Truffle Chocolate Market Size, Share, Growth, Forecast 2030

Truffle Chocolate Market By Distribution Channel (Online Stores, Specialty Stores, Brand-Owned Stores, Supermarkets & Hypermarkets, and Others), By Flavor (Milk Chocolate Truffles, Dark Chocolate Truffles, Flavored Truffles, and White Chocolate Truffles), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1243.69 Million | USD 1884.36 Million | 5.28% | 2022 |

Truffle Chocolate Industry Prospective:

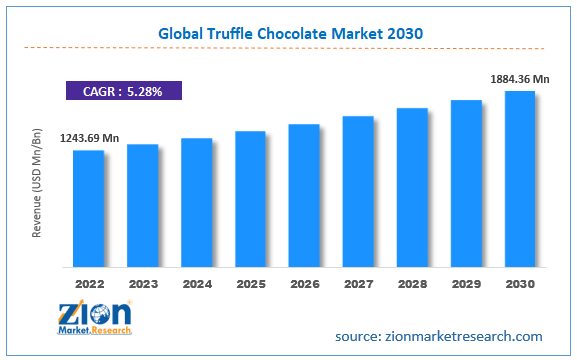

The global truffle chocolate market size was worth around USD 1243.69 million in 2022 and is predicted to grow to around USD 1884.36 million by 2030 with a compound annual growth rate (CAGR) of roughly 5.28% between 2023 and 2030.

The report delves deeper into several crucial aspects of the global truffle chocolate industry. It includes a detailed discussion of existing growth factors and restraints. Future growth opportunities and challenges that impact the truffle chocolate market are comprehensively addressed in the report.

Truffle Chocolate Market: Overview

Truffle chocolates are typically referred to as truffles. They are categorized into the chocolate confectionery segment in the larger food & beverages (F&B) industry. Truffle chocolates derive their name from the truffle fungus since they resemble the earthy appearance and irregular shape of the fungi. The most standard forms of truffle chocolates are produced using a combination of extremely rich and creamy ganache coated externally with chocolate. The ganache filling is made using heavy cream which is heated and then poured into finely chopped chocolate. The mixture thus created is stirred continuously until it becomes smooth and evenly consistent. It is then allowed to cool and set. Various market players provide truffle chocolates across flavor ranges by using options such as vanilla extract, liqueurs, or spices. This helps in enhancing the taste of the ganache. The truffle chocolate industry may register steady growth as there are a growing number of consumers across the globe.

Key Insights:

- As per the analysis shared by our research analyst, the global truffle chocolate market is estimated to grow annually at a CAGR of around 5.28% over the forecast period (2023-2030)

- In terms of revenue, the global truffle chocolate market size was valued at around USD 1243.69 million in 2022 and is projected to reach USD 1884.36 million, by 2030.

- The truffle chocolate market is projected to grow at a significant rate due to the increasing spending on gourmet food

- Based on flavor segmentation, dark chocolate truffles were predicted to show maximum market share in the year 2022

- Based on distribution channel segmentation, specialty stores were the leading channels in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Truffle Chocolate Market: Growth Drivers

Increasing spending on gourmet food to drive market growth

The global truffle chocolate market is expected to register high growth owing to the increasing spending globally on gourmet food. Truffle chocolates are considered in this category due to their high-quality ingredients, meticulous craftsmanship, and indulgent flavor profiles. Premium chocolates have registered high demand across nations especially in developed countries. A 2019 report by Fox DC stated that nearly 4 out of 10 Americans are expected to spend nearly USD 50 per week on gourmet food items. This can be seen in the increasing number of recent luxury chocolate launched by companies producing high-end chocolates. In September 2022, Lily O’Brien’s Chocolates, an Irish brand of premium chocolates, unveiled a new range of truffle chocolates which was made available in 2 flavors including Salted Caramel Truffles and Milk Chocolate Truffles. They were sold for £5.00 each. The company used marketing tactics such as unique boxes to enhance the overall look of the product packaging thus contributing to its luxury feel.

Truffle Chocolate Market: Restraints

High cost of truffle chocolate production to restrict market expansion

The production process of truffle chocolates is extremely labor intensive. They are carefully produced only by skilled chocolatiers that follow meticulous production processes. Moreover, since truffle chocolates are made of high-quality ingredients such as premium chocolate, fresh cream, and other high-grade flavorings, the total cost of production is further pushed to new heights. As companies invest in chocolate innovation, the associated expense is likely to continue growing. A recent example is the 2020 inauguration of an expansive and the world’s largest research & development center by the premium chocolate-making company Lindt & Sprüngli. The center is launched by The Lindt Chocolate Competence Foundation and is a 3-story, 1500 m2 facility that is expected to help the global chocolate truffle industry register higher consumer demand.

Truffle Chocolate Market: Opportunities

Product portfolio expansion to provide high-growth opportunities

The global truffle chocolate market is expected to come across multiple growth opportunities as international and world-famous chocolatiers are expanding their product portfolio. In May 2023, VELVEETA, a company popular for its creamy and texture-rich cheese announced a partnership with Compartés Chocolatier, a leading chocolate company for the production of TruffVels. It is the first-ever chocolate cheese truffle introduced in the commercial market. Similarly in July 2020, Mother Dairy announced the launch of a new flavor ice cream called the Chocolate Truffle Ice Cream which allowed the company to make an entry in the ice cream segment.

Truffle Chocolate Market: Challenges

Restricted range of consumer groups to challenge the market expansion

Truffle chocolates are expensive and although they are considered an affordable luxury, the consumer share for these chocolates is limited especially when compared to mass-produced chocolates. These products are likely to have fewer buyers in countries that are ruled by other forms of traditional sweets or dessert items. For instance, research suggests that an average Chinese citizen consumes less than 110 grams of chocolate per year. Although the choice of food items is a personal one, the number indicates that the majority of the people in non-Western countries spend more on traditional cuisines. The product is a perishable item and may not prove to be worthy of the cost of low to medium-income families in developing countries.

Truffle Chocolate Market: Segmentation

The global truffle chocolate market is segmented based on distribution channel, flavor, and region.

Based on distribution channel, the global market is segmented into online stores, specialty stores, brand-owned stores, supermarkets & hypermarkets, and others. The truffle chocolate industry is expected to register the highest growth in the specialty stores and brand-owned stores segment. This is mainly because the majority of the companies that produce high-end truffle chocolate tend to have an established brick-and-mortar store where consumers visit to enjoy the gourmet food in a relevant setting. In addition to this, supermarkets & hypermarkets are also significant revenue generators since truffle chocolate producers sell their products with the help of the established supply chain network created by these units. For instance, in 2018, Walmart, the US supermarket giant, started selling Swiss-made chocolates called Schoggihüsli. It is noteworthy that around 68% of chocolate consumers in the US regularly spend on premium chocolate.

Based on flavor, the global market is divided into milk chocolate truffles, dark chocolate truffles, flavored truffles, and white chocolate truffles. The demand and consumption of dark chocolate truffles are higher mainly due to the extreme popularity of dark chocolates and the intense flavor profile of dark chocolate truffles. They tend to provide a more pronounced chocolate experience when compared to white or milk variants. The dark chocolate truffle segment caters to the need of health-conscious consumers as dark chocolate is known to have several health benefits when consumed in appropriate quantities. Studies indicate that dark chocolate is a rich source of magnesium, iron, copper, zinc, and other minerals. A 1 ounce of dark chocolate containing 69% to 85% cacao solids has around 170 calories. In December 2021, Alter Eco Foods launched the Truffle Thins™ Dark Chocolate Bars which were made of 60% cacao shell and other organic ingredients.

Truffle Chocolate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Truffle Chocolate Market Research Report |

| Market Size in 2022 | USD 1243.69 Million |

| Market Forecast in 2030 | USD 1884.36 Million |

| Growth Rate | CAGR of 5.28% |

| Number of Pages | 222 |

| Key Companies Covered | Lindt & Sprüngli, Ferrero, Mondelez International (Cadbury), Nestlé, Mars, Incorporated, The Hershey Company, Godiva Chocolatier, Ghirardelli Chocolate Company, Neuhaus, Toblerone, Valrhona, Guylian, Chocoladefabriken Lindt & Sprüngli AG, Frey, Kinder (Ferrero), Milka (Mondelez International), Côte d'Or (Mondelez International), Ritter Sport, Ferrero Rocher, Green & Black's, Patchi, Tony's Chocolonely, Leonidas, and Barry Callebaut. |

| Segments Covered | By Distribution Channel, By Flavor, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Truffle Chocolate Market: Regional Analysis

North America to register the highest growth

The global truffle chocolate market is expected to be led by North America during the forecast period. Regions such as the US and Canada are the leading revenue generators. One of the primary reasons for higher regional growth is the presence of a strong gifting culture in these countries. A recent survey conducted by the National Confectioners Association concluded that nearly 92% of the survey respondents would prefer to receive chocolates or candies as gifts. These items register high sales during the holiday seasons.

During Christmas, the sale of chocolates, across the range, goes up by 5.75% while during Easter, the sale increase rate is 5.19%. Furthermore, the US is home to some of the most dominant manufacturers of gourmet chocolates and these companies are spread across nations including developing countries. The Hershey Company, the world's biggest chocolate maker generated more than USD 2.7 million in the 2nd quarter of 2022. Although the number showed a decline when compared to the 1st quarter, the net profit by Hershey in 2022 was positive.

Truffle Chocolate Market: Competitive Analysis

The global truffle chocolate market is led by players like:

- Lindt & Sprüngli

- Ferrero

- Mondelez International (Cadbury)

- Nestlé

- Mars

- Incorporated

- The Hershey Company

- Godiva Chocolatier

- Ghirardelli Chocolate Company

- Neuhaus

- Toblerone

- Valrhona

- Guylian

- Chocoladefabriken Lindt & Sprüngli AG

- Frey

- Kinder (Ferrero)

- Milka (Mondelez International)

- Côte d'Or (Mondelez International)

- Ritter Sport

- Ferrero Rocher

- Green & Black's

- Patchi

- Tony's Chocolonely

- Leonidas

- Barry Callebaut

The global truffle chocolate market is segmented as follows:

By Distribution Channel

- Online Stores

- Specialty Stores

- Brand-Owned Stores

- Supermarkets & Hypermarkets

- Others

By Flavor

- Milk Chocolate Truffles

- Dark Chocolate Truffles

- Flavored Truffles

- White Chocolate Truffles

- Integrated

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Truffle chocolates are typically referred to as truffles. They are categorized into the chocolate confectionery segment in the larger food & beverages (F&B) industry.

The global truffle chocolate market is expected to register high growth owing to the increasing spending globally on gourmet food

According to study, the global truffle chocolate market size was worth around USD 1243.69 million in 2022 and is predicted to grow to around USD 1884.36 million by 2030.

The CAGR value of the truffle chocolate market is expected to be around 5.28% during 2023-2030.

The global truffle chocolate market is expected to be led by North America during the forecast period.

The global truffle chocolate market is led by players like Lindt & Sprüngli, Ferrero, Mondelez International (Cadbury), Nestlé, Mars, Incorporated, The Hershey Company, Godiva Chocolatier, Ghirardelli Chocolate Company, Neuhaus, Toblerone, Valrhona, Guylian, Chocoladefabriken Lindt & Sprüngli AG, Frey, Kinder (Ferrero), Milka (Mondelez International), Côte d'Or (Mondelez International), Ritter Sport, Ferrero Rocher, Green & Black's, Patchi, Tony's Chocolonely, Leonidas, and Barry Callebaut.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed