organization Size (Large Enterprises and Small and Medium Enterprises), and By Vertical (BFSI, Manufacturing, Healthcare, Consumer Goods, Chemicals, Metals, & Energy, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

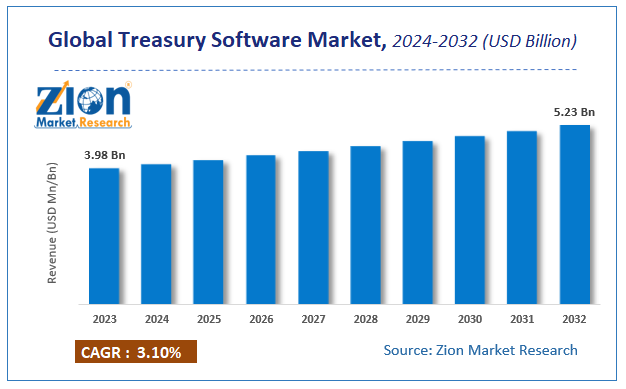

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.98 Billion | USD 5.23 Billion | 3.1% | 2023 |

Treasury Software Market Insights

According to a report from Zion Market Research, the global Treasury Software Market was valued at USD 3.98 Billion in 2023 and is projected to hit USD 5.23 Billion by 2032, with a compound annual growth rate (CAGR) of 3.1% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Treasury Software Market industry over the next decade.

Treasury SoftwareMarket: Growth Drivers

Treasury software for treasury management is defined as the application that supports the commercial treasury operations including that of financial service businesses along with corresponding to all the financial functionalities. The treasury software automates all the repetitive steps required to manage a company’s financial transactions. Treasury software not only calculates the value of a certain financial transaction but also provides a basis for the entire organization to improve their workflows and save time and effort in even the smallest of units or departments. The treasury software can be managed in-house or from a third-party service provider. It consists of hardware, software, and real-time financial data regarding direct financial transactions, fund transfers, cash positions, interest rates, foreign exchange rates, payables, and receivables. The treasury software can be used stand-alone or can be integrated with any other ERP software.

The global treasury software market is likely to grow substantially in the future, owing to the increase in the demand for overall automation systems. Treasury software is an important tool for financial professionals, particularly the ones with limited resources. With the vastness of today’s financial transactions, these professionals find the treasury software as a boon against all the limitations that they are faced with. Treasury software has the ability to connect the BFSI with many industries like healthcare, retail, energy, and even the government. Blockchain has the ability to eliminate several functions of treasury management, including financial settlement activities, auditing, payment transactions, and reconciliations.

This report offers a comprehensive view of the global treasury software market along with market trends, drivers, and restraints. This report also includes a detailed competitive scenario and product portfolio of the key market vendors. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces Model for the treasury software market has also been included. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

However, the increasing threats of a data breach, the lack of awareness regarding the benefits of treasury software in developing regions, and a dearth of skilled professionals may restrain the treasury software market globally in the years ahead. Alternatively, the development of treasury software using cloud technologies has made treasury systems more cost-effective and highly flexible at adapting to varied user requirements.

Treasury Software Market: Segmentation

The study provides a decisive view of the treasury software market by segmenting it based on deployment, organization size, vertical, and region.

The deployment segment of the treasury software market includes cloud-based and on-premises. Cloud-based software is dominating the market in terms of compound annual growth.

The organization size segment is bifurcated into large and small and medium enterprises.

The vertical segment of the global treasury software market is classified into BFSI, manufacturing, healthcare, consumer goods, chemicals, metals, and energy, and others. The consumer goods vertical is likely to be the fastest growing vertical in the upcoming years in the global treasury software market.

Treasury Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Treasury Software Market |

| Market Size in 2023 | USD 3.98 Billion |

| Market Forecast in 2032 | USD 5.23 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 110 |

| Key Companies Covered | Finastra, FIS, GTreasury, ION, Kyriba Corp., Salmon Software, TreasuryXpress, Eurobase International, Calypso Technology, ABM CLOUD, Access Systems, BELLIN, Oracle, CAPIX Software, Cash Analytics CRM Treasury Systems, DataLog Finance, SAP, and Financial Sciences |

| Segments Covered | By deployment, By organization size, By vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Treasury Software Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. These regions are further sub-segmented into the U.S., Canada, Germany, U.K., France, China, Italy, Japan, India, and Brazil.

In terms of revenue, North America holds the largest share of the global treasury software market. This regional share can be attributed to the growing penetration of technological advancements in the treasury software sector, the increasing number of government initiatives, and rising awareness about treasury software.

Treasury Software Market: Competitive Analysis

The global treasury software market is led by players like:

- Finastra

- FIS

- GTreasury

- ION

- Kyriba Corp

- Salmon Software

- TreasuryXpress

- Eurobase International

- Calypso Technology

- ABM CLOUD

- Access Systems

- BELLIN

- Oracle

- CAPIX Software

- Cash Analytics CRM Treasury Systems

- DataLog Finance

- SAP

- Financial Sciences

This report segments the global treasury software market into:

Global Treasury Software Market: Deployment Analysis

- Cloud-Based

- On-Premises

Global Treasury Software Market: Organization Size Analysis

- Large Enterprises

- Small and Medium Enterprises

Global Treasury Software Market: Vertical Analysis

- BFSI

- Manufacturing

- Healthcare

- Consumer Goods

- Chemicals, Metals, and Energy

- Others

Global Treasury Software Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Organisations utilise treasury software, a specialised financial instrument, to effectively manage their treasury operations, which encompass financial transactions, investments, liquidity, risk, and cash management. The software automates and facilitates a variety of financial processes, thereby assisting businesses in the optimisation of their financial resources, mitigate risks, and ensure compliance with regulations.

The demand for sophisticated treasury software is being driven by the increasing emphasis that businesses are placing on efficient cash management and liquidity optimisation, particularly in uncertain economic environments.

According to a report from Zion Market Research, the global Treasury Software Market was valued at USD 3.98 Billion in 2023 and is projected to hit USD 5.23 Billion by 2032.

According to a report from Zion Market Research, the global Treasury Software Market a compound annual growth rate (CAGR) of 3.1% during the forecast period 2024-2032.

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. These regions are further sub-segmented into the U.S., Canada, Germany, U.K., France, China, Italy, Japan, India, and Brazil.

Some key participants operating in the global treasury software market include Finastra, FIS, GTreasury, ION, Kyriba Corp., Salmon Software, TreasuryXpress, Eurobase International, Calypso Technology, ABM CLOUD, Access Systems, BELLIN, Oracle, CAPIX Software, Cash Analytics CRM Treasury Systems, DataLog Finance, SAP, and Financial Sciences.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed