UAE Perfume Market Size, Share Report, Analysis, Trends, Growth 2032

UAE Perfume Market By Price (Mass Products and Premium Products), By Gender (Female, Male and Unisex), By Perfume Type (French, Arabic and Others), and By State - Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

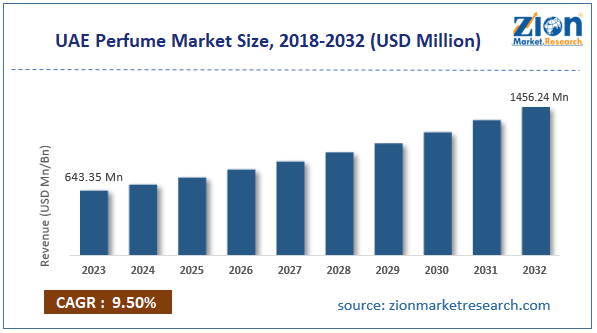

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 643.35 million | USD 1456.24 million | 9.5% | 2023 |

UAE Perfume Industry Prospective:

UAE Perfume market size was worth around USD 643.35 million in 2023 and is predicted to grow to around USD 1456.24 million by 2032 with a compound annual growth rate (CAGR) of roughly 9.5% between 2024 and 2032.

UAE Perfume Market: Overview

Various essential oils, scent compounds, fixatives, and solvents combine to create perfume, a fragrant liquid. To create a harmonic and agreeable aroma that leaves the wearer or the surrounding area with a pleasant and distinct odor, various smell components are blended to create this fragrance. Furthermore, people experience psychological benefits from it, such as elevated confidence, lowered stress levels, and improved mood. A perfume's top smell notes determine which of the following categories it falls into floral, fruity, spicy, woody, and oriental. Because concentration affects both lifespan and intensity, perfumes can also be classified according to this factor. For example, Eau de perfume, eau de toilette, and Eau de cologne are the most popular concentration levels. The UAE Perfume market is being driven by several factors including rising disposable income, growing product launches, changing lifestyles, Investment by manufacturers in marketing, product innovation and others.

Key Insights

- As per the analysis shared by our research analyst, the UAE Perfume market is estimated to grow annually at a CAGR of around 9.5% over the forecast period (2024-2032).

- In terms of revenue, the UAE Perfume market size was valued at around USD 643.35 million in 2023 and is projected to reach USD 1456.24 million, by 2032.

- The growing disposable income of the population is expected to propel the market growth over the projected period.

- Based on the price, the premium products segment is expected to dominate the market over the forecast period.

- Based on gender, the male segment is expected to capture the largest market share over the forecast period.

- Based on the perfume type, the Arabic segment is expected to capture a significant market share during the forecast period.

- Based on the region, Dubai is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

UAE Perfume Market: Growth Drivers

Increase in demand for eco-friendly fragrance products drive market growth

The key driver of market expansion is the increasing popularity of goods based on organic and natural components. Sandalwood, geranium bourbon, and patchouli are a few substances that are frequently used in these kinds of scents. In this industry, synthetic components are largely used; 60–65% of the market is devoted to synthetic scents, while the remaining 30–35% is taken up by fragrances made of natural materials. The rising consciousness among consumers regarding the components in perfumes is the reason behind the surge in demand for organic fragrances. Additionally, a key driver of the market's expansion is the increased awareness of health and hygiene in the UAE and around the world.

UAE Perfume Market: Restraints

Economic volatility and seasonal fluctuation impeding market growth

The economy of the United Arab Emirates is susceptible to variations in external factors such as global oil prices, even though the country is generally prosperous. Reductions in discretionary expenditure on luxury items such as fragrances might result from economic downturns or uncertainty that affect consumer spending habits. Furthermore, the United Arab Emirates encounters severe weather, especially in the summer, which may impact the sales of perfumes. Stagnation in demand can be caused by extreme heat and humidity, which can impact fragrance effectiveness and longevity. Moreover, fluctuations in the number of visitors impact duty-free sales throughout the year. Thus, this is expected to hinder the market growth over the forecast period.

UAE Perfume Market: Opportunities

Increasing investment offers an attractive opportunity for market growth

The growing investment in the UAE perfume sector is expected to offer a lucrative opportunity for market growth during the forecast period. In November 2023, A luxury perfume firm based in the United Arab Emirates, Savia Perfume Industry, created a splash at the much-awaited Beautyworld Middle East. Savia, which debuted in 2022, is a 75,000-square-foot, cutting-edge production and warehousing complex. With its own design studio and R&D department, it guarantees the production of distinctive and superior perfumes for its clientele.

UAE Perfume Market: Challenges

Competition from counterfeit products poses a major challenge to market expansion

The UAE deals with issues relating to fake and copycat perfumes, just like many other markets do. Authentic brands' reputation is damaged by counterfeit products, which also undercut legal enterprises. Sales of authentic items may suffer as a result of consumers' reluctance to buy perfume from unreliable sources.

UAE Perfume Market: Segmentation

The UAE Perfume industry is segmented based on price, gender, perfume type and region.

Based on the price, the UAE Perfume market is bifurcated into mass products and premium products. The premium products segment is expected to dominate the market over the forecast period. An affinity for luxury items is high among the consumer base in the United Arab Emirates. The market for luxury fragrance goods is fueled by high disposable incomes and a society that prizes elegance and refinement. High-end scents that express their individuality and social standing are affordable for both expats and Emiratis. Furthermore, with flagship stores and boutiques situated in esteemed retail establishments like Dubai Mall and The Galleria in Abu Dhabi, numerous well-known worldwide perfume brands enjoy a significant market share in the USA. Catering to discerning consumers seeking luxury and exclusivity, these firms provide a wide choice of high-end fragrances, many of which are limited editions.

Based on gender, the UAE Perfume industry is segmented into female, male and unisex. The male segment is expected to capture the largest market share over the forecast period. Perfume manufacturers that cater to males frequently use influencer marketing and celebrity endorsements to increase brand awareness and appeal to certain target audiences. Aspirational associations and perfume promotion are achieved through collaborations with male sports, celebrities, and social media influencers that appeal to male consumers in the United Arab Emirates.

Based on the perfume type, the UAE Perfume market is segmented into French, Arabic and others. The Arabic segment is expected to capture a significant market share during the forecast period. In Arabic culture, perfumes are deeply symbolic of hospitality, elegance, and personal grooming. The focus of traditional Arabic perfumery is frequently on deep, complex fragrances made with organic components like musk, oud, rose, and amber. In Arabic perfumery, oud in particular is highly valued and associated with refinement and status.

UAE Perfume Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | UAE Perfume Market |

| Market Size in 2023 | USD 643.35 Million |

| Market Forecast in 2032 | USD 1456.24 Million |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 220 |

| Key Companies Covered | Johnson & Johnson, Rasasi Perfumes Industry LLC, Abdul Samad Al Qurashi, Arabian Oud, The Procter & Gamble Company, Christian Dior SE, Marico Limited, Beiersdorf AG, Bath & Body Works Direct Inc., Nuxe Inc., Unilever Group, Candle-Lite Company LLC, Rituals Cosmetics Enterprise BV, Weleda Group, Ajmal Perfumes, Victoria's Secret & Co., and others. |

| Segments Covered | By Price, By Gender, By Perfume Type, and By Region |

| Regions Covered in UAE | Dubai, Abu Dhabi, Sharjah, Rest of UAE |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Region Analysis

Dubai is expected to dominate the market over the forecast period

Dubai is expected to dominate the market over the forecast period. Narrow and artisanal perfume brands have sprung up in Dubai to meet the needs of discriminating customers looking for rare and special scents. Personalized scent experiences and bespoke fragrance creations are offered by boutique perfume companies and local artists in Dubai's affluent areas, where they display their ingenuity and workmanship. In addition, Dubai's reputation as a hub for innovation and technology is also evident in the perfume sector, where companies use state-of-the-art methods and developments to produce unique fragrance combinations and packaging designs. Dubai's perfume shops use virtual reality and internet platforms to improve customer engagement and the shopping experience for tech-savvy customers. Thus, this is expected to drive the market growth in Dubai.

UAE Perfume Market: Competitive Analysis

UAE Perfume market is dominated by players like:

- Johnson & Johnson

- Rasasi Perfumes Industry LLC

- Abdul Samad Al Qurashi

- Arabian Oud

- The Procter & Gamble Company

- Christian Dior SE

- Marico Limited

- Beiersdorf AG

- Bath & Body Works Direct Inc.

- Nuxe Inc.

- Unilever Group

- Candle-Lite Company LLC

- Rituals Cosmetics Enterprise BV

- Weleda Group

- Ajmal Perfumes

- Victoria's Secret & Co.

The UAE Perfume market is segmented as follows:

By Price

- Mass Products

- Premium Products

By Gender

- Female

- Male

- Unisex

By Perfume Type

- French

- Arabic

- Others

By Region

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Table Of Content

Methodology

FrequentlyAsked Questions

Various essential oils, scent compounds, fixatives, and solvents combine to create perfume, a fragrant liquid. To create a harmonic and agreeable aroma that leaves the wearer or the surrounding area with a pleasant and distinct odor, various smell components are blended to create this fragrance. Furthermore, people experience psychological benefits from it, such as elevated confidence, lowered stress levels, and improved mood. A perfume's top smell notes determine which of the following categories it falls into floral, fruity, spicy, woody, and oriental. Because concentration affects both lifespan and intensity, perfumes can also be classified according to this factor. For example, eau de parfum, eau de toilette, and eau de cologne are the most popular concentration levels.

The UAE Perfume market is being driven by several factors including rising disposable income, growing product launches, changing lifestyles, Investment by manufacturers in marketing, product innovation and others.

According to the report, India's Pan Masala market size was worth around USD 643.35 million in 2023 and is predicted to grow to around USD 1456.24 million by 2032.

The UAE Perfume market is expected to grow at a CAGR of 9.5% during the forecast period.

UAE Perfume market growth is driven by Dubai. It is currently the nation's highest revenue-generating market due to the growing disposable income and increasing product innovation.

UAE Perfume market is dominated by players like Johnson & Johnson, Rasasi Perfumes Industry LLC, Abdul Samad Al Qurashi, Arabian Oud, The Procter & Gamble Company, Christian Dior SE, Marico Limited, Beiersdorf AG, Bath & Body Works Direct Inc., Nuxe Inc., Unilever Group, Candle-Lite Company LLC, Rituals Cosmetics Enterprise BV, Weleda Group, Ajmal Perfumes and Victoria's Secret & Co. among others.

The UAE Perfume Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed