UHT Milk Market Size, Share, Trends, Growth and Forecast 2032

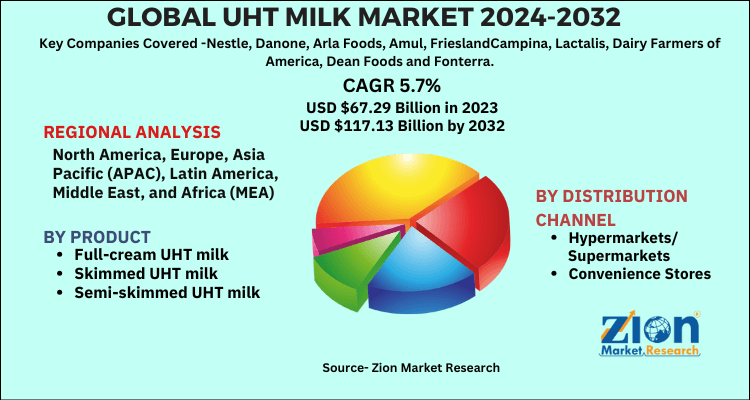

UHT Milk Market by Product Type (Full-cream UHT milk, Skimmed UHT milk, and Semi-skimmed UHT milk), by Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores and Other): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 67.29 Billion | USD 117.13 Billion | 5.7% | 2023 |

Global UHT Milk Market Insights

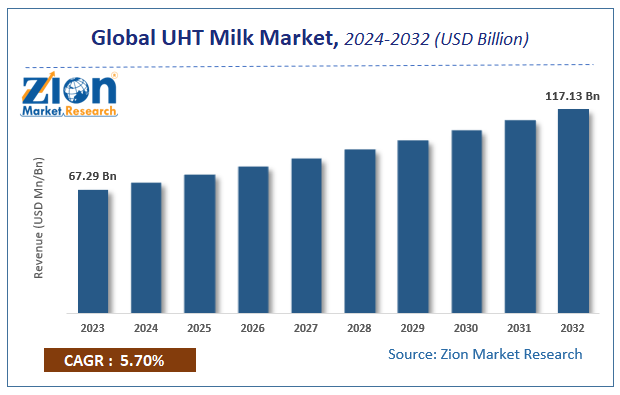

Zion Market Research has published a report on the global UHT Milk Market, estimating its value at USD 67.29 Billion in 2023, with projections indicating that it will reach USD 117.13 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.7% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the UHT Milk Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

UHT Milk Market: Overview

Ultra-high temperature milk is heated at 140°C for one to two seconds and packaged aseptically. Since the milk is heated at high temperatures, it kills all the bacteria present in the milk and increases the shelf life of the products. As compared to regular milk, packaged UHT milk does not need to refrigerate as it offers higher shelf life of up to 9 months due to no presence of bacteria. However, it needs to be consumed within 3 days once opened.

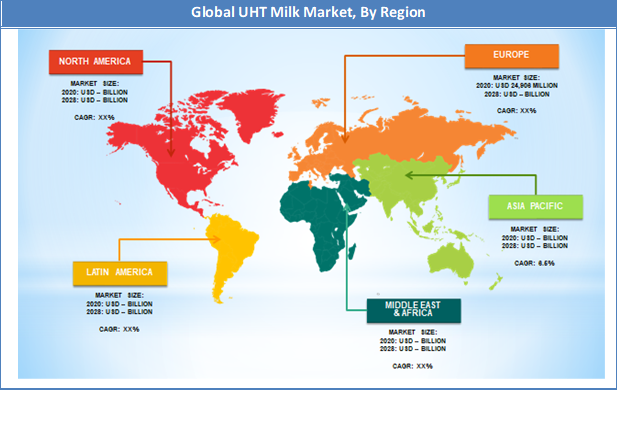

Globally, the demand for UHT milk is constantly increasing. Europe is holding more than 40% of the global market share. Most of the countries present in the region are consuming UHT milk. For instance, 2 out of 3 liters of milk consumed in Germany is UHT. In addition to this, France and Belgium are also consuming UHT on large scale. Asia Pacific is projected to emerge as the second-largest market for UHT milk and is expected to grow at the fastest CAGR. It is followed by North America. The adoption of UHT milk in North America is highly limited due to various factors such as higher preference to fresh milk, more focus on nutrients and milk value, limited presence of manufacturers, and high cost, among others.

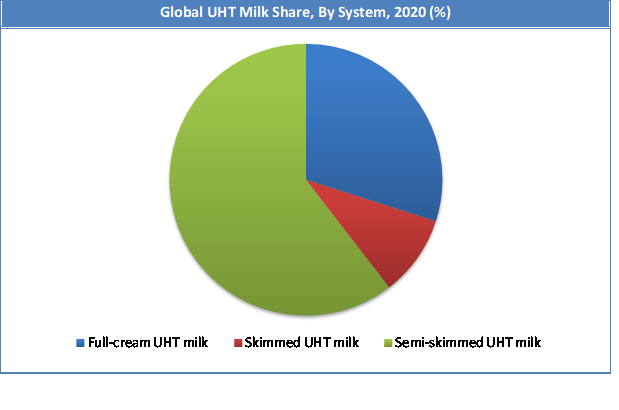

As per our analysis, semi-skimmed UHT milk is consumed on large scale around the globe, which is followed by whole milk. The dominance of semi-skimmed UHT milk is attributed to better flavor, high nutritional value, limited calories due to low-fat content, and higher consumption in Europe.

To know more about this report, request a sample copy.

UHT Milk Market: Growth Factors

UHT milk offers higher shelf life than any other available type of milk. It is heated up to 140°C for one to two seconds and then packaged aseptically. During this process, the high temperature kills all the bacteria present in the milk, thus sterilizes it. Since the milk is sterilized and packaged aseptically, the packaged milk can stay in good shape for up to 6 months and sometimes up to 9 months. The higher shelf life encourages consumers to buy the product in bulk and store out of fridge without worrying about going bad. However, once opened, it has be refrigerated and consumed within 3 days.

UHT milk can be stored for longer period without needing refrigeration. The need for refrigeration is eliminated because of the sterilized packaging process. In addition to this, the demand for the product is majorly driven by the Western European countries, China, Australia, and Japan because of climatic conditions. Wherein, the transport and cold storage add more cost to the final product.

UHT Milk Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | UHT Milk Market |

| Market Size in 2023 | USD 67.29 Billion |

| Market Forecast in 2032 | USD 117.13 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 177 |

| Key Companies Covered | Nestle, Danone, Arla Foods, Amul, FrieslandCampina, Lactalis, Dairy Farmers of America, Dean Foods and Fonterra |

| Segments Covered | By Product, By Distribution Channel And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Product Segment Analysis Preview

Semi-skimmed UHT milk segment held a share of around 60.43% in 2022. As per our findings, the products is consumed on large scale around the globe, especially in the developed countries such as the U.S., Italy, France, Spain, Sweden, Germany, and Canada, among others. This type of milk is majorly preferred by the consumers who are more concerned about taste of milk and nutrient contents. Semi-skimmed UHT milk is used for households as well as commercial applications because it offers better taste and makes coffee frothier.

Hypermarkets/Supermarkets Segment Analysis Preview

It has been found that consumers based in the European and North American countries are predominantly buying the UHT milk products from this segment. This is further supported by countries based in Asia Pacific such as Japan, Malaysia, Singapore, India and China, among others. In the last few years, the consumers based in the Asia Pacific and Latin America have started purchasing such products from supermarkets. This is majorly attributed to the growing number of supermarket/hypermarkets, easy availability of various brands, heavy discounts on UHT milk, and availability of different flavors.

Regional Analysis Preview

The European region held a share of 35.15% in 2022. Consumers in these regions prefer buying semi-skimmed milk over other types. Demand for flavored UHT milk is increasing from past few years and this is due to the increased tourists visiting this region. The strong presence of companies offering UHT milk and being the largest producer of milk is also another factor driving the growth of the market. In 2019, Europe produced over 158.2 million tons of milk and the number is constantly growing.

Consumers prefer buying UHT milk from supermarket/hypermarket. In 2021, per capita milk consumption was accounted for 64.94 kg. Countries with a strong dairy culture like Holland, Germany and Belgium have seen a strong rise in sales of UHT milk. In Germany, two out of every three liters is now long-life and in Belgium UHT dominates the market, particularly due to the fact that both production and distribution of UHT milk is easier than conventional milk.

The Asia Pacific region is projected to grow at a CAGR of 6.5% over the forecast period. China, Japan, Australia, and India are the largest consumers. Consumers in this region are price sensitive, UHT cost two times than regular milk. In the last four years, the demand and import for UHT milk increased four time in China. Most of the leading producers in Europe is exporting UHT milk to China and other Asia Pacific countries. Demand for the product is increasing as more consumers in the region have started looking for safe and quality food products. Large number of European players is eyeing to tap the rapidly growing market for UHT milk in China and Japan.

Key Market Players & Competitive Landscape

Some of key players in UHT milk market are-

- Nestle

- Danone

- Arla Foods

- Amul

- FrieslandCampina

- Lactalis

- Dairy Farmers of America

- Dean Foods and Fonterra

The global UHT milk market is segmented as follows:

By Product Type

- Full-cream UHT milk

- Skimmed UHT milk

- Semi-skimmed UHT milk

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global UHT milk market was valued at USD 67.29 Billion in 2023.

The global UHT milk market is expected to reach USD 117.13 Billion by 2032, growing at a CAGR of 5.7% between 2024 to 2032.

Some of the key factors driving the global UHT milk market growth are higher shelf life, and no need to refrigerate, among others.

Asia Pacific region held a substantial share of the UHT milk market in 2020. Consumers in this region are price sensitive, UHT cost two times than regular milk. In the last four years, the demand and import for UHT milk increased four time in China. Most of the leading producers in Europe is exporting UHT milk to China and other Asia Pacific countries.

Some of the major companies operating in the UHT milk market are Nestle, Danone, Arla Foods, Amul, FrieslandCampina, Lactalis, Dairy Farmers of America, Dean Foods and Fonterra, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed