Global UK Ceramic Tableware Market Size, Share, Growth Analysis Report - Forecast 2034

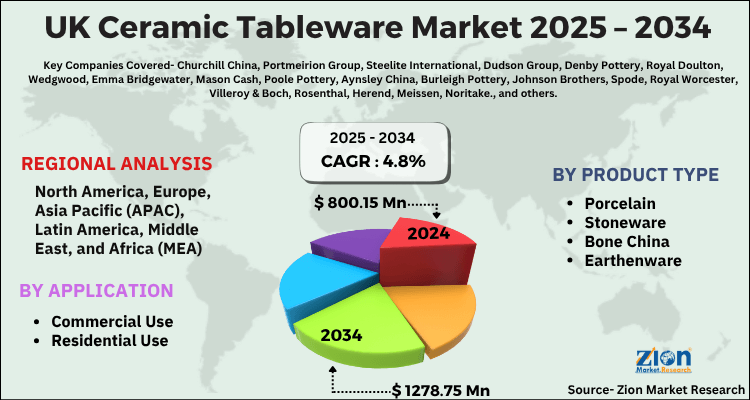

UK Ceramic Tableware Market By Product Type (Porcelain, Stoneware, Bone China, Earthenware, Others), By Application (Commercial Use, Residential Use), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

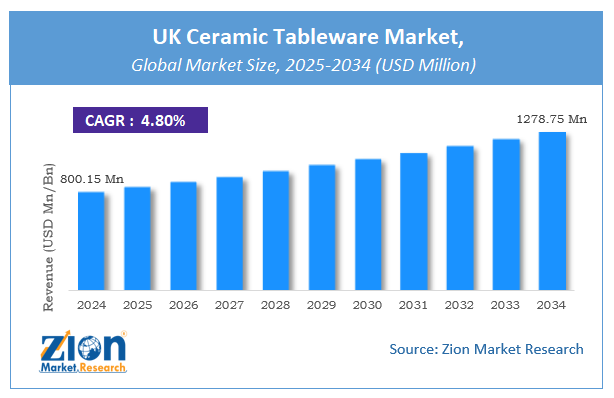

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 800.15 Million | USD 1278.75 Million | 4.8% | 2024 |

UK Ceramic Tableware Market: Industry Perspective

The global UK ceramic tableware market size was worth around USD 800.15 Million in 2024 and is predicted to grow to around USD 1278.75 Million by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034. The report analyzes the global UK ceramic tableware market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the UK ceramic tableware industry.

The UK ceramic tableware market report offers remarkable insights into the essential drivers, opportunities, constraints, and challenges impacting the UK ceramic tableware industry.

UK Ceramic Tableware Market: Overview

Imports of British ceramic tableware fluctuated a little between 2020 and 2023. The United Kingdom is among the top European importers of HDHT (Home Decoration and Home Textiles) products from developed countries. Therefore, in Europe, the UK is the biggest market for HDHT goods imported directly from developed countries.

Historically, the UK has had trading relations with many emerging major HDHT exporting countries. Moreover, British organizations purchase directly from Asian countries to a great extent, rather than purchasing from European companies.

Although the average annual rise in the total value of HDHT imports has been lesser than the usual European trend, the United Kingdom still remains one of the most notable and important European markets for exporters in developing countries.

UK Ceramic Tableware Market: Drivers

Surge in demand for reliable and affordable dinnerware drive the growth of the market

The UK ceramic tableware market is driven by a number of factors, including the growing demand for stylish and affordable dinnerware. Consumers are increasingly looking for products that are both functional and aesthetically pleasing, and ceramic tableware fits the bill. In addition, the popularity of home cooking and dining has led to increased demand for high-quality tableware, as consumers look to create a restaurant-quality experience in their own homes.

Another driver of the market is the increasing popularity of artisanal and handmade products. Consumers are looking for unique and one-of-a-kind items that reflect their personal style and taste, and ceramic tableware made by skilled artisans fits the bill. Additionally, the rise of e-commerce and online shopping has made it easier for consumers to purchase ceramic tableware from a wider range of sources, further driving demand for these products.

Opportunities:

Growing inclination towards environmental-friendly products to create ample opportunities for the industry

The UK ceramic tableware industry presents a number of opportunities for both established players and new entrants. One key opportunity is the growing demand for sustainable and environmentally friendly products. As consumers become more aware of the impact of their purchasing decisions, they are looking for products that are made from natural and sustainable materials, and that have a minimal environmental impact.

Another opportunity is the increasing demand for customizable products. Consumers are looking for products that they can personalize and make their own, and ceramic tableware is no exception. Manufacturers that offer customizable options, such as the ability to choose colors or patterns, or to add personalized text or images, are likely to attract a loyal following.

Finally, the rise of social media presents a significant opportunity for manufacturers of ceramic tableware. Platforms such as Instagram and Pinterest are popular among consumers looking for inspiration for their home décor and table settings, and manufacturers that are able to create visually appealing products that resonate with consumers are likely to see increased demand for their products.

Restraints:

Competition and availability of substitutes might hinder the growth to some extent

Despite the many drivers and opportunities in the UK ceramic tableware market, there are also a number of restraints that manufacturers and retailers must contend with. One major restraint is the competition from other materials, such as plastic and metal, which can be cheaper and more durable than ceramic.

Another restraint is the changing consumer preferences, particularly among younger generations who may be less interested in traditional tableware and more drawn to alternative materials and designs. This can make it difficult for manufacturers to predict and meet demand, particularly as trends and tastes change rapidly.

Challenges:

Rise in cost of raw materials might act as a challenge to the growth of the industry

In addition to these restraints, the UK ceramic tableware industry also faces a number of challenges. One major challenge is the increasing cost of raw materials, particularly as the demand for sustainable and environmentally friendly products grows.

This can make it difficult for manufacturers to maintain profit margins and may lead to higher prices for consumers. Another challenge is the need to innovate and stay ahead of the competition. With so many players in the market, manufacturers must constantly be developing new designs and products that meet consumer demand, while also keeping costs low and maintaining quality standards.

Key Insights

- As per the analysis shared by our research analyst, the global UK ceramic tableware market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global UK ceramic tableware market size was valued at around USD 800.15 Million in 2024 and is projected to reach USD 1278.75 Million by 2034.

- The UK ceramic tableware market is projected to grow at a significant rate due to increasing demand for stylish and affordable dinnerware, rising popularity of home cooking and dining, and growing interest in sustainable and eco-friendly products.

- Based on Product Type, the Porcelain segment is expected to lead the global market.

- On the basis of Application, the Commercial Use segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

UK Ceramic Tableware Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | UK Ceramic Tableware Market |

| Market Size in 2024 | USD 800.15 Million |

| Market Forecast in 2034 | USD 1278.75 Million |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 217 |

| Key Companies Covered | Churchill China, Portmeirion Group, Steelite International, Dudson Group, Denby Pottery, Royal Doulton, Wedgwood, Emma Bridgewater, Mason Cash, Poole Pottery, Aynsley China, Burleigh Pottery, Johnson Brothers, Spode, Royal Worcester, Villeroy & Boch, Rosenthal, Herend, Meissen, Noritake., and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

UK Ceramic Tableware Market: Segmentation

The global UK ceramic tableware market is segmented based on product type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on product type, the market is segmented into Porcelain, Stoneware, Bone China, Earthenware, and others. The porcelain segment held the largest market share in 2022 and is further predicted to grow remarkably during the forecast period. The porcelain segment of the UK ceramic tableware market has experienced steady growth in recent years, driven by several factors.

One key driver is the popularity of minimalist and contemporary home decor, which has led to increased demand for simple and elegant porcelain designs. Porcelain is also seen as a premium material, and its durability and non-porous nature make it a popular choice for both home and commercial use.

Additionally, advancements in manufacturing technology have enabled producers to create new and innovative designs, which appeal to consumers looking for unique and personalized products. Therefore, the porcelain segment is expected to continue to grow in the coming years, driven by changing consumer preferences and increasing demand for high-quality, sustainable tableware.

Based on application, the market is segmented into commercial and residential segments. The residential segment held the largest market share in 2024 and is further predicted to grow rapidly during the forecast period.

The residential segment of the UK ceramic tableware industry has seen significant growth in recent years, driven by several factors. One key driver is the rising trend of home cooking and dining, which has led to increased demand for high-quality and stylish tableware. Additionally, consumers are increasingly seeking customizable and sustainable products that reflect their personal values and lifestyle choices.

The residential segment is also influenced by changing consumer preferences, such as the move towards minimalist and eco-friendly designs. As a result, manufacturers are investing in new production technologies and innovative design processes to cater to this growing demand. Thus, the residential segment is expected to continue to grow in the coming years, driven by the increasing importance of home as a central hub for socialization and personal expression.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Recent Developments

- In 2024, Churchill China announced the launch of a new range of sustainable tableware made from recycled materials. The range, named ‘Eco Glaze,’ is made from up to 40% recycled raw materials and has a durable and scratch-resistant surface. This development aligns with the company’s commitment to sustainability and its efforts to reduce its carbon footprint.

- In 2024, Denby Pottery announced a collaboration with designer Monika Lubkowska-Jonas to launch a new range of tableware. The range, named ‘Halo Speckle,’ features a unique glaze and speckled effect, giving each piece a one-of-a-kind appearance. This development highlights the company’s focus on innovation and design, and its commitment to producing high-quality and stylish tableware.

- In 2024, Emma Bridgewater released a new range of hand-decorated pottery called Spring Flowers, which features a range of colorful floral designs inspired by the English countryside. The collection includes mugs, plates, and bowls, and is designed for home use. The range has been popular with consumers looking for handmade and unique tableware options.

UK Ceramic Tableware Market: Regional Analysis

The UK ceramic tableware market shows regional variations driven by differences in consumer preferences, income levels, and hospitality industry concentration. Southern regions, particularly London and the South East, account for a significant share due to higher disposable incomes, urban lifestyles, and a thriving restaurant and hospitality sector that boosts demand for premium and designer tableware. In contrast, regions in the North and the Midlands display steady demand, driven more by value-for-money products and traditional purchasing patterns, although interest in artisanal and locally crafted ceramics is growing. Additionally, tourist-heavy areas such as the South West contribute to the market through increased demand from hotels, cafes, and boutique retailers, while sustainability trends and the popularity of British-made products are influencing purchasing decisions nationwide.

UK Ceramic Tableware Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the UK ceramic tableware market on a global and regional basis.

The global UK ceramic tableware market is dominated by players like:

- Churchill China

- Portmeirion Group

- Steelite International

- Dudson Group

- Denby Pottery

- Royal Doulton

- Wedgwood

- Emma Bridgewater

- Mason Cash

- Poole Pottery

- Aynsley China

- Burleigh Pottery

- Johnson Brothers

- Spode

- Royal Worcester

- Villeroy & Boch

- Rosenthal

- Herend

- Meissen

- Noritake.

UK Ceramic Tableware Market: Segmentation Analysis

The global UK ceramic tableware market is segmented as follows;

By Product Type

- Porcelain

- Stoneware

- Bone China

- Earthenware

- Others

By Application

- Commercial Use

- Residential Use

UK Ceramic Tableware Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Ceramic tableware is a popular choice for serving and eating meals. It's durable, easy to clean, and comes in a variety of designs, colors, and styles. From classic white plates to artisanal bowls, ceramic tableware is both functional and aesthetically pleasing, making it a staple in households and restaurants around the world.

The global UK ceramic tableware market is expected to grow due to rising demand for premium and artisanal dining products, increasing hospitality industry growth, growing consumer preference for sustainable materials, and expanding e-commerce influence on homeware sales.

According to a study, the global UK ceramic tableware market size was worth around USD 800.15 Million in 2024 and is expected to reach USD 1278.75 Million by 2034.

The global UK ceramic tableware market is expected to grow at a CAGR of 4.8% during the forecast period.

Europe is expected to dominate the UK ceramic tableware market over the forecast period.

Leading players in the global UK ceramic tableware market include Churchill China, Portmeirion Group, Steelite International, Dudson Group, Denby Pottery, Royal Doulton, Wedgwood, Emma Bridgewater, Mason Cash, Poole Pottery, Aynsley China, Burleigh Pottery, Johnson Brothers, Spode, Royal Worcester, Villeroy & Boch, Rosenthal, Herend, Meissen, Noritake., among others.

The report explores crucial aspects of the UK ceramic tableware market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed